India’s PC market grows at its fastest rate in a decade as shipments jump 45% in 2021

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 24 March 2022

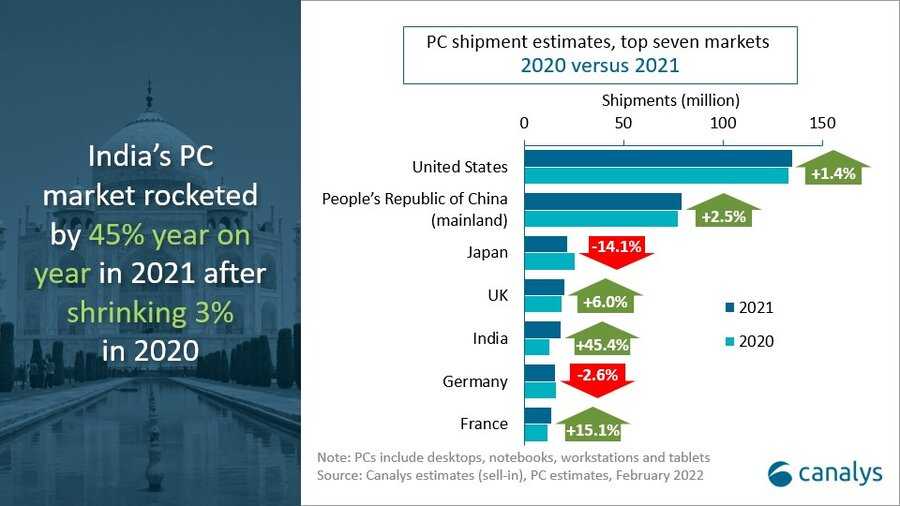

India’s PC market grew 45% in 2021, with shipments of desktops, notebooks and tablets reaching 18.6 million units. This was the best year for India since 2013, when shipments grew by 29%. This is a notable achievement, considering most of India was under lockdown in Q1 and Q2, when the second wave of the COVID-19 pandemic was at its peak. While the pandemic dampened business activities to a large extent, it also fueled demand for PCs, especially as students and professionals found themselves out of schools and offices for a prolonged period. Notebooks made up 63% of total shipments, with 11.8 million units shipping, up by 49% year on year and accounting for most of the market growth. Tablets reached 4.4 million units shipped, up 48%, a contrast to the global fall of 3%. 2.4 million desktops shipped, up 27% on 2020.

|

India PC (including tablets) shipments (market share and annual growth) Canalys PC Market Pulse: 2021 |

|||||

|

Vendor |

2021 |

2021 |

2020 |

2020 |

Annual |

|

HP |

4,677 |

25.1% |

2,948 |

23.0% |

58.6% |

|

Lenovo |

4,287 |

23.0% |

3,295 |

25.7% |

30.1% |

|

Dell |

2,590 |

14.0% |

1,843 |

14.4% |

40.5% |

|

Samsung |

1,344 |

7.2% |

673 |

5.3% |

99.8% |

|

Acer |

1,261 |

6.8% |

781 |

6.1% |

61.5% |

|

Others |

4,453 |

23.9% |

3,262 |

25.5% |

36.5% |

|

Total |

18,612 |

100.0% |

12,802 |

100.0% |

45.4% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2022 |

|||||

“While this seems like a great year on paper, it is important to consider 2021 not just as a standalone year but in relation to 2020,” said Jash Shah, Research Analyst at Canalys. “When the pandemic hit in 2020 and PC supplies were squeezed, vendors naturally prioritized western markets, such as the US and Western Europe, leaving markets like India with a reduced supply. India’s PC shipments fell 3% in 2020, creating a lot of pent-up demand, which was amplified due to the second COVID-19 wave in the first half of 2021, leading to the record growth that we’ve seen this year.”

“While 2021 saw a huge jump in shipments, the same is not expected of 2022 in India,” said Shah. “We will see major corrections, especially in the consumer market, affecting notebooks and tablets. But there will be stronger demand from SMBs and enterprise customers, as the number of COVID-19 cases falls, vaccination rates surge, and businesses and schools return to normal. Key themes will remain local production of PCs, important from a government orders fulfilment perspective, and commercial upgrades, which will be spurred by the return to offices and new policies around hybrid working. PCs in education remain a major opportunity in the long term, given India’s low student PC ownership ratios. But as students return to school, demand is expected to soften in the short term. The threat, however, lies not in local demand, but in global supply. As China takes a strong stance on its Zero-COVID policy, implementing lockdowns in major manufacturing hubs across the country, supply disruptions will occur, and India is again expected to get the short end of the stick.”

|

India PC (including tablets) shipments (market share and annual growth) Canalys PC Market Pulse: Q4 2021 |

|||||

|

Vendor |

Q4 2021 |

Q4 2021 |

Q4 2020 |

Q4 2020 |

Annual |

|

HP |

1,321 |

25.0% |

785 |

21.7% |

68.3% |

|

Lenovo |

1,151 |

21.8% |

795 |

21.9% |

44.7% |

|

Dell |

805 |

15.2% |

604 |

16.7% |

33.2% |

|

Acer |

362 |

6.9% |

203 |

5.6% |

78.0% |

|

Apple |

359 |

6.8% |

179 |

5.0% |

100.0% |

|

Others |

1,286 |

24.3% |

1,059 |

29.2% |

21.5% |

|

Total |

5,283 |

100.0% |

3,625 |

100.0% |

45.7% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2022 |

|||||

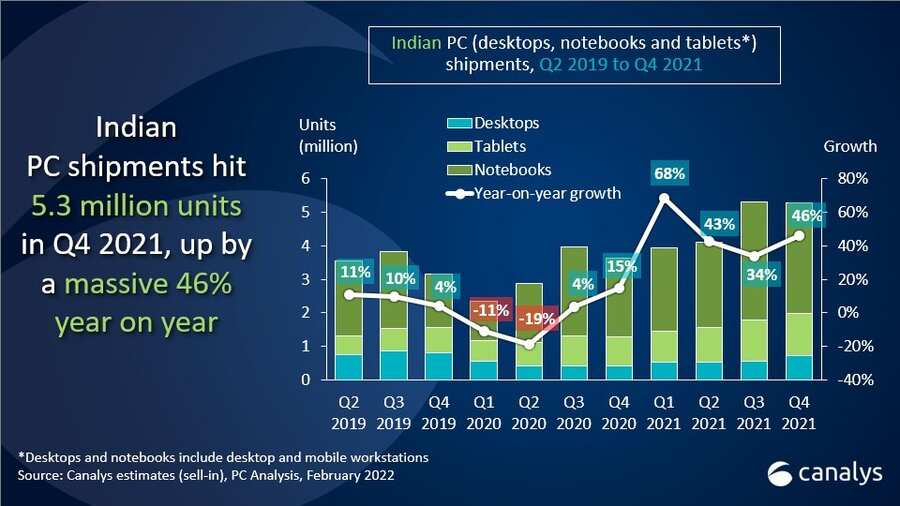

PC shipments in Q4 2021 reached a total of 5.3 million units, up 46% on Q4 2020, and 67% on Q4 2019, when 3.2 million units shipped. Notebooks grew 40% to reach 3.3 million shipments, while desktop shipments were up 70% year on year to surpass 700,000 units for the first time in eight quarters. Tablet shipments grew 49% over the same period last year to reach 1.3 million units. Most of this growth is due to companies such as Lenovo and Samsung, which have increased their ability to fulfil orders by manufacturing locally.

|

India desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q4 2021 |

|||||

|

Vendor |

Q4 2021 |

Q4 2021 |

Q4 2020 |

Q4 2020 |

Annual |

|

HP |

1,321 |

32.8% |

785 |

28.2% |

68.3% |

|

Dell |

804 |

20.0% |

604 |

21.7% |

33.1% |

|

Lenovo |

714 |

17.7% |

540 |

19.4% |

32.3% |

|

Acer |

340 |

8.4% |

189 |

6.8% |

80.1% |

|

Apple |

187 |

4.7% |

105 |

3.8% |

78.6% |

|

Others |

662 |

16.4% |

558 |

20.1% |

18.6% |

|

Total |

4,028 |

100.0% |

2,781 |

100.0% |

44.9% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2022 |

|||||

|

India desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: 2021 |

|||||

|

Vendor |

2021 |

2021 |

2020 |

2020 |

Annual |

|

HP |

4,677 |

33.0% |

2,948 |

30.1% |

58.7% |

|

Lenovo |

2,733 |

19.3% |

2,225 |

22.7% |

22.8% |

|

Dell |

2,588 |

18.3% |

1,843 |

18.8% |

40.4% |

|

Acer |

1,160 |

8.2% |

723 |

7.4% |

60.5% |

|

Asus |

873 |

6.2% |

649 |

6.6% |

34.5% |

|

Others |

2,134 |

15.1% |

1,407 |

14.4% |

51.7% |

|

Total |

14,165 |

100.0% |

9,795 |

100.0% |

44.6% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2022 |

|||||

Vendor performances

|

India tablet shipments (market share and annual growth) Canalys PC market pulse: Q4 2021 |

|||||

|

Vendor |

Q4 2021 |

Q4 2021 |

Q4 2020 |

Q4 2020 |

Annual |

|

Lenovo |

436 |

34.8% |

255 |

30.2% |

71.0% |

|

Samsung |

317 |

25.3% |

197 |

23.4% |

60.8% |

|

Apple |

172 |

13.7% |

75 |

8.8% |

130.1% |

|

Lava |

110 |

8.8% |

- |

- |

N/A |

|

TCL |

22 |

1.8% |

25 |

3.1% |

-13.5% |

|

Others |

197 |

15.6% |

292 |

34.5% |

-32.5% |

|

Total |

1,255 |

100.0% |

845 |

100.0% |

48.5% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2022 |

|||||

|

India tablet shipments (market share and annual growth) Canalys PC market pulse: 2021 |

|||||

|

Vendor |

2021 |

2021 |

2020 |

2020 |

Annual |

|

Lenovo |

1,554 |

35.0% |

1,070 |

35.6% |

45.2% |

|

Samsung |

1,344 |

30.2% |

673 |

22.4% |

99.8% |

|

Apple |

547 |

12.3% |

272 |

9.1% |

100.9% |

|

Lava |

110 |

2.5% |

- |

- |

N/A |

|

Acer |

101 |

2.3% |

58 |

1.9% |

74.2% |

|

Others |

791 |

17.7% |

935 |

31.0% |

-15.4% |

|

Total |

4,447 |

100.0% |

3,008 |

100.0% |

47.9% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2022 |

|||||

For more information, please contact:

Jash Shah (India): jash_shah@canalys.com +91 95661 11317

Ashweej Aithal (India): ashweej_aithal@canalys.com +91 97386 19281

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.