Southeast Asia's smartphone market fell 15% in Q2 2023, marking the sixth consecutive drop

Wednesday, 30 August 2023

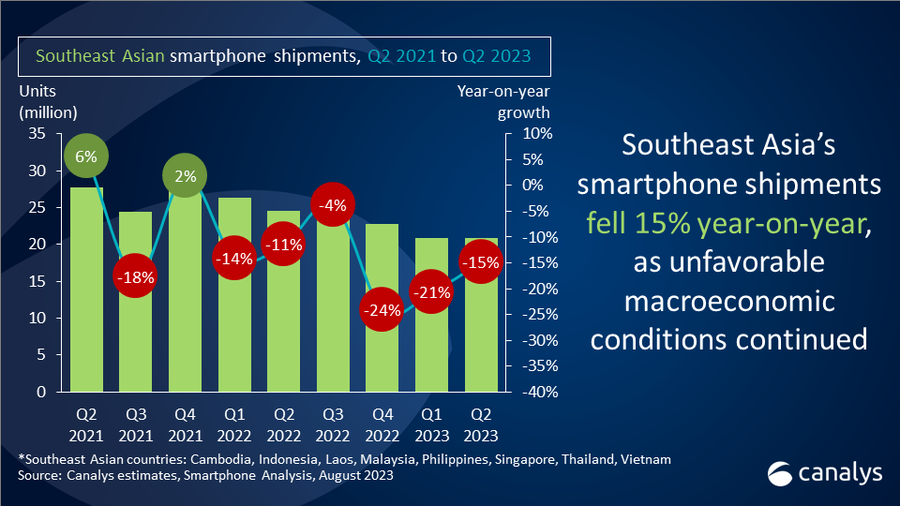

Canalys research reveals that the Southeast Asia smartphone market fell 15% year-on-year in Q2 2023 to 20.9 million units, the lowest shipment since 2014, as the unfavorable macroeconomic conditions continued. This led to an increase in old stock, stifling new initiatives and inventory from vendors and a lackluster festive season.

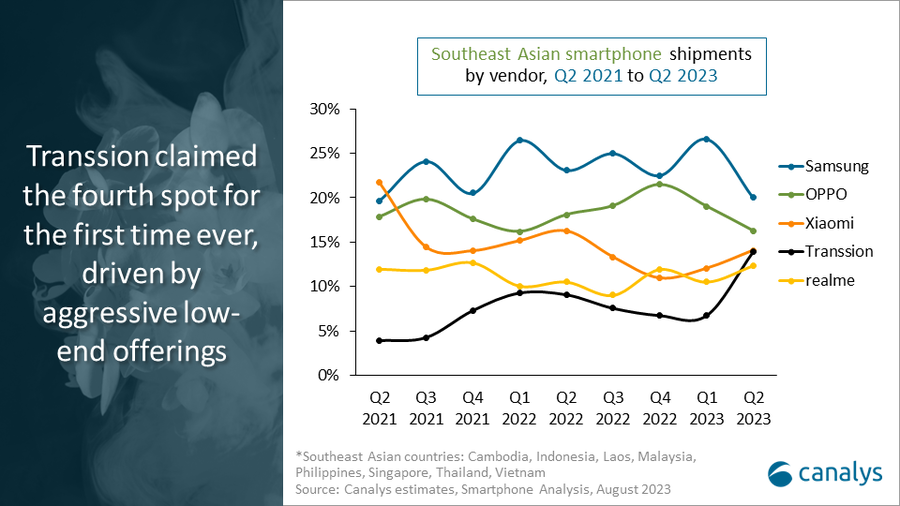

The decline in shipments marked the sixth consecutive drop in growth in Southeast Asia. “Brands maintained a cautious approach to the quarter and focused on strengthening channel positioning for long-term share sustainability,” said Le Xuan Chiew, Analyst at Canalys. “Apple increased channel incentive efforts as it faced challenges in calibrating its inventory of non-pro iPhone 14. Samsung normalized channel inventory as well. Its low and mid-range models faced product cannibalization as discounted old stocks caused unstable pricing and cluttered product offerings. Meanwhile, Transsion was the only vendor to grow (31%), entering the top five for the first time, with aggressive channel incentives by focusing on Tier-2 cities. Sub-brands Infinix and Tecno employed initiatives such as free device bundles and rebates, along with affordable low-end models.

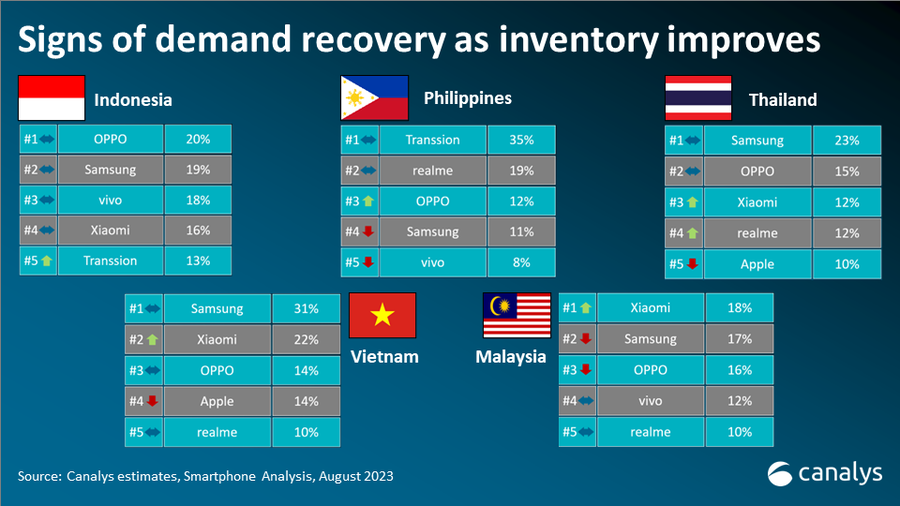

Despite a year-on-year decline of 26%, Samsung maintained its lead in Southeast Asia, shipping 4.2 million units, gaining 20% market share, driven by its new A-series models. OPPO maintained its second position by shipping 3.4 million units and capturing a 16% market share. OPPO invested in boosting its Find and Reno series' brand visibility and expanded its operator footprint in markets like Malaysia and Thailand. Xiaomi and Transsion both shipped 2.9 million units, each gaining 14% market share respectively. Xiaomi leveraged the new launch of its Redmi Note 12 series as a key volume driver. Transsion expanded its market share by expanding in Malaysia, Thailand and Indonesia while solidifying its market leader position in the Philippines. realme reclaimed the fifth spot, shipping 2.6 million units and capturing a 12% market share as it saw success with its new C-series launches.

“In Q2 2023, increased 5G adoption in operator-centric markets like Thailand and Malaysia drove some momentum, as telco operators seek cost-effective 5G devices for promotions,” added Chiew. “Shipments fell by 7% and 11% year-on-year respectively in these markets, but the growing telco channel softened the decline. Affordable 5G remains a key driver for maintaining long-term share in telco-driven markets. Samsung, for example, achieved success with its A14 5G in the telco channel while OPPO and vivo also entered this segment via A78 5G and Y36 5G. On the other hand, markets such as Indonesia and the Philippines dropped 13% and 18% respectively. Brands in these markets had to subsidize their channel partners as excess channel inventory forced retailers to clear stocks below cost to create room for new shipments. Vietnam, being an export-driven economy, witnessed a shipment decline of 24% as it was highly exposed to the global economic slowdown.

“The market is expected to gain momentum in H2 2023 as channel inventory returns to healthier levels,” said Sheng Win Chow, Analyst at Canalys. “The ramp-up of incentive programs and new high-end launches should increase retail sales Q3 2023 onward. The long-term outlook for Southeast Asia is intact and Canalys expects mid-single-digit growth in 2024. Expansion of the online channel will contribute largely to future growth as investments from e-commerce operators improve infrastructure, and timely payment and logistics will enable e-retailers to scale more efficiently. Increased marketing expenditure will spur demand by enabling more aggressive discounting. In addition, the region’s increasing disposable income from an expanding middle-class and young population entering the workforce are strong reasons to expect an improved landscape.”

|

Southeast Asian smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q2 2023 |

|||||

|

Vendor |

Q2 2023 |

Q2 2023 |

Q2 2022 |

Q2 2022 |

Annual |

|

Samsung |

4.2 |

20% |

5.7 |

23% |

-26% |

|

OPPO |

3.4 |

16% |

4.4 |

18% |

-24% |

|

Xiaomi |

2.9 |

14% |

4.0 |

16% |

-26% |

|

Transsion |

2.9 |

14% |

2.2 |

9% |

31% |

|

realme |

2.6 |

12% |

2.6 |

11% |

0% |

|

Others |

4.9 |

23% |

5.6 |

23% |

-13% |

|

Total |

20.9 |

100% |

24.5 |

100% |

-15% |

|

Note: Xiaomi estimates include sub-brand POCO. OPPO excludes OnePlus. |

|

||||

For more information, please contact:

Chiew Le Xuan: lexuan_chiew@canalys.com

Sheng Win Chow: shengwin_chow@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.