Global EV market grew 55% in 2022 with 59% of EVs sold in Mainland China

Wednesday, 15 March 2023

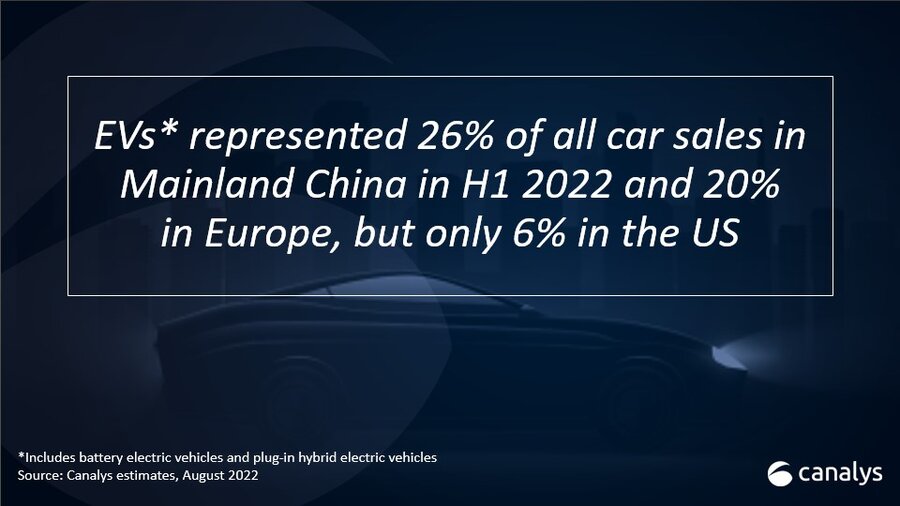

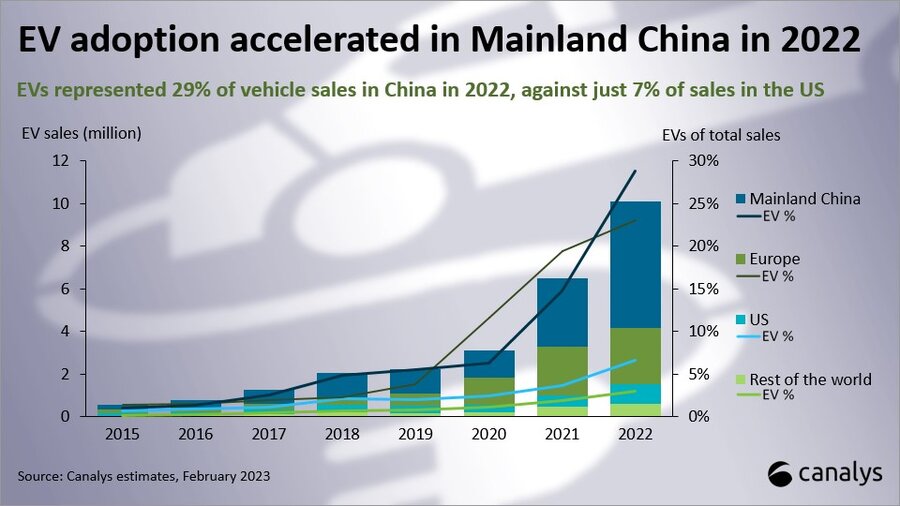

Canalys’ latest research shows that worldwide sales of electric vehicles (EVs) grew annually by 55% to 10.1 million units in 2022. Mainland China was by far the largest EV market, with 59% of EVs sold there in 2022, a total of 5.9 million units. This represents 29% of all light vehicles sold in the region, up from 15% in 2021. Europe is the second largest EV market, with a 26% share and 2.6 million units sold. In comparison, the US is still behind at just 9% of worldwide sales, but with positive signs of growth, with 920,000 EVs sold in 2022, up 72%.

Mainland China pulled away from other markets in terms of EV sales in 2022. “Buyers are spoilt for choice. From inexpensive city cars to luxury vehicles, there are EVs at every price point and in every car segment,” said Jason Low, Canalys Principal Analyst, based in Shanghai. “Most Chinese car-makers, including BYD, NIO and Xpeng, expanded their EV offerings in 2022. They have been investing heavily to improve the performance and range of their EVs and develop new models to meet growing demand. BYD held first place in EV sales in 2022, both in China and worldwide. Six BYD model families appeared in the top 10 model list in China. The Wuling Hongguang Mini EV has been a success story in the Chinese EV market and will dominate the tiny city EV sector again in 2023. Tesla remains a major player in the country, and its price cuts, at a time when subsidies are being removed, will put pressure on its competitors. GAC made it into the top 10 with the Aion Y.”

Europe is the world’s second-largest market for EVs, though the region’s rapid growth rate slowed. EVs represented 23% of vehicles delivered in 2022, up from 20% in 2021. Chris Jones, Chief Analyst, said, “Demand for EVs was good in 2022, but supply was constrained, and like the other major markets, changes to EV subsidies in many European countries disrupted the end of the year, and will also affect 2023. Consumer demand is spread across many brands and models, with no single EV model accounting for more than 6% of the market in 2022. Tesla held the top two positions, while Stellantis kept two models in the top 10, with EV variants of popular compact cars – the Fiat 500e and Peugeot e-208. Volkswagen Group had four models in the top 10, but it must keep its momentum with new model launches to stay competitive in 2023.”

In the US, EVs accounted for 7% of new vehicles sold in 2022. New federal tax credits for eligible EVs combined with price cuts should grow the market in 2023, but not for all brands. Jones said, “The EV percentage share of vehicles sold in the US will only mirror the growth in Mainland China in the last two years when EV customers have choice across all vehicle sectors – they don’t today.” Tesla held the top two spots and accounted for well over 50% of EV sales in 2022. Despite several EV launches in 2022, no other model has more than a 5% share. Ford held third place with the Mustang Mach-E, but as Jones explains, “All other brands competing in the premium SUV EV segment have struggled to make an impact due to the continued success of the Tesla Model Y.” Many EVs will not be eligible for tax credits in 2023, including two models from Hyundai/Kia that made it into the top 10 in 2022. “Several EV pick-up trucks have launched,” said Jones, “but despite pick-ups being the most popular vehicle type in the US, no EV variant has made it into the EV top 10 so far.”

Note: EVs include battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

For more information, please contact:

Jason Low: jason_low@canalys.com

Chris Jones: chris_jones@canalys.com

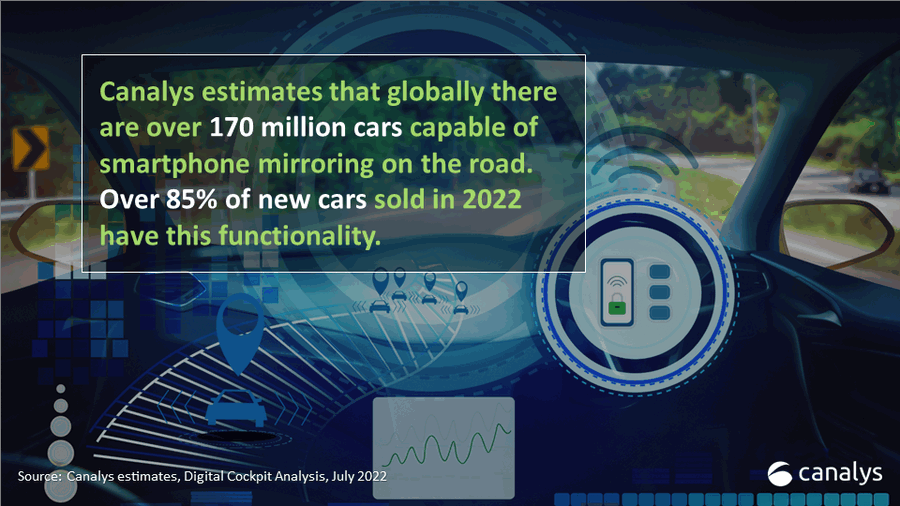

Canalys tracks innovation in the automotive industry, positioning itself where smart technology intersects with the mobility industry. We track the shift to the new era in our Electric Vehicle Analysis and Autonomous Vehicle Analysis services. Our Automotive Digital Cockpit Analysis service provides qualitative and quantitative insights into the digital cockpit and automotive operating system markets. Canalys automotive research guides technology companies and automotive OEMs to make the right decisions on their solutions’ features, choose the right channel partners, and sell on the right platforms to engage in different markets around the world.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.