Global PC shipments grew 3.8% to 255 million in 2024

Friday, 10 January 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

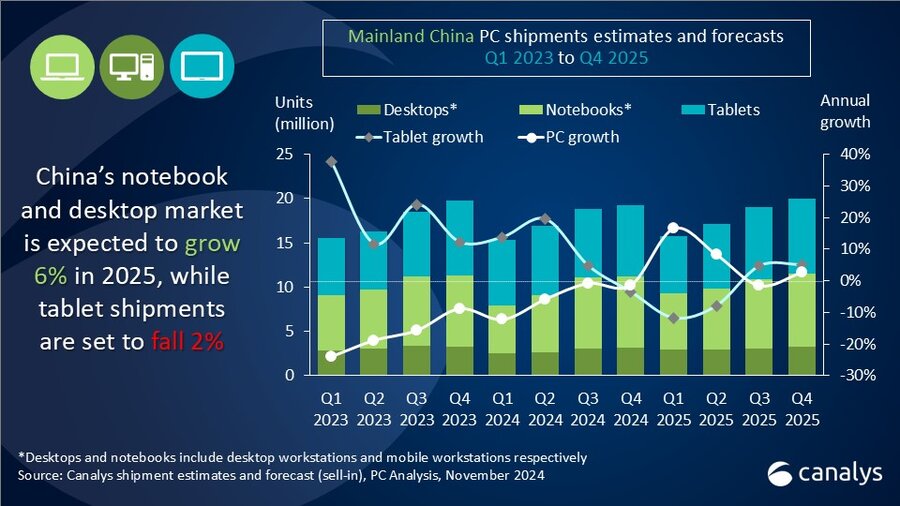

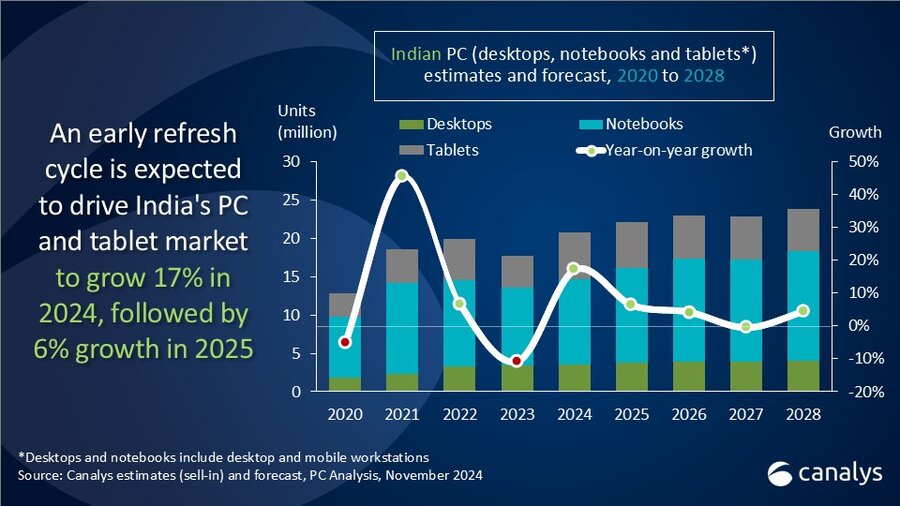

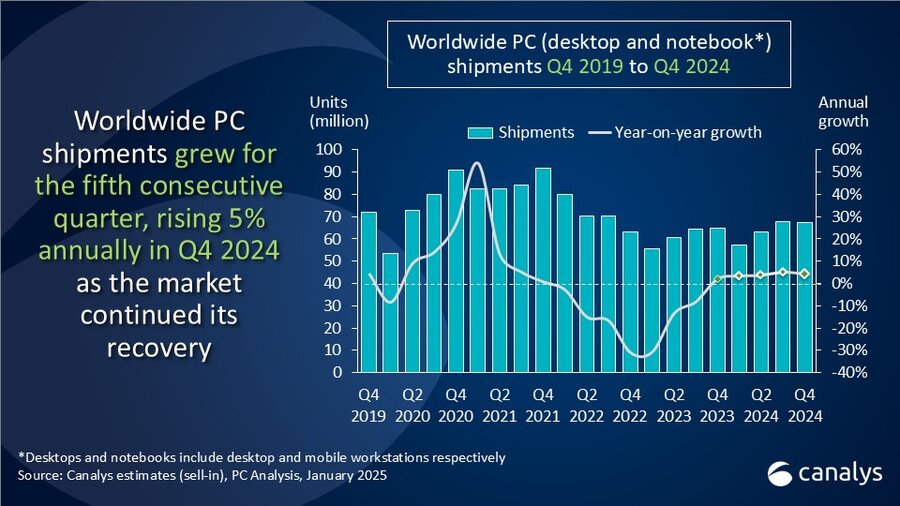

The global PC market in 2024 was marked by stabilization and ended on the road to recovery and a commercial refresh cycle in 2025. According to the latest Canalys data, the PC market achieved its fifth consecutive quarter of growth in Q4, with total shipments of desktops, notebooks and workstations rising 4.6% to 67.4 million units. Notebook shipments (including mobile workstations) reached 53.7 million units, growing 6.2%. While desktops (including desktop workstations) shipments fell 1.4% to 13.7 million units. 2025 is expected to be a year of accelerating growth as the Windows 10 end-of-support deadline in October pushes hundreds of millions of PC users to refresh their devices.

“2024 was a year of modest recovery and a return to traditional seasonality for the PC market as full-year shipments grew 3.8%. Growth increased slightly in Q4, with shipments rising by 4.6% year on year, signaling a positive trend as we moved to within a year of the Windows 10 end-of-support date,” said Kieren Jessop, Analyst at Canalys. “Holiday season demand was supported by strong discounting by vendors and retailers, enticing consumers who have become increasingly price-sensitive. Additionally, the use of buy now, pay later services supported this trend, with increasing examples of these offerings being leveraged to drive spending on big-ticket items, such as PCs. In China, government stimulus in the form of consumer subsidies helped to promote spending on notebooks amid a demand environment that had been weakening.”

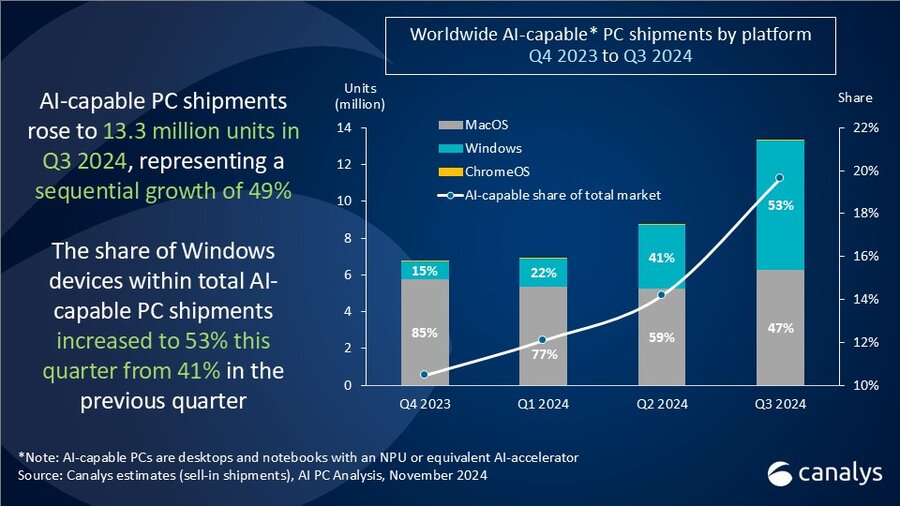

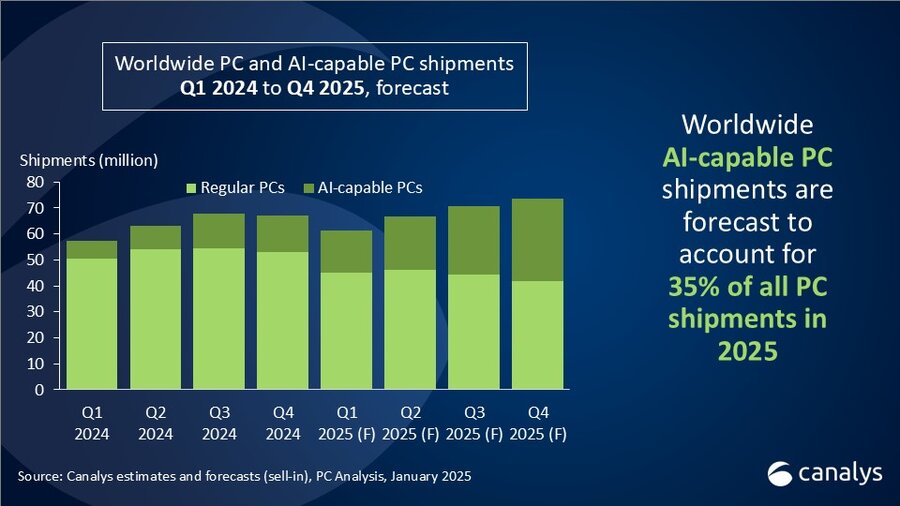

“Looking ahead, the PC market is set for accelerating growth, primarily driven by commercial demand as businesses prepare for the end of Windows 10,” said Ishan Dutt, Principal Analyst at Canalys. “The advances showcased at CES 2025 highlight the industry’s commitment to making AI-capable PCs a halo category, enticing customers into conversations around a wider fleet refresh. As CPU and PC vendor roadmaps begin to bring on-device AI into more categories, price bands and regions, we anticipate that AI-capable PCs will account for 35% of worldwide shipments in 2025.”

Lenovo took the top spot in Q4 2024, shipping 16.9 million units worldwide, reflecting 4.9% year-on-year growth against an already strong shipment performance in Q4 2023. HP followed in second place with a 1.6% decline in shipments, totaling 13.7 million units globally. Dell held onto third place but declined in every quarter of the year, falling 0.2% in Q4. Apple remained in fourth place, shipping 5.9 million units with 3.1% annual growth, while Asus rounded out the top five, boasting the highest growth among the top vendors with a 21.6% year-on-year increase.

|

Worldwide desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q4 2024 |

|||||

|

Vendor |

Q4 2024 |

Q4 2024 |

Q4 2023 |

Q4 2023 |

Annual |

|

Lenovo |

16,884 |

25.0 % |

16,094 |

24.9% |

4.9% |

|

HP |

13,724 |

20.3% |

13,945 |

21.6% |

-1.6% |

|

Dell |

9,898 |

14.7% |

9,914 |

15.4% |

-0.2% |

|

Apple |

5,934 |

8.8% |

5,756 |

8.9% |

3.1% |

|

Asus |

4,977 |

7.4% |

4,092 |

6.3% |

21.6% |

|

Others |

16,038 |

23.8% |

14,711 |

22.8% |

9.0% |

|

Total |

67,455 |

100.0% |

64,512 |

100.0% |

4.6% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), January 2025 |

|

||||

|

Worldwide desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Full-year 2024 |

|||||

|

Vendor |

2024 |

2024 |

2023 |

2023 |

Annual |

|

Lenovo |

61,871 |

24.2% |

59,106 |

24.0% |

4.7% |

|

HP |

52,991 |

20.7% |

52,900 |

21.5% |

0.2% |

|

Dell |

39,096 |

15.3% |

39,979 |

16.2% |

-2.2% |

|

Apple |

22,820 |

8.9% |

22,382 |

9.1% |

2.0% |

|

Asus |

18,334 |

7.2% |

16,524 |

6.7% |

11.0% |

|

Others |

60,422 |

23.6% |

55,369 |

22.5% |

9.1% |

|

Total |

255,534 |

100.0% |

246,261 |

100.0% |

3.8% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), January 2025 |

|

||||

For more information, please contact:

Kieren Jessop: kieren_jessop@canalys.com

Ishan Dutt: ishan_dutt@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys, part of Informa TechTarget, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.