Cybersecurity market grows 16% despite deteriorating economic conditions

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Monday, 19 December 2022

The worldwide cybersecurity market grew 15.9% year on year in Q3 2022, to US$17.8 billion, despite deteriorating economic conditions, though vendors saw a tightening in the SMB sector.

Palo Alto Networks was the number one vendor in the quarter, growing 24.9% year on year and increasing its market share to 8.4%, up from 7.8% in Q3 2021. Cisco was the second-largest cybersecurity vendor, with growth of 16.7% and a flat market share of 6.9%. Fortinet placed third, achieving growth of 29.9% to reach a 6.7% market share, up from 6.0% a year ago.

Endpoint security was the fastest-growing category, up 18.7% year on year at US$2.7 billion. Network security was the largest category, representing US$5.1 billion and growing 14.8%.

The technology sector faces deteriorating economic conditions, increasing uncertainty and greater scrutiny of IT spending, factors that most vendors considered in their forecasts. Falls in new business, reductions in spending commitments and delays to subscription start dates were worse than expected, which will filter into future results.

“Many cybersecurity vendors have shifted toward subscription-led business models, which also helped to shield them from the immediate impact of the economic slowdown,” said Matthew Ball, Chief Analyst at Canalys. “The move to subscription-based platforms and increased focus on upselling existing accounts will sustain revenue growth for cybersecurity vendors over the next 12 months.”

|

Worldwide cybersecurity market share Q3 2022 Vendor |

Q3 2022 |

Q3 2021 |

Annual |

|

|

Palo Alto Networks |

8.4% |

7.8% |

24.9% |

|

|

Cisco |

6.9% |

6.9% |

16.7% |

|

|

Fortinet |

6.7% |

6.0% |

29.9% |

|

|

Check Point |

3.8% |

4.0% |

8.4% |

|

|

CrowdStrike |

3.2% |

2.4% |

52.9% |

|

|

Okta |

3.1% |

2.6% |

38.4% |

|

|

Trellix |

3.1% |

3.6% |

0.8% |

|

|

Symantec |

2.9% |

3.2% |

3.4% |

|

|

Microsoft |

2.9% |

2.4% |

38.6% |

|

|

Trend Micro |

2.4% |

2.6% |

8.7% |

|

|

IBM |

2.3% |

2.7% |

-1.3% |

|

|

Zscaler |

2.1% |

1.6% |

52.1% |

|

|

Others |

52.1% |

54.1% |

11.6% |

|

|

|

|

|

|

|

|

Total |

100.0% |

100.0% |

+15.9% |

|

|

Note: Percentages may not add up to 100% due to rounding |

|

|||

Channel sales accounted for 90.6% of the overall market, with the other 9.4% of sales done directly with customers. Channel sales grew by 15.9% year on year, outpacing direct sales.

Channel partners remained optimistic about the opportunities in cybersecurity. 27% expected their cybersecurity revenue to grow by more than 20% in 2023, according to a Canalys poll of 393 respondents taken between 21 November 2022 and 9 December 2022. Another 27% anticipated growth of 11% to 20% next year. Only 10% of partners expected cybersecurity sales to decline.

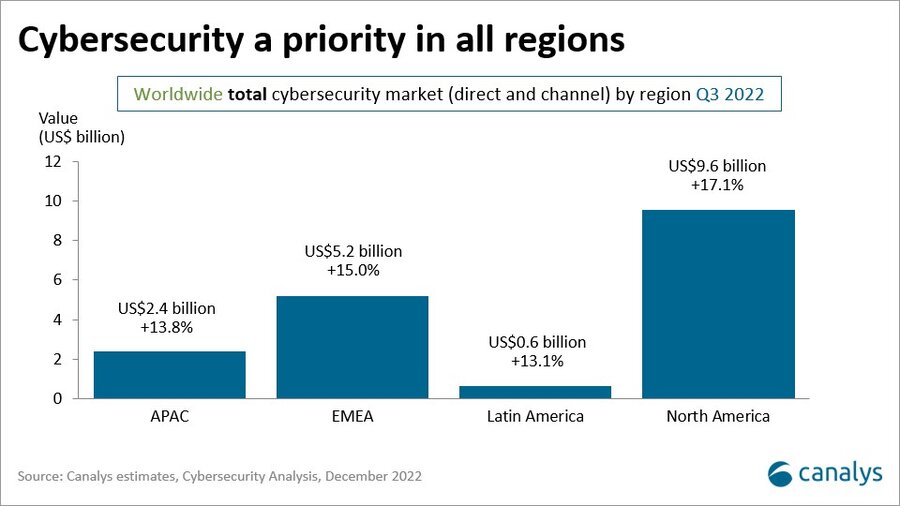

US$9.6 billion of sales came from North America, which remained by far the largest cybersecurity market, representing 53.8% of global spending. It was also the fastest-growing market at 17.1%. EMEA sales reached US$5.2 billion, APAC US$2.4 billion and Latin America US$0.6 billion.

For more information, please contact:

Matthew Ball: matthew_ball@canalys.com

Srikara Upadhyaya: srikara_upadhyaya@canalys.com

Canalys’ Cybersecurity Analysis is a comprehensive service that offers qualitative and quantitative analysis of route-to-market, end-user and technology deployment for the leading cybersecurity vendors, and insights into new emerging vendors. Canalys provides competitive intelligence information across six security segments: endpoint security, network security, data security, web and email security, vulnerability and security analytics, and identity access management. Quarterly deliverables focus on identifying and analyzing the latest cybersecurity market, vendor trends, and providing updates to the segment’s short-term quarterly and longer-term five-year forecasts.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.