Western Europe’s PC market falls 37% in Q1 2023, but is on road to recovery

Tuesday, 13 June 2023

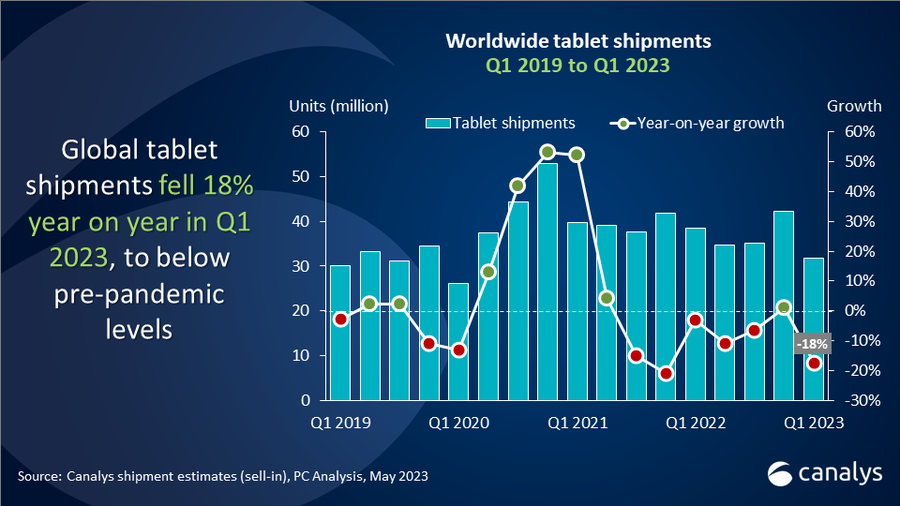

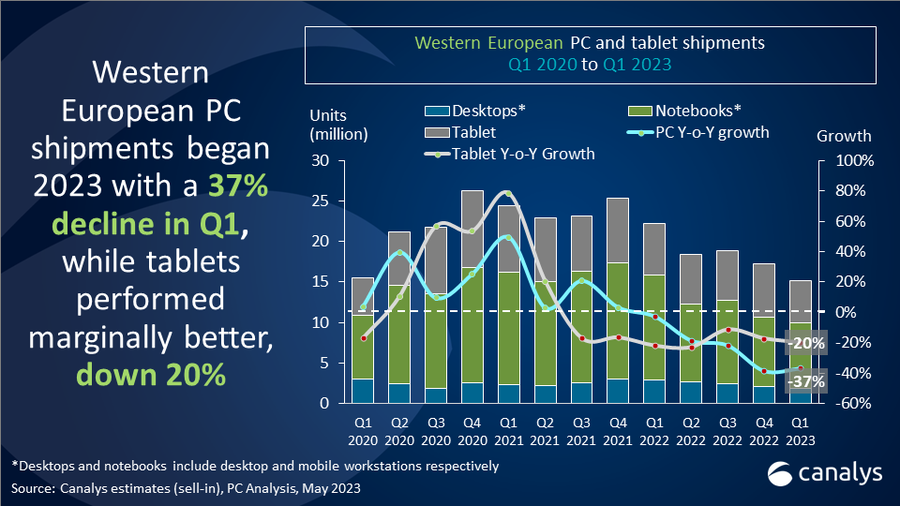

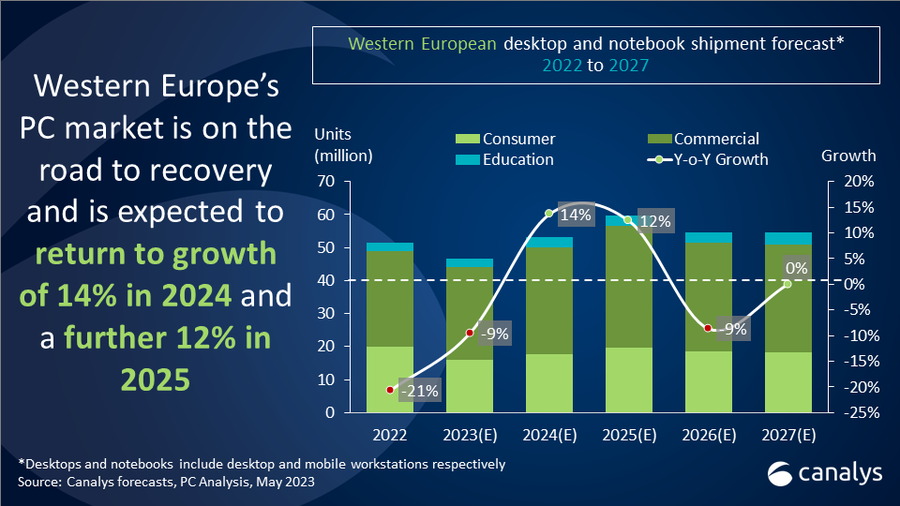

The latest Canalys estimates show Western European PC shipments (desktops, notebooks and workstations) fell 37% year-on-year to 10.0 million units in Q1 2023. Both PC categories faced similarly large drops, with notebook shipments down 37% to 8.1 million units and desktop shipments declining 35% to 1.9 million units. The tablet market performed comparatively better, with shipments down 20% year-on-year to 5.2 million units. The latest Canalys forecast anticipates PC and tablet shipments to Western Europe will fall 9% and 12% respectively for the full year 2023. However, both device category markets are on the road to recovery and are expected to show sequential growth for the remainder of 2023 and accelerated improvement in 2024.

“Western Europe’s PC market faced another large decline in Q1 2023 but there are positive signals that the region is past the worst,” said Canalys Research Analyst Kieren Jessop. “Although the consumer segment suffered a large year-on-year decline, the sequential drop after the holiday season was less drastic than in recent years. Consumer confidence levels in the EU have been rising for several months now, but inflation remains a drag on PC spending in the short-term. However, positive impacts from inventory level corrections and planned promotional activities will see the segment make a modest recovery by the end of the year.”

“On the commercial side, businesses are facing economic pressures that are limiting their immediate willingness to invest in their PC fleets,” added Jessop. “The ECB is expected to raise interest rates further this year after approving three hikes already. However, ensuring employees are outfitted with suitable PCs to maintain productivity will be crucial to organizations, especially as remote and hybrid workstyles continue to gain traction. With budgets tight, more companies in the region are open to Device-as-a-Service (DaaS) models to maintain flexibility on IT investments. This bodes well for longer term shipment volumes as it locks customers into a more regular cadence of device refreshes and derives additional value from attached services.”

A recent Canalys poll of EMEA channel partners found that a majority (57%) believe their DaaS revenue will grow in 2023; only 12% are forecasting a year-on-year decline.

Looking ahead, Canalys expects sequential growth for Western Europe’s PC market for the remainder of 2023. By 2024, every end-user segment is anticipated to grow double-digits year-on-year as demand recovers and delayed purchases re-emerge. As we approach the Windows 10 end-of-life in late 2025, the transition towards Windows 11 will also become a significant factor for device refreshes, particularly in the business segment. As of Q1 2023, more than a third of surveyed EMEA channel partners reported that Windows 11 is a significant driver of their PC sales.

|

Western Europe desktop, notebook, and workstation shipments (market share and annual growth) Canalys PC Market Pulse: Q1 2023 |

|||||

|

Vendor |

Q1 2023 shipments |

Q1 2023 |

Q1 2022 |

Q1 2022 |

Annual |

|

Lenovo |

2,632 |

26.4% |

4,119 |

26.0% |

-36.1% |

|

HP |

2,540 |

25.4% |

3,924 |

24.8% |

-35.3% |

|

Apple |

1,456 |

14.6% |

1,791 |

11.3% |

-18.8% |

|

Dell |

1,313 |

13.1% |

2,213 |

14.0% |

-40.7% |

|

Asus |

659 |

6.6% |

974 |

6.1% |

-32.4% |

|

Others |

1,389 |

13.9% |

2,823 |

17.8% |

-50.8% |

|

Total |

9,989 |

100.0% |

15,844 |

100.0% |

-37.0% |

|

|

|

|

|||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding |

|

||||

|

Western Europe tablet shipments (market share and annual growth) Canalys PC Market Pulse: Q1 2023 |

|||||

|

Vendor |

Q1 2023 shipments |

Q1 2023 |

Q1 2022 |

Q1 2022 |

Annual |

|

Apple |

2,276 |

44.1% |

2,644 |

41.1% |

-13.9% |

|

Samsung |

1,235 |

23.9% |

1,212 |

18.9% |

1.9% |

|

Lenovo |

461 |

8.9% |

901 |

14.0% |

-48.9% |

|

Amazon |

375 |

7.3% |

621 |

9.7% |

-39.6% |

|

Huawei |

159 |

3.1% |

302 |

4.7% |

-47.2% |

|

Others |

658 |

12.7% |

750 |

11.7% |

-12.4% |

|

Total |

5,164 |

100.0% |

6,431 |

100.0% |

-19.7% |

|

|

|

|

|||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Kieren Jessop: kieren_jessop@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.