China PC market to stabilize in 2023 as growth looms in 2024

Monday, 13 March 2023

Recent research from Canalys shows that total PC (desktop, notebook and workstation) shipments in mainland China ended 2022 on a low note, declining 26% year-on-year in Q4. Desktop (including desktop workstation) shipments dropped to 3.7 million units, a 34% decline, while the notebook shipment (including mobile workstations) was down 22% to 8.5 million units. However, tablet shipments in Q4 rose 39% to 7.5 million units, driven by new device launches from major vendors. For 2022, PC (desktop, notebook and workstation) shipments reached 48.5 million units, a decline of 15% from 2021. Canalys estimates showed tablet shipments were up 6% year-on-year to 24.0 million units, benefiting from the demand surge caused by lockdowns throughout last year.

"Despite the severe adjustment in the market, notebooks (including mobile workstation) and tablet shipments were at a higher level than pre-pandemic, 8% and 22% higher respectively than those in 2019," said Canalys Analyst Emma Xu. "The vendor landscape in the notebook and tablet markets remains volatile as more smartphone vendors join the game. We expect the android tablet space to see even more intense competition as those new entrants are ambitious in snapping up the market to pave the road of their connective ecosystem strategies."

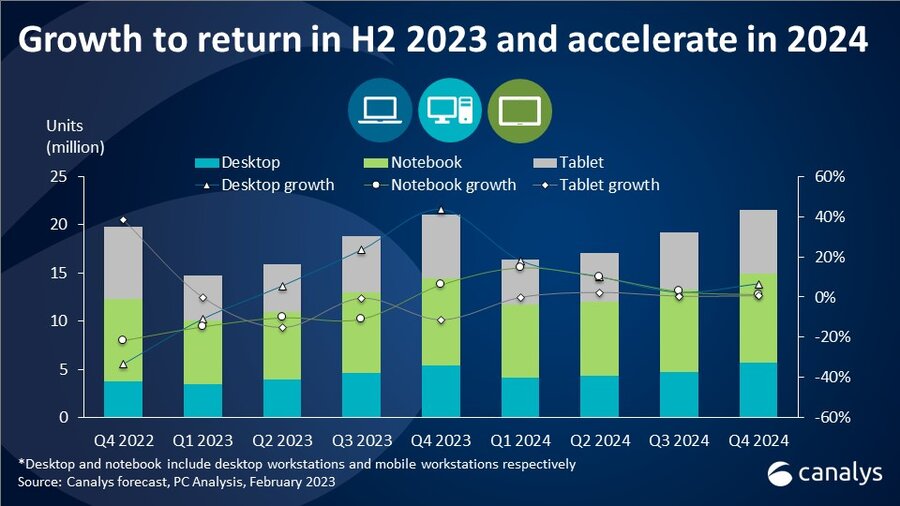

Canalys expects PC (desktop, notebook and workstation) shipments to stabilize in 2023, with around 48.3 million shipments to maintain a similar shipment level to 2022. The commercial sector will bounce by 10% in 2023, thanks to the gradual recovery of the local economy and business activities. The consumer segment will still experience a 9% drop, as recovery is not expected until the fourth quarter. Canalys expects desktops (including desktop workstations) to grow by 15% in 2023, to reach 17.3 million units, while notebooks (including mobile workstations) will decline by 7% to 30.9 million units. In the tablet space, consumer demand will be moderated, given the expanded adoption in the past three years; the category is set to go down by 8% to 22.1 million in 2023, as commercial adoption has yet to be developed.

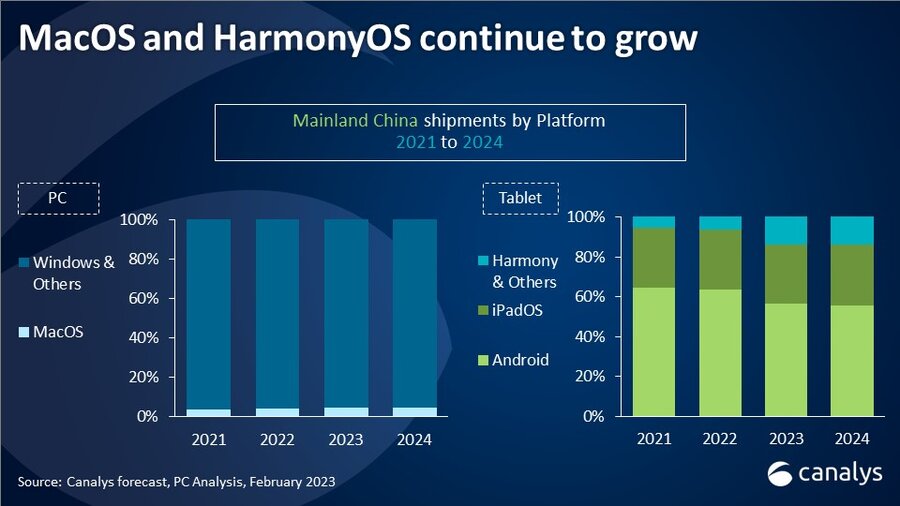

Windows still dominates in desktop, but there is a looming threat from home grown OSs. So far these have failed to attract consumers despite a strong push, due to their limited software compatibility and efficiency. In the notebook segment, Apple's upcoming Macbook (2023) and its efforts to push into enterprises will enhance the MacOS market share with nearly 16% shipment growth expected in 2023. Canalys forecasts that iPadOS and Andriod will see a decline of 18% and 8%, respectively, while the "Others" operating system, mainly HarmonyOS, is expected to expand further with 105% growth in the coming year, albeit from a small base, driven by replacement demand.

"The mid-term outlook of the PC market will hinge on the return of business and consumer confidence as the newly formed government vows to drive consumption and increase disposable income as a priority in 2023," added Xu. Canalys expects China's PC market to return to moderate growth in 2024 as PC (desktop, notebook and workstation) and tablet categories will grow by 7% and 1% over 2023. "Consumer awareness of the ‘connected device ecosystem’ will continue to rise, thanks to the marketing efforts of international and domestic vendors. Vendors focusing on user experience across devices will likely attract the upgraders and younger generation. At the same time, a concerted effort in channel strategy in commercial and consumer channels is equally crucial to an ecosystem play."

|

People's Republic of China (mainland) desktop and notebook shipments (market share and annual growth) |

|||||

|

Canalys PC Market Pulse: Q4 2022 |

|||||

|

Vendor |

Q4 2022 |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

Lenovo |

5,343 |

43.5% |

6,890 |

41.8% |

-22.4% |

|

HP |

1,253 |

10.2% |

1,522 |

9.2% |

-17.6% |

|

Dell |

1,100 |

9.0% |

2,057 |

12.5% |

-46.5% |

|

Huawei |

1,002 |

8.2% |

580 |

3.5% |

72.7% |

|

Asus |

964 |

7.9% |

908 |

5.5% |

6.1% |

|

Other |

2,609 |

21.3% |

4,540 |

27.5% |

-42.5% |

|

Total |

12,271 |

100.0% |

16,496 |

100.0% |

-25.6% |

|

|

|

||||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

Source: Canalys PC Analysis (sell-in shipments), February 2023 |

|

||||

|

People's Republic of China (mainland) desktop and notebook shipments (market share and annual growth) |

|||||

|

Canalys PC Market Pulse: 2022 |

|||||

|

Vendor |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Lenovo |

19,253 |

39.7% |

22,772 |

40.0% |

-15.5% |

|

Dell |

5,644 |

11.6% |

7,187 |

12.6% |

-21.5% |

|

HP |

4,380 |

9.0% |

5,255 |

9.2% |

-16.6% |

|

Asus |

3,770 |

7.8% |

3,540 |

6.2% |

6.5% |

|

Huawei |

3,576 |

7.4% |

1,891 |

3.3% |

89.1% |

|

Other |

11,885 |

24.5% |

16,338 |

28.7% |

-27.3% |

|

Total |

48,508 |

100.0% |

56,982 |

100.0% |

-14.9% |

|

|

|

||||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

Source: Canalys PC Analysis (sell-in shipments), February 2023 |

|

||||

|

People's Republic of China (mainland) tablets shipments and annual growth |

|||||

|

Canalys PC Market Pulse: Q4 2022 |

|||||

|

|

|

|

|

|

|

|

Vendor |

Q4 2022 |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

Apple |

2,650 |

35.4% |

1,533 |

28.4% |

72.9% |

|

Huawei |

1,024 |

13.7% |

1,109 |

20.5% |

-7.7% |

|

Honor |

842 |

11.3% |

400 |

7.4% |

110.3% |

|

Xiaomi |

816 |

10.9% |

490 |

9.1% |

66.5% |

|

Lenovo |

587 |

7.9% |

771 |

14.3% |

-23.8% |

|

Other |

1,561 |

20.9% |

1,096 |

20.3% |

42.5% |

|

Total |

7,479 |

100.0% |

5,399 |

100.0% |

38.5% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

Source: Canalys estimates (sell-in shipments), PC Analysis, February 2023 |

|

||||

|

People’s Republic of China (mainland) tablets shipments and annual growth |

|||||

|

Canalys PC Market Pulse: 2022 |

|||||

|

Vendor |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Apple |

7,245 |

30.2% |

6,814 |

30.2% |

6.3% |

|

Huawei |

3,924 |

16.4% |

4,437 |

19.7% |

-11.6% |

|

Xiaomi |

2,374 |

9.9% |

900 |

4.0% |

163.8% |

|

Lenovo |

2,271 |

9.5% |

2,658 |

11.8% |

-14.6% |

|

Honor |

2,249 |

9.4% |

1,918 |

8.5% |

17.3% |

|

Other |

5,917 |

24.7% |

5,814 |

25.8% |

1.8% |

|

Total |

23,980 |

100.0% |

22,541 |

100.0% |

6.4% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

Source: Canalys estimates (sell-in shipments), PC Analysis, February 2023 |

|

||||

For more information, please contact:

Emma Xu (Shanghai): emma_xu@canalys.com

Canalys' PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.