Tide turning in Europe’s smartphone market despite 6% shipment decline in Q3

Thursday, 23 November 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

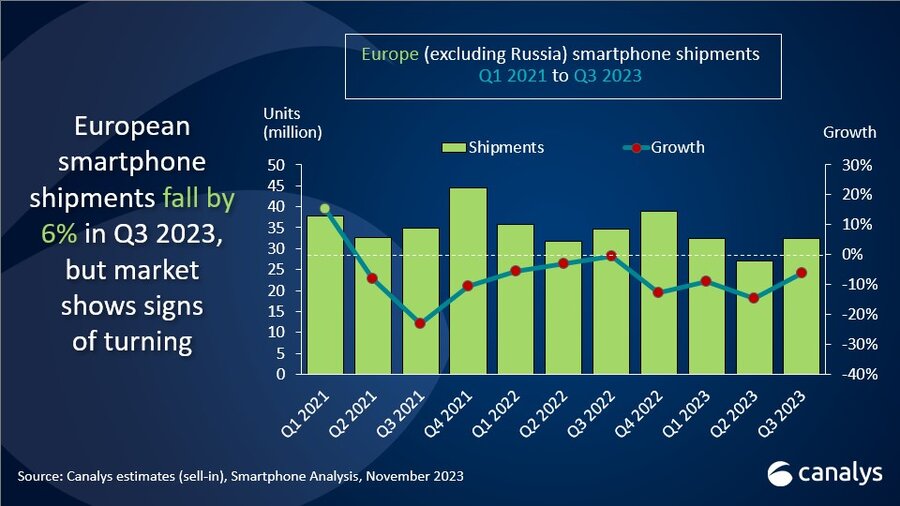

Canalys’ latest research shows that European smartphone shipments (excluding Russia) fell by 6% year on year to 32 million in Q3 2023. Though Q3 marked the tenth consecutive quarter of annual decline, there are signs of increasing demand as we near 2024. In the vendor ranking table, Samsung held onto first place with a 35% market share, despite its shipments falling 6% year on year. Apple took second place with a 22% share and a decline of 13%, partially offset by the strong performance of the iPhone 15.

Apple and Samsung focus on new and premium models

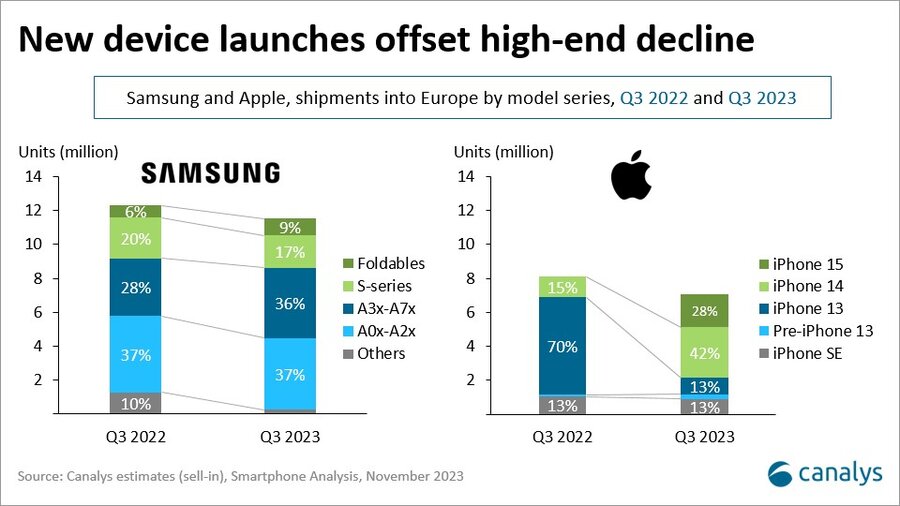

“The challenging demand environment particularly affected Apple and Samsung in Q3, despite their product launches,” said Runar Bjørhovde, Analyst at Canalys. “In Apple’s case, its decline was primarily due to a rapid drop in shipments of older models compared with Q3 2022. This decline was partly to prevent overstocking of the iPhone 14 and earlier models, which must be phased out by the end of 2024 to align with the European Commission’s USB-C directive. In contrast, the iPhone 15 had a robust start, growing its launch quarter shipments by 59% compared with the iPhone 14. Reduced launch prices across the region supported its performance. Samsung’s decline was because of its low-end A series, which the company has deprioritized due to revenue and profitability targets. This step drove Samsung to its highest-ever quarterly ASP in Europe, strongly supported by 38% annual growth in its foldable shipments alongside robust mid-range A series and S series performance. Overall, Samsung and Apple’s performances show resilient demand for the latest premium devices, even as the high-end segment has started to shrink.”

Xiaomi, Motorola and TCL have a good quarter

“Behind the top two, the market situation has started to improve as most vendors grew sequentially in Q3,” said Brandon Gurney, Research Analyst at Canalys. “Demand is still limited in the low-to-mid-range, but Samsung’s shift away from the low end has created opportunities for vendors. Xiaomi finished third on the ranking table with flat annual growth, an improvement after six consecutive quarters of decline. This was thanks to strong growth in Central and Eastern Europe with the Redmi and Redmi Note 12 models. Motorola continued its progress in Europe and grew its shipments 30% year on year to reach its best quarterly performance as a part of Lenovo.” TCL rounded out the top five, growing 5% year on year to 0.8 million units.

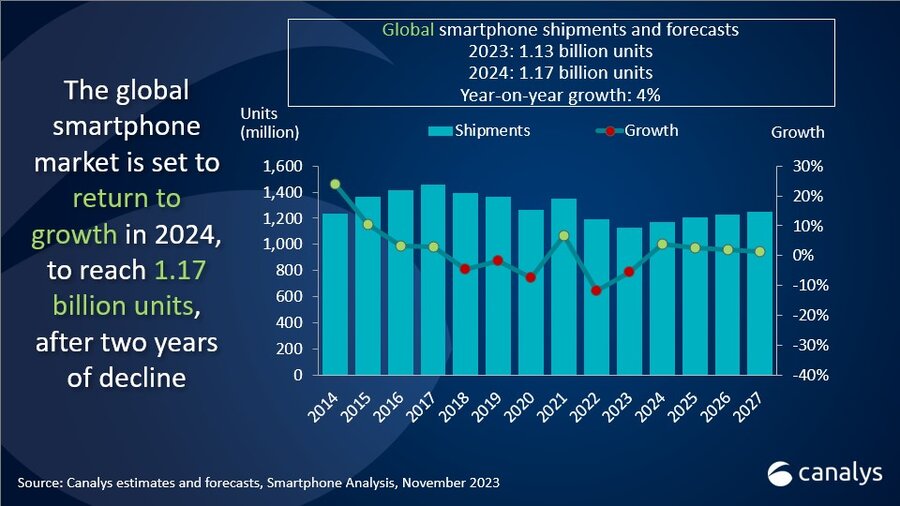

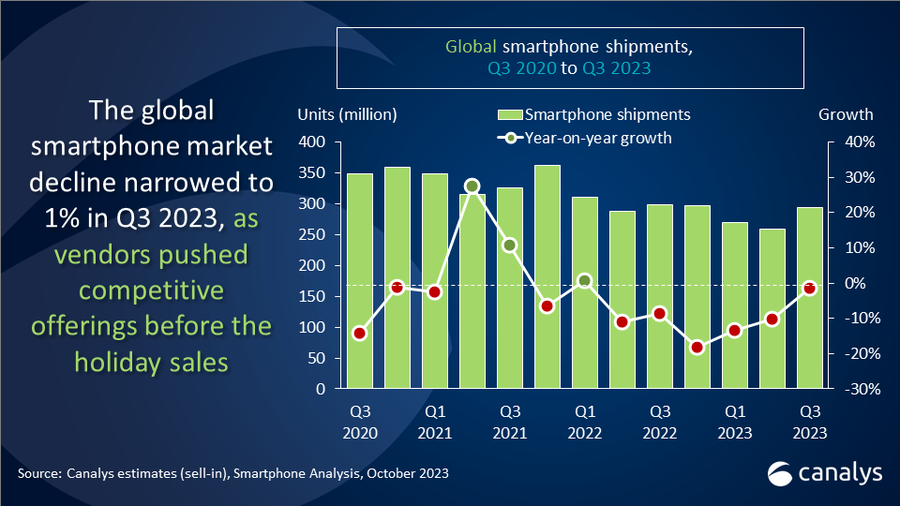

Smartphone market set to grow in 2024

“Though full-year 2023 will deliver the lowest number of smartphone shipments in over a decade, there are signs of the market improving as we near 2024,” said Bjørhovde. “Canalys predicts the market will grow by 4% in 2024. A refresh cycle of mid-range devices bought in 2020 and 2021 should provide an opportunity for vendors in the first half of the year. The rest of this year remains important for vendors seeking to redeem their performance in 2023, start 2024 with positive momentum and clear out channel inventory ahead of new product launches in the first half of 2024. Given consumers’ caution in spending this year, vendors are hoping for an emergence of buyers who have delayed purchases for enticing deals and promotions during the holiday shopping season. Still, profitability is key to all players, and consumers should consequently be aware of occasional fake discounting amid intense price and discount competition.”

|

Europe (excluding Russia) smartphone shipments and annual growth |

|||||||

|

Vendor |

Q3 2023 |

Q3 2023 |

Q3 2022 |

Q3 2022 |

Annual |

||

|

Samsung |

11.5 |

35% |

12.3 |

36% |

-6% |

||

|

Apple |

7.1 |

22% |

8.1 |

23% |

-13% |

||

|

Xiaomi |

6.2 |

19% |

6.2 |

18% |

0% |

||

|

Motorola |

1.7 |

5% |

1.3 |

4% |

+30% |

||

|

TCL |

0.8 |

3% |

0.8 |

2% |

+5% |

||

|

Others |

5.2 |

16% |

5.9 |

17% |

-12% |

||

|

Total |

32.5 |

100% |

34.6 |

100% |

-6% |

||

|

Note: Percentages may not add up to 100% due to rounding. |

|

||||||

For more information, please contact:

Runar Bjørhovde: runar_bjorhovde@canalys.com

Brandon Gurney: brandon_gurney@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.