Latin American smartphone shipments fall just 3% in Q1 2022 as Samsung tightens its grip

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Tuesday, 31 May 2022

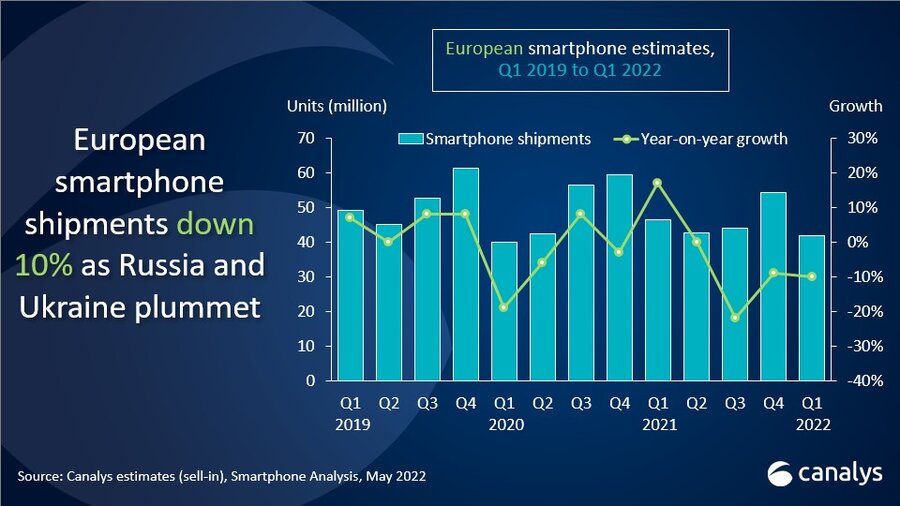

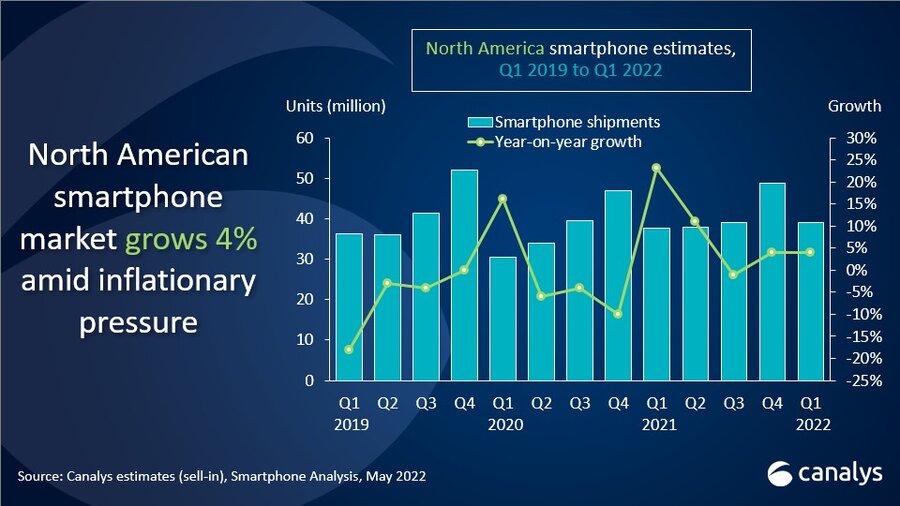

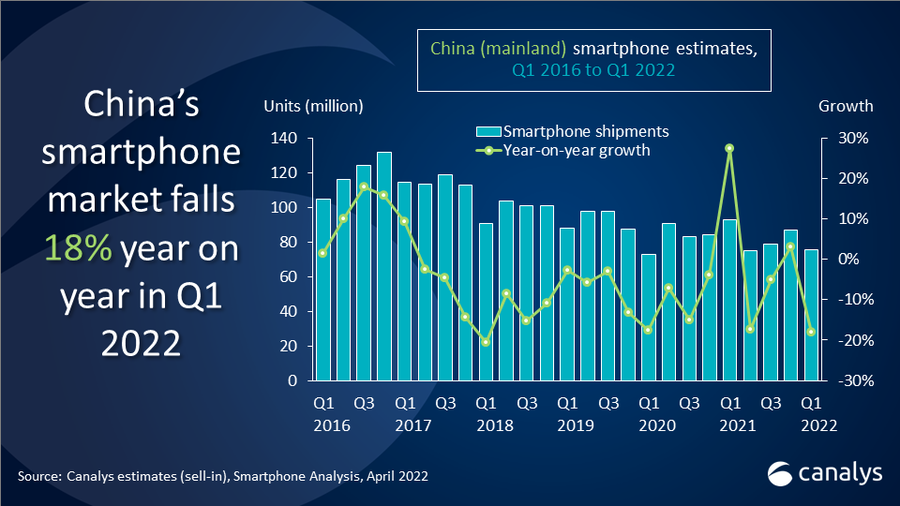

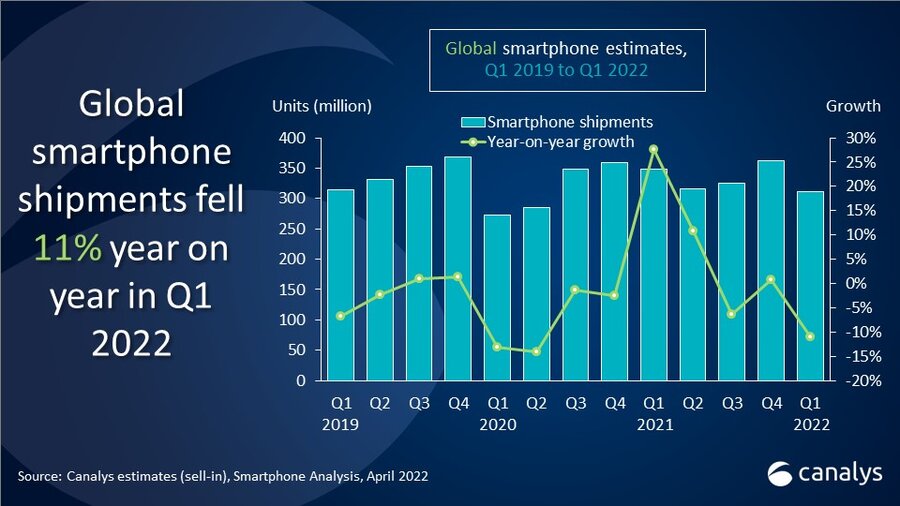

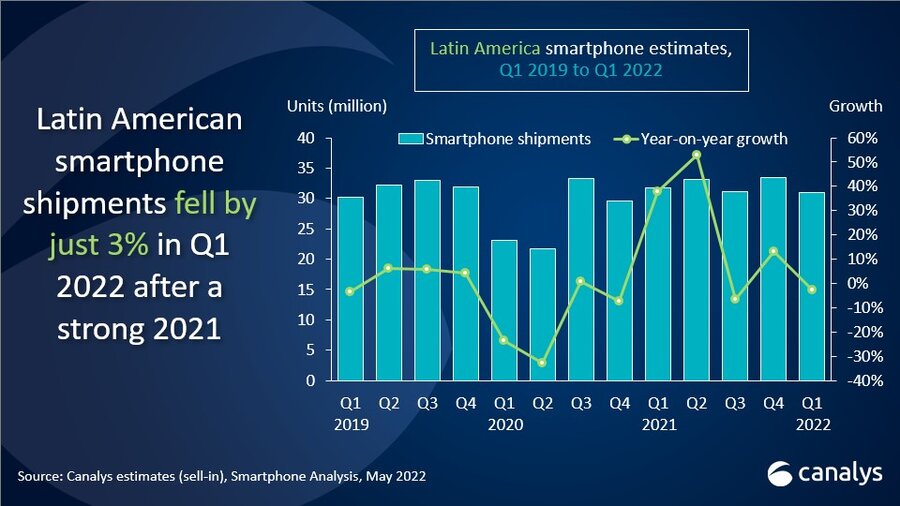

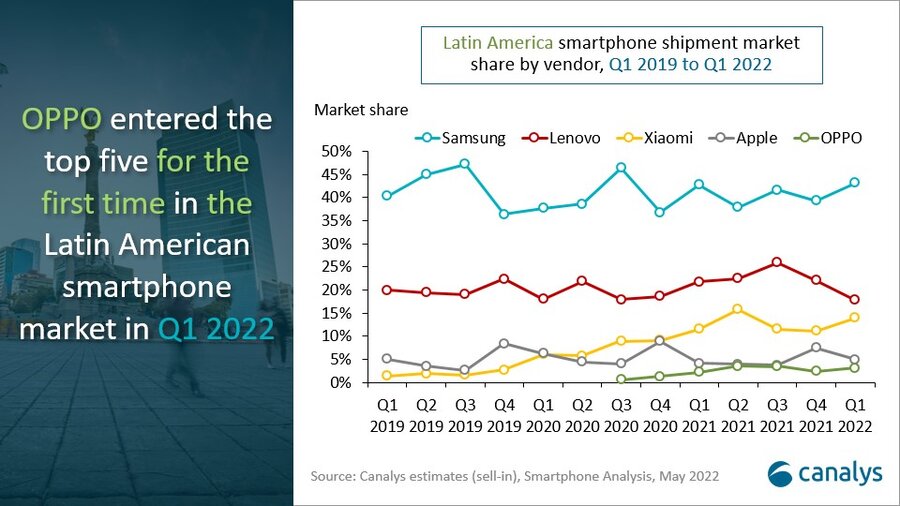

After a strong 2021, the Latin American smartphone market remained resilient in Q1 2022. Shipments fell slightly by 3% against Q1 2021, but worldwide shipments were down 11% year on year. Samsung’s market share returned to 43%, its highest since Q2 2020, as the company once more grew its lead over second-placed Lenovo, which shipped 5.5 million units for an 18% share. Xiaomi came third as it continues to focus on growing its presence in the region, boosted by more device allocations and new product launches. Apple ranked fourth, helped by an improved supply of its iPhone 13 series, while OPPO entered the top five for the first time, thanks to its strong performance in Mexico.

“Latin America is fertile territory for new smartphone vendors, and this hasn’t gone unnoticed,” said Canalys Senior Analyst and LATAM Manager Damian Leyva-Cortes. “Vendors such as HONOR, Realme, Xiaomi, Transsion and vivo have made ambitious expansion plans in the region, despite global challenges. Vendors are committing to building local presence by investing in new distribution centers and local assembly, opening offline experience stores and making supply agreements with telcos and retailers in new markets.”

“Markets such as Mexico and Colombia are the most buoyant, thanks to the investments international vendors have made to drive demand. Both markets have strong telco players in device distribution channels, along with low entry barriers and a good perception of Chinese consumer technology products due to Huawei’s legacy. It is also astonishing to see how quickly these markets have replaced LG’s and Huawei’s shipments with other brands, which shows the dynamism and openness of the two markets,” added Leyva-Cortes.

“Compared with the macroeconomic challenges other regions are facing, many markets in Latin America have a relatively optimistic outlook. Vendors will shift strategic priorities toward the region, which is forecast to see 4% growth in smartphone shipments in 2022. As telcos are still a dominant regional force in the channel, emerging players should use telco partnerships to explore as many markets as possible. For more established brands in the region, such as Xiaomi and OPPO, future opportunities lie in the more protectionist markets, as there is much unmet demand, especially from the younger consumer segments where the dominant players are not paying attention,” said Leyva-Cortes.

|

Latin America smartphone shipments, market share, and annual growth Canalys Smartphone Market Pulse: Q1 2022 |

|||||

|

Vendor |

Q1 2022 |

Q1 2022 |

Q1 2021 |

Q1 2021 |

Annual |

|

Samsung |

13.4 |

43% |

13.6 |

43% |

-2% |

|

Lenovo |

5.5 |

18% |

6.9 |

22% |

-20% |

|

Xiaomi |

4.3 |

14% |

3.6 |

11% |

18% |

|

Apple |

1.5 |

5% |

1.3 |

4% |

16% |

|

OPPO |

1.0 |

3% |

0.7 |

2% |

34% |

|

Others |

5.3 |

17% |

5.6 |

18% |

-6% |

|

Total |

31.0 |

100% |

31.8 |

100% |

-3% |

|

|

|

|

|

||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding. Source: Canalys Smartphone Analysis (sell-in shipments), May 2022 |

|

||||

For more information, please contact:

Damian Leyva-Cortes: damian_leyva-cortes@canalys.com +34 605 511 998

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.