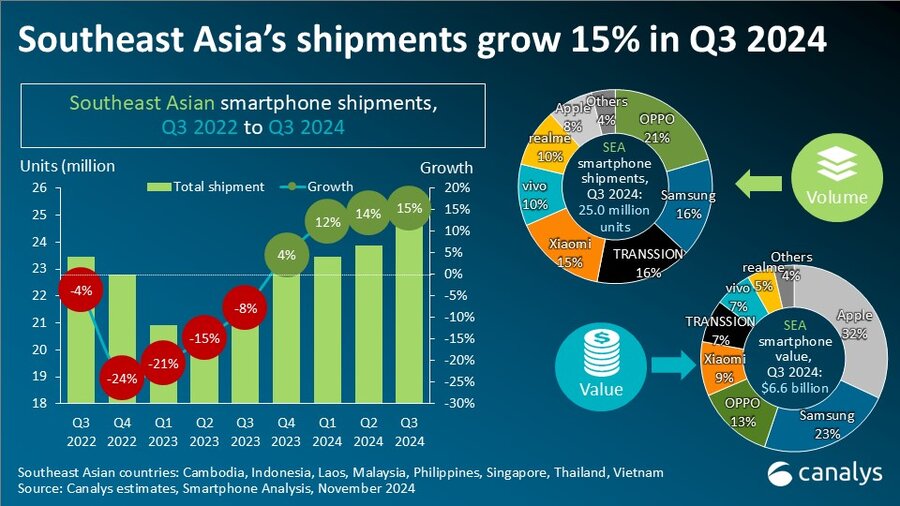

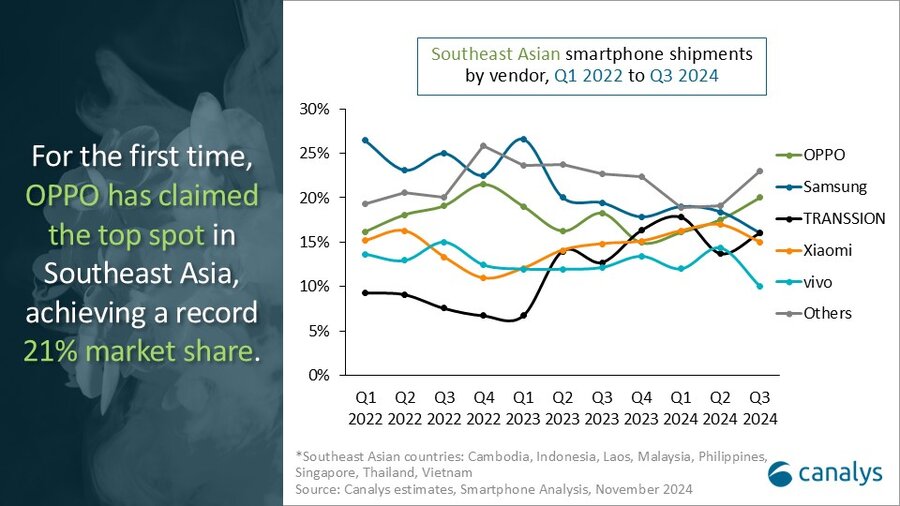

Southeast Asia’s smartphone market grew 15% in Q3 2024 with OPPO leading for first time

Monday, 11 November 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Canalys' latest research reveals that the Southeast Asia smartphone market grew 15% year on year in Q3 2024 to 25.0 million units. OPPO led the smartphone market in Southeast Asia with 5.1 million units shipped and a 21% market share, driven primarily by its re-branded entry-level models, the A3x and A3. Samsung followed with 16% market share and 23% value share. The outstretched value over volume share reflects its ongoing premiumization strategy to prioritize ASP growth over shipment growth. TRANSSION secured third place, shipping 4.0 million units and capturing a 16% market share. However, the company’s rapid growth appears to be leveling off as it shifts focus from expanding market share to enhancing profitability and value in the coming quarters. Xiaomi ranked fourth with a 15% market share and 3.9 million units shipped, bolstered by strong growth of competitively priced models like the Redmi 14C and A3. Rounding out the top five, vivo shipped 2.6 million units, capturing a 10% market share.

“The volume growth in Q3 2024 was accompanied by a 4% decline in the region's ASP,” commented Sheng Win Chow, Analyst at Canalys. “This price drop was primarily due to increased new launches and oversaturation of devices in the low and mid-range price points. Vendors, particularly in the mass market (US$100 to US$300) segment, struggle to differentiate beyond price and affordability, leading to heavy reliance on promotions and discounts to drive volume. Moreover, heavy discounts on older models exacerbate the issue, by creating price conflicts with new model launches. This ‘price war’ is increasingly unsustainable. Rising Bill of Materials (BOM) and inflationary costs in running sales activities are reducing profitability. To counter these pressures, vendors are consolidating their entry-level portfolios to achieve lower costs and clearer product segmentation. OPPO's A3x, for instance, simplified the entry-level offering to a single model, driving volume through better pricing. Samsung's strategy is similar - it opted not to launch an A0s variant with this year's A06 as the less cluttered offering helps to create clearer differentiation between the A06 and A16 series.”

“Changing dynamics in Vietnam’s 5G landscape makes it a pivotal battleground for the mid-range smartphone market,” said Le Xuan Chiew, Analyst at Canalys. “High activation costs for 5G devices made launching affordable 5G devices challenging. OPPO benefited from this in recent quarters, capturing market share with a strong lineup of competitive 4G devices in the US$175 to US$250 price range. However, as the 5G rollout accelerates through a combined effort by network operators with government support, the outlook for affordable 5G devices will improve. Samsung is well-positioned to regain market share as an early leader in 5G and has strong relationships with telco operators. To remain competitive, other brands will need to adapt their offerings to align with initiatives that drive 5G penetration. Xiaomi’s recent success in Malaysia serves as a model. Its strategic expansion in early 2024 enabled its premium Xiaomi 14T series to launch across all telcos, boosting affordability and accessibility.”

“Canalys anticipates ASP to trend upward in the future despite the current dip,” noted Le Xuan Chiew, Analyst at Canalys. “Brands are leveraging different channel strategies to create product differentiation and segmentation. OPPO and Samsung are increasing their investment in premium experience stores across Southeast Asia to boost brand perception and capture replacement demand. HONOR and Xiaomi are expanding partnerships with mobile operators in Thailand and Malaysia, using these channels to reach a broader audience. Apple, which saw 34% year-on-year growth in the region through aggressive expansion of its distribution and branded stores, further highlights the region’s potential as a crucial market for premium smartphone brands. Despite Southeast Asia’s potential, a one-size-fits-all approach is ineffective. Vendors must stay flexible to address local market challenges. Indonesia's recent ban on the iPhone 16, following disputes over Apple’s investment commitments, is a case in point. Despite this, Chinese OEMs that meet Indonesia’s localization requirements have also achieved notable success, highlighting the importance of localization in this high potential region.”

|

Southeast Asian smartphone shipments and annual growth |

|||||

|

Vendor |

Q3 2024 |

Q3 2024 |

Q3 2023 |

Q3 2023 |

Annual |

|

OPPO |

5.1 |

21% |

4.0 |

18% |

29% |

|

Samsung |

4.1 |

16% |

4.2 |

19% |

-2% |

|

TRANSSION |

4.0 |

16% |

2.8 |

13% |

46% |

|

Xiaomi |

3.9 |

15% |

3.2 |

15% |

20% |

|

vivo |

2.6 |

10% |

2.6 |

12% |

-2% |

|

Others |

5.3 |

21% |

4.9 |

23% |

8% |

|

Total |

25.0 |

100% |

21.6 |

100% |

15% |

|

|

|

||||

For more information, please contact:

Sheng Win Chow: shengwin_chow@canalys.com

Le Xuan Chiew: lexuan_chiew@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.