Expert Hubs 2021: the circular economy in APAC

10 December 2021

The success of Xiaomi in Latin America hasn’t gone unnoticed by other Chinese smartphone vendors. In fact, since its successful incursion in the region, other brands such as Oppo and Vivo have followed - establishing operations in the region and shipping to markets like Chile, Colombia, Mexico and Peru. OnePlus has signed an agreement with TelCel (America Movil) in Mexico, to offer its Nord series and Transsion has signed an agreement with Positivo, the Brazilian smartphone vendor, to assemble and distribute Infinix smartphones in Brazil.

The success of Xiaomi in Latin America hasn't gone unnoticed by other Chinese smartphone vendors. In fact, since its successful incursion in the region, other brands such as Oppo and Vivo have followed - establishing operations in the region and shipping to markets like Chile, Colombia, Mexico and Peru. OnePlus has signed an agreement with TelCel (America Movil) in Mexico, to offer its Nord series and Transsion has signed an agreement with Positivo, the Brazilian smartphone vendor, to assemble and distribute Infinix smartphones in Brazil.

Xiaomi is currently the top smartphone vendor in Peru and second in Colombia, reaching a market share of 31% and 27% respectively in Q3 2021, and number three in Latin America overall with 11% market share. However, its strategy has evolved considerably over time. Back in 2017, Xiaomi was shipping all sorts of devices in more liberal markets like Colombia, Chile and Mexico, an average of 290,000 per quarter for the three markets together. Shipments were moving into the markets through a very limited number of authorised distributors and finally offered to local retailers both online and offline. By 2019 Xiaomi started shipping devices into the Peruvian and Brazilian markets, by that year Xiaomi was already growing 200% Y-o-Y in Colombia and 390% in Mexico.

In 2019 Telcos represented approximately 64% of shipments in the LATAM region. That year Xiaomi started in Chile, Colombia, Mexico and Peru through Telcos, as a result it combined several channels that were helping it grow organically almost every quarter. Another relevant growth factor was the launch of more models. Before 2019, the focus was on devices in the price band between US$100-299, however since then Xiaomi has started shipping models in other price bands, offering models in the US$50-99 and US$400 and above bands, which are responsible for almost half of their 200% shipments growth Y-o-Y in Latin America.

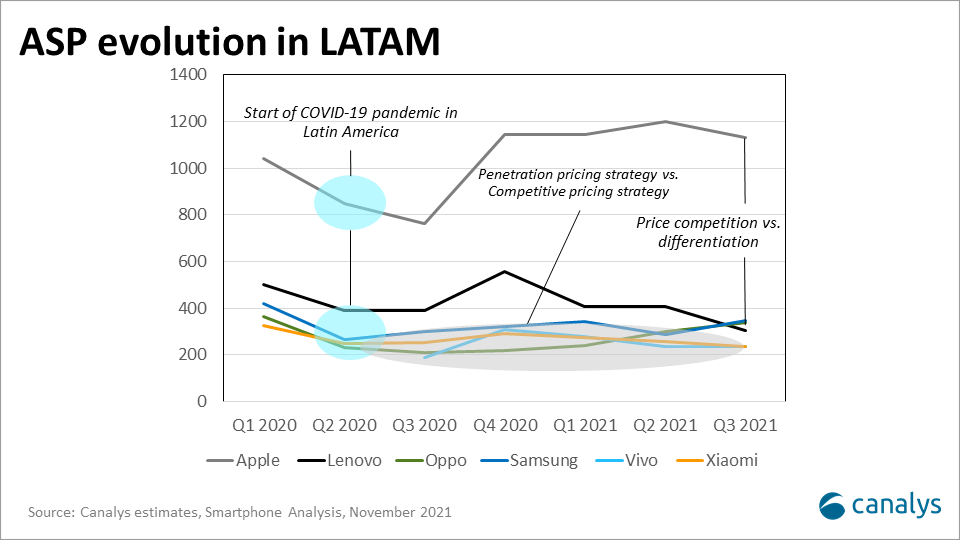

By middle of 2020, a new executive was appointed to lead the region. The same Xiaomi executive that catapulted it in Eastern Europe now leads Latin America. He reinforced Xiaomi's position by signing a new alliance with the largest operator in the region, America Movil, which helped increase shipments through operators in 2020 by 6,500% in Colombia, 244% in Mexico and 1610% in Chile, and the agreement was only in place by Q3 2020. Its presence in retail was also reinforced both online and offline. In Mexico in Q1 2021 both retail and online retail shipments grew similarly, 724% and 520% Y-o-Y respectively. In Colombia, retail shipments grew 13% Y-o-Y while online retail shipments experienced a rocket growth of about 2,000% for the same period. In the second half of 2020, the launch of Mi 10T and Mi 10T Pro, both 5G devices, helped Xiaomi considerably increase its ASP, as these devices were in the price bands of US$625-649 and US$825-849 respectively.

So what is the so-called "Xiaomi effect"? It is an strategy initiated by Xiaomi's success which, as a result, sparked other Chinese vendors to enter LATAM markets. They applied penetration marketing strategies for several quarters, entered into a price war and saturated some price ranges. The market share reached by the emerging Chinese vendors in the region has been impressive - by Q3 2021 ZTE achieved 4%, Oppo 3.4%, TCL 2.5% and Vivo 2%. While vendors are attempting to keep prices low amid increasing shipment and production costs, there is another front - product availability. LATAM has been deeply impacted by the component shortage and international supply chain disruption, significantly reducing shipments in some countries like Colombia (-17%) and Chile (-27%) and down 6% in the overall region.

Smartphone vendors must adapt or even transform their strategies in the coming quarters to survive. Canalys will continue monitoring them on a monthly and quarterly basis.