Hyperscaler cloud marketplace sales to hit US$85 billion by 2028

Thursday, 15 August 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

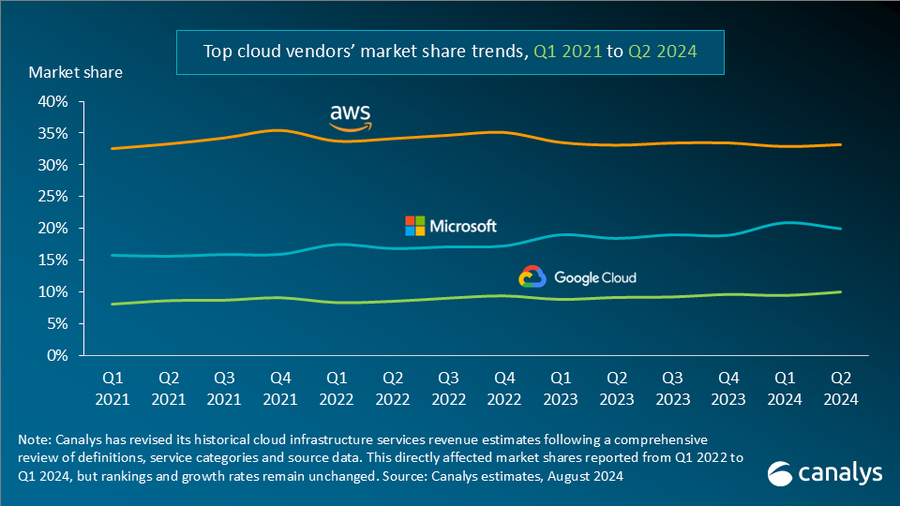

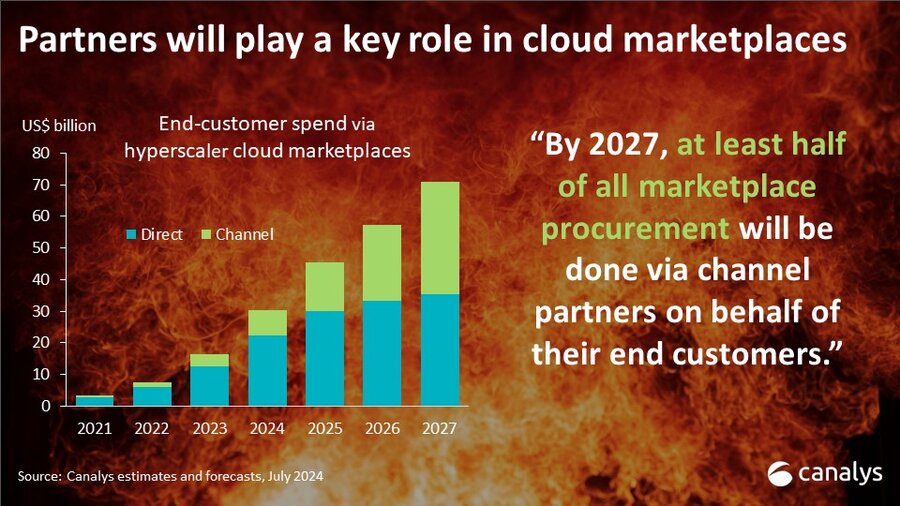

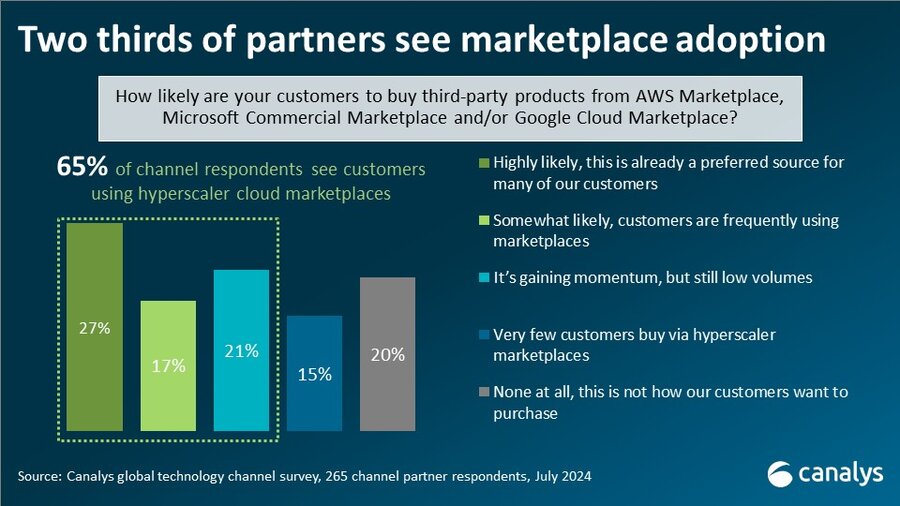

Enterprise software sales through hyperscaler cloud marketplaces – led by AWS, Microsoft and Google Cloud – are projected to reach US$85 billion by 2028, rising from US$16 billion in 2023. The availability of cloud credits for third-party purchases through the hyperscalers’ marketplaces and the emergence of new digital-first buyers are reshaping enterprise customer procurement behavior, vendor sales strategies and channel models. While most vendor sales via these marketplaces are today “direct” to end customers, channel partners are playing an increasingly important role. By 2027, Canalys expects more than 50% of marketplace sales to flow through the channel.

This trend is explored in a new Canalys research report: Now and next for hyperscaler marketplaces.

Enterprise customers have committed to spend over US$360 billion on the top three hyperscalers’ cloud services on a multi-year basis. Spend is shifting to the hyperscalers’ marketplaces as customers seek to burn down a portion of their cloud credits on third-party software and SaaS. AWS Marketplace remains the clear leader in terms of sales volume, but Microsoft and Google Cloud are focused on closing the gap. With enterprises facing IT budget pressure, the opportunity to use pre-approved cloud budgets to source a wide array of software and cybersecurity products while taking advantage of simplified billing and consolidated purchasing can be highly compelling.

This is tempting vendors from across the technology spectrum to sell through the hyperscalers’ marketplaces. CrowdStrike and Snowflake were among the first to publicly claim US$1 billion of total cumulative sales through marketplaces, and a host of the largest software and cybersecurity vendors are actively embracing this route to market. Cisco, Citrix, IBM, NetApp, Nutanix, Red Hat, Salesforce, ServiceNow and Zoom are just some of the vendors that have launched or grown their sales on the hyperscalers’ marketplaces so far in 2024.

At the same time, many smaller “digital native” ISVs built on one of the three top hyperscalers’ cloud platforms are using their respective marketplaces as their primary routes to market. The hyperscalers meanwhile are funneling substantial investments into marketplace co-sell resources, demand generation, sales incentives and channel programs (along with cuts to marketplace fees) to attract vendors to their cloud platforms.

The channel is becoming a focal point in the battle between the hyperscalers as vendors prioritize partner-first marketplace strategies. Through models such as AWS’ Channel Partner Private Offers, Microsoft’s Multiparty Private Offers and Google Cloud’s newly launched Marketplace Channel Private Offers, vendors can enable their partners to create customized offers for their customers on the hyperscalers’ marketplaces while seeking to maintain margins for the channel.

“The channel has concerns about the rise of marketplaces, but both hyperscalers and vendors acknowledge the vital role of channel partners in driving customer adoption and growth,” said Alastair Edwards, Chief Analyst at Canalys. “Customers often prefer buying through trusted partners for help with managing cloud commitments and accessing professional services and technical expertise when sourcing complex technologies from multiple marketplaces.”

IT distributors are facing increasing competition from hyperscaler marketplaces that are themselves acting as digital distribution platforms. Yet distributors will be important to reduce operational challenges for partners and vendors as adoption grows globally and to support the growing number of second-tier partners whose customers want to buy this way. Canalys expects the development and expansion of new programs, such as AWS DSOR, to support greater distributor involvement.

Channel partners are vital to ensure customers can access the technologies they need, regardless of their buying preferences. “A seamless buying experience is essential, and success will depend on greater API-led integration between hyperscalers, distributors and partner platforms,” said Edwards.

Download the full Canalys report: Now and next for hyperscaler marketplaces.

For more information, please contact:

Alastair Edwards (UK): alastair_edwards@canalys.com

Jay McBain (US): jay_mcbain@canalys.com

Canalys established itself on its channel research expertise. Through industry-leading analysis of technology channels worldwide, Canalys’ expert analysts help the world’s largest technology companies develop successful go-to-market strategies and understand the ever-changing channel landscape. The Channels Analysis service provides a unique and comprehensive view of the key issues affecting technology product sales, marketing and distribution, helping channel managers develop better strategies that deliver desired business results.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.