Southeast Asian smartphone market’s drop softened amid healthier inventory level

Friday, 1 December 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

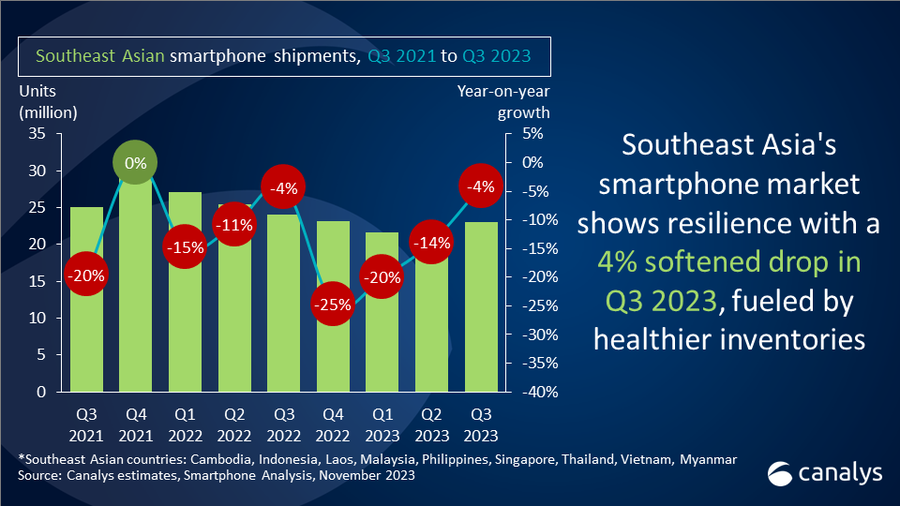

Canalys' latest research reveals that the Southeast Asia smartphone market fell 4% year-on-year in Q3 2023 to 23 million units due to volatile macroeconomic conditions. However, the magnitude of the decline has diminished to single digits. The market is rebounding as smartphone manufacturers improve their inventories and ramp up channel activities. Vendors are investing in high-profile launches to elevate their brand image and ignite excitement in the market.

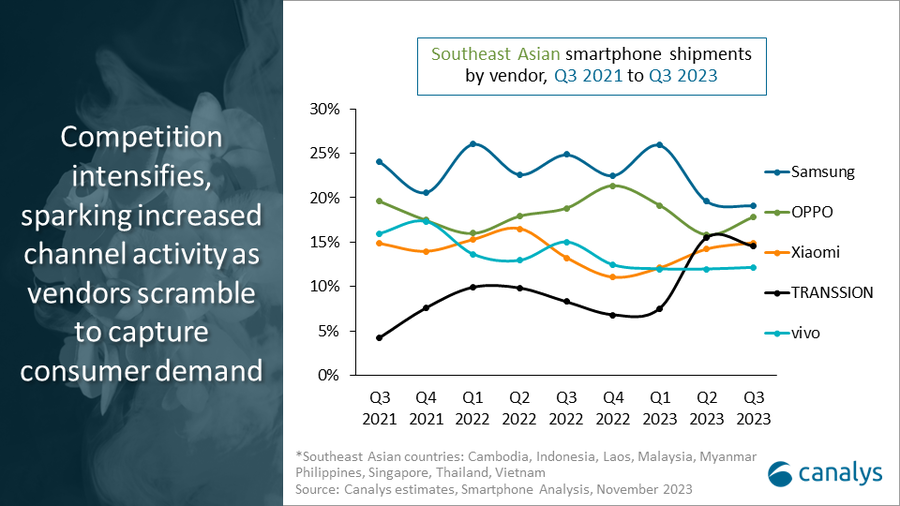

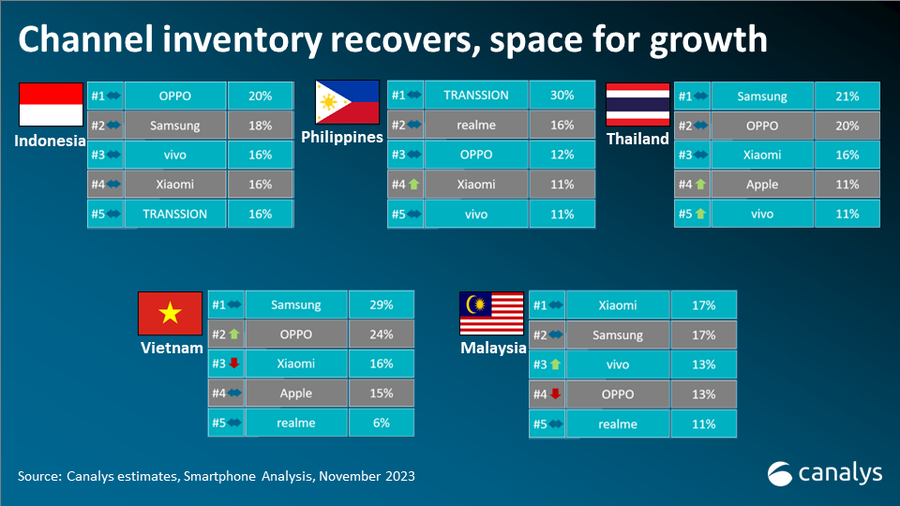

“The decline in shipments marked the seventh consecutive drop in annual growth in Southeast Asia as inflation and high interest rates continue to plague the region. Having weathered a few challenging quarters, smartphone brands are becoming more prudent in their inventory management,” said Le Xuan Chiew, Analyst at Canalys. “Despite Samsung leading the market with a 19% market share, it witnessed the largest year-over-year decline of 26% as it remains impacted by inventory woes. OPPO came in close second with a market share of 18%, driven by new launches of Ax8 to defend its mid-low-end share. Xiaomi regained third position with a market share of 15% as it increased its low-end aggression through channel incentive programs. TRANSSION followed closely, taking the fourth spot with a market share of 15% as it began to expand into countries outside of Indonesia and the Philippines. vivo came in fifth with a market share of 12% through a defensive dual price band strategy.”

“Smartphone manufacturers optimized channel investments and calibrated product portfolio to drive brand visibility among the price-sensitive consumers,” added Chiew. “The gap between top Android players has narrowed while the dynamic landscape of the region offers opportunities to new entrants like HONOR, Google and TRANSSION who are looking for a piece of the smartphone pie. Despite tighter margins, brands like Xiaomi and TRANSSION are stepping up their price aggression in the sub-US$150 price band. The entry level provides brands a sure-fire way to drive brand penetration into high volume but highly price-sensitive Tier-2 cities. In the high-end segment, to compete with Apple, Android vendors are testing new innovative go-to-market strategies with foldables and creative marketing approaches to drive ecosystem conversion. The high-profile launch of OPPO’s new Find N3 series and Google’s Pixel 8 series sparked higher-than-expected consumer demand and were key additions to its premium portfolio.”

“The growing middle class makes the region an attractive market for mid-high-end consumers,” said Sheng Win Chow, Analyst at Canalys. “Smartphone vendors are increasing their investments in distribution channels to enhance affordability and expand their share of consumers' wallets. Apple and Samsung are expanding their operator channels in countries like Thailand and Malaysia which is critical to driving brand volume and improving affordability for their mid-high-end portfolios. Brands like OPPO, Xiaomi and Samsung are focusing their channel expansion resources on developing high-end experience stores in high-traffic areas to grow their presence through brand ambassadors. Meanwhile, TRANSSION and HONOR are looking to stabilize their distribution into Tier-1 cities by growing their channel partnerships to solidify their positioning within the region.”

“In line with our expectation, the market is rebounding, with recovering consumer confidence fueled by year-end sales and heightened brand promotions,” said Chow. “Growing interest rates increase the cost of borrowing for consumers. However, affordability is eased by the availability of various financing options, trade-in programs and support through different channels. Smartphone vendors need to further optimize their resources to expertly navigate the uncertain channel landscape to stimulate consumer demand and drive brand awareness. Price war in the ultra-low end is no longer a sustainable solution for smartphone vendors, given that already small margins in the low-end are further stressed by inflationary conditions and volatile interest rates.”

|

Southeast Asian smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q3 2023 |

|||||

|

Vendor |

Q3 2023 |

Q3 2023 |

Q3 2022 |

Q3 2022 |

Annual |

|

Samsung |

4.4 |

19% |

6.0 |

25% |

-26% |

|

OPPO |

4.1 |

18% |

4.5 |

19% |

-9% |

|

Xiaomi |

3.4 |

15% |

3.2 |

13% |

8% |

|

TRANSSION |

3.4 |

15% |

2.0 |

8% |

69% |

|

vivo |

2.7 |

12% |

3.6 |

15% |

-24% |

|

Others |

5.0 |

22% |

4.8 |

20% |

5% |

|

Total |

23.0 |

100% |

24.1 |

100% |

-4% |

|

|

|

|

|||

|

Note: percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Chiew Le Xuan: lexuan_chiew@canalys.com

Sheng Win Chow: shengwin_chow@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.