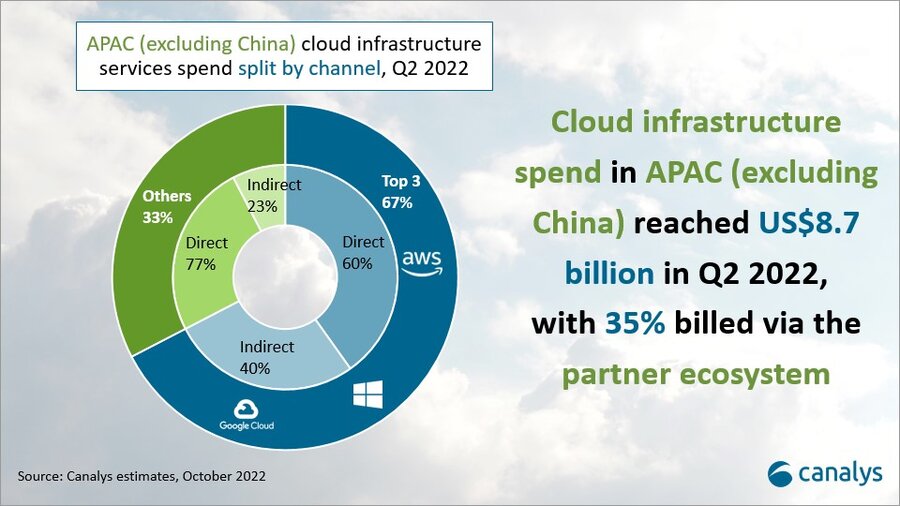

35% of cloud spend in APAC (excluding China) goes via the partner ecosystem

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Tuesday, 18 October 2022

Cloud infrastructure services spend in the Asia Pacific region (excluding China) reached US$8.7 billion in Q2 2022, up 35% and accounting for 14% of worldwide cloud spend. Amazon Web Services (AWS) and Microsoft Azure are the clear leaders in the region’s cloud market. The acceleration of digital transformation has brought tremendous demand for cloud in APAC. Small and medium-sized business cloud spend is set to increase and will be a major driver of cloud market growth in the coming year. Channel partners, which provide the most reach into SMBs in the region, will be key to winning and retaining customers in the future. Most of the major cloud providers in APAC are investing in channel growth and recruitment.

Demand for cloud services remains strong in APAC, driven by governments’ digitalization efforts and companies’ desire to future-proof to ensure business continuity. APAC now accounts for 14% of global cloud spend, and the region’s cloud market continues to grow rapidly.

Because of the varying levels of cloud maturity and readiness, and the differences in regulatory requirements and localization needs, navigating the APAC cloud market is difficult. Cloud partners play an increasingly important role in cloud adoption as they help remove barriers and lower the cost of entering new markets. Marketplaces are also developing as a key route to market – cloud provider marketplaces are in place to attract ISVs and drive cloud use, while distributor marketplaces support automation of cloud and SaaS delivery and help cloud vendors reach new partner types.

“Microsoft Azure has a mix of broadline distributors and specialists, which gives it a head start over its competitors in the channel,” said Canalys Research Analyst Yi Zhang. “A mature channel strategy has allowed Microsoft to build trusted relationships between partners and customers. Working with distributors to access SMB customers, it has successfully won mindshare within the SMB market. But both AWS and Google Cloud are developing broader and deeper channel relationships in the region to support their own SMB growth.”

SMBs in APAC are taking a growing piece of the pie, showing consistent growth across the region as they are increasingly recognized for their contribution to economic growth. Estimates from Canalys show that there are roughly 60 million SMBs in this region, which represent about 55% of the IT market in APAC. This brings huge potential demand for cloud migration and adoption, but will come with challenges. Though the pandemic accelerated SMB cloud adoption, many are still slow to migrate to the cloud because of the lack of IT leadership and skills.

“Unlike enterprise customers, which have mature best-of-breed strategies, SMBs’ IT buying decisions are usually more reactive, rather than strategic or proactive,” said Canalys Analyst Sheena Wee. “Most may not have strong IT knowledge and capabilities internally, so there continues to be a strong reliance on channel partners to be trusted advisors for their IT decisions.”

Canalys defines cloud infrastructure services as services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly but includes revenue generated from the infrastructure services being consumed to host and operate them.

For more information, please contact:

Yi Zhang (China): yi_zhang@canalys.com

Sheena Wee (APAC): sheena_wee@canalys.com

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.