Middle Eastern smartphone market to return to double-digit growth in 2023

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 6 October 2022

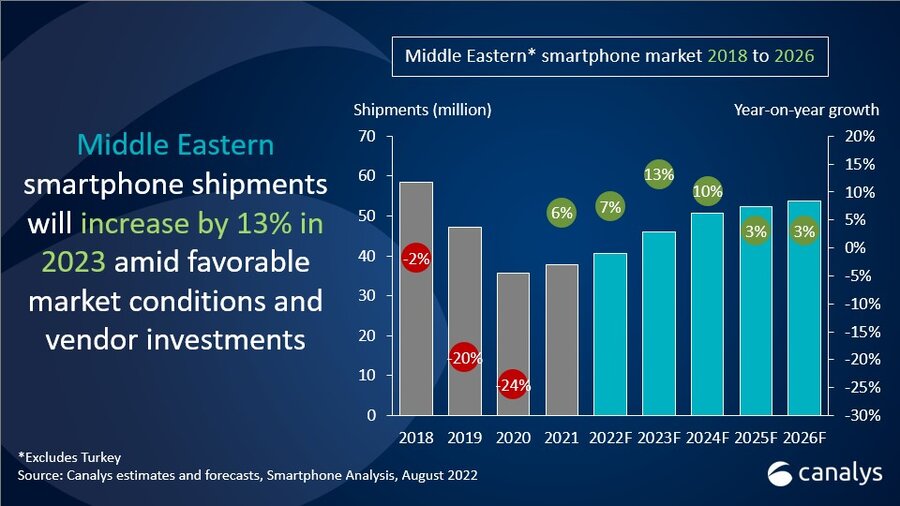

The latest forecasts from Canalys’ ongoing smartphone research show that the Middle East (excluding Turkey) is expected to be one of the best-performing regions in 2023 in terms of smartphone shipment growth. The market will be driven by economic recovery and digital initiatives from the countries of the Gulf Cooperation Council. Shipments are forecast to reach nearly 46 million in units and US$15 billion in sales value in 2023, representing 13% growth and bringing the region’s smartphone ASP to US$325.

“The Middle East is on the fast track to digitalization post-pandemic,” said Dubai-based Manish Pravinkumar, Senior Consultant at Canalys. “The governments in UAE and Saudi Arabia are prioritizing digital investments, such as 5G, to drive the economy toward a knowledge-based economy. Smartphones are leading the transition to a digital lifestyle, driven by statewide consumer initiatives, such as digital payment. In the short term, the strong smartphone market recovery is underpinned by the region’s rapid recovery of business and leisure travel, and relaxed long-term visa policies, such as Golden Visas, which are driving investments across sectors from real estate to start-ups. Global events, particularly the FIFA World Cup 2022 in Qatar, will also bring opportunities to various business sectors in neighboring countries. These are all positive signals luring smartphone vendors to further invest in the region and strengthen their market shares, contrasting with the negative business and consumer outlook in other regions.”

“The region’s polarized consumer segment has also provided different opportunities for emerging players, especially those making inroads at the high end. On the one hand, the region is attracting a large population of working immigrants, bringing new demand for mass-market devices. On the other hand, there is a lot of wealth in the region and more than half of the sales value in the Middle East (excluding Turkey) is from the US$500-plus price band. It is a segment dominated by Apple and Samsung, which together account for nearly 96% of shipments. Chinese vendors, such as HONOR, OPPO and Xiaomi, aspire to challenge the status quo by increasing their investments significantly in the region over the years,” said Canalys Analyst Sanyam Chaurasia.

“There is no quick way to gain local consumers and the channel’s mindshare. It requires more than just brand-level investments,” said Pravinkumar. “The full stack device service and ecosystem approach would take years to build with local retail channels and operators, but it is the foundation of sustainable development in the region for smartphone vendors.”

For more information, please contact:

Manish Pravinkumar: manish_pravinkumar@canalys.com +97 15039 14848

Sanyam Chaurasia: sanyam_chaurasia@canalys.com +91 89820 33054

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.