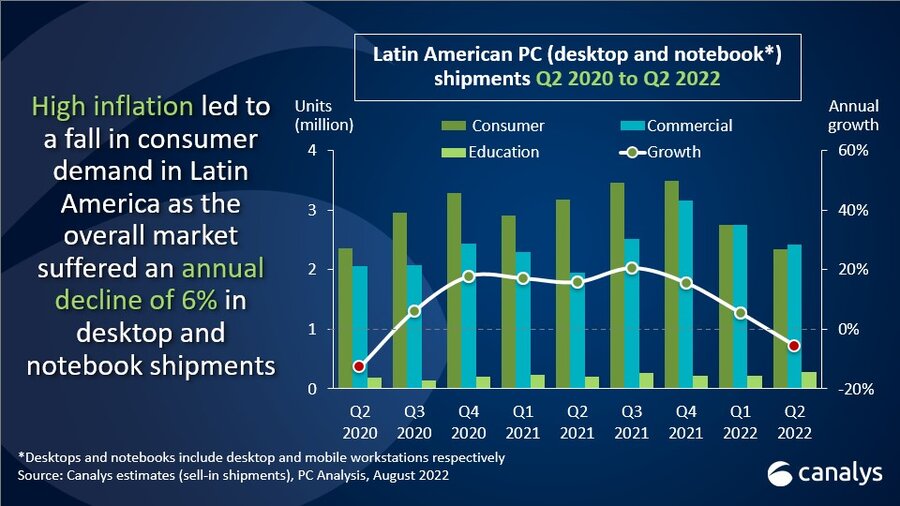

Latin American PC shipments fell 6% in Q2 2022 as soaring inflation gripped the region

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 22 September 2022

Shipments of desktops, notebooks and workstations in Latin America fell by 6% year on year in Q2 2022 to 5 million units. Desktops performed best in the region, with shipments remaining flat at 840,000 units, as the category stabilized after its pandemic-era woes. Notebook shipments fell by 7% to 4.2 million shipments. Tablet shipments were down by 30% at 1.4 million, consumer spending plummeting as Latin America battled high inflation.

“PC and tablet demand in Latin America has been hampered by rising concerns about inflation,” said Brian Lynch, Research Analyst at Canalys. “Leading markets, such as Brazil, Chile and Mexico, have all seen sharp spikes in prices, and in Argentina inflation has passed 80%. As a result, consumer demand for PCs has dwindled, leading to a 30% annual decline in shipments. Brazil, the region’s largest PC market, suffered a 26% fall in consumer shipments as inflation there reached its highest level in 26 years in Q2. The overall market has managed to avoid even larger declines thanks to a relatively robust commercial sector, which has weathered high inflation levels far better than the consumer market.”

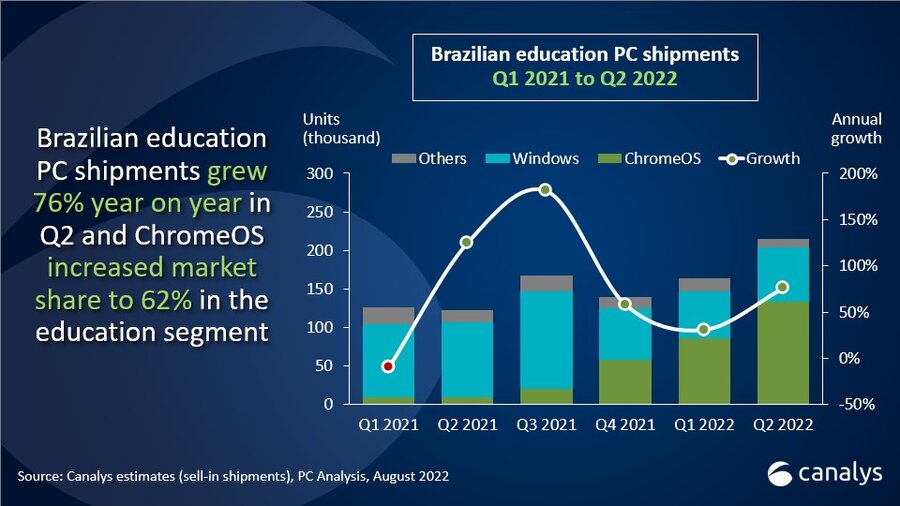

“While consumers grapple with inflation, the education segment has found renewed growth, stemming primarily from Brazil,” said Lynch. “Funding from federal, state and local governments has ramped up, leading to large-scale deployments of PCs to students. In Q2, the Brazilian education market surpassed 200,000 shipments, up 76% on Q2 2021, even as the country made efforts to equip students with PCs during the pandemic. This resilience indicates that the market will continue to see high shipment numbers as the government strives to achieve its digital education goals. Vendors have taken note of the public sector effort and, due to local manufacturing regulations, have begun domestic production of education-purposed devices. Chromebooks have benefited most, growing over 1,300% in Q2 as local manufacturing expanded for the platform. Local vendors Multilaser and Positivo came first and second in Chromebook shipments in Q2, followed by Samsung.”

Lenovo took first place in Latin America’s desktop and notebook market. The vendor posted a 12% decline, largely because of falling consumer demand. HP suffered from similar struggles as its shipments fell 15% to 1 million units. Dell, up 7%, took third place, the only major vendor to post growth, leaning on its specialty in the commercial segment. Acer and Asus recorded 9% and 8% declines respectively to round out the top five.

|

Latin American desktop, notebook and workstation shipments (market share and annual growth) Canalys PC Market Pulse: Q2 2022 |

|||||

|

Vendor |

Q2 2022 |

Q2 2022 |

Q2 2021 |

Q2 2021 |

Annual |

|

Lenovo |

1,068 |

21.2% |

1,219 |

22.8% |

-12.4% |

|

HP |

1,057 |

21.0% |

1,247 |

23.4% |

-15.3% |

|

Dell |

1,002 |

19.9% |

941 |

17.6% |

6.5% |

|

Acer |

438 |

8.7% |

482 |

9.0% |

-9.1% |

|

Asus |

326 |

6.5% |

356 |

6.7% |

-8.4% |

|

Others |

1,150 |

22.8% |

1,091 |

20.4% |

5.3% |

|

Total |

5,041 |

100.0% |

5,337 |

100.0% |

-5.5% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), August 2022 |

|

||||

Lenovo claimed first place in Latin America’s tablet market with modest growth of 2% and 438,000 units shipped. Second-placed Samsung and third-placed Apple both posted minor falls in shipments of 2% and 1% respectively. Multilaser secured fourth place but struggled in Q2 as it shrunk 17%. Its tablets lost traction in Brazil, where high inflation has reduced enthusiasm for tech spending among cash-constrained consumers. TCL claimed fifth place, despite posting a dramatic 81% fall in shipments. It struggled with supply constraints amid lockdowns in China and prioritized developed markets, such as the US, where it made significant gains.

|

Latin American tablet shipments (market share and annual growth) Canalys PC Market Pulse: Q2 2022 |

|||||

|

Vendor |

Q2 2022 |

Q2 2022 |

Q2 2021 |

Q2 2021 |

Annual |

|

Lenovo |

438 |

30.5% |

430 |

21.0% |

2.0% |

|

Samsung |

285 |

19.8% |

289 |

14.1% |

-1.6% |

|

Apple |

176 |

12.2% |

178 |

8.7% |

-1.0% |

|

Multilaser |

84 |

5.8% |

101 |

4.9% |

-17.1% |

|

TCL |

82 |

5.7% |

421 |

20.6% |

-80.6% |

|

Others |

374 |

26.0% |

631 |

30.8% |

-40.8% |

|

Total |

1,438 |

100.0% |

2,051 |

100.0% |

-29.9% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), August 2022 |

|

||||

For more information, please contact:

Brian Lynch: brian_lynch@canalys.com +1 503 927 5489

Damian Leyva-Cortes: damian_leyva-cortes@canalys.com +57 323 795 5181

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.