50 series smartphones herald a new era for Honor

18 June 2021

A flock of black swan events in quick succession – the US-China trade war, the COVID-19 pandemic, Russia’s invasion of Ukraine – have all played a role in shaping the economic reality of 2022.

Inflation – few topics are more top of mind for business leaders around the world, including those in the technology sector. A flock of black swan events in quick succession – the US-China trade war, the COVID-19 pandemic, Russia’s invasion of Ukraine – have all played a role in disrupting global supply chains, leading to price increases for all types of goods. Meanwhile, renowned economist Charles Goodhart predicts a prolonged period of higher inflation due to a shrinking labor force, which collectively will push for higher wages. Inflation has certainly arrived in 2022, but whether it is a short-term blip that will be wrestled under control, or a long-term reality as Goodhart predicts remains to be seen. Either way, all corners of the technology industry will be affected. The only question is, how severely?

In these uncertain times, Canalys has a few predictions to share:

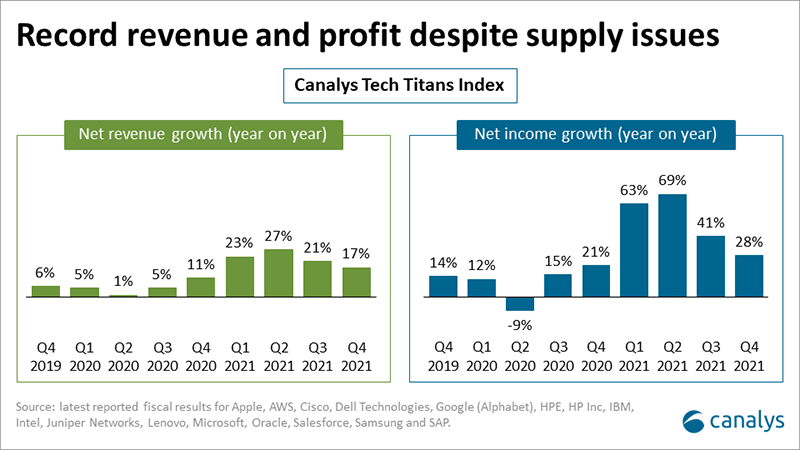

Tech profits will come under pressure in 2022. 2021 was a strong growth year for the technology industry. The Canalys Tech Titans, for example, collectively grew their revenue by 21%. Meanwhile, income growth for that group was more than double the rate at 46%. Customers, desperate to gain access to the latest technology, showed a strong propensity to spend despite supply chain challenges inflating product prices. HP’s latest results in its PC business paint a strong picture of what is happening in hardware sales: revenue was up 15% year on year while unit shipments were down 6%. Product costs have been passed onto customers, and this will continue. Cisco, for example, announced an average 10% price increase across its portfolio in early 2022 due to greater costs in the supply chain, having already implemented rises in 2021. But more rises are inevitable as inflation is a spiraling force and, at some point, cracks in the cycle will emerge as consumers and businesses struggle to bear these increases. Technology companies (like most companies) will be faced with a workforce demanding higher wages to offset increases in their own cost of living; they also face customers that have their own pressures to manage costs. Other operating costs will increase: more people in offices, more travel, more in-person events. All these factors will lead to profit pressures.

Cloud infrastructure expansion will begin to stall. No technology segment has performed better than cloud over the past few years, and hyperscalers have been driving rampant expansion to meet continued demand. AWS has announced plans to launch new availability zones in over 30 cities around the world over the next two years. This will become an increasingly expensive undertaking. While hyperscalers do have a size advantage when buying equipment, they are not immune to rising component prices. This, combined with labor cost increases, rising interest rates (which will affect capital leasing costs) and rising energy costs, make the business of running global cloud infrastructure more expensive. Microsoft has announced price rises to Office 365, while Google Cloud has also announced some price increases, highlighting that the cost pressures are not just being felt by hardware companies. Amazon and Microsoft will be better placed to overcome these challenges given their size and leading positions, but challengers will struggle to invest in infrastructure at a similar pace. Cloud vendors will have to raise their prices, which will force customers to reevaluate and prioritize their cloud needs. Expect more businesses to scrutinize their cloud use in 2022 and beyond.

Unicorns begin to starve as talent leaves for greener pastures and investors prioritize profit. The last decade in technology has been about revenue growth over profitability. These companies, buoyed by growth-minded investors, relied heavily on lucrative stock options to lure talent across the industry. A depressed stock market (amplified by the war in Ukraine and expected interest rate rises) will lead to underwater equity options for many employees. Against a backdrop of a highly competitive labor market, salaries will be vital to lure and retain talent. Palo Alto Networks, for example, has made this a priority with its Welcome Home program to bring back former employees and retain current staff. Amazon, too, made a significant change to its compensation structure, raising the cap on the cash component of salaried employees. Meanwhile, the mindset of the investor community will also change as stock values fall. Profit will take precedent ahead of growth. Software companies that have shown less than expected growth have already suffered in 2022, falling from the incredible highs reached in 2021. Profitable companies will be in an advantageous position to both win the talent war and attract investment dollars.

The flood of M&A activity will continue over the next 18 months. According to PwC, M&A activity reached a record high in 2021. But economic headwinds (rising costs and inflation) as well as political headwinds (war, taxes and the regulatory environment) are blowing. Within tech, startups and venture-backed companies are faced with a nervous stock market, which may make IPOs less appealing. Meanwhile, large cash-rich vendors will be looking to turn their capital into capabilities to maximize their returns. At the end of 2021, Oracle made an all-cash move to buy healthcare specialist Cerner for US$28 billion, which is expected to close this year. Microsoft kickstarted 2022 with its announced acquisition of gaming company Activision Blizzard (an all-cash transaction valued at US$68.7 billion). Intel followed with its US$5.4 billion addition of Tower Semiconductor in February to expand its foundry capacity. In March, Google announced its purchase of Mandiant for US$5.4 billion, its second largest acquisition to date. Cisco had reportedly explored a takeover of Splunk, which, had it come to fruition, would have been its largest ever acquisition. Private equity companies will play their role in shaping the vendor landscape too. Citrix and Tibco Software will be merged into one company under PE owners Vista Equity Partners and Evergreen Coast Capital. This follows a similar combining of McAfee and FireEye under Symphony Technology Group in late 2021.

More vendors will lean on their partners to augment both sales and support. On one hand, retaining top talent is high on the corporate agenda for technology firms (as already highlighted). But on the other, vendors will lean on the partner ecosystem not only for sales reach, but increasingly to augment their services and support capabilities too. Recently, it was reported that Google Cloud would be making some layoffs in its support organization. While the total number of employees affected appears small, it was noted that some of those responsibilities would be shifted to third-party vendors. It is a reminder that even in areas like cloud, where direct sales have historically been the primary route, partners will play a larger role. AWS grew its share of indirect sales in 2021 and expanded its channel agreements with key distributors Ingram Micro and TD Synnex. Across the partner ecosystem, inflation has so far benefited partners in terms of higher prices contributing to top-line revenue. The next wave of benefits for partners will be increased opportunities in their services and support businesses, which will now also command higher prices. The challenge for partners will be similar to that for vendors – services and support are traditionally people-led businesses so their costs will be higher. Those that have automated service delivery will be better placed.

There will be a new wave of hardware design. At the heart of rising technology prices are the issues experienced in the supply chain: tariffs, raw materials shortages, manufacturing and logistical disruptions. Pressures were abating, allowing the industry to play catch up, until war broke out in Ukraine. The last five years have highlighted that fragilities in the global supply chain are not only possible but increasingly likely. Hardware vendors’ R&D departments will now need to think carefully about their product design, with resiliency and reducing risks in the supply chain high priorities. Designing modular form factors, using fewer but more attainable components, and incorporating software that is not hardware-restricted will be the primary outcomes. The good news is that some of these principles are also in step with sustainability ambitions, which also feature high on the corporate agenda. Building sustainable products that are resilient to global supply chain disruptions is an ambition that all hardware vendors will strive for.

Automation will become widespread. Goodhart’s theory for a prolonged period of inflation is largely based on a shrinking supply of workers. Automation may not be enough to completely offset this decline, but it will undoubtedly play a role. There are countless jobs and tasks that can be increasingly automated over time; most of them are highly specific sector jobs. Upstart, a US-based online lending company, claims it is underwriting 60% of its loans without any human intervention, relying instead on artificial intelligence and automation. It is the latest example of a technology company disrupting an age-old sector. Within the traditional technology sector, vendors and partners will look to automation to drive more profitability across their activities. Software vendors will lean on APIs to connect with marketplaces. MSPs will use automation to monitor and remediate IT events. But there is a danger that over-automation reduces the personal touch. In the area of partner program management, for example, automation has risen to a top five complaint among partners, while in 2018, it ranked last in overall complaints. Businesses will need to strike the right balance across their engagements with partners and customers.