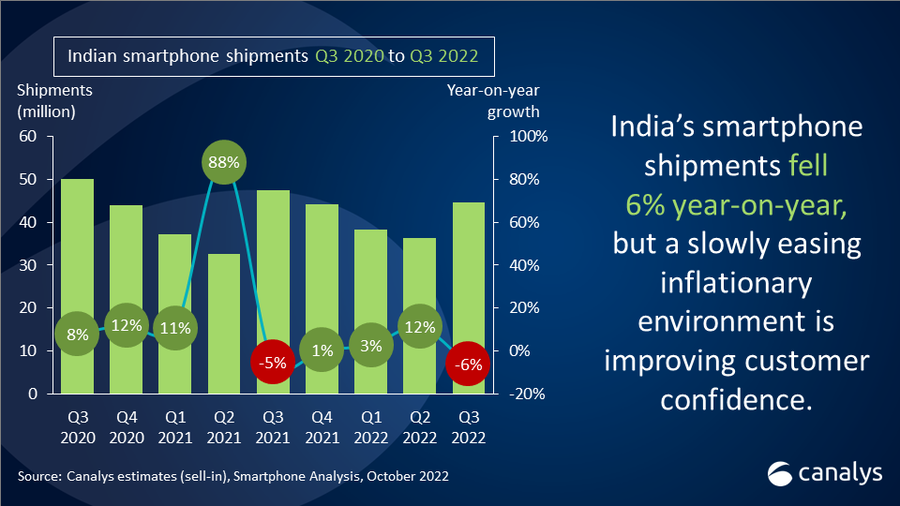

Indian smartphone shipments fell 6% in Q3 2022 dragged by weak low-end demand

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Friday, 21 October 2022

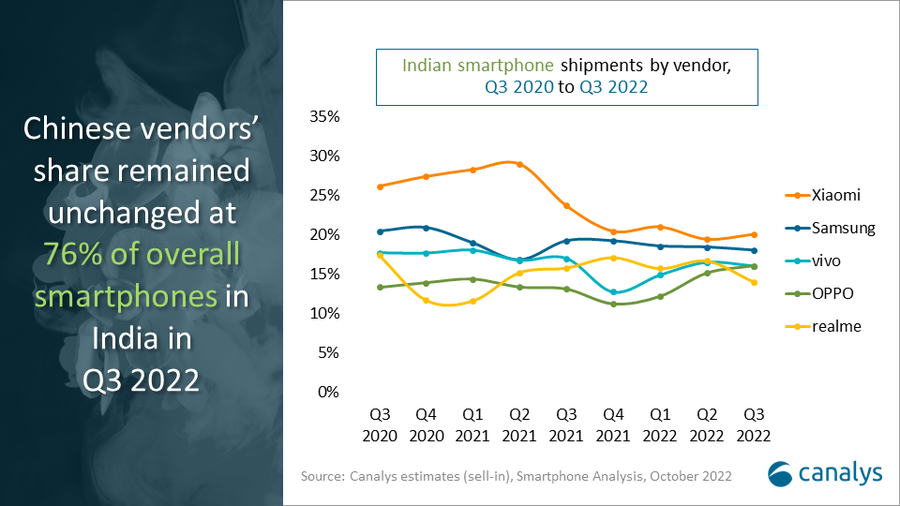

India’s smartphone shipments in Q3 2022 were 44.6 million units, a 6% decline from the previous year dragged by a lackluster low-end segment. Xiaomi held onto first place with 9.2 million units as the brand gained traction from July's online sales ahead of the festival season. Samsung came second with 8.1 million shipments and saw strong momentum in the mid-high-end category owing to aggressive offers and promotions. vivo and OPPO jumped to third and fourth place, shipping 7.3 million and 7.1 million units respectively, while realme dropped to fifth, shipping 6.2 million.

“Early Monsoon and Independence Day online sales were great opportunities for vendors to clear inventory before heading into the festive season,” said Canalys Analyst Sanyam Chaurasia. “The good news is, as the festival season began, in the last few weeks of the quarter, consumer demand improved. Hit by inflation, entry-level device contribution declined this year, while the mid-to-high segment performed relatively well thanks to aggressive promotions. OPPO’s OnePlus and vivo’s iQOO were the two brands driving mid-range growth in the e-commerce channel during this period. Ultra-premium category smartphones, especially older generation flagships, also experienced strong demand momentum amid price cuts. Samsung offered deep discounts on its older generation Galaxy Z Fold3 and latest Galaxy S22 series in online and offline channels. Similarly, demand for the aggressively discounted iPhone 13 outstripped the latest iPhone 14, whose value proposition is very similar to the former.”

“5G devices are gaining in popularity, supporting overall device ASP growth and sales revenue,” said Chaurasia. “It is perfect timing for vendors to push their 5G portfolios to smartphone upgraders in the next couple of years, as operators are rolling out 5G services in Tier 1 cities. Entry-level brands are also trying to capitalize on 5G opportunities. Jio and Google are developing the most affordable 5G smartphones to compete with major brands. Although from a cost perspective the ultra-affordable category is unlikely to hit the market in the near term as 5G chipsets are unlikely to decrease in price dramatically.”

“Business activities remained resilient as India's consumer confidence is gradually improving. However, the Indian Rupee has steadily depreciated against the US dollar since June, falling to a record low of INR83.06 on 20 October. Importers will continue to feel the heat from an operational perspective, especially rising material costs,” continued Chaurasia. “These challenges will persist into Q4, mostly affecting price-sensitive consumers as device ASPs continue to rise. As the mass market segment remains critical to vendors’ overall market share, brands will look for different ways to improve operational and channel efficiency, to minimize increased costs passing to end consumers.”

|

Indian smartphone shipments and annual growth |

||||||

|

Vendor |

Q3 2022 |

Q3 2022 |

Q3 2021 |

Q3 2021 |

Annual |

|

|

Xiaomi |

9.2 |

21% |

11.2 |

24% |

-18% |

|

|

Samsung |

8.1 |

18% |

9.1 |

19% |

-11% |

|

|

vivo |

7.3 |

16% |

8.1 |

17% |

-9% |

|

|

OPPO |

7.1 |

16% |

6.2 |

13% |

14% |

|

|

realme |

6.2 |

14% |

7.5 |

16% |

-18% |

|

|

Others |

6.7 |

15% |

5.4 |

11% |

26% |

|

|

Total |

44.6 |

100% |

47.5 |

100% |

-6% |

|

|

|

|

|

||||

|

Note: Xiaomi estimates include sub-brand POCO, vivo includes iQOO and OPPO includes OnePlus. |

|

|||||

For more information, please contact:

Sanyam Chaurasia: sanyam_chaurasia@canalys.com +91 89820 33054

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.