India’s smartphone shipments grew 5% in 2024, Apple entered top five for the first time in Q4

Monday, 20 January 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

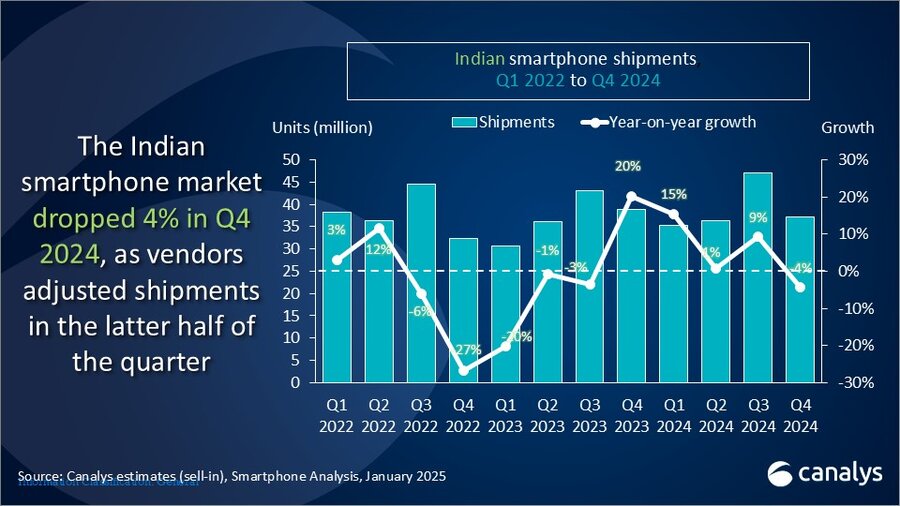

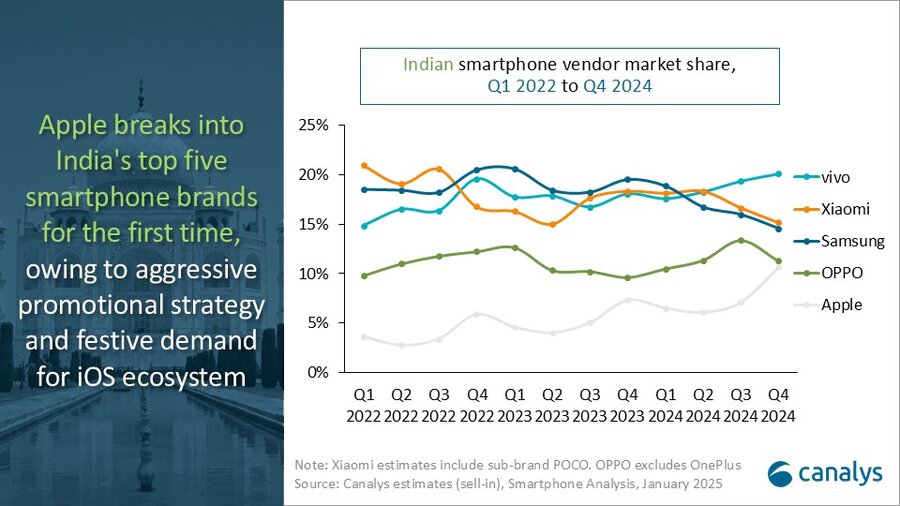

The latest Canalys research shows that Indian smartphone shipments fell 4% to 37.2 million units in Q4 2024, as vendors adjusted inventory post-festive season. vivo maintained its pole position with 7.5 million units and a 20% market share. Xiaomi followed in second place with 5.7 million units, while Samsung secured third place with 5.4 million units. OPPO (excluding OnePlus) and Apple rounded out the top five, shipping 4.2 million and 4.0 million units, respectively. Apple captured fifth place for the first time, bolstered by aggressive promotions and strong festive demand.

For full year 2024, India’s smartphone market grew 5%, reaching 155.9 million shipments, driven by the pandemic refresh cycle and 5G upgrades. Vendors aggressively launched devices in the first three quarters, with some using product mix strategies to focus on higher price bands. However, during the festive season, brands faced inventory pileups due to weaker mass-market demand. This prompted brands to offer heavy discounts and extended channel margins to clear stock and finish the year with a better inventory situation.

“Apple has broken into the top five in the Indian smartphone market for the first time, with a continued focus on driving upgrades and strengthening its ecosystem,” said Sanyam Chaurasia, Senior Analyst at Canalys. “In 2024, the competition in the ultra-premium segment has intensified amid aggressive launches from Android vendors. Consequently, Apple has been assertive with channel-driven promotions, particularly during competitors’ flagship launches, ahead of iPhone releases and festive seasons. Beyond instant cashback and discounting, programs like the ‘Buyback Program’ and the ‘iPhone for Life Program – offering interest-free EMI plans’ have significantly driven affordability and boosted upgrades. Merchants are willing to absorb the cost of running these zero-interest programs, recognizing Apple’s strong brand appeal as a key driver. Going forward, Apple will focus on three key areas – driving Pro series upgrades for existing customers post local production price adjustments, expanding into lower-tier cities to attract new iOS users amid the high aspirational value of iPhones and boosting ecosystem demand across the market.”

“Q4 witnesses cautious vendor strategies as high channel inventories weigh on volume growth post-festivities, but strong value growth underscores premium demand,” said Chaurasia. “Limited new launches and subdued brand push allowed channels to focus on clearing existing inventories. Brands such as vivo and OPPO maintained strong momentum, leveraging diversified strategies. vivo performed well online with its T3 series and offline with its value-driven Y-series. OPPO sustained its momentum by focusing on standout features like design and durability in models such as the K12x, A3 and F27 series. Meanwhile, the premium segment sustained robust growth, fueled by strong demand for Samsung and Apple’s previous-generation models. Samsung’s Galaxy S23 and S23 FE, gained volumes despite an overall shipment decline, while iPhone 15 demand remained resilient even with the launch of the latest models. This momentum was bolstered by channel-driven strategies such as attractive trade-in offers, extended warranties and zero prepayment schemes, effectively driving consumer interest in higher-value segments.”

“With limited growth catalysts and the pandemic replacement cycle nearing its end, Canalys projects modest single-digit growth for 2025,” said Chaurasia. “In the mass market (sub-US$200), strong demand in the US$100 to US$200 price range will continue, driven by 5G adoption. However, the sub-US$100 segment faces challenges from macroeconomic pressures, 4G feature phone competition and a growing second-hand market. Late 2024 saw launches like Xiaomi's Redmi A4 5G featuring the Snapdragon 4s Gen 2 with SA 5G support, but mixed early performance reflects lingering uncertainties. In 2025, brands are expected to cautiously expand their sub-US$100 5G offerings while navigating these challenges. In the premium segment, brands face multiple headwinds despite ongoing premiumization trends. High-end refurbished devices are gaining traction, urban consumers are holding onto quality devices longer and upgrade demand is primarily channel-driven rather than fueled by strong consumer pull. To sustain growth in the premium segment, brands must invest in consumer education, develop AI-driven localized use cases and optimize retail channels to stimulate upgrades effectively.”

|

Indian smartphone shipments and annual growth |

|||||

|

Vendor |

Q4 2024 |

Q4 2024 |

Q4 2023 |

Q4 2023 |

Annual |

|

vivo |

7.5 |

20% |

7.0 |

18% |

6% |

|

Xiaomi |

5.7 |

15% |

7.2 |

18% |

-21% |

|

Samsung |

5.4 |

15% |

7.6 |

20% |

-29% |

|

OPPO |

4.2 |

11% |

3.7 |

10% |

12% |

|

Apple |

4.0 |

11% |

2.9 |

7% |

39% |

|

Others |

10.5 |

28% |

10.5 |

27% |

0% |

|

Total |

37.2 |

100% |

38.9 |

100% |

-4% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO. OPPO excludes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

|

Indian smartphone shipments and annual growth |

|||||

|

Vendor |

2024 |

2024 |

2023 |

2023 |

Annual |

|

vivo |

29.5 |

19% |

26.1 |

18% |

13% |

|

Xiaomi |

26.6 |

17% |

25.1 |

17% |

6% |

|

Samsung |

25.7 |

16% |

28.4 |

19% |

-10% |

|

OPPO |

18.3 |

12% |

15.7 |

11% |

16% |

|

realme |

16.6 |

11% |

17.4 |

12% |

-5% |

|

Others |

39.3 |

25% |

35.8 |

24% |

10% |

|

Total |

155.9 |

100% |

148.6 |

100% |

5% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO. OPPO excludes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Sanyam Chaurasia: sanyam_chaurasia@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys, part of Informa TechTarget, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.