Middle East smartphone market grew 14% in 2024, reaching pre-pandemic levels

Monday, 17 February 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

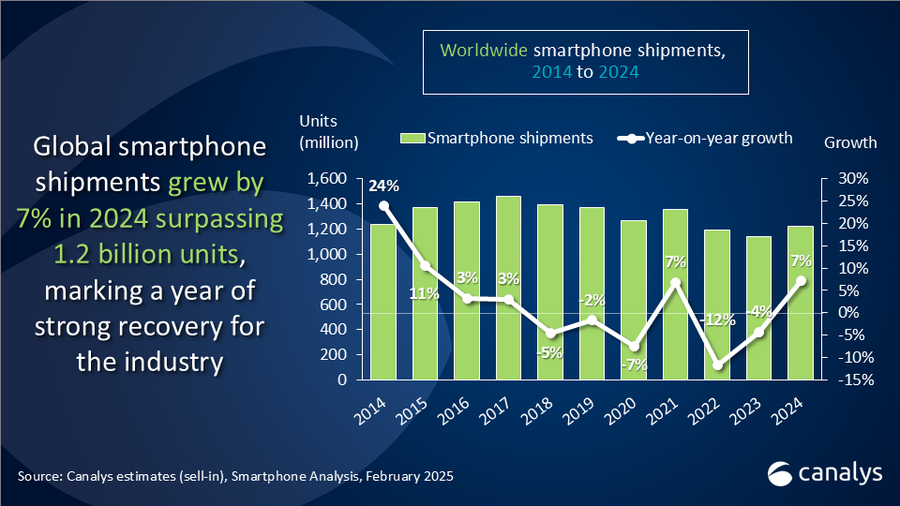

Canalys, now part of Omdia, reports that the Middle East (excluding Turkey) smartphone market surged in 2024, recording a robust 14% annual growth, nearly double the global recovery rate of 7%. A total of 48.4 million smartphones were shipped during the year, fueled by vendors’ market expansion and rising demand for premium devices. However, growth momentum slowed in Q4 2024, with shipments rising by just 3% year on year to 12.5 million units, following a 29% surge in the first half of the year. This slowdown was driven by channel inventory buildup from H1 and macroeconomic challenges, including inflationary pressures and shifting consumer spending patterns. Looking ahead, while premium devices continue to see strong demand, longer replacement cycles in 2025 will pose challenges for brands as consumers adopt a more cautious approach to upgrades.

Key markets grew modestly as channels stayed cautious post-H1 shipments surge

Saudi Arabia’s smartphone market grew 6% year on year in Q4 2024, down from earlier double-digit gains in the first half of the year. The rise of an “always-on” shopping culture, fueled by ecommerce expansion like iQOO’s exclusive launch with Noon and year-end promotions from retailers like Xtra’s annual “Mega Sale”, continue to influence consumer engagement. However, rising housing and energy costs are driving cautious spending into 2025.

The UAE’s smartphone market too saw modest 4% growth, driven by aggressive promotions. Retailers like Jumbo and Emax boosted repeat purchases with loyalty-driven offers, bundling high-end phones with gold prizes, travel vouchers and accessories. Meanwhile, Iraq’s smartphone market fell 4% due to rising inflation and unemployment, dampening demand. In contrast, Kuwait and Qatar witnessed strong growth at 19% and 15%, respectively, driven by record consumer spending in Kuwait (+4.4% year on year) and Qatar’s tourism-driven retail boom.

Top brands continue to strengthen their premium offerings through product and channel-led initiatives

“In Q4 2024, smartphone ASPs in the Middle East rose for the third consecutive quarter, reflecting a sustained shift toward premium devices,” said Canalys Senior Analyst Manish Pravinkumar. “Samsung’s ASP soared 27% to US$487, fueled by a 54% year-on-year surge in demand for the AI-powered Galaxy S24 series. This growth was driven by early AI adoption, aggressive marketing and enticing trade-in offers from retailers like Emax in the UAE. The demand for S24 is expected to stay strong in 2025, while the latest Galaxy S25 series will push AI-first capabilities further, with deeper ecosystem integration and more natural user interactions.”

“Xiaomi’s shipments declined, but its ASP grew 15% as the Xiaomi 14T series gained traction, with plans for stronger channel-led branding in 2025,” added Pravinkumar. “Meanwhile, Apple retained its 15% market share in the premium segment, though its ASP dipped 6%. With Saudi Arabia as a key focus, Apple is expanding its retail and online presence to tap into the region’s growing demand for high-end devices in 2025.”

“Emerging brands such as HONOR and Motorola continue to expand in the region, achieving double-digit shipments growth in Q4,” continued Pravinkumar. “HONOR continued its momentum, posting a 30% year-on-year shipment increase in the quarter, marking the strongest growth among the top five brands. Its momentum was fueled by aggressive product launches and regional expansion, including seven new experience stores in the UAE and entry into Oman and Qatar. Motorola posted double-digit growth by expanding across price segments, focusing on CMF (color, materials and finish) to appeal to Gen Z with trendy designs and vibrant UIs. In 2025, it will continue to focus on retail visibility to ensure sustainability and expand into the B2B/enterprise segment with strategic partnerships in the region.”

The Middle East smartphone market outlook stays cautious amid evolving macro and consumer trends

“The Middle East smartphone market is set for cautious single-digit growth in 2025, driven by shifting retail dynamics and consumer behavior,” stated Pravinkumar. “Non-oil economic expansion and strategic fiscal policies are fostering market diversification, while AI-driven devices, BNPL services and social commerce through platforms like Instagram and TikTok are reshaping purchasing patterns across the region. Retailers in key markets like Saudi Arabia and the UAE are driving new initiatives through hyperlocal strategies and immersive technologies, setting benchmarks for engagement. The region’s mobile-first approach continues to accelerate ecommerce, self-checkout innovations and seamless payments. Upcoming product launches will emphasize gaming, AI integration and ecosystem-based offerings while improving trade-in programs to make upgrades more accessible. To unlock new growth in 2025 and beyond, smartphone vendors must prioritize value, innovation and convenience, aligning with progressing consumer expectations.”

|

Middle East* smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q4 2024 |

|||||

|

Vendor |

Q4 2024 |

Q4 2024 |

Q4 2023 |

Q4 2023 |

Annual |

|

Samsung |

3.8 |

31% |

3.5 |

29% |

8% |

|

TRANSSION |

1.9 |

16% |

2.2 |

18% |

-14% |

|

Apple |

1.8 |

15% |

1.8 |

15% |

4% |

|

Xiaomi |

1.8 |

14% |

2.0 |

16% |

-10% |

|

HONOR |

1.0 |

8% |

0.8 |

6% |

30% |

|

Others |

2.1 |

17% |

1.9 |

15% |

12% |

|

Total |

12.5 |

100% |

12.2 |

100% |

3% |

|

Note: *Excludes Turke. Xiaomi estimates include sub-brand POCO and Redmi. TRANSSION includes TECNO, Infinix and iTel. Percentages may not add up to 100% due to rounding. |

|

||||

|

Middle East* smartphone shipments and annual growth Canalys Smartphone Market Pulse: Full year 2024 |

|||||

|

Vendor |

2024 |

2024 |

2023 |

2023 |

Annual |

|

Samsung |

14.4 |

30% |

14.5 |

34% |

0% |

|

TRANSSION |

8.3 |

17% |

7.6 |

18% |

9% |

|

Xiaomi |

8.1 |

17% |

6.1 |

14% |

33% |

|

Apple |

5.3 |

11% |

5.6 |

13% |

-5% |

|

HONOR |

3.2 |

7% |

1.9 |

5% |

67% |

|

Others |

9.1 |

19% |

6.9 |

16% |

32% |

|

Total |

48.4 |

100% |

42.5 |

100% |

14% |

|

Note: *Excludes Turke. Xiaomi estimates include sub-brand POCO and Redmi. TRANSSION includes TECNO, Infinix and iTel. Percentages may not add up to 100% due to rounding. |

|

||||

Supercharge your MWC 2025 experience with insights from Canalys and Omdia analysts! Gain cutting-edge knowledge on market trends, strategies, and partnership opportunities.

Register now as seats are limited - https://canalys.com/mwc-25

For more information, please contact:

Manish Pravinkumar: manish_pravinkumar@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys, now part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.