Global cloud spending leaps 19% in Q2 2024

Tuesday, 13 August 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

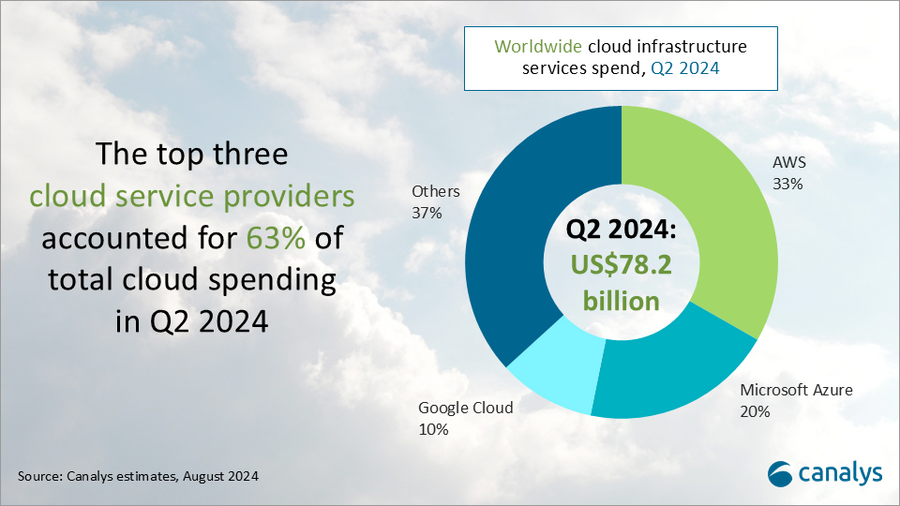

In Q2 2024, global spending on cloud infrastructure services grew 19% year on year to reach US$78.2 billion. While enterprises’ IT budgets have returned to growth, a significant portion of spending is now directed toward AI-related investments. The top three vendors – AWS, Microsoft Azure and Google Cloud – collectively grew by 24% this quarter to account for 63% of total spending. AWS showed a notable increase in growth compared with the previous quarter, with Q2 sales up 19%. Meanwhile, Microsoft Azure and Google Cloud continued to show robust double-digit growth, up 29% and 30% respectively. Over a third of cloud market share globally is still held by other cloud providers, but the market is shifting toward the top hyperscalers, which are capturing an increasing share of the market.

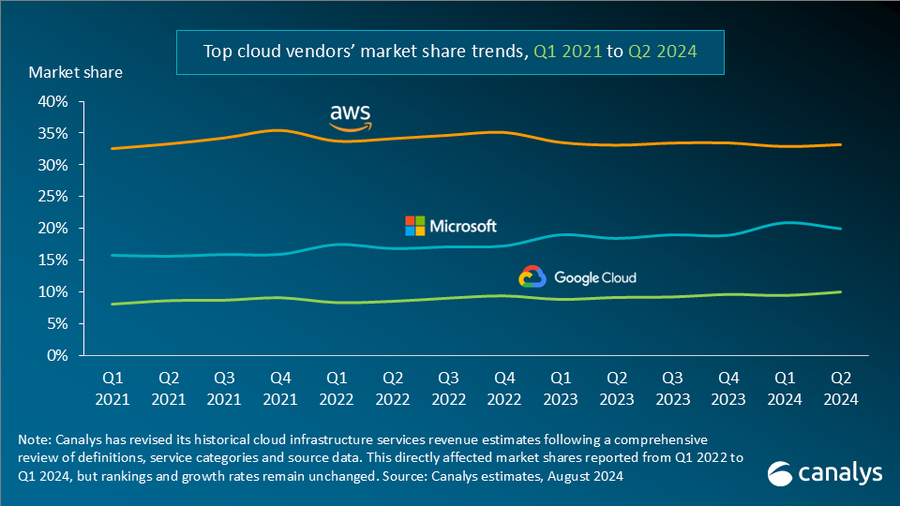

Canalys has revised its historical cloud infrastructure services revenue estimates following a comprehensive review of definitions, service categories and source data. This directly affected market shares reported from Q1 2022 to Q1 2024, but rankings and growth rates remain unchanged.

Below are the revised estimates for the period from Q1 2022 to Q1 2024, along with the latest Q2 2024 market share figures.

|

Worldwide cloud infrastructure services market |

||||

|

Amazon Web Services |

Microsoft Azure |

Google Cloud |

Others |

|

|

Q1 2022 |

34% |

17% |

8% |

41% |

|

Q2 2022 |

34% |

17% |

9% |

41% |

|

Q3 2022 |

35% |

16% |

9% |

40% |

|

Q4 2022 |

35% |

17% |

9% |

38% |

|

Q1 2023 |

34% |

19% |

9% |

39% |

|

Q2 2023 |

33% |

18% |

9% |

39% |

|

Q3 2023 |

33% |

18% |

9% |

39% |

|

Q4 2023 |

34% |

19% |

10% |

38% |

|

Q1 2024 |

33% |

21% |

10% |

37% |

|

Q2 2024 |

33% |

20% |

10% |

37% |

|

Note: percentages may not add up to 100% due to rounding |

|

|||

Accelerating demand for AI is expected to generate significant opportunities for sustained growth in cloud services. As enterprises adopt AI technologies, they will need more advanced and scalable cloud infrastructure, driving ongoing investment and development in cloud services. But concerns are emerging regarding potential over-investment in AI, as returns appear to be taking longer than initially anticipated. Despite these concerns, hyperscalers continue to increase their investments in AI – all three of the top hyperscalers ramped up their capital expenditure on data centers by tens of billions of dollars in the quarter – recognizing that overestimating investment risks may be more detrimental than underestimating them.

All three hyperscalers reported a significant surge in the number of customers using AI. They continue to introduce new AI products, such as Google Cloud’s Gemini 1.5 and Azure’s GPT-4o mini. AWS, through its cloud platform Bedrock, also offers Claude 3.5 Sonnet and other APIs.

“Commercialization of new technologies doesn’t happen overnight,” said Alex Smith, VP at Canalys. “The future of cloud computing remains promising. In the face of transformative tools like AI, the main providers will invest for fear of missing out. AI relies on large-scale computing power and storage, and the hyperscalers hope that AI-powered services become the next compelling reason for customers to transition to the cloud.”

In addition to launching new AI products and solutions, hyperscalers are intensifying efforts to strengthen their AI partner ecosystems. This quarter, leading vendors are placing particular emphasis on fostering AI startups. Notable initiatives include AWS’ Generative AI Accelerator and Google Cloud’s Google for Startups Accelerator, both aimed at engaging AI startups and driving innovation within the industry.

“Startups bring fresh perspectives, agility and specialist expertise, providing hyperscalers with opportunities to tap into emerging markets, address technological gaps and acquire new talent,” said Yi Zhang, Analyst at Canalys. “By supporting startups, hyperscalers ensure that even smaller companies can contribute to and benefit from the rapid advances in AI technology, ultimately driving growth, strengthening their ecosystems and maintaining their competitive edge in the industry.”

Canalys defines cloud infrastructure services as services providing infrastructure (IaaS and bare metal) and platforms that are hosted on third-party providers and made available to users through the Internet.

For more information, please contact:

Alex Smith: alex_smith@canalys.com

Yi Zhang: yi_zhang@canalys.com

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.