Global smartphone market soared 7% in 2024 as vendors prepare for tricky 2025

Monday, 3 February 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

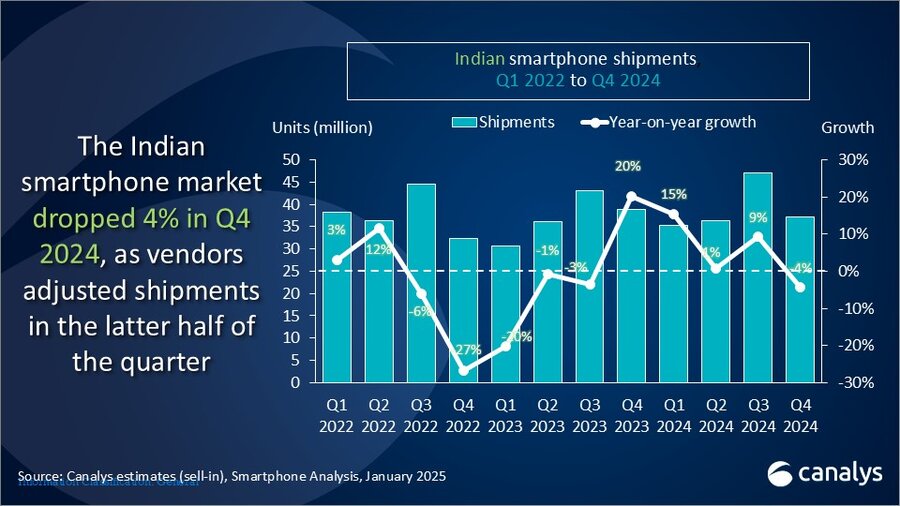

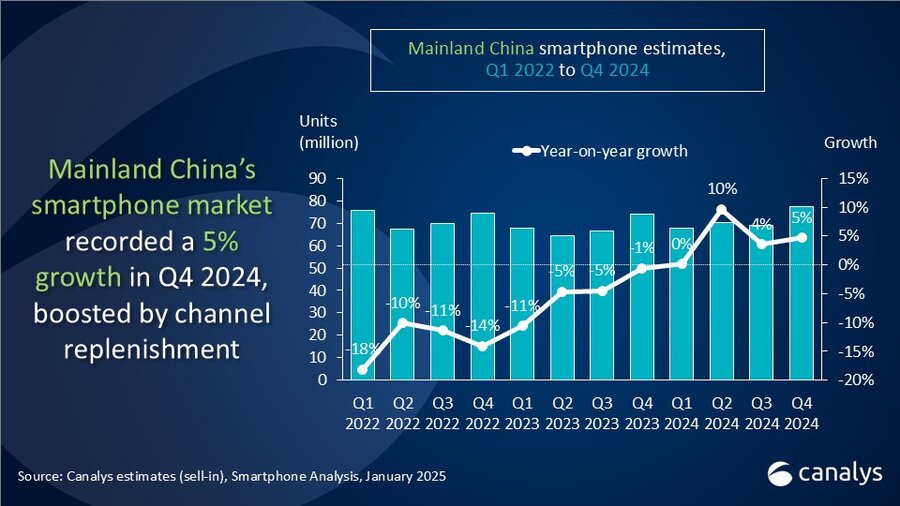

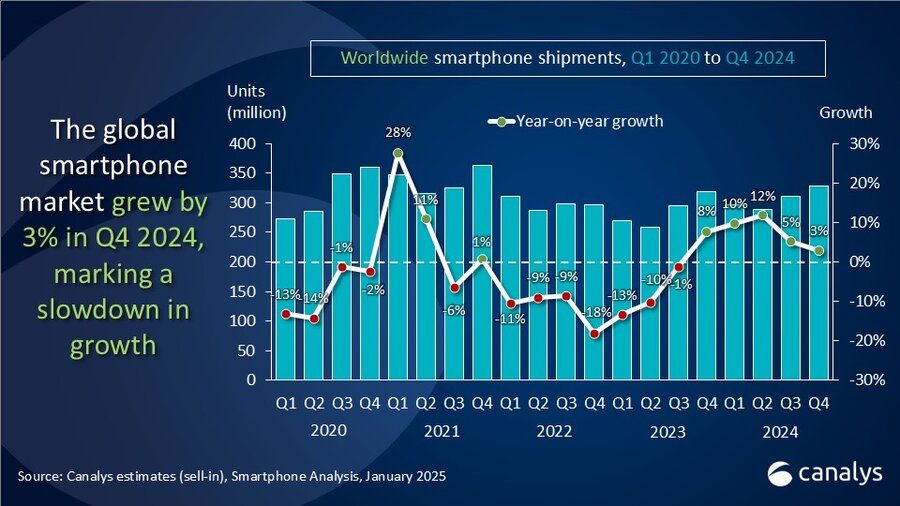

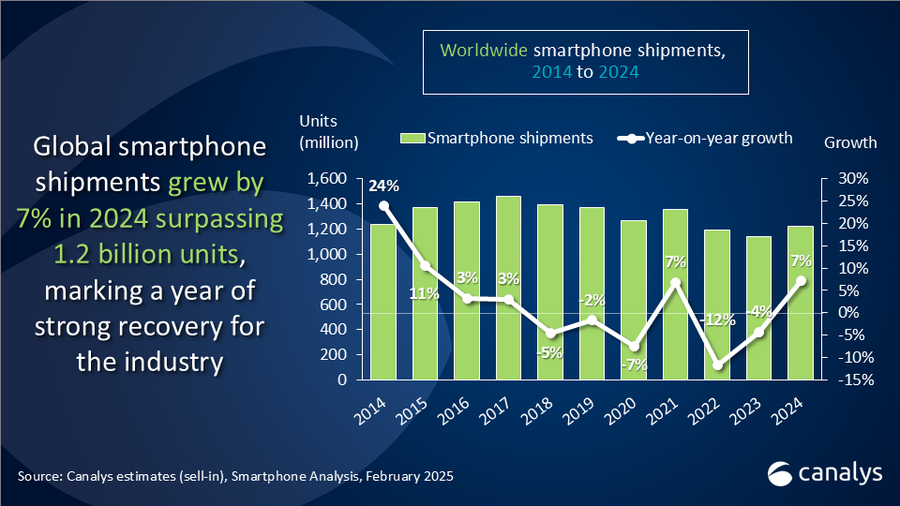

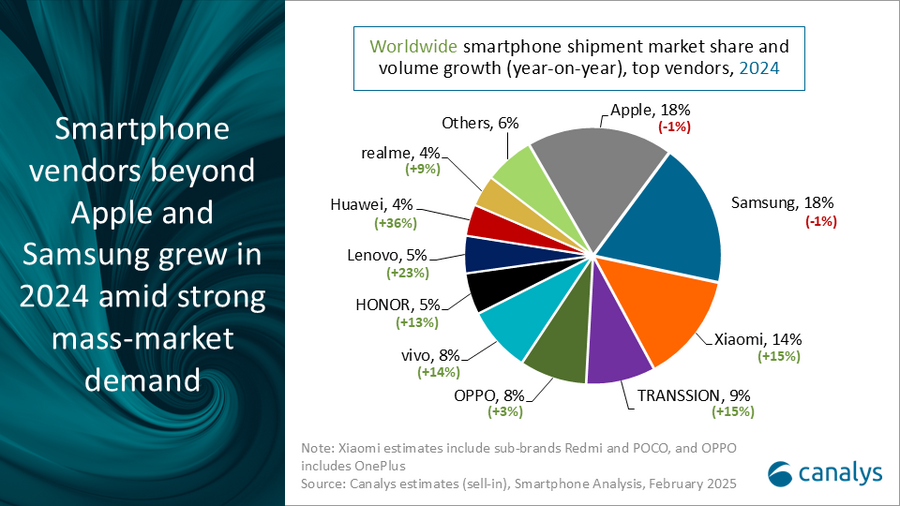

According to the latest Canalys research, the global smartphone market grew 7% in 2024, reaching 1.22 billion units, marking a rebound following two consecutive years of declines. Apple defended its pole position on the vendor ranking table for the second year, backed by emerging market growth and stable performances in North America and Europe, which helped offset its challenges in Mainland China. For the full year 2024, iPhone shipments declined by 1% to 225.9 million units. Samsung followed closely in second amid its continued profitability focus, as its shipments also declined by 1% to 222.9 million units. Xiaomi maintained a stronghold on the third spot, being the biggest contributor to the industry’s volume growth in 2024. Driven by strong momentum in Mainland China and continued strategic expansion into emerging markets, its shipments grew by a strong 15% to 168.6 million units. TRANSSION claimed the fourth spot for the very first time while OPPO (including OnePlus) rounded off the top five, growing 15% and 3% to 106.7 million and 103.6 million units, respectively.

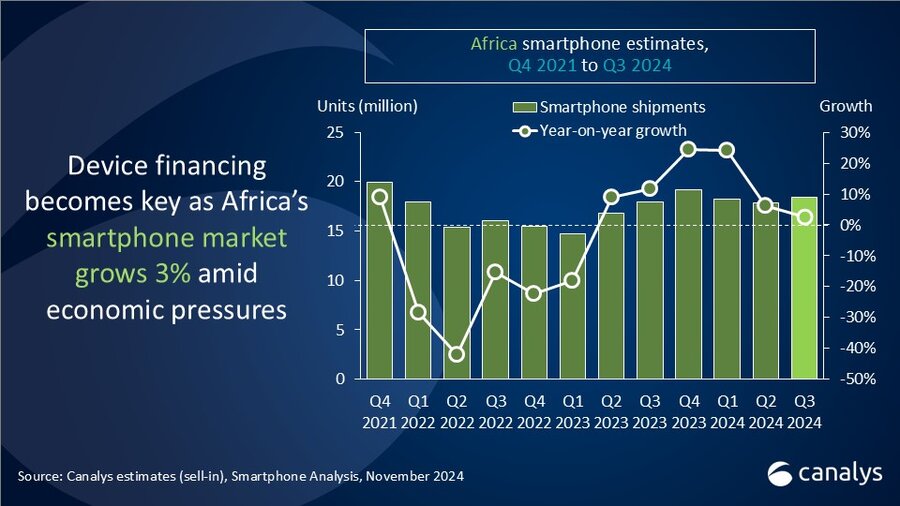

“2024 has been a comeback year for the smartphone industry, delivering the highest annual global shipment volume post-pandemic,” said Runar Bjørhovde, Analyst at Canalys. “Demand has been soaring in the mass-market segment, driven by a refresh cycle of pandemic-bought smartphones alongside channel replenishments. Several vendors have capitalized on this trend, targeting the open-market channel and leading with strong value-for-money-focused products. However, the focus on scaling volume has come with a risk of margin erosion to keep prices competitive. To counter this and manage profitability, vendors have reduced fixed costs and optimized their resource planning. Beyond the emerging markets’ robust growth, mature economies started recovering, exemplified by Mainland China’s growth at 4%, North America at 1% and Europe at 3%. Demand in these regions has been accelerated by high vendor promotions, such as discounts, trade-ins and device bundles, used across the channel.”

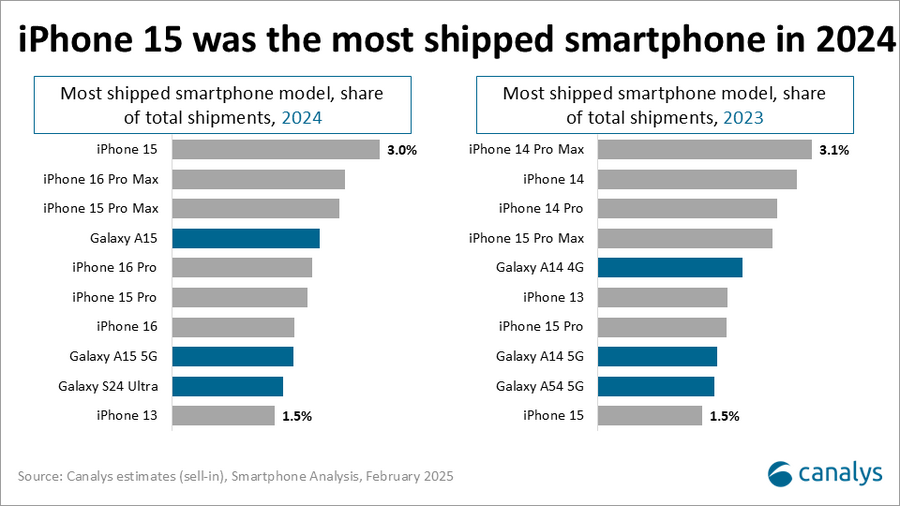

“Apple and Samsung remained resilient amid strong flagship demand, reflecting the continued premiumization trend of the market,” commented Sanyam Chaurasia, Senior Analyst at Canalys. “In the high-end, consumers are increasingly opting for the premium version of the flagship series, helped by vendors’ clearer differentiating models within their flagship series in an already price-inelastic segment. In Apple’s case, shipments of the 16 Pro and Pro Max in 2024 were 11% higher than the 15 Pro and Pro Max in 2023, reaching over 55 million units. The performance of the Pro models in the 16 series was a key driver to the iPhone 16 outperforming the launch year performance of the iPhone 15. Samsung delivered its strongest S-series volume since 2019, skewed more toward the Ultra than ever before. It aspires to continue the S-series growth with the Galaxy S25, through a continued focus on AI-powered experiences including a complementary Gemini Advanced subscription. Upgrading current users of the mid-range A-series to the standard and plus models will be a key element for Samsung to achieve its ambition.”

“Vendors are facing a tricky 2025 with mounting complexities both globally and regionally,” added Bjørhovde. “Emerging markets have been the industry’s growth engine in 2024, but growth has slowed down as some markets are reaching a point of saturation. Finding the right balance between short-term performance, inventory management and long-term investments will be key for vendors to succeed in these markets. Economic fluctuations, potential US tariffs and compliance requirements add further unpredictability to market dynamics. However, opportunities such as rising premiumization trends, Mainland China’s subsidy scheme and evolving financing models offer vendors growth potential. In 2025, vendors will prioritize ASP and profitability growth across segments while strengthening their market presence through diversified product portfolios, brand-driven marketing, and deeper channel collaborations. The ability to navigate these challenges while capitalizing on emerging opportunities will define the leaders of the next phase of industry evolution.”

|

Global smartphone shipments and annual growth |

|||||

|

Vendor |

Q4 2024 |

Q4 2024 |

Q4 2023 |

Q4 2023 |

Annual |

|

Apple |

77.1 |

23% |

78.1 |

24% |

-1% |

|

Samsung |

51.9 |

16% |

53.5 |

17% |

-3% |

|

Xiaomi |

42.7 |

13% |

40.7 |

13% |

5% |

|

TRANSSION |

27.2 |

8% |

28.5 |

9% |

-4% |

|

vivo |

26.4 |

8% |

23.9 |

7% |

10% |

|

Others |

102.7 |

32% |

94.5 |

30% |

4% |

|

Total |

328.0 |

100% |

319.2 |

100% |

3% |

|

Note: Xiaomi estimates include sub-brands Redmi and POCO. Percentages may not add up to 100% due to rounding. |

|

||||

|

Global smartphone shipments and annual growth |

|||||

|

Vendor |

2024 |

2024 |

2023 |

2023 |

Annual |

|

Apple |

225.9 |

18% |

229.1 |

20% |

-1% |

|

Samsung |

222.9 |

18% |

225.5 |

20% |

-1% |

|

Xiaomi |

168.6 |

14% |

146.1 |

13% |

15% |

|

TRANSSION |

106.7 |

9% |

92.6 |

8% |

15% |

|

OPPO |

103.6 |

8% |

100.7 |

9% |

3% |

|

Others |

395.4 |

33% |

347.9 |

30% |

14% |

|

Total |

1,223.1 |

100% |

1,141.9 |

100% |

7% |

|

Note: Xiaomi estimates include sub-brands Redmi and POCO, and OPPO includes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Runar Bjørhovde: runar_bjorhovde@canalys.com

Sanyam Chaurasia: sanyam_chaurasia@canalys.com

Canalys' worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys, now part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved