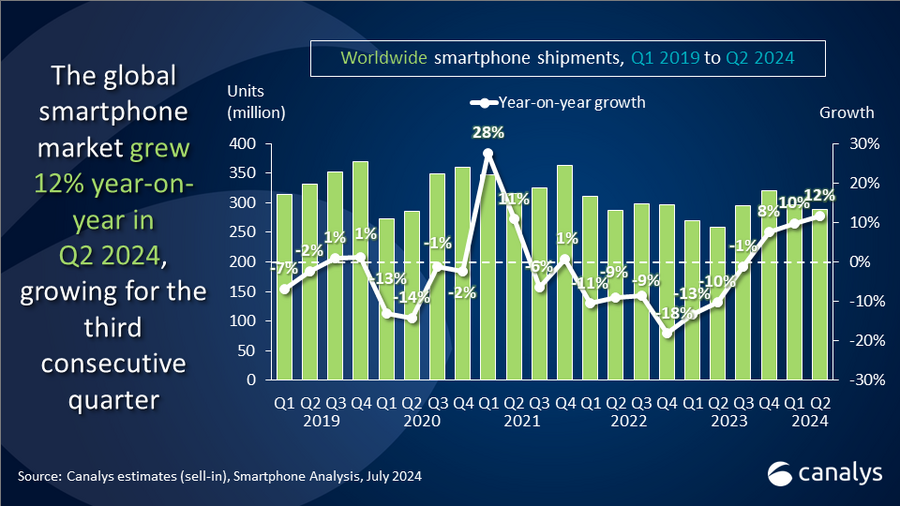

The global smartphone market rebounds for the third consecutive quarter with a 12% growth

Monday, 15 July 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

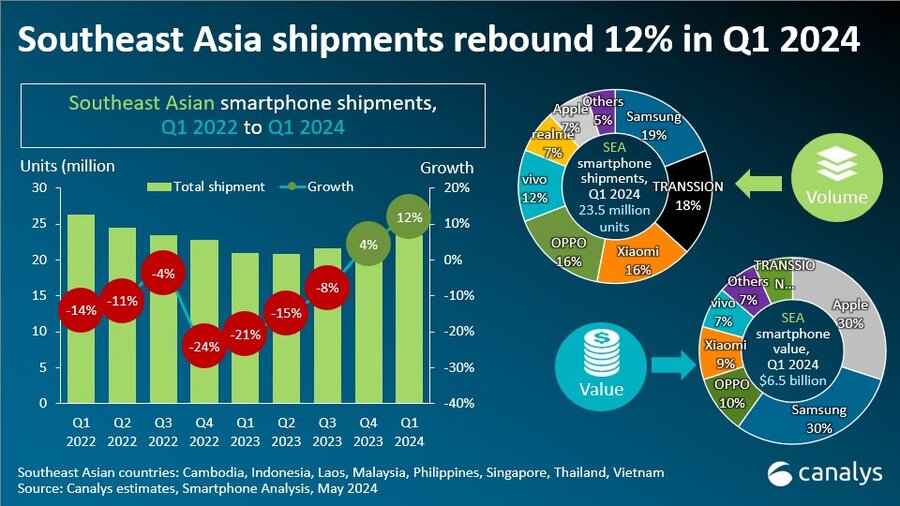

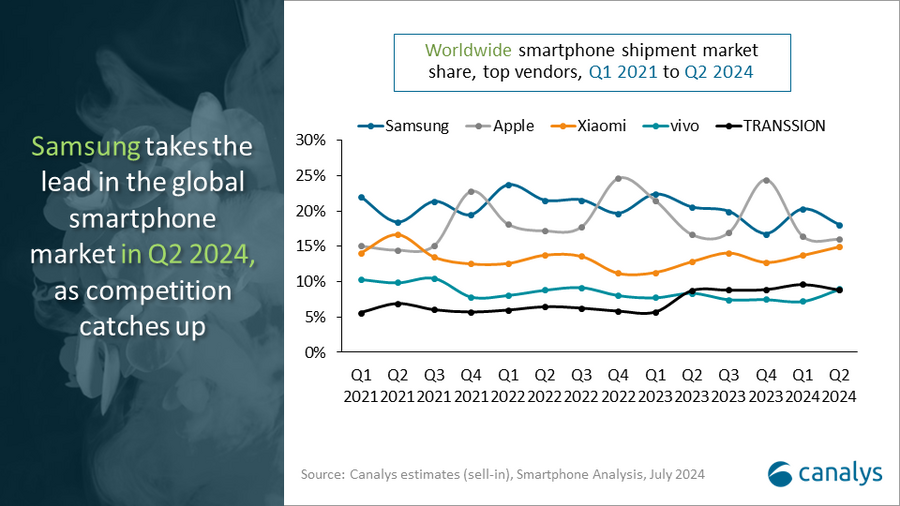

According to Canalys' latest research, the global smartphone market hit the third quarter streak of year-on-year growth, with a 12% shipment expansion in Q2 2024, reaching 288 million units. Samsung remained the global leader with an 18% market share as it renewed its emphasis on the high-end market as a strategic priority. Apple followed closely with a 16% market share, ranking second. Xiaomi came closely after Apple this quarter with a 15% market share, growing the fastest among the top five players with a 27% annual growth. vivo ranked fourth worldwide with a 9% market share. TRANSSION took the fifth spot this quarter, also with a 9% market share.

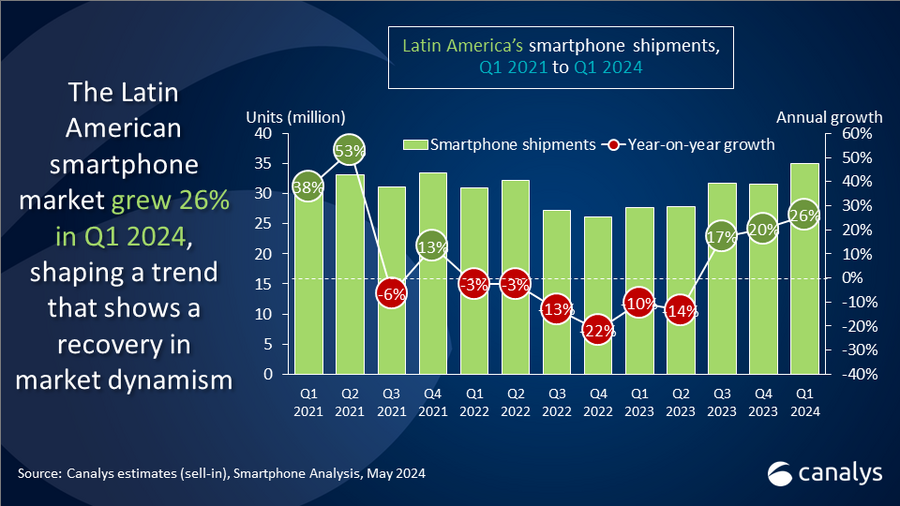

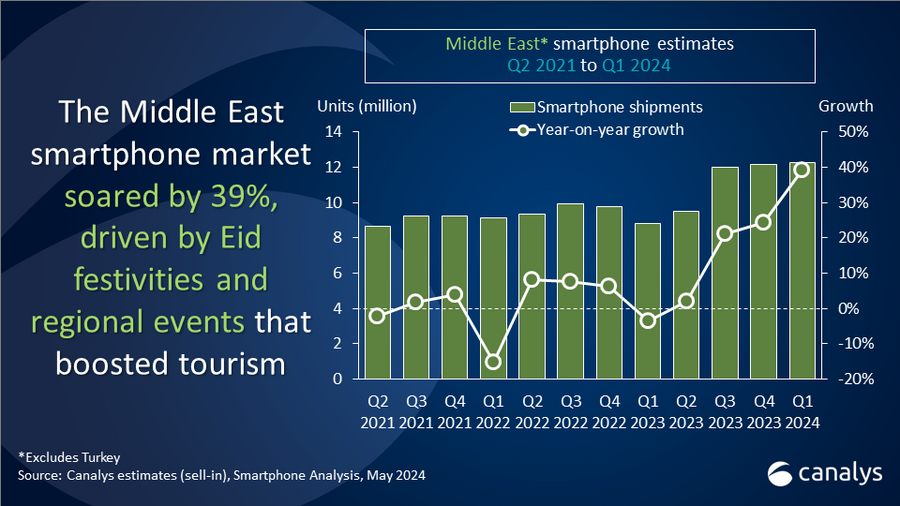

“Optimism continues to build in the global smartphone market, fueled by innovative technologies like GenAI and recovering demand from the mass market,” said Amber Liu, Research Manager at Canalys. “Since early 2024, easing inflation in emerging markets across Asia-Pacific, the Middle East, Africa and Latin America has stimulated shipment growth in the mass-market price segment. Companies, including Xiaomi and TRANSSION, are actively promoting product upgrades to capitalize on these opportunities. Meanwhile, HONOR, OPPO and vivo are focusing their expansion outside Mainland China this year as competition in the domestic market is heating up.”

“Samsung and Apple are rapidly advancing their premium product strategies with GenAI feature as a key focus,” said Sheng Win Chow, Analyst at Canalys. “Samsung recently launched its Galaxy Z Fold6 and Flip6 series, building on the AI capabilities first introduced with the Galaxy S24 to deliver enhanced experiences on its latest foldable devices. By integrating software innovation with the foldable form factor, Samsung aims to provide differentiated value to users. While Apple has yet to announce new products, the company generated excitement at WWDC around anticipated refreshes coming soon that will likely demonstrate its leadership in technology innovation.”

|

Worldwide smartphone market share split |

||||

|

Vendor |

Q2 2024 market share |

Q2 2023 market share |

||

|

Samsung |

18% |

21% |

||

|

Apple |

16% |

17% |

||

|

Xiaomi |

15% |

13% |

||

|

vivo |

9% |

8% |

||

|

TRANSSION |

9% |

9% |

||

|

Others |

33% |

33% |

||

|

|

|

|

||

|

Preliminary estimates are subject to change on final release OPPO includes OnePlus. Source: Canalys estimates (sell-in shipments), Smartphone Analysis, July 2024 |

|

|||

Please get in touch with our analysts for comments on the Samsung Galaxy AI event and additional information on smartphone vendors' on-device AI strategies.

For more information regarding this press release, please contact:

Amber Liu: amber_liu@canalys.com

Sheng Win Chow: shengwin_chow@canalys.com

Canalys' worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.