Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Exploring NVIDIA's leadership in high-end ADAS in China

Canalys explores NVIDIA's supremacy in China's ADAS market and the strategic evolution driving its leadership against competitive pressures. Discover how NVIDIA's diverse SoC portfolio and collaborative initiatives position the company for sustained growth in the ever-changing automotive technology landscape.

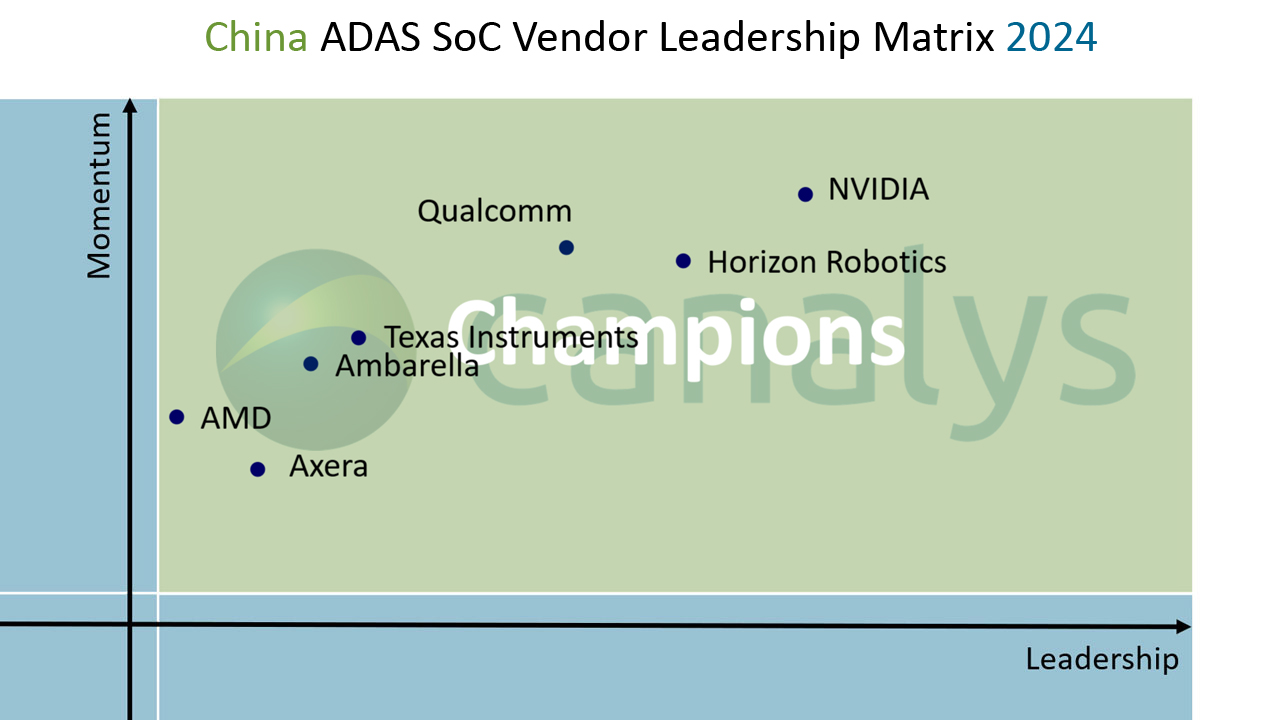

NVIDIA was recently crowned a Champion in the Canalys China ADAS SoC Vendor Leadership Matrix. While the industry anticipates more automotive-related announcements surrounding AI integration and autonomous driving in GTC 2024, let's look at why NVIDIA is highly competitive and regarded by partners as one of the best SoC vendors in the ADAS market in China.

In the ever-evolving landscape of automotive technology, NVIDIA stands out as a formidable force, leveraging its brand recognition in AI, autonomous driving, and computing prowess to lead the high-end ADAS market in China. Its diverse product portfolio, from Xavier to Orin and Thor SoCs, ensures comprehensive coverage for various ADAS needs. By offering an end-to-end solution, NVIDIA simplifies development and deployment allowing partners to focus on differentiation. Best-in-class support and solid profitability help retain partners for the long-term. Additionally, automotive OEMs rely on NVIDIA to elevate their vehicles to premium status, which could even impact OEMs' choices. Despite its dominance in high-end computing, ADAS is not NVIDIA's primary focus compared to its other automotive ventures. While its product portfolio is robust, it needs more competitiveness in entry-level and mass-market ADAS segments. Partners in China expect improved support from NVIDIA through better response times from a larger team, especially when other SoC vendors quickly improve their service quality to increase competitiveness. Unlike SoC vendors seeing design wins and deployments in mass market vehicles, NVIDIA may see scalability issues in real-world data gathering for system improvements.

Beyond its current strengths, NVIDIA has significant growth opportunities. The company fosters a strong collaborative environment with tier-one suppliers and OEMs. This willingness to partner, positions them at the forefront of industry-leading software development and feature set optimization. As autonomous driving technology continues to evolve, NVIDIA is well-positioned to play a central role, further propelling future growth as the market shifts from L2+ to L3 autonomy. Furthermore, its expertise in AI research can be leveraged to develop more effective simulation environments for ADAS testing and development, creating a powerful synergy within its automotive offerings.

NVIDIA faces threats from geopolitical tensions and increased pressure on cost and demand. Competition from Qualcomm, especially in the high-end ADAS space, poses a risk of displacement. Furthermore, NVIDIA's heavy reliance on AI exposes it to risks associated with unforeseen events in the AI landscape.

Despite its formidable position in the high-end ADAS market, NVIDIA must navigate challenges and capitalize on opportunities to maintain dominance. By addressing weaknesses and mitigating threats while leveraging its strengths and exploring opportunities, NVIDIA has strong potential to solidify its leadership position in the rapidly evolving ADAS landscape in China.