Southeast Asia’s smartphone shipments up 11% in 2024 as OPPO takes lead for first time

Tuesday, 11 February 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

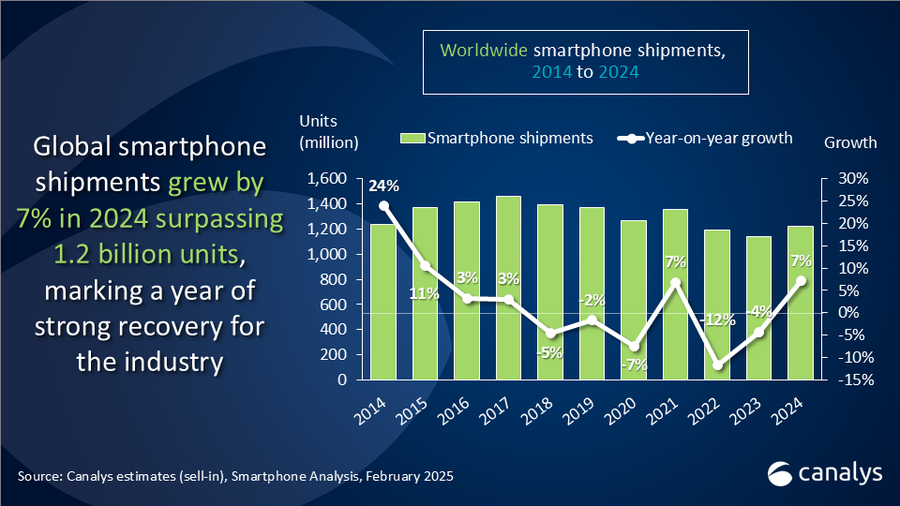

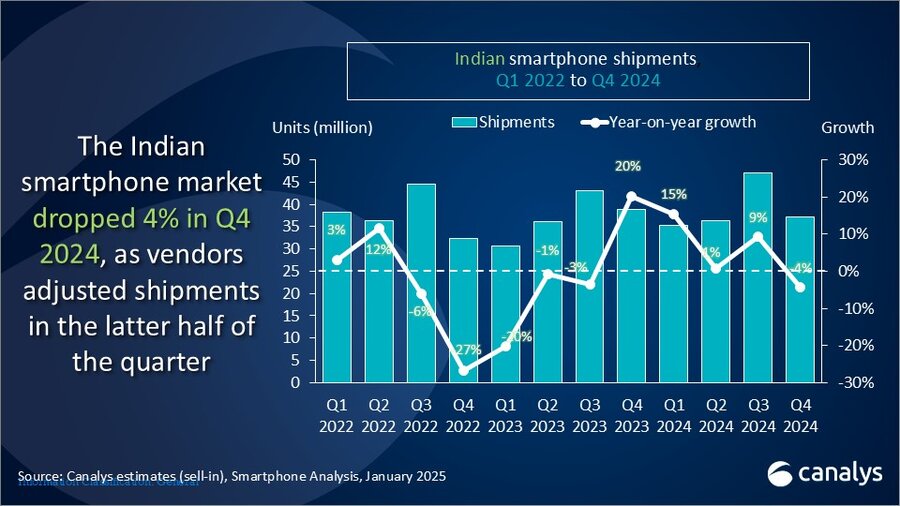

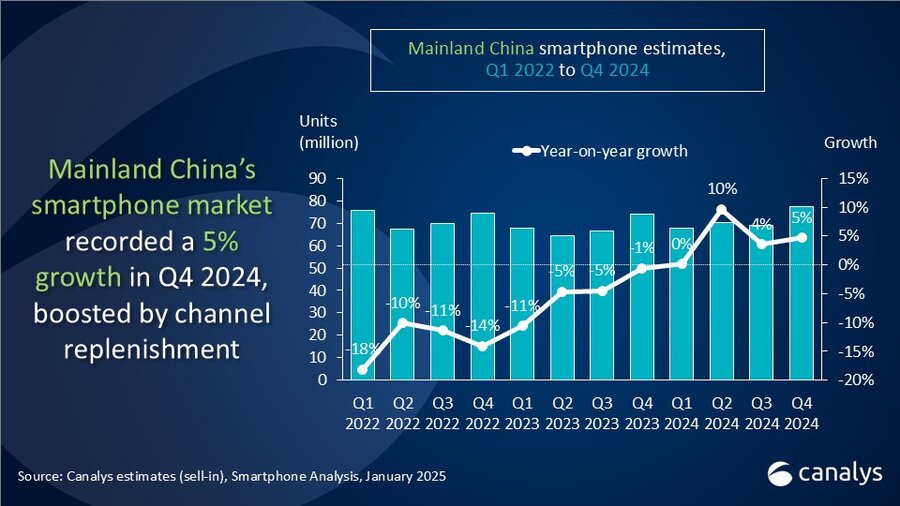

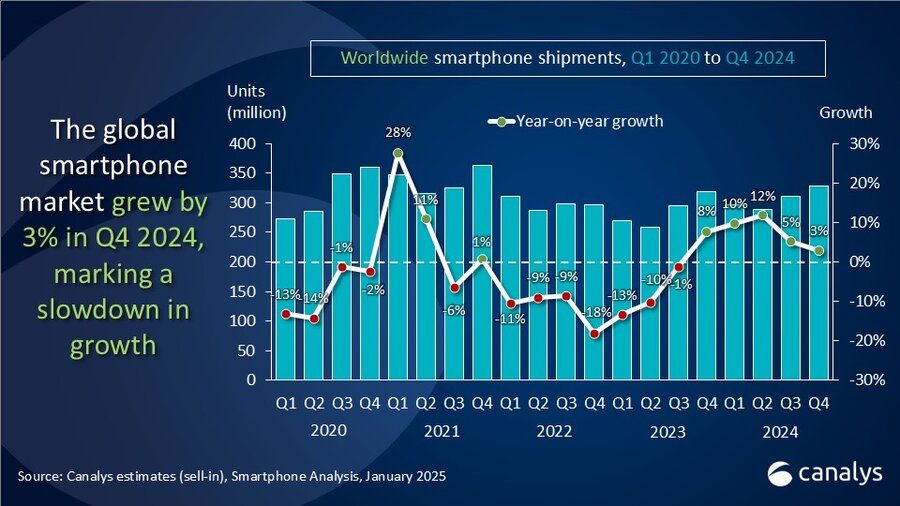

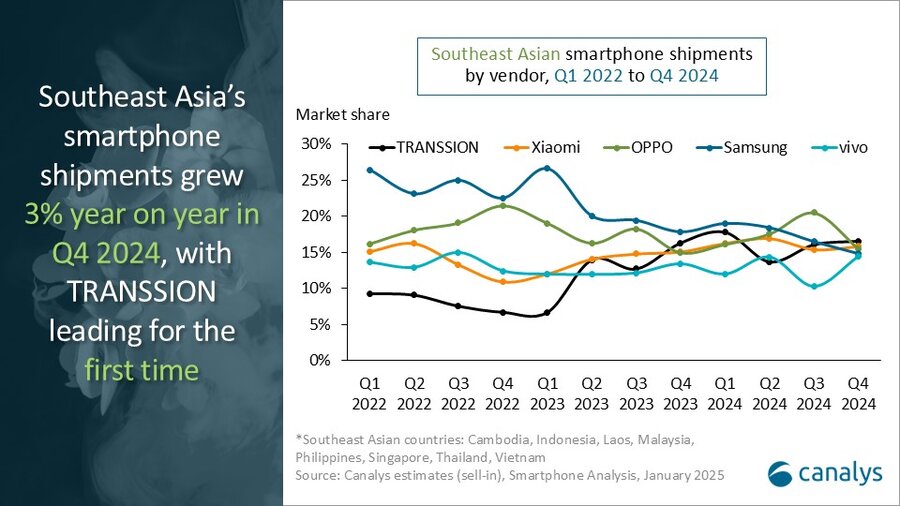

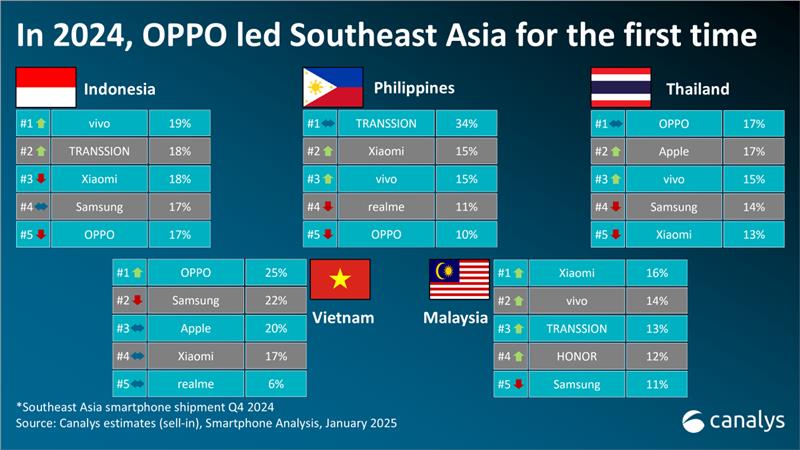

Canalys’ latest research reveals that Southeast Asia’s smartphone market rebounded in 2024, with vendors shipping 96.7 million units – up 11% year on year after two years of decline. OPPO led the market for the first time, capturing an 18% share with 16.9 million shipments, marking a 14% annual increase. Samsung followed closely in second place with 16.6 million units and a 17% market share. TRANSSION and Xiaomi took joint third place, each securing 16% of the market, while vivo rounded out the top five with a 13% share. In Q4 2024, Southeast Asian smartphone shipments grew 3% year on year, reaching 24.4 million units. TRANSSION took the lead for the first time ever as new launches saw it perform strongly in Indonesia and Philippines, shipping a record 4.1 million smartphones and capturing 17% of the market. OPPO (excluding OnePlus) took second place, shipping 3.9 million units for a market share of 16%. In third place, Xiaomi’s push in the low end saw it close the gap with 3.8 million units and a market share of 16%. Samsung’s focus on prioritizing value over volume saw it take fourth place with 3.6 million units and a 15% market share. vivo recorded its best quarter since 2022, shipping 3.5 million units and securing a 14% market share, driven by its Y19s, which outperformed its predecessor.

“Southeast Asia’s smartphone market rebounded strongly in 2024, outpacing global growth of 7%,” said Canalys Analyst Le Xuan Chiew. “OPPO’s strong performance in 2024 reflects its success in product calibration and high-end investments. The A18 was the year’s best-selling model, while the rebranded A3x helped drive higher channel shipments. But contrary to global trends, the ASP has dropped in Southeast Asia due to increasing price sensitivity in the region. TRANSSION took the top spot in Q4, thanks to its entry level Hot and Smart series and expanded dealer distribution. For TRANSSION, brand volume is a priority as it looks to gain more consumer awareness in tier-two cities. Though Samsung’s overall Southeast Asian shipments fell, its ASP bucked the market and increased by 14% from US$285 in Q4 2023 to US$326 in Q4 2024. Strong growth of more expensive models, such as the Galaxy A55 and Galaxy S series, made up for large volume declines among its mass-market models, such as the A1x and A2x. Samsung’s ability to transition Southeast Asia’s large low-end Android user base to higher-priced models will be a key future success factor. Through its S25 series, Samsung looks to drive AI innovation and ecosystem advances to further expand its offerings to drive upgraders and expand its premium segment.”

“The high-end smartphone market in Southeast Asia has gained momentum, driven by vendors expanding their distribution through new channels,” added Chiew. “Brands that invested in their channels during the 2023 slowdown are now capitalizing on those efforts, ramping up marketing to attract a growing base of upgraders. HONOR, for example, saw 11% shipment growth in 2024, supported by investments in the operator channel and its mid-to-high-end portfolio in Malaysia and looks to begin its expansion into Indonesia. For the first time, in Q4 2024, it took the fourth spot in Malaysia and Singapore, aided by its premium-focused strategy. Apple achieved a 15% year-on-year growth in 2024, driven by its successful emerging market strategy and expanded distribution network, further strengthening its dominance in the high-end market. To ensure long-term profitability in the premium segment though, all brands must ensure they minimize price and margin erosion from heavy promotion subsidies caused by overstocking. Brands have been doing this by forging partnerships with sales channels and local financing solution partners to expand user bases and affordability with more financing options.”

“Prudent inventory management will shape vendor strategies in 2025,” said Canalys Analyst Sheng Win Chow. “Overambitious sales targets can erode profitability, as overstocked channels require costly promotional subsidies to clear excess inventory in subsequent quarters. Conversely, underestimating demand can hinder a vendor’s ability to grow market share. With increasingly short product lifecycles and shipment lead times and a constant flood of new smartphone launches each quarter, there is little time and room to recover from underestimating demand after a product’s initial release. The frequent reshuffling of vendor rankings in Southeast Asia highlights that volume leadership alone is no longer a reliable measure of a brand’s market position. Other key factors – such as value share, operational efficiency and profitability – are just as important in assessing a brand’s overall health and competitive standing. In the long run, vendors that expand revenue streams beyond device sales – into software and services, for example – will secure a stronger foothold in the market. Samsung’s recently launched Digital Lighthouse School Program, which integrates its Galaxy Tab S and A series tablets with the Galaxy Classroom software suite to support students and teachers while paving the way for future smartphone opportunities, is a prime example of how vendors can build more integrated and sustainable solutions.

|

Southeast Asian smartphone shipments and annual growth |

||||||

|

Vendor |

Q4 2024 |

Q4 2024 |

Q4 2023 |

Q4 2023 |

Annual |

|

|

TRANSSION |

4.1 |

17% |

3.9 |

16% |

4% |

|

|

OPPO |

3.9 |

16% |

3.6 |

15% |

9% |

|

|

Xiaomi |

3.8 |

16% |

3.6 |

15% |

5% |

|

|

Samsung |

3.6 |

15% |

4.2 |

18% |

-15% |

|

|

vivo |

3.5 |

14% |

3.2 |

13% |

10% |

|

|

Others |

5.6 |

23% |

5.3 |

22% |

4% |

|

|

Total |

24.4 |

100% |

23.8 |

100% |

3% |

|

|

|

|

|

||||

|

Note: Xiaomi estimates include sub-brand POCO, and OPPO excludes OnePlus. Percentages may not add up to 100% due to rounding. |

|

|||||

|

Southeast Asian smartphone shipments and annual growth |

|||||

|

Vendor |

2024 |

2024 |

2023 |

2023 |

Annual |

|

OPPO |

16.9 |

18% |

14.9 |

17% |

14% |

|

Samsung |

16.6 |

17% |

18.2 |

21% |

-9% |

|

TRANSSION |

15.5 |

16% |

11.0 |

13% |

41% |

|

Xiaomi |

15.5 |

16% |

12.3 |

14% |

26% |

|

vivo |

12.3 |

13% |

10.8 |

12% |

14% |

|

Others |

19.9 |

21% |

20.1 |

23% |

-1% |

|

Total |

96.7 |

100% |

87.2 |

100% |

11% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO, and OPPO excludes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Le Xuan Chiew: lexuan_chiew@canalys.com

Sheng Win Chow: shengwin_chow@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys, now part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.