AI-capable PC shipment share rises to 20% in Q3 2024

Wednesday, 13 November 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

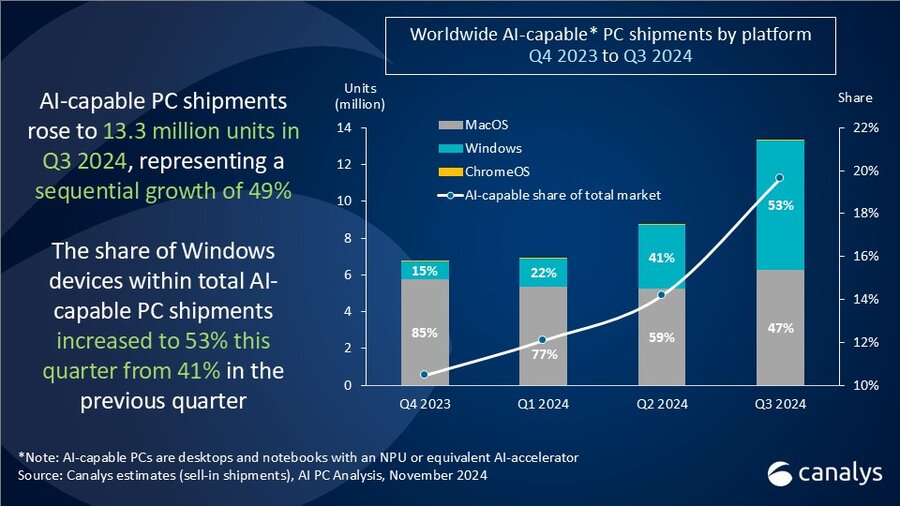

The latest Canalys data shows that AI-capable PC shipments hit 13.3 million units in Q3 2024, accounting for 20% of all PC shipments during the quarter. AI-capable PCs are defined as desktops and notebooks that include a chipset or block for dedicated AI workloads such as an NPU. The ramp-up in the availability of such devices led to a sequential growth of 49% for this new category of PCs. Windows devices accounted for a majority of AI-capable PC shipments for the first time, capturing a 53% share. While the Windows 11 refresh cycle and processor roadmaps will continue to drive penetration, a key challenge moving forward will be to convince customers to future-proof for a boom in on-device AI use cases.

“Progress along AI-capable PC roadmaps maintained a strong pace in Q3 2024,” said Ishan Dutt, Principal Analyst at Canalys. “Copilot+ PCs equipped with Snapdragon X series chips enjoyed their first full quarter of availability while AMD brought Ryzen AI 300 products to the market and Intel officially launched its Lunar Lake series. However, both x86 chipset vendors are still awaiting Copilot+ PC support for their offerings from Microsoft which is expected to arrive this month.”

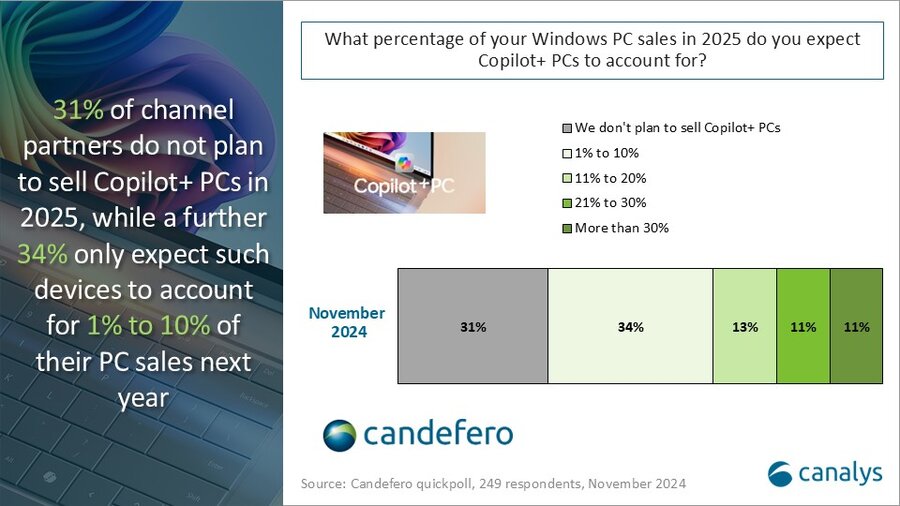

“Despite the positive momentum, significant work must still be done to convince both channel partners and end customers of the benefits of AI-capable PCs,” said Dutt. “This is especially true for more premium offerings such as Copilot+ PCs, which Microsoft requires to have at least 40 NPU TOPS alongside other hardware specifications. A November poll of channel partners revealed that 31% do not plan to sell Copilot+ PCs in 2025, while a further 34% expect such devices to account for less than 10% of their PC sales next year. With the Windows 10 end-of-support now less than a year away, the coming quarters represent a critical opportunity to drive a significant portion of an aged installed based to be upgraded to an AI-capable PC.”

Vendor and platform highlights

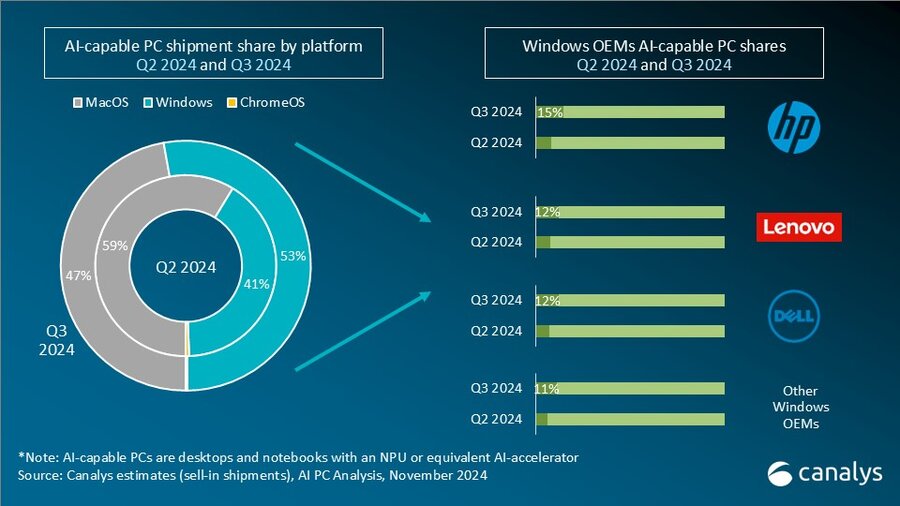

Total Windows AI-capable PC shipments grew 93% sequentially, accounting for 12% of all Windows PC shipped in Q3. “There is currently little to distinguish the major Windows vendors’ AI-capable PC shipment performance as a proportion of their overall shipment,” said Kieren Jessop, Analyst at Canalys. “The key factor in their future success in the space will rely on compelling differentiation beyond hardware.”

HP, at its “Imagine AI” event in September, emphasized its collaboration with ISVs and third-party developers to deliver on-device AI experiences. Meanwhile for Lenovo, a key focus in recent months has been around proprietary AI tools and agents embedded into its PCs, such as its Creator Zone, Learning Zone and Lenovo AI Now. For vendors like Lenovo and Dell, whose offerings extend beyond PCs, on-device AI will be a key component of the delivery of broader, more holistic AI services and solutions.

“Apple’s strategic approach in this landscape is distinct,” added Jessop. “It is leveraging its vertically integrated ecosystem to create features that do not need to directly compete with Microsoft’s suite of productivity tools such as Copilot Pro for Microsoft 365, which is compatible with macOS. Apple can instead focus its differentiation at the hardware and OS level, positioning itself against Windows OEMs in an effort to make market share gains during the ongoing refresh cycle.”

Canalys AI capable PC definition:

At a minimum, an AI-capable PC must be a desktop or notebook possessing a dedicated chipset or block to run on-device AI workloads. Examples of these dedicated chipsets include AMD’s XDNA, Apple’s Neural Engine, Intel’s AI Boost and Qualcomm’s Hexagon.

Further reading:

Canalys special report: Now and Next for AI-capable PCs

For more information, please contact:

Ishan Dutt: ishan_dutt@canalys.com

Kieren Jessop: kieren_jessop@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and broken down by market, vendor and channel, with additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.