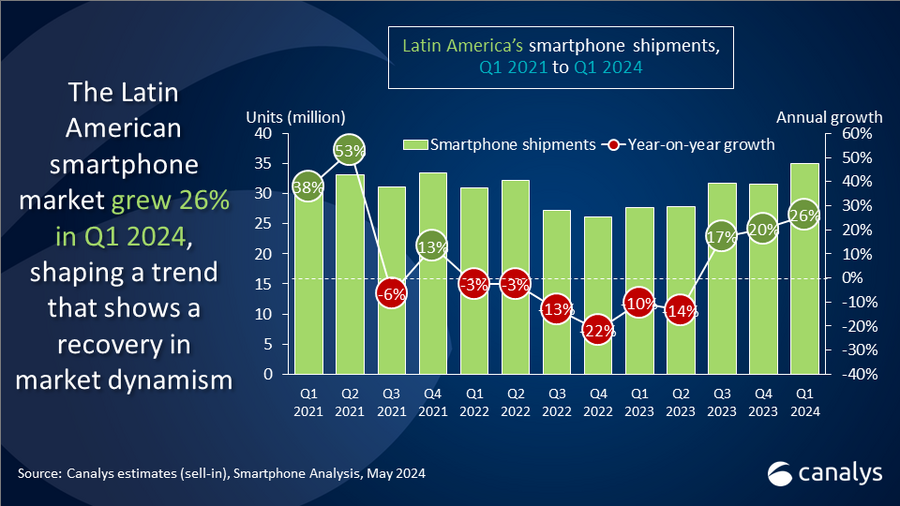

Latin America's smartphone market maintains its hypergrowth by growing 26% in Q1 2024

Monday, 27 May 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

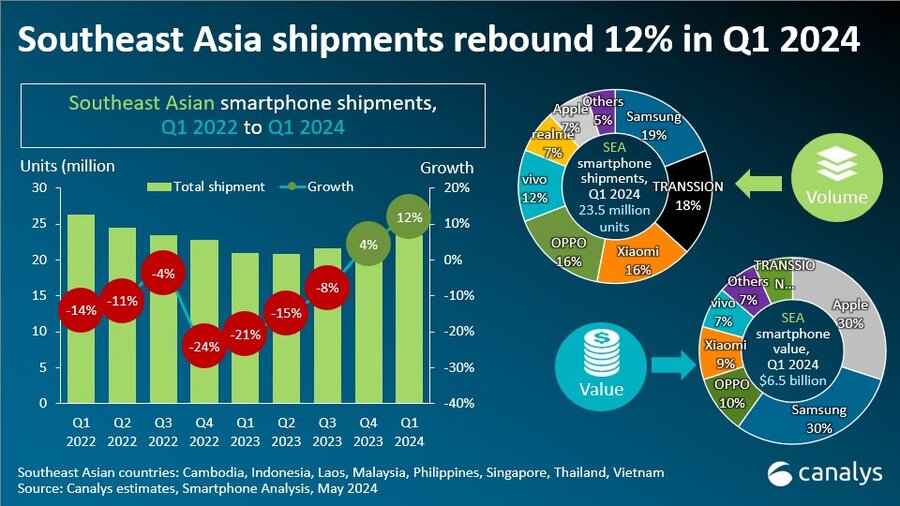

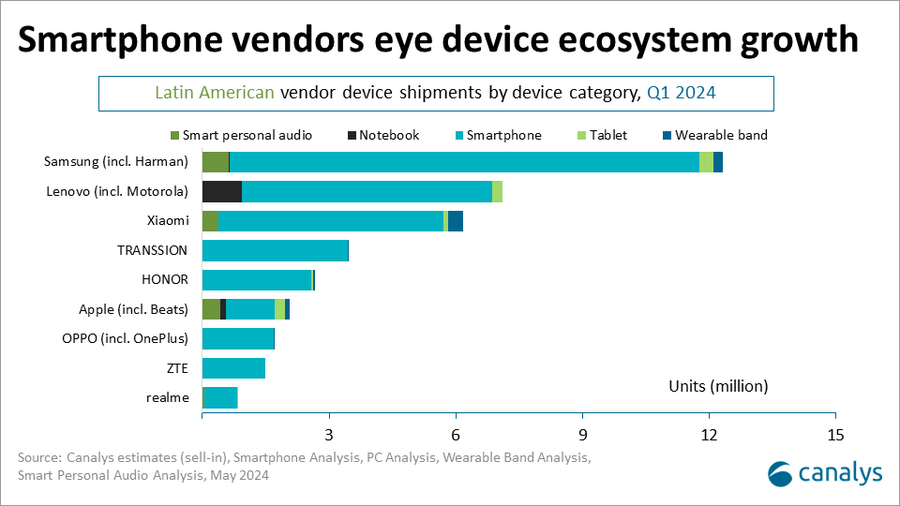

Canalys' latest research highlights a sustained boom in the Latin American smartphone market, with shipments increasing by 26% year-on-year to 34.9 million units in Q1 2024. This marks the third consecutive quarter of double-digit growth. Samsung retained its lead position, bolstered by strong sales of its budget-friendly A-series, witnessing a 6% increase to 11.1 million units. Motorola maintained its second-place ranking with a modest 1% growth, reaching 5.9 million units. Xiaomi, TRANSSION and HONOR also demonstrated robust growth rates of 45%, 215%, and 293%, respectively, solidifying their positions among the top five vendors with sales of 5.3 million, 3.4 million, and 2.6 million units.

“Improving economic conditions, alongside healthier channel inventory levels and a refresh cycle for devices purchased during the pandemic, have played a crucial role in sustaining the growth momentum of the Latin American smartphone market,” said Miguel Perez, Senior Consultant at Canalys. “This resurgence in demand is widespread, with nine of the top ten vendors experiencing significant annual growth in Q1 2024. Particularly notable is the strong performance in the low-to-mid-range price segments, where the most shipped models include Samsung's low-end A-series, Xiaomi's Redmi series and Motorola's G series. The intense competition not only benefits consumers by offering a variety of choices but also pushes vendors to innovate and distinguish themselves as they prepare for a potential market slowdown. Strategies such as opening more branded stores, enhancing online sales platforms and expanding presence in physical retail locations are key as vendors strive to stand out in a crowded market.”

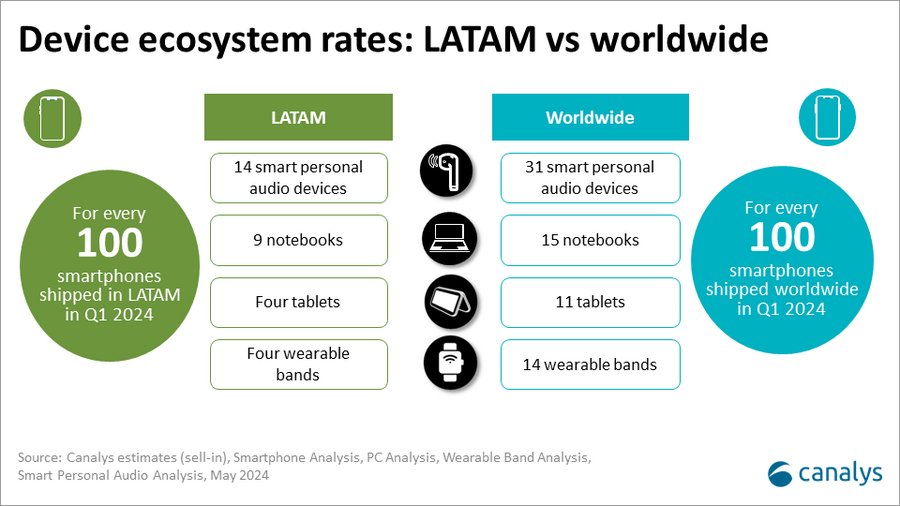

“Several vendors in Latin America experiencing strong growth, are broadening their product ecosystems to secure and expand their market positions,” Perez elaborated. “Products like wearable bands, TWS and tablets are not just designed to diversify offerings but also to captivate consumer interest and differentiate brands. Such strategies are aimed at scaling revenues and increasing customer loyalty in the long term. In the short term, however, these ecosystem products are more likely to enhance brand visibility and feature prominently in promotional campaigns and bundles. This focus on ecosystem devices presents a significant, mostly untapped opportunity in the Latin American market, where the adoption rate of these devices per smartphone sold is still low compared to global averages. Moving forward, it is crucial for vendors to maintain the value of their ecosystems while avoiding the pitfalls of undermining long-term value for short-term sales gains.”

“In Latin America, AI features and capabilities are increasingly pivotal in smartphone marketing strategies, yet the predominance of lower-priced smartphones poses a unique challenge,” noted Perez. “While advanced generative AI features are central to the marketing and product strategies for high-end devices, these technologies are slower to become accessible in the mid-to-low-end market segments that dominate the region. In Q1 2024, for instance, only 7% of smartphones sold were priced at US$800 or above, whereas a substantial 82% were priced under US$400. Consequently, while marketing campaigns might build high expectations with cutting-edge AI features, it is crucial for vendors to ensure these expectations are realistically aligned with the capabilities of lower-priced models to avoid consumer disillusionment and the high costs associated with trying to upgrade and upsell within this price-sensitive market.”

|

LATAM smartphone shipments and annual growth |

|||||

|

Vendor |

Q1 2024 |

Q1 2024 |

Q1 2023 |

Q1 2023 |

Annual |

|

Samsung |

11.1 |

32% |

10.5 |

38% |

6% |

|

Lenovo(Motorola) |

5.9 |

17% |

5.9 |

21% |

1% |

|

Xiaomi |

5.3 |

15% |

3.7 |

13% |

45% |

|

TRANSSION |

3.4 |

10% |

1.1 |

4% |

215% |

|

HONOR |

2.6 |

7% |

0.7 |

2% |

293% |

|

Others |

6.5 |

19% |

5.9 |

21% |

10% |

|

Total |

34.9 |

100% |

27.7 |

100% |

26% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brands POCO and Redmi, and TRANSSION includes sub-brands Tecno and Infinix. |

|

||||

For more information, please contact:

Miguel Pérez: miguel_perez@canalys.com

Canalys' worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.