Global smartphone market grew by 3% in Q4 2024, with Apple leading for the full year

Tuesday, 14 January 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

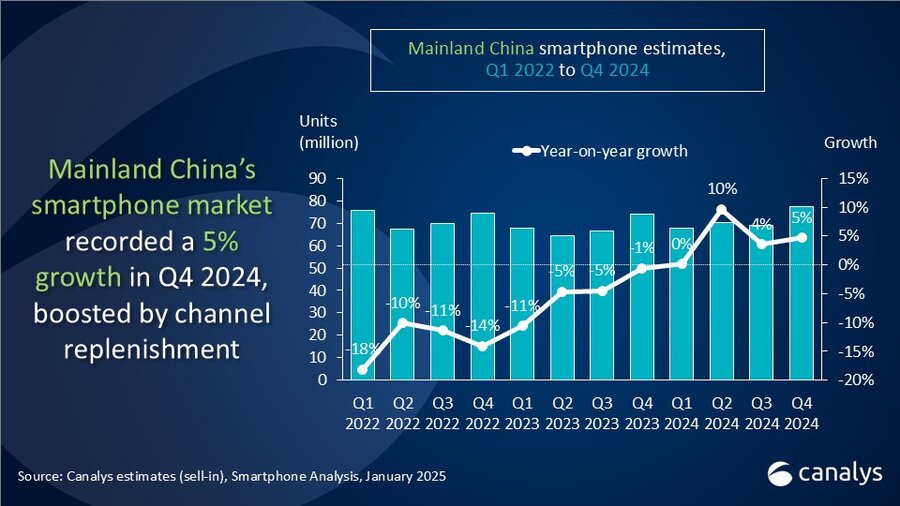

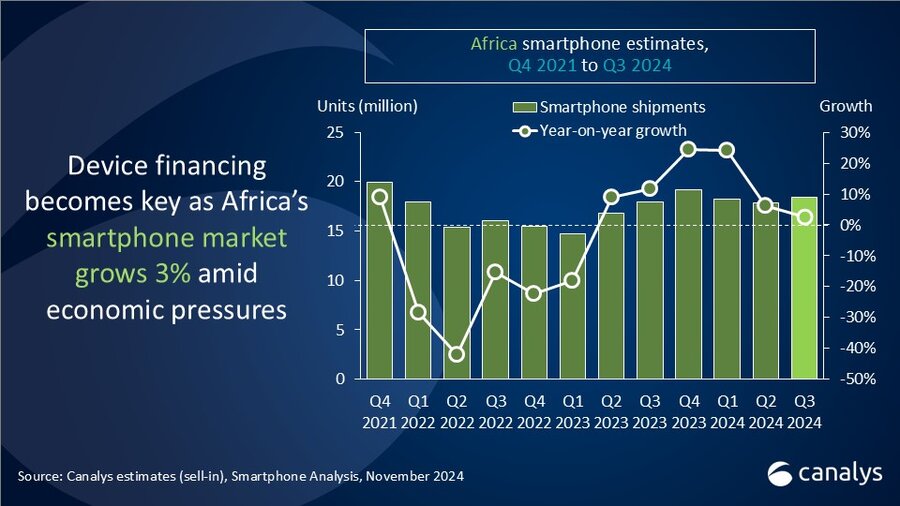

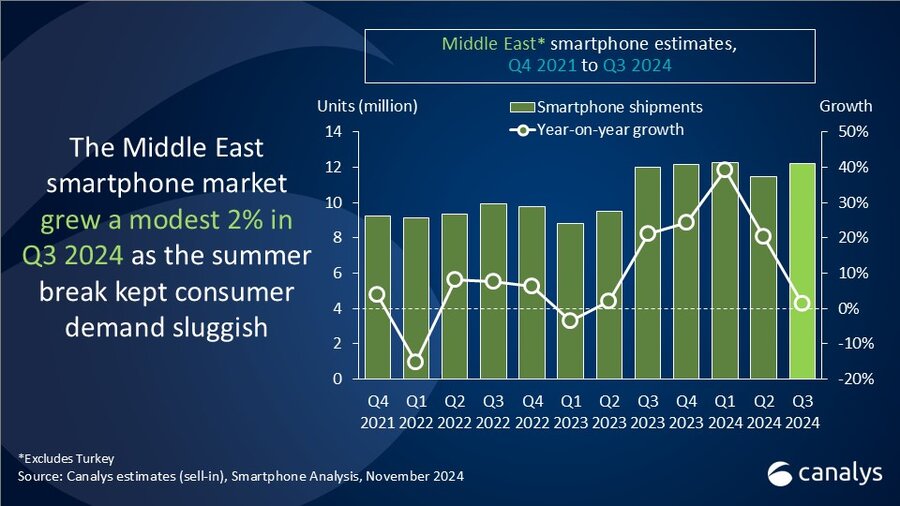

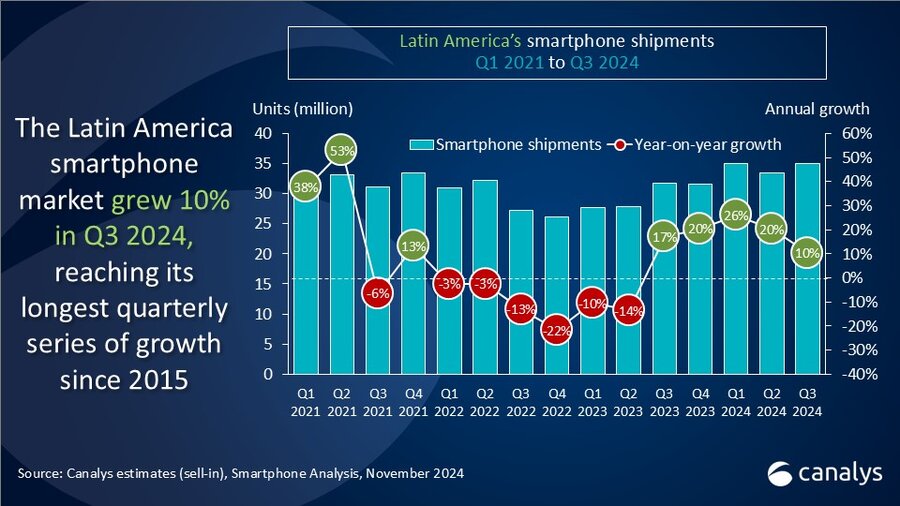

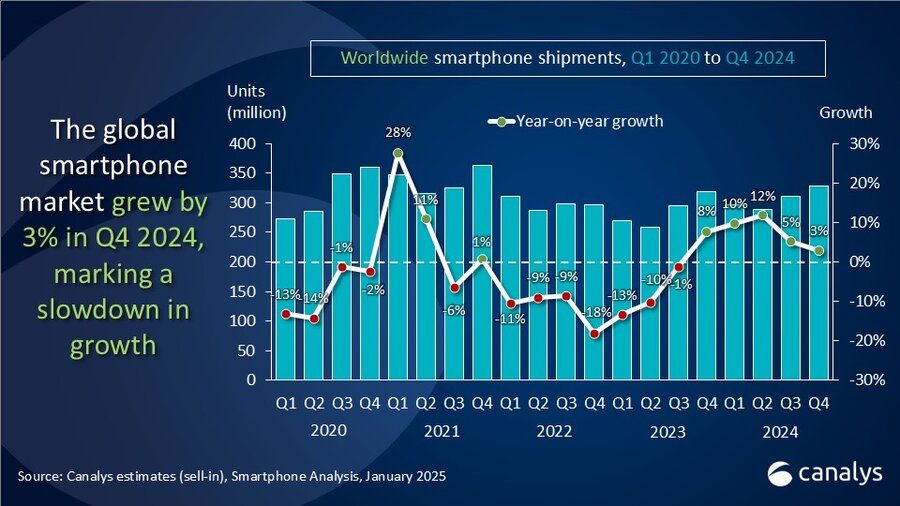

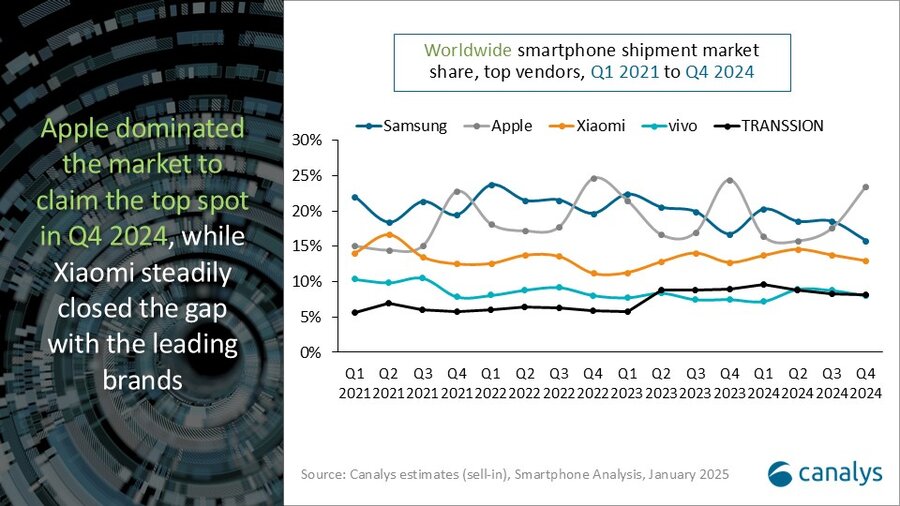

According to latest Canalys research, the global smartphone market grew by 3% to reach 330 million units in Q4 2024, marking the fifth consecutive quarter of growth. However, the growth rate has significantly slowed. Apple showcased strong performance during its traditional new launch season, securing the top spot with a 23% market share. Samsung followed with a 16% market share, experiencing a decline. Xiaomi maintained its third position with a 13% market share, being the only brand to achieve year-on-year growth among the top three, driven by increasing presence in its home market and globalization efforts. TRANSSION and vivo ranked fourth and fifth respectively, benefiting from the recovery of emerging markets in the Asia-Pacific region. For full year 2024, global smartphone shipments totaled 1.22 billion units, reflecting a 7% year-on-year increase. Apple maintained its lead over Samsung for the second consecutive year.

“Apple solidified its global position through growth in emerging markets like India and Southeast Asia in 2024,” stated Canalys Analyst Le Xuan Chiew. “By expanding channel coverage and influence in the Asia-Pacific region, and leveraging active marketing and branding strategies, Apple captured growth opportunities. However, competition and a prolonged replacement cycle limited its growth momentum in some developed markets. Looking ahead to 2025, Apple is expected to achieve growth, driven by a refreshed portfolio, hardware upgrades and broader adoption of Apple Intelligence.”

“The prosperity of mass-market products was a key driver of global smartphone growth in 2024,” added Canalys Senior Analyst Toby Zhu. “Despite challenges from rising supply chain costs since early 2024, Android brands like Xiaomi, TRANSSION and vivo achieved double-digit growth, supported by extensive channel networks, competitive products, and effective inventory management. Meanwhile, mid-range devices faced demand pressure as consumers in emerging markets favored value-for-money products, while mature markets showed a trend toward higher average selling prices.”

“It will be challenging to replicate the market performance of 2024 in 2025,” commented Zhu. “Last year’s growth largely came from inventory replenishment through vendor and channels, and macroeconomic recovery in specific markets. Demand fluctuations and macro uncertainties remain key challenges. Vendors will focus more on high-end products, enhancing competitiveness through AI integration, product innovation and stronger marketing strategies. Inventory management will adopt a more cautious approach to mitigate the effects of geopolitical conflicts and macroeconomic volatility. Besides, regional vendors will expand their channel coverage and product portfolios, activating localized market opportunities. This could again reduce market concentration among leading vendors.”

|

Worldwide smartphone market share split |

|||

|

Vendor |

Q4 2024 |

Q4 2023 |

|

|

Apple |

23% |

24% |

|

|

Samsung |

16% |

17% |

|

|

Xiaomi |

13% |

13% |

|

|

TRANSSION |

8% |

9% |

|

|

vivo |

8% |

7% |

|

|

Others |

32% |

30% |

|

|

|

|

|

|

|

Preliminary estimates are subject to change on final release |

|

||

For more information, please contact:

Toby Zhu: toby_zhu@canalys.com

Le Xuan Chiew: lexuan_chiew@canalys.com

Canalys' worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys, part of Informa TechTarget, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.