Europe’s smartphone market predicted to rebound 7% in 2024

Thursday, 7 September 2023

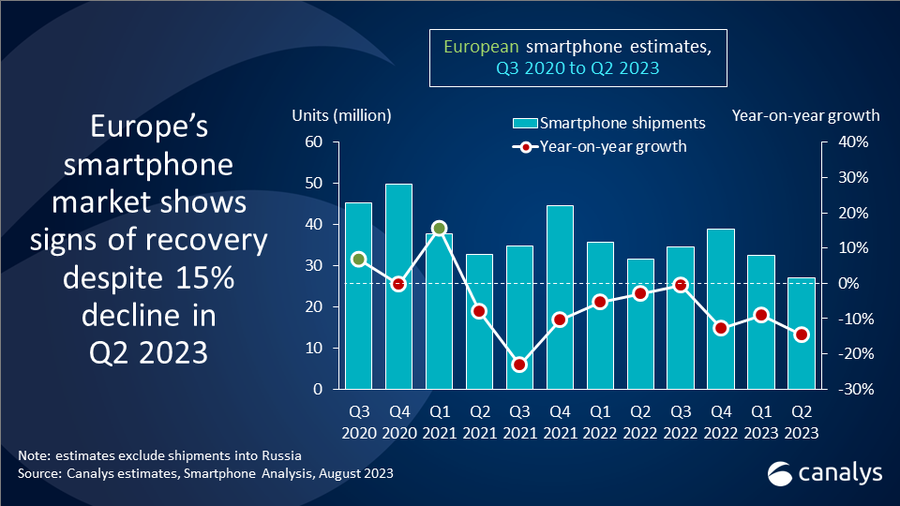

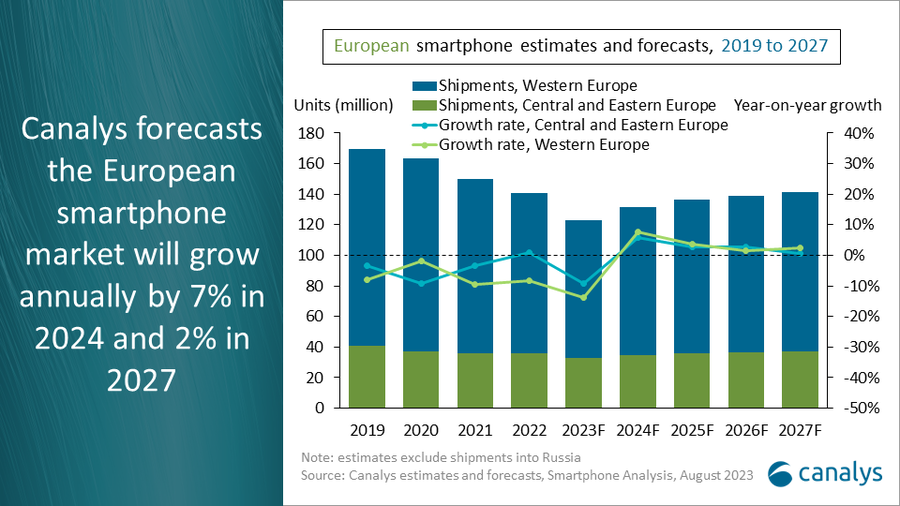

The latest Canalys research forecasts smartphone shipments in Europe (excluding Russia) will increase by 7% in 2024 to reach 132 million. An upcoming refresh cycle and easing economic pressures will drive volume growth in Europe. But the rest of 2023 will remain challenging. Canalys forecasts the market will fall by 13% in 2023 as shipments are constrained due to extended device lifetimes and purchasing cycles, increased pressure from secondhand markets and high channel inventory levels across the region.

“Conditions remain tough for the European smartphone market, but falling inflation and improving inventory levels have sown the seeds of optimism,” said Runar Bjørhovde, Analyst at Canalys. “With the decline in demand stabilizing and channel inventory levels improving, market growth will return in 2024. Central and Eastern Europe, Italy, Spain and Portugal present the biggest short-term opportunities for ambitious smartphone vendors due to shorter refresh cycles and the channel being positive to new propositions and selling smartphones from emerging brands. Markets skewed toward the US$800+ segment, such as Germany, France and the Nordics, will start to grow in the second half of 2024 as economic pressures ease. Though these markets had the largest declines in Q2, their substantial installed bases will drive a resurgence in shipments as devices reach the end of their lifecycles and require a refresh. We anticipate the rebound in the shopping holiday season in 2024.”

“As competition at the high end is intense and dominated by Apple and Samsung, other ambitious vendors should target different segments to establish their presence,” added Bjørhovde. “Opportunities have opened in the sub-US$200 price band as Samsung has deprioritized it and many other vendors are quitting the price segment because they are struggling with profitability. There is demand in this segment across the region, but there is only space for two or three successful vendors as the segment requires economies of scale and close collaboration with the channel to succeed.”

“Several vendors are also widening their end-user reach, strengthening their positions for when growth returns,” said Bjørhovde. “For example, Samsung and Google are investing further in the B2B segment, aiming to match Apple’s Distributor Partner Program, which targets SMBs via distribution channels. In contrast, Motorola is prioritizing growth in the consumer segment and investing in marketing development funds for the channel. The vendor landscape in Europe is shrinking. To succeed, vendors need strong omnichannel sales support across a wide channel. This needs to be combined with portfolios fitting local requirements in terms of pricing and specifications.”

“The market’s long-term outlook is for moderate cyclical growth, which will challenge current revenue models for vendors and the channel,” said Bjørhovde. “Longer device lifetimes, stringent regulations aimed at reducing new device volumes, and increased demand for used and refurbished devices will force vendors to search for new opportunities to generate revenue and stay profitable. Within this market dynamic, vendors must take greater control of device lifecycles to meet trends and capture revenue opportunities. Selling original spare parts, helping the channel to drive device trade-ins and offering vendor-refurbished devices will be good areas for vendors to start with. This will be vital to succeed in markets skewed toward the US$800+ segment in the short term and will grow in importance in markets skewed toward the lower price bands over time.”

Canalys forecasts that the European smartphone market’s (excluding Russia) year-on-year growth rate will reach 7% in 2024 and slow to 2% in 2027, when volumes will recover to 2022 levels. “Ultimately, vendors that show resilience in the current market environment and an ability to quickly adapt to new regulations will prove themselves as strong long-term partners to the channel,” concluded Bjørhovde.

For more information, please contact:

Runar Bjørhovde: runar_bjorhovde@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.