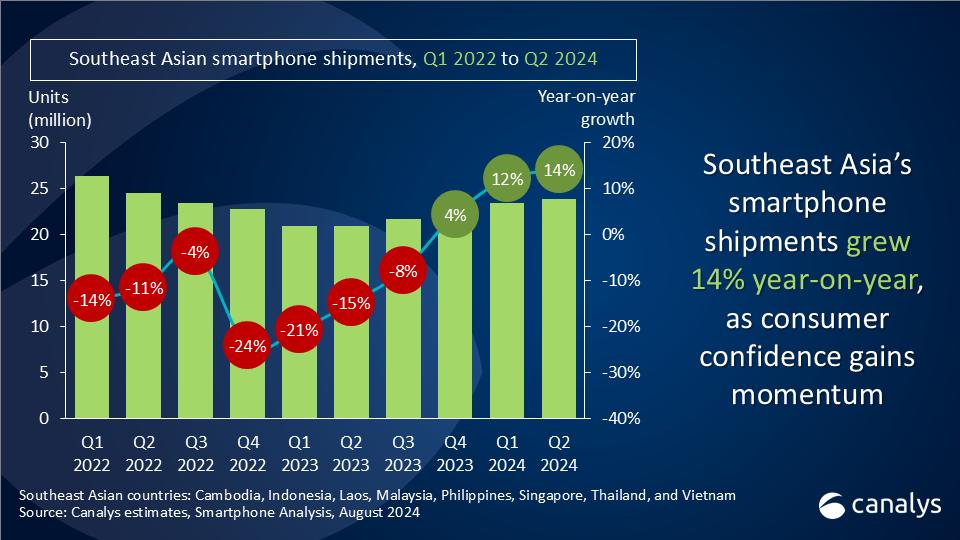

Southeast Asia smartphone shipments surge 14% Y-o-Y, outperforming global growth

Monday, 12 August 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

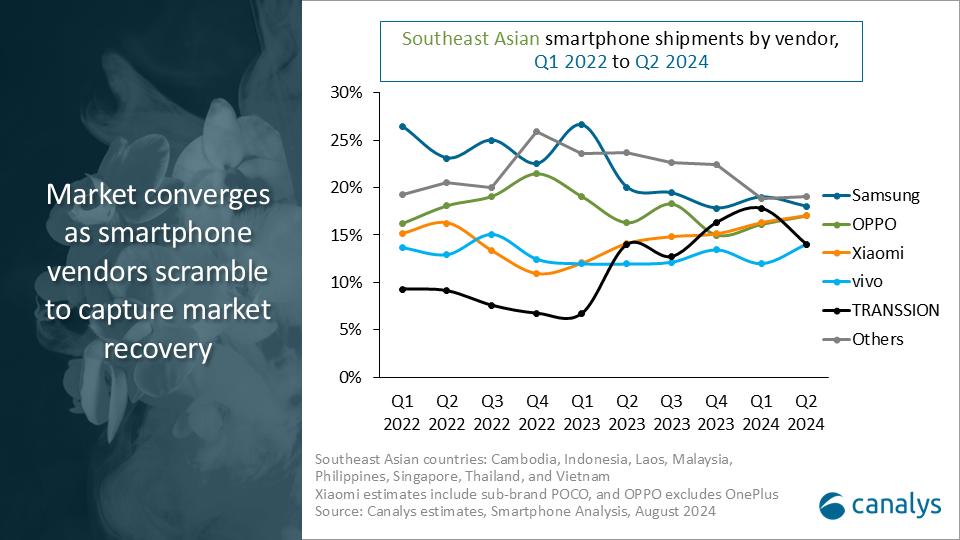

According to the latest Canalys data, Southeast Asia smartphone shipments experienced a 14% year-on-year growth in Q2 2024, reaching 23.9 million units. Samsung saw a slight recovery after seven consecutive quarters of year-on-year decline, shipping 4.4 million units and capturing 18% market share. OPPO (excluding OnePlus) reclaimed second position, shipping 4.2 million units for a market share of 17%. In third place, Xiaomi’s push in the low end saw it close the gap with 4.0 million units and a market share of 17%. vivo recaptured fourth spot with 3.4 million units and 14% market share. TRANSSION’s shipments slowed after a Q1 spike, finishing fifth with a 3.3 million shipment and a market share of 14%.

“The Southeast Asia smartphone market’s recovery is being driven by a macroeconomic recovery and growing consumer sentiment,” said Canalys Analyst Le Xuan Chiew. Smartphone vendors are optimizing product pricing strategies to capture this rebound. In the mass market segment, Xiaomi and TRANSSION lead with aggressive pricing and sales incentives, capitalizing on the region's price sensitivity. To support this growth, Xiaomi is also expanding its channel presence. For example, in Malaysia, according to Canalys’ monthly tracker, Xiaomi’s telco shipments have grown significantly since April, as it listed devices across all major telcos for the first time, driving volume with the affordable Redmi 13C 5G to align with government efforts to drive 5G devices to the masses. OPPO, in addition to launching its A60 in the US$100-200 price segment, enhanced its presence in the mid-to-high-end market by introducing the Reno12 series and brought the popular A3 Pro series from mainland China to the Southeast Asian market. vivo's dual-band strategy, with the Y03 for low-end and the V-series for mid-high segments, ensures healthy growth and a balanced product mix.

“The Southeast Asia high-end market has shown growth momentum, driven by vendors' investments in innovative technologies such as AI and diversified marketing and channel efforts,” added Chiew. “Vendor investment to develop high-end retail channels and experience stores in the region seems to be yielding positive results, with the premium segment seeing growth. The premium (above US$600) segment has grown 18% Y-o-Y from 4.3 million units in H1 2023 to 5.1 million units in H1 2024. Samsung has realigned its global strategy with laser focus on the high-end market. By investing heavily in marketing and creating exclusive pop-up events to showcase its AI capabilities, the company aims to enhance consumer awareness and drive device upgrades. Meanwhile, Apple grew 15% versus its H1 2023 results by expanding retail efforts in Vietnam and Malaysia, aggressive marketing, and Tim Cook’s Southeast Asia tour. Additionally, offering older generation devices at heavily discounted prices helped Apple drive its presence in the region, opening revenue streams through services and strengthening its ecosystem.”

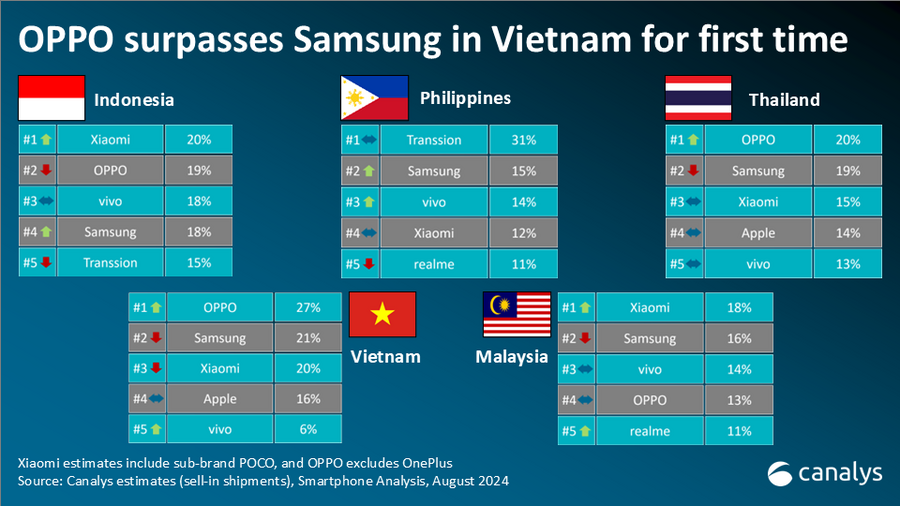

“Forex volatility and market price sensitivities are challenges vendors need to closely monitor,” said Canalys Analyst Sheng Win Chow. “Southeast Asia is increasingly recognized as a key market for smartphone vendors looking to expand their global footprint. The region's governments generally support foreign investment and have effectively managed currency and inflation risks with minimal trade restrictions. Additionally, its diverse demographics present significant opportunities for brands to engage with mass market segments, which can serve as a gateway to growth in the premium segment. Following TRANSSION’s successful market penetration in Indonesia and the Philippines with its strong value proposition, new vendors are now entering the region. HONOR’s accomplishments in Malaysia and Thailand in the mid-to-high-end segments have also opened new opportunities in these markets. To capitalize on the region’s geopolitical advantages in production and trade, brands should build strong relationships with local governments and telecom operators. This approach will help leverage digital transformation opportunities, foster strategic growth, reach new consumers, and enhance brand trust.”

|

Southeast Asian smartphone shipments and annual growth |

|||||

|

Vendor |

Q2 2024 |

Q2 2024 |

Q2 2023 |

Q2 2023 |

Annual |

|

Samsung |

4.4 |

18% |

4.2 |

20% |

5% |

|

OPPO |

4.2 |

17% |

3.4 |

16% |

24% |

|

Xiaomi |

4.0 |

17% |

2.9 |

14% |

37% |

|

vivo |

3.4 |

14% |

2.5 |

12% |

37% |

|

TRANSSION |

3.3 |

14% |

2.9 |

14% |

12% |

|

Others |

4.6 |

19% |

5.0 |

24% |

-8% |

|

Total |

23.9 |

100% |

20.9 |

100% |

14% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO, and OPPO excludes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Le Xuan Chiew: lexuan_chiew@canalys.com

Sheng Win Chow: shengwin_chow@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.