India’s smartphone shipments fall by 6% in 2022, with the first-ever Q4 decline

Thursday, 19 January 2023

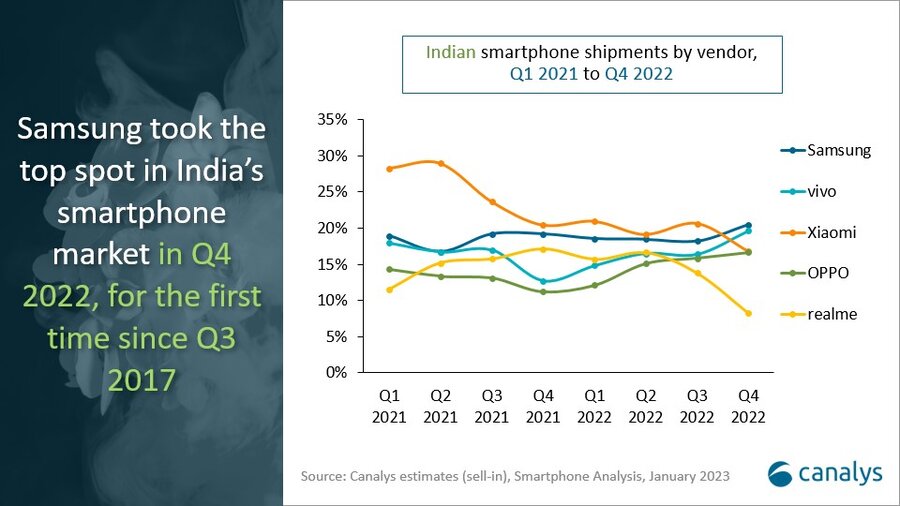

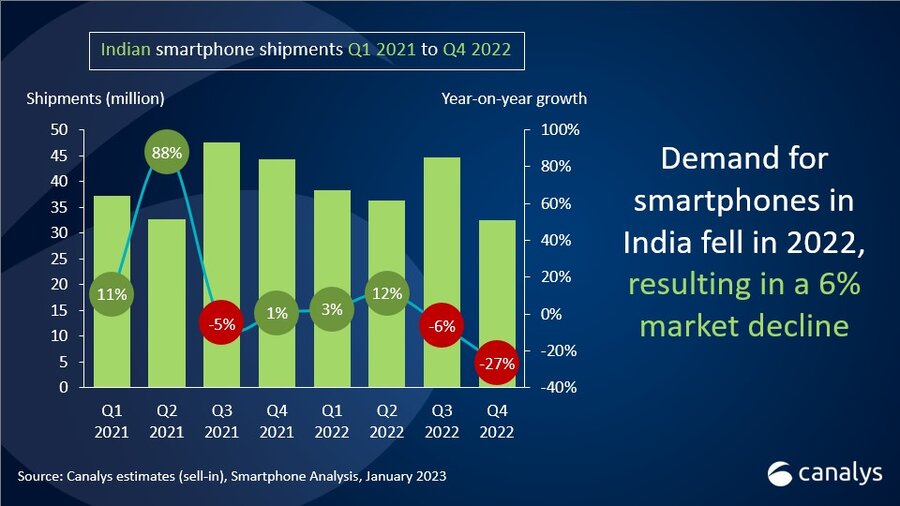

Canalys research shows that India’s smartphone shipments fell to 151.6 million units in 2022, declining by 6% compared with 2021. 2022 began with intermittent supply issues and low demand caused by global macroeconomic headwinds. India’s smartphone market suffered its first-ever drop in shipments in the fourth-quarter holiday period, falling by 27% to 32.4 million. Samsung took the number one spot in Q4 2022 for the first time since Q3 2017, shipping 6.7 million units for a market share of 21%. Second place went to vivo, which shipped 6.4 million units, mainly via offline channels. After 20 quarters, Xiaomi lost its leadership position in Q4 2022 and fell to third place with shipments of 5.5 million units. For full-year 2022, Xiaomi was still the number one vendor. OPPO and realme remained in fourth and fifth place, with shipments of 5.4 million and 2.7 million units respectively.

“India was better positioned to weather the global downturn than other markets. But domestic consumer spending cooled in the last few months of 2022,” said Sanyam Chaurasia, Analyst at Canalys. “Even during the festive season, the domestic market suffered a fall in transactions, retail spending and electronic imports. In 2022, consumers already had up-to-date technology that they had bought during the pandemic, thereby delaying further purchases. This led to smartphone brands struggling with inventory management because demand was subdued. Vendor channel management strategies became more important than ever. The mid-to-high-end segment performed well this year, which will further catalyze the upgrade cycle.”

“Vendors that were focused predominantly on online channels suffered from a poor ecommerce festive sales performance in Q4 2022,” added Chaurasia. “Xiaomi aimed to clear out inventory of its older models using the ecommerce channel. But, due to poor ecommerce festive sales performance, Xiaomi and realme saw significant stockpiling of their products in online channels in Q4 2022. At the same time, in tier-three and tier-four cities, vivo and OPPO focused on offline channels, which helped them to be the only vendors to grow year on year. With strength in the retail channel to drive volume, Samsung continues to target consumers across routes to market.”

“After a rollercoaster 2022, India’s potential is still intact in the long term,” said Chaurasia. “The Indian economy started to feel the impact of the global economic slowdown toward the end of 2022. We are entering 2023 with economic indicators suggesting a sluggish performance in the short term. But, in 2024, India is set to hold its general election and the government’s strategy will be to boost consumers’ purchasing power, even if inflation remains high. Growth in the mass-market segment remains vital for smartphone vendors and will depend on many uncertain macroeconomic factors. Canalys expects moderate growth in the Indian smartphone market in 2023 fueled by a replacement cycle driven by 5G devices, state government deals, smartphone penetration and the introduction of new use cases.”

|

Indian smartphone shipments and annual growth |

|||||

|

Vendor |

Q4 2022 |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

Samsung |

6.7 |

21% |

8.5 |

19% |

-21% |

|

vivo |

6.4 |

20% |

5.6 |

13% |

13% |

|

Xiaomi |

5.5 |

17% |

9.0 |

20% |

-40% |

|

OPPO |

5.4 |

17% |

5.0 |

11% |

9% |

|

realme |

2.7 |

8% |

7.6 |

17% |

-65% |

|

Others |

5.7 |

18% |

8.5 |

19% |

-32% |

|

Total |

32.4 |

100% |

44.2 |

100% |

-27% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO and OPPO includes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

|

Indian smartphone shipments and annual growth |

|||||

|

Vendor |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Xiaomi |

29.6 |

20% |

40.2 |

25% |

-26% |

|

Samsung |

28.6 |

19% |

30.1 |

19% |

-5% |

|

vivo |

25.4 |

17% |

25.8 |

16% |

-2% |

|

OPPO |

22.6 |

15% |

20.9 |

13% |

8% |

|

realme |

20.9 |

14% |

24.3 |

15% |

-14% |

|

Others |

24.5 |

16% |

20.2 |

13% |

22% |

|

Total |

151.6 |

100% |

161.5 |

100% |

-6% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO and OPPO includes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Sanyam Chaurasia: sanyam_chaurasia@canalys.com +91 89820 33054

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processors, memory, cameras and many other parameters. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.