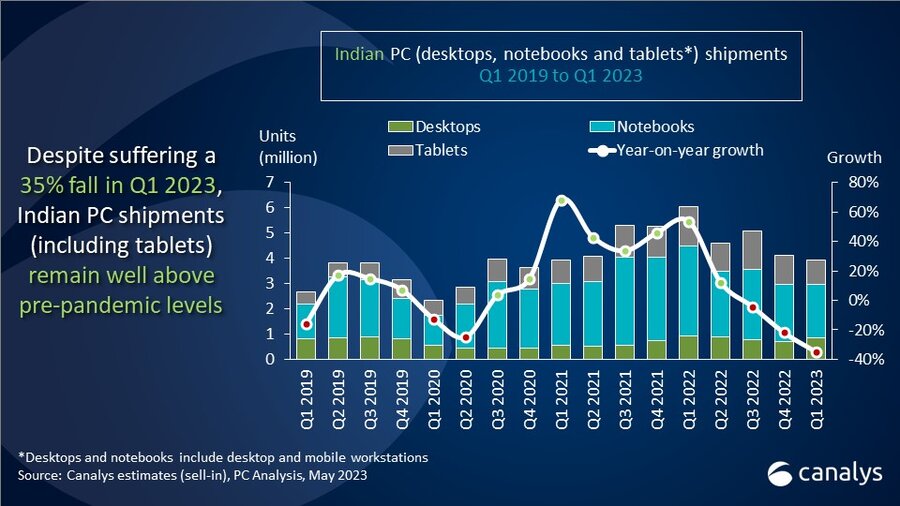

Indian PC shipments above pre-pandemic levels despite 35% fall in Q1 2023

Monday, 5 June 2023

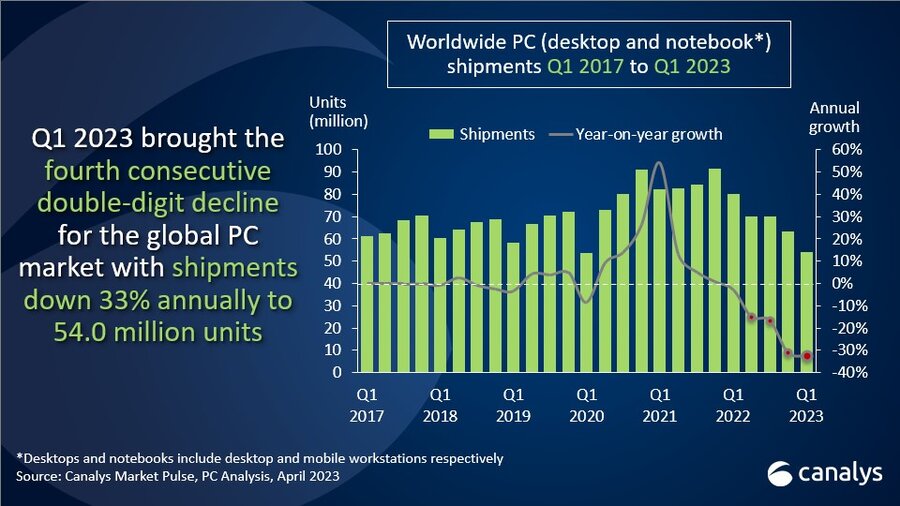

According to the latest Canalys data, the Indian PC market (desktops, notebooks and tablets) suffered a major year-on-year decline of 35%, with 3.9 million units shipped. Notebook shipments were hit by a sharp decline of 41%, reaching 2.1 million units. Desktop shipments also fell, but much less dramatically, down 7% to 859,000 units. Tablet shipments faced a similar fate, down by 37% at 987,000 units. Despite the large annual decline, Q1 2023 shipments remain above pre-pandemic levels, 47% higher than in Q1 2019.

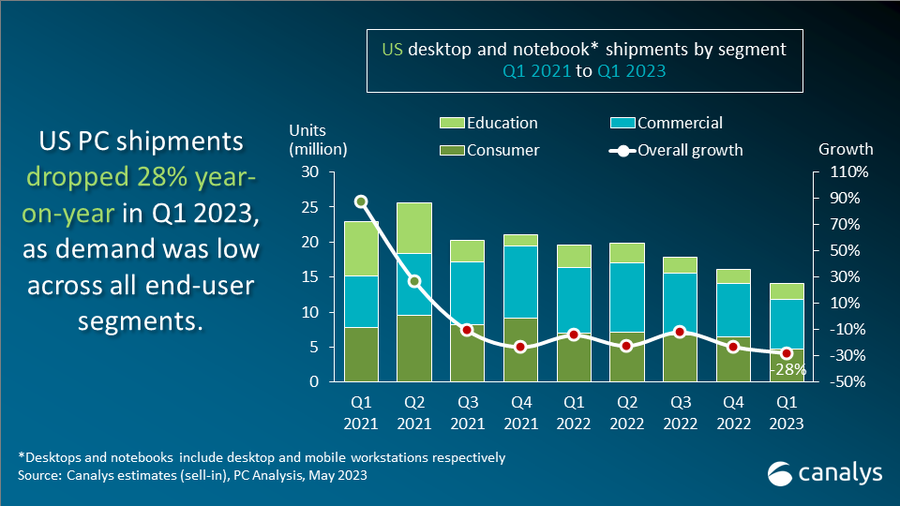

Both consumer and commercial segment shipments fell 34%, while education shipments were down 45% in Q1 2023. “All end-user segments are suffering from a short-term slowdown in demand, market saturation and elevated inventory levels,” said Canalys Analyst Ashweej Aithal. “But, according to a recent survey by the Reserve Bank of India (RBI), consumer confidence is on an upward trend, and there has been an improvement in sentiment regarding general economic conditions. Meanwhile, business confidence levels have come down from the highs of 2022 but remain well above the historical average. Education and public sector tenders that had been on hold for an extended period are expected to close by June, which will help drive shipments in the second half of the year. All this suggests that while the market is currently experiencing a dip, a recovery is anticipated, and India will be an increasingly important market for the global industry.”

After a muted 2023, Canalys forecasts that the Indian PC market (including tablets) will rebound strongly with 11% growth in 2024 and a further 13% growth in 2025. “Vendors remain optimistic about the Indian market and are taking steps to target its growing consumer base,” said Aithal. “HP announced its first gaming experience zones, known as Omen Playground stores, in February, with a plan to expand to over 40 outlets over the course of the year. Apple opened its first stores in Mumbai and New Delhi in April. Beyond the move to drive interest through offline retail locations, vendors are also increasingly turning to manufacturing in India, helping ensure future supply to the market and allowing them to tap into new commercial opportunities.”

Most PC (excluding tablet) vendors faced significant double-digit shipment declines in India in Q1 2023 as they prioritized working through substantial inventory build-up. HP extended its leadership streak in the market, holding 34% market share even as its shipments fell 30%. Dell narrowly secured second place but underwent the biggest decline of the top five vendors with its shipments down 41%. Lenovo was close behind in third place, posting a similar shipment drop of 38%. Acer took fourth place with a relatively small drop of 10%, helped by its participation in government tenders and a robust desktop business, while Asus rounded out the top five with a 27% shipment decline.

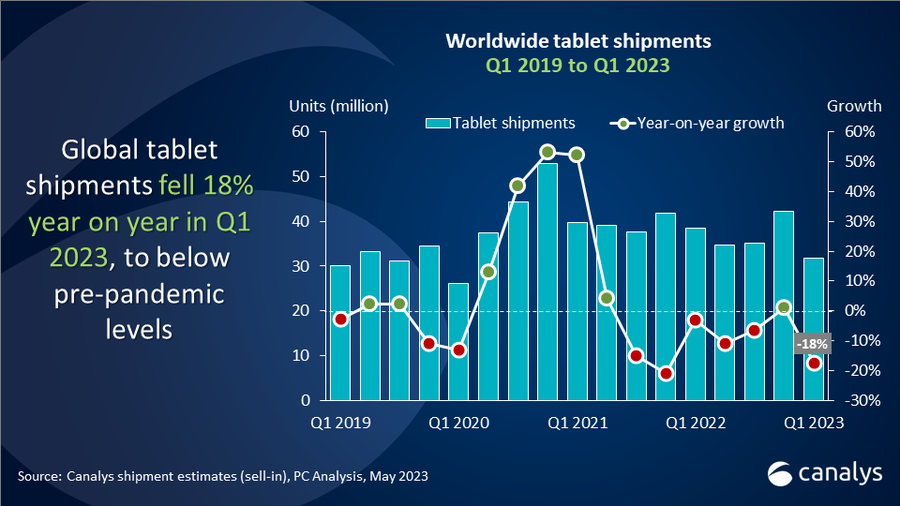

Tablet shipments in India fell below the million-unit mark for the first time in eight quarters. Samsung regained a commanding lead with a 32% market share in Q1 2023 after ceding the top spot to Apple during the holiday season. Its participation in education tenders this year will help bolster future shipment numbers. Second-placed Apple had a relatively small shipment decline of 16%. Lenovo took third place in the tablet market but suffered a massive 65% fall in shipments as both consumer and commercial demand for its tablets dropped significantly, while realme and Acer ranked fourth and fifth respectively.

|

India PC (including tablets) shipments (market share and annual growth) Canalys PC Market Pulse: Q1 2023 |

|||||

|

Vendor |

Q1 2023 shipments |

Q1 2023 |

Q1 2022 |

Q1 2022 |

Annual |

|

HP |

1,012 |

25.6% |

1,449 |

23.9% |

-30.2% |

|

Lenovo |

600 |

15.2% |

1,122 |

18.5% |

-46.5% |

|

Dell |

479 |

12.1% |

813 |

13.4% |

-41.1% |

|

Acer |

446 |

11.3% |

626 |

10.3% |

-28.7% |

|

Samsung |

312 |

7.9% |

433 |

7.1% |

-27.9% |

|

Others |

1,098 |

27.8% |

1,611 |

26.6% |

-31.9% |

|

Total |

3,947 |

100.0% |

6,054 |

100.0% |

-34.8% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), June 2023 |

|

||||

|

India desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q1 2023 |

|||||

|

Vendor |

Q1 2023 shipments |

Q1 2023 |

Q1 2022 |

Q1 2022 |

Annual |

|

HP |

1,012 |

34.2% |

1,449 |

32.3% |

-30.2% |

|

Dell |

477 |

16.1% |

813 |

18.1% |

-41.3% |

|

Lenovo |

470 |

15.9% |

752 |

16.8% |

-37.5% |

|

Acer |

379 |

12.8% |

421 |

9.4% |

-10.0% |

|

Asus |

195 |

6.6% |

265 |

5.9% |

-26.5% |

|

Others |

427 |

14.4% |

787 |

17.5% |

-45.8% |

|

Total |

2,959 |

100.0% |

4,487 |

100.0% |

-34.0% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), June 2023 |

|

||||

|

India tablet shipments (market share and annual growth) Canalys PC market pulse: Q1 2023 |

|||||

|

Vendor |

Q1 2023 shipments |

Q1 2023 |

Q1 2022 |

Q1 2022 |

Annual |

|

Samsung |

312 |

31.6% |

433 |

27.6% |

-27.9% |

|

Apple |

166 |

16.8% |

197 |

12.6% |

-15.8% |

|

Lenovo |

130 |

13.2% |

370 |

23.6% |

-64.9% |

|

realme |

91 |

9.2% |

- |

- |

- |

|

Acer |

67 |

6.8% |

205 |

13.1% |

-67.2% |

|

Others |

221 |

22.4% |

363 |

23.1% |

-39.0% |

|

Total |

987 |

100.0% |

1,567 |

100.0% |

-37.0% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), June 2023 |

|

||||

Ashweej Aithal: ashweej_aithal@canalys.com +91 97386 19281

Ishan Dutt: ishan_dutt@canalys.com +65 8399 0487

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.