India breaks record again with 5.8 million PC shipments in Q1 2022

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Tuesday, 31 May 2022

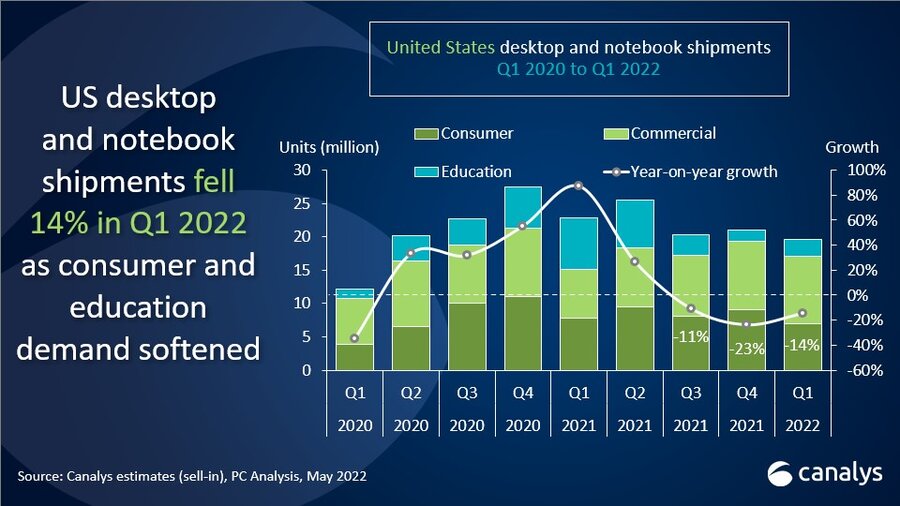

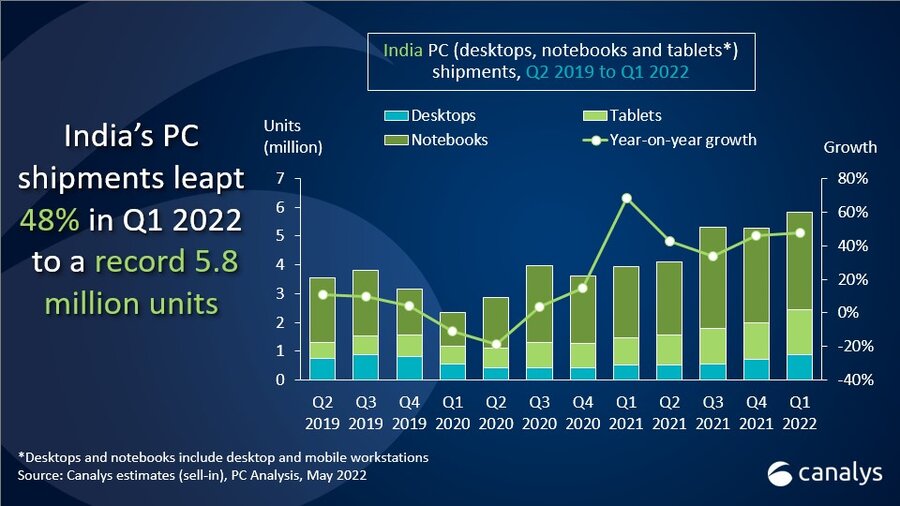

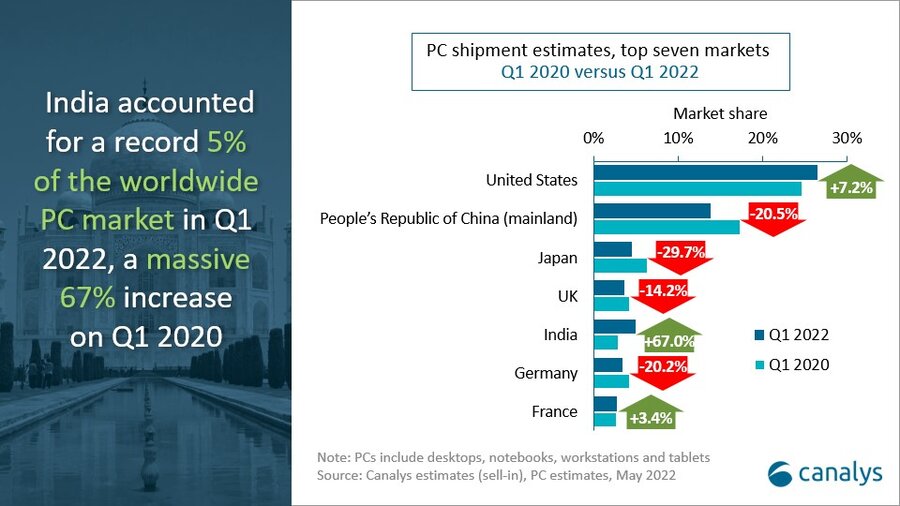

India’s PC shipments (desktops, notebooks and tablets) rocketed by 48% in Q1 2022 to a record-breaking 5.8 million units, beating the previous record of 5.3 million in Q3 2021. In the last six quarters, shipments have grown by 44% on average, despite sustained pressure on the global supply chain. They have now surpassed the 5 million-mark for a third quarter in a row. India now accounts for 5% of global PC shipments, compared with just 3% two years ago. Notebooks were the largest category, with 3.4 million units shipped, up 36% year on year. Desktop shipments surpassed 880,000 units, a phenomenal 64% increase over Q1 2021. But tablets were the strongest category, with shipments reaching 1.6 million, up 69% on a year ago, largely due to government orders picking up again after a two-year hiatus.

|

Indian PC (including tablets) shipments (market share and annual growth) Canalys PC Market Pulse: Q1 2022 |

||||||

|

Vendor |

Q1 2022 |

Q1 2022 |

Q1 2021 |

Q1 2021 |

Annual |

|

|

HP |

1,449 |

24.9% |

1,022 |

25.9% |

41.8% |

|

|

Lenovo |

1,122 |

19.3% |

867 |

22.0% |

29.4% |

|

|

Acer |

626 |

10.7% |

176 |

4.5% |

256.2% |

|

|

Dell |

583 |

10.0% |

534 |

13.6% |

9.1% |

|

|

Samsung |

433 |

7.4% |

331 |

8.4% |

30.8% |

|

|

Others |

1,611 |

27.7% |

1,011 |

25.7% |

59.3% |

|

|

Grand Total |

5,824 |

100.0% |

3,940 |

100.0% |

47.8% |

|

|

|

|

|

||||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), May 2022 |

|

|||||

“There are two main reasons for India’s phenomenal performance this quarter,” said Jash Shah, Research Analyst at Canalys. “Firstly, India’s success at managing COVID-19, despite its huge population, has to be recognized. While most of the world was in lockdown, India remaining open for business as usual to a large degree. This helped the economy resurge, creating additional demand for PCs and other IT infrastructure. Secondly, India is slowly but surely inching toward self-reliance in PC production. 18% of all PCs sold in India are now manufactured locally, implying that India’s vulnerability to black swan events in China is diminishing, and that its own appetite for PC consumption is increasing. While global macroeconomic events are raising multiple concerns over the sustainability of this growth, India will stay strong for the coming few quarters, despite the softness expected in other global markets.”

“Inflation woes continue to plague the market in 2022, as unprecedented global food prices have sent local prices soaring, with average inflation over 6% for the past three months,” added Shah. “With the Reserve Bank of India pushing up base lending rates, which are expected to continue to increase through the year to battle wholesale inflation, businesses in debt will feel the crunch, as they have less capital to work with. While consumers will stop making discretionary purchases, companies, both small and large, have shown an inclination to freeze budgets, stop hiring and cut spending, which will have a ripple effect on IT procurement, and thereby PC demand. Canalys advises PC vendors to exercise caution while planning for the quarters ahead. At the same time, large government tenders for education are expected to keep the market buoyant.”

|

India desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q1 2022 |

||||||

|

Vendor |

Q1 2022 |

Q1 2022 |

Q1 2021 |

Q1 2021 |

Annual |

|

|

HP |

1,449 |

34.1% |

1,022 |

33.9% |

41.8% |

|

|

Lenovo |

752 |

17.7% |

624 |

20.7% |

20.5% |

|

|

Dell |

582 |

13.7% |

533 |

17.7% |

9.1% |

|

|

Acer |

421 |

9.9% |

161 |

5.3% |

161.5% |

|

|

Asus |

265 |

6.2% |

167 |

5.5% |

58.8% |

|

|

Others |

787 |

18.5% |

505 |

16.8% |

55.9% |

|

|

Grand Total |

4,256 |

100.0% |

3,012 |

100.0% |

41.3% |

|

|

|

|

|

||||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), May 2022 |

|

|||||

Vendor performances

|

India tablet shipments (market share and annual growth) Canalys PC market pulse: Q1 2022 |

||||||

|

Vendor |

Q1 2022 |

Q1 2022 |

Q1 2021 |

Q1 2021 |

Annual |

|

|

Samsung |

433 |

27.6% |

331 |

35.6% |

30.8% |

|

|

Lenovo |

370 |

23.6% |

243 |

26.1% |

52.5% |

|

|

Lava |

206 |

13.2% |

- |

- |

N/A |

|

|

Acer |

205 |

13.1% |

15 |

1.6% |

1,288.4% |

|

|

Apple |

197 |

12.6% |

100 |

10.8% |

96.1% |

|

|

Others |

156 |

10.0% |

240 |

25.8% |

-34.7% |

|

|

Grand Total |

1,567 |

100.0% |

928 |

100.0% |

68.9% |

|

|

|

|

|||||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), May 2022 |

|

|||||

For more information, please contact:

Jash Shah: jash_shah@canalys.com +91 95661 11317

Ashweej Aithal: ashweej_aithal@canalys.com +91 97386 19281

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.