Global PC market recovery continues with 3% growth in Q2 2024

Tuesday, 9 July 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

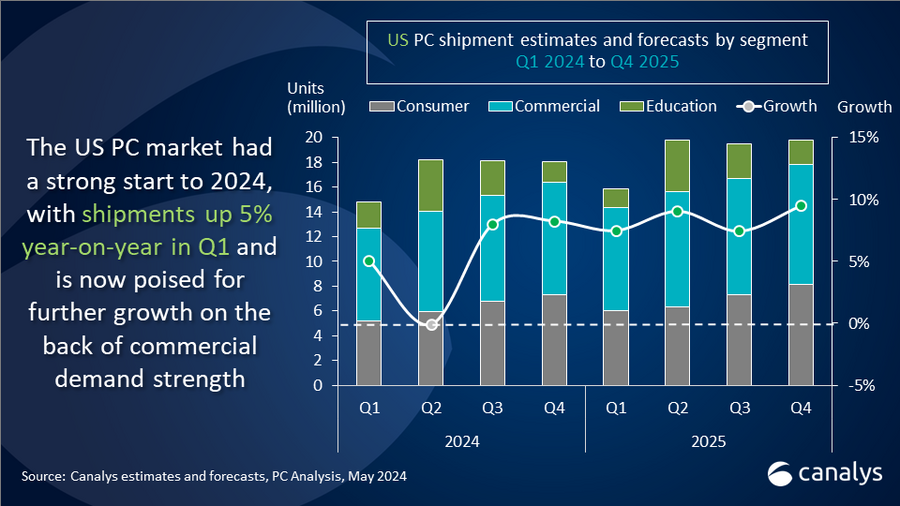

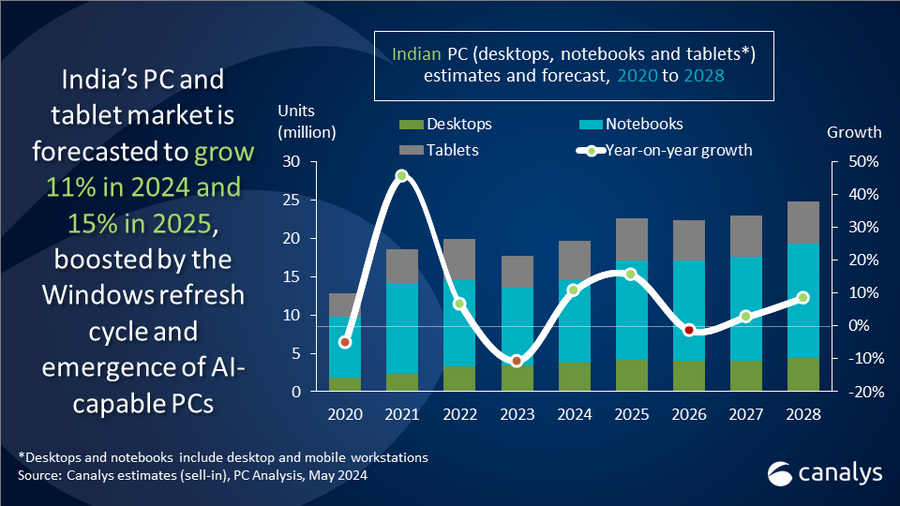

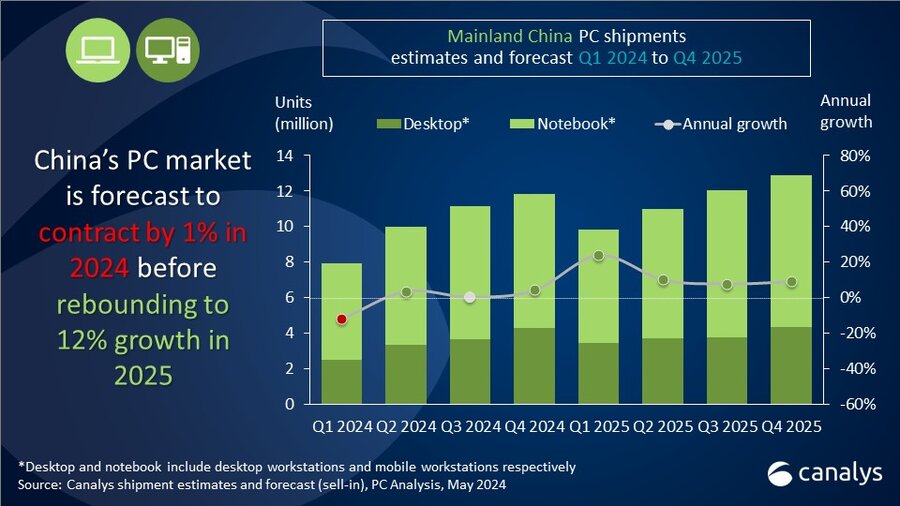

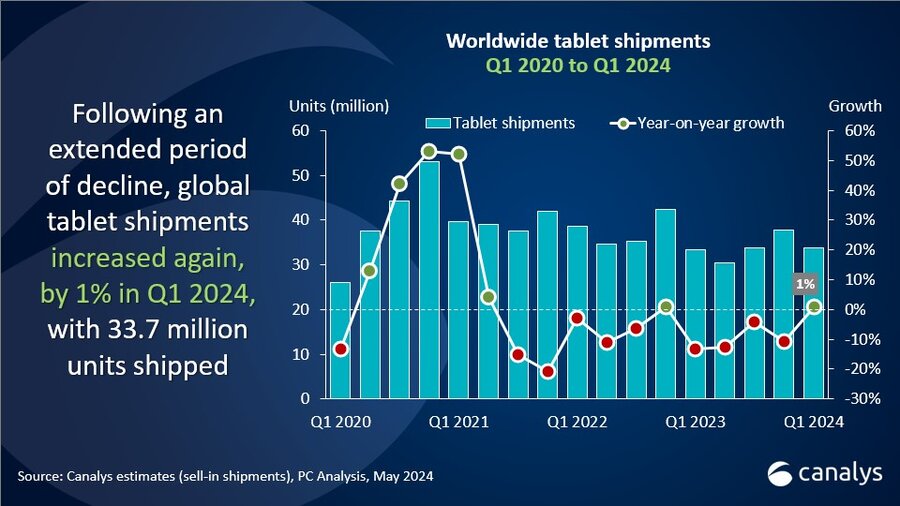

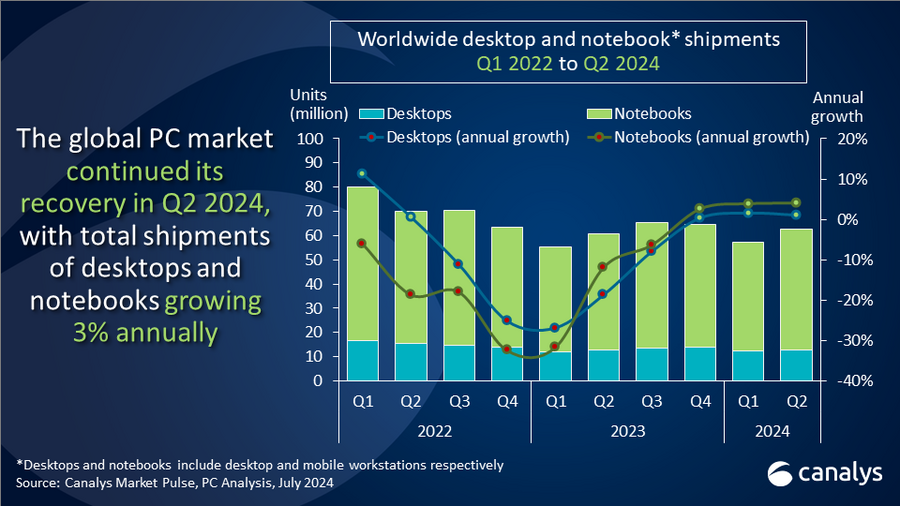

The PC market gathered momentum in Q2 2024, with worldwide shipments of desktops and notebooks up 3.4% year-on-year, reaching 62.8 million units. Shipments of notebooks (including mobile workstations) hit 50 million units, growing 4%. Desktops (including desktop workstations), which constitute 20% of the total PC market, experienced a slight 1% growth, totaling 12.8 million units. The stage is now set for accelerated growth as the refresh cycle driven by the Windows 11 transition and AI PC adoption ramps up over the next four quarters.

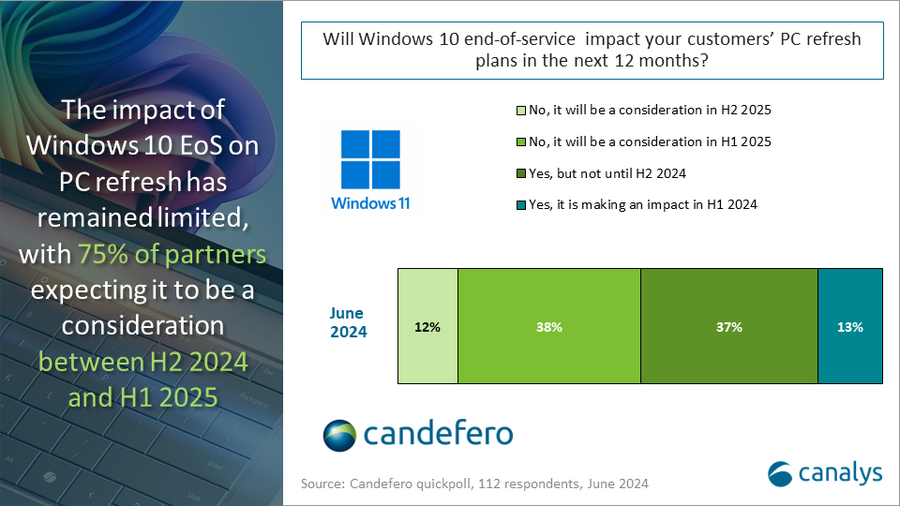

“The PC industry is going from strength to strength with a third consecutive quarter of growth,” said Ishan Dutt, Principal Analyst at Canalys. “The market turnaround is coinciding with exciting announcements from vendors and chipset manufacturers as their AI PC roadmaps transition from promise to reality. The quarter culminated with the launch of the first Copilot+ PCs powered by Snapdragon processors and more clarity around Apple’s AI strategy with the announcement of the Apple Intelligence suite of features for Mac, iPad and iPhone. Beyond these innovations, the market will start to benefit even more from its biggest tailwind - a ramp-up in PC demand driven by the Windows 11 refresh cycle. The vast majority of channel partners surveyed by Canalys in June indicated that Windows 10 end-of-life is likely to impact customer refresh plans most in either the second half of 2024 or the first half of 2025, suggesting that shipment growth will only gather steam in upcoming quarters.”

Lenovo maintained its position as the market leader in the global PC market, shipping 14.7 million units in Q2 2024, reflecting a 4% annual growth. HP followed closely, shipping 13.7 million units, securing the second spot. Dell ranked third but was the only vendor to report an annual decline, with a 2% year-on-year drop, shipping 10.1 million units. This decline was primarily due to reduced shipments in the US market, where other top vendors saw growth. Apple secured the fourth position, shipping 5.5 million units and capturing a 9% market share, marking a 6% increase compared to the same period last year. Asus rounded out the top five, overtaking Acer, thanks to the success of its gaming PCs. Asus experienced the highest growth in Q2 2024, with a 17% annual increase, shipping 4.5 million units.

|

Worldwide desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q2 2024 |

|||||

|

Vendor |

Q2 2024 |

Q2 2024 |

Q2 2023 |

Q2 2023 |

Annual |

|

Lenovo |

14,724 |

23.4% |

14,230 |

23.4% |

3.5% |

|

HP |

13,681 |

21.8% |

13,444 |

22.1% |

1.8% |

|

Dell |

10,078 |

16.0% |

10,329 |

17.0% |

-2.4% |

|

Apple |

5,510 |

8.8% |

5,198 |

8.6% |

6.0% |

|

Asus |

4,535 |

7.2% |

3,865 |

6.4% |

17.3% |

|

Others |

14,280 |

22.7% |

13,669 |

22.5% |

4.5% |

|

Total |

62,809 |

100.0% |

60,736 |

100.0% |

3.4% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), July 2024 |

|

||||

For more information, please contact:

Ishan Dutt: ishan_dutt@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and broken down by market, vendor and channel, with additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.