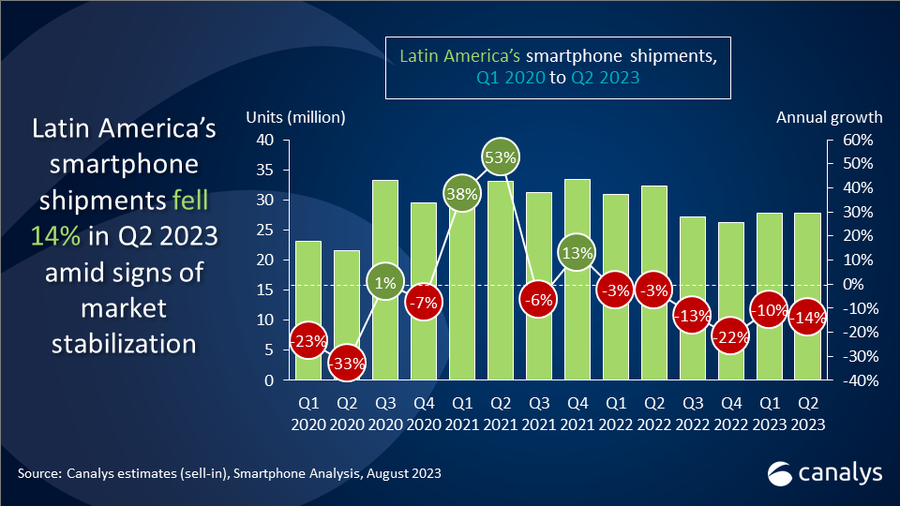

Latin American smartphone market falls 14% in Q2 2023 amid signs of recovery

Wednesday, 30 August 2023

Canalys’ latest research shows that smartphone shipments in Latin America fell 14% year on year to 28 million units. Despite this decline, the market is stabilizing and showing signs of recovery, thanks to increased consumer confidence, improvements in inventory levels and smartphone vendors’ focus on key segments.

“Subdued consumer demand has led to an increase in vendors’ smartphone inventories. This has led to companies adopting a more cautious approach, targeting specific market segments that could bring them better returns,” said Miguel Perez, Senior Consultant at Canalys. “Samsung, Motorola and Xiaomi were hit by double-digit year-on-year declines. But adopting a conservative approach will help avoid overstocking, increasing profitability and concentrating resources strategically to enhance adaptability to evolving market conditions.” The top three vendors are executing these strategies through varying tactics. Samsung is shifting away from the sub-US$200 price segment to focus on higher-margin models in its portfolio. After an aggressive launch for the Moto Razr and Moto Edge 40 families, Motorola is now focusing on the low-end and mid-price segments with volume drivers, such as the Moto E13, G23, G13 and G53. Xiaomi is recovering shipment volumes after a considerable drop in Q1 2023 by focusing on models priced between US$100 and US$500, such as the Redmi Note 12 4G, Redmi 12C, A2 and Note 12S.

“Beyond the top three, despite significant variations in vendor performance, some brands are substantially expanding their presence in the region,” added Perez. “Transsion, HONOR and OPPO made significant progress in the market in Q2 2023, highlighting opportunities for vendors in Latin America. These three vendors have been strategic with their investments. Transsion returned to fourth place with impressive performances in Colombia, Ecuador and Peru, thanks to its wide portfolio of entry-level devices. HONOR achieved the strongest volume growth, increasing shipments by 168% year on year overall in Latin America. Meanwhile, OPPO is focusing on Colombia and Mexico as its two key markets to set up a strong presence in the region through significant channel marketing investment. For these Chinese brands, which are grappling with challenges in their home market, Latin America is not just an option but a vital part of their global strategies.”

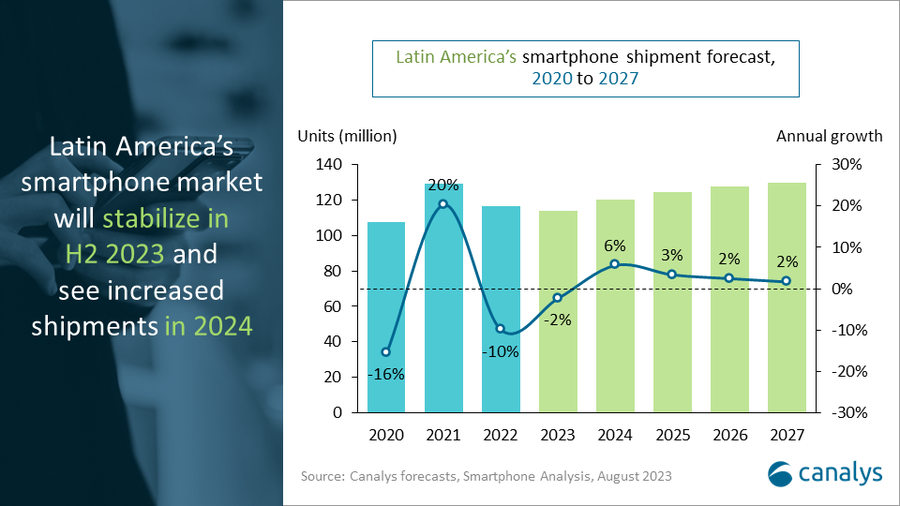

Even amid varied socio-political landscapes, Latin America’s overall economic stability is fostering a favorable climate for the smartphone market. While the possibility of a recession has not entirely faded, inflation is largely in check across the region, and its three economic powerhouses, Brazil, Mexico and Colombia, are growing steadily. This positive outlook has led to an upgraded economic growth forecast for 2023, making the region a focus for smartphone market expansion.

Though Canalys projects a 2% contraction in Latin America’s smartphone market for 2023 as part of a broader market stabilization, the bigger picture is one of opportunity. Boosted consumer confidence and increased overall spending have set the stage for potential growth in the year’s latter half, especially with the peak sales season approaching. To capitalize on this, brands need to sharpen their planning, forge strong channel partnerships and maintain fiscal health, aligning their actions with strategic opportunities.

|

Latin American smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q2 2023 |

|||||

|

Vendor |

Q2 2023 |

Q2 2023 |

Q2 2022 |

Q2 2022 |

Annual |

|

Samsung |

9.4 |

34% |

11.6 |

36% |

-19% |

|

Motorola |

5.7 |

21% |

7.0 |

22% |

-18% |

|

Xiaomi |

4.6 |

17% |

5.3 |

17% |

-14% |

|

Transsion |

2.1 |

7% |

1.3 |

4% |

56% |

|

Apple |

1.4 |

5% |

1.5 |

5% |

-8% |

|

Others |

4.7 |

17% |

5.5 |

17% |

-14% |

|

Total |

27.9 |

100% |

32.2 |

100% |

-14% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brands POCO and Redmi, and Transsion estimates include sub-brands Tecno and Infinix. |

|

||||

For more information, please contact:

Miguel Perez: miguel_perez@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.