In the first week of October 2023, Xiaomi introduced its latest smartwatch, the Watch 2 Pro. This launch positions the vendor as the third major wearable band manufacturer to integrate Wear OS, following Google and Samsung. Xiaomi has predominantly focused on the basic watch form factor for global market devices, using an in-house-developed real-time operating system. This aims to reduce device costs and enhance battery life. But trade-offs include no third-party app support and fewer device functions.

Xiaomi is experiencing robust shipment growth, particularly in developing regions and Southern European markets, where basic watches make up a large proportion of shipments. Xiaomi’s shipments grew 87% year on year in Central and Eastern Europe and 88% in the Middle East in Q3 2023. At the same time, 54% of its Western European shipments were in Spain and Italy. These entry-level wearables serve as a gateway for first-time buyers to engage with Xiaomi, fostering brand familiarity and loyalty. These basic devices have formed the foundations for recent Xiaomi performance, so why has the company decided to use Wear OS this time around?

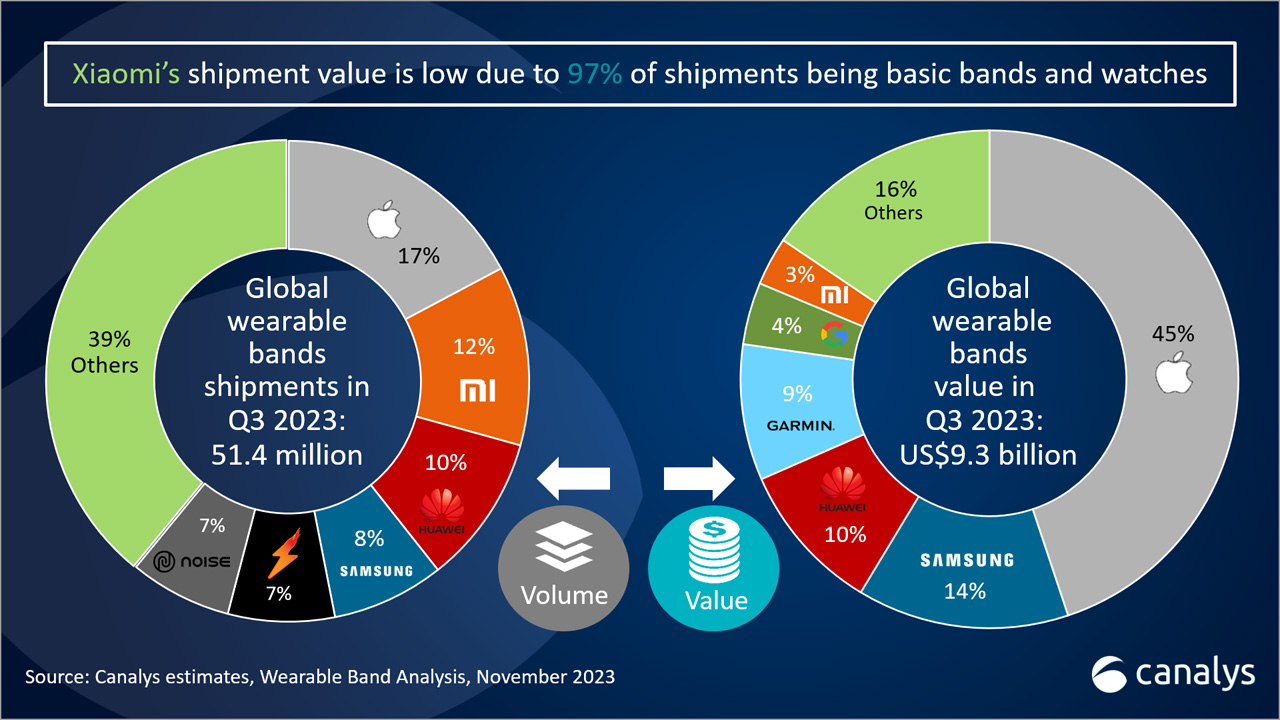

- To adapt to changing market dynamics: As the wearable band market matures, the scope for shipment growth diminishes as the number of potential new entrants falls. Therefore, switching priorities to driving higher ARPU is growing in importance. But Q3 2023 Canalys estimates reveal that Xiaomi lags in terms of value, holding just a 3% share of the global wearable band shipment value. To address this, Xiaomi is strategically expanding the presence of basic devices and its brand, paving the way for future, higher-value smartwatches.

- To align with its smartphone strategy: The Watch 2 Pro marks an attempt to appeal to the high end of the market, to match Xiaomi’s investment and R&D in smartphones. The creation of a premium smartwatch and device ecosystem should cause a multiplier effect, elevating the appeal of each device on its own and when used in combination.

- To build a strategy to compete with Huawei: Xiaomi’s international smartwatch commitment serves as a strategic response to Huawei’s growing dominance in the domestic sector. Huawei’s Mainland Chinese smartwatch market share hit 34% in Q3, up from 15% in Q3 2022. By targeting foreign markets where Huawei’s presence is less formidable, Xiaomi aims to generate higher value from smartwatch sales. This international revenue can then be reinvested to strengthen Xiaomi’s smartwatch and smartphone hardware, as well as HyperOS (based on Android) R&D efforts. The engagement with Wear OS offers valuable insights for refining Xiaomi’s new operating system, HyperOS, recently integrated into its latest watch range. This move is crucial, given Huawei’s advancements in HarmonyOS ecosystem integration and NearLink technology.

- To find a market gap for more affordable Wear OS watches: A large number of global Android devices are priced in the low-to-mid range and aimed at the mass market. According to Canalys research, 86% of Android smartphones had a list price of US$500 or lower and 65% had a list price of US$300 or lower in the first three quarters of 2023. The Watch 2 Pro comes in at a considerably lower price in European markets, priced at €269 (US$295), significantly lower than Samsung’s Galaxy 6 at €319 (US$350). Affordable Wear OS smartwatches will tempt Android users and expand and strengthen the Android/Wear OS ecosystem by converting more Android users into Wear OS smartwatch users by underpricing the competition.

But there are a number of issues that will arise from the adoption of Wear OS:

- Loss of iPhone compatibility: Basic watches are platform-agnostic, connecting to any smartphone. But tying to the Android ecosystem excludes iPhone users.

- Competition and expertise: Developing a smartwatch is complex, and Xiaomi competes with seasoned players such as Samsung and Google, both experienced in smartwatch development and the Wear OS platform. Overcoming this head start is a significant challenge for Xiaomi.

- Google and Samsung have priority: Wear OS, primarily developed by Google with Samsung contributing to hardware, prioritizes updates and features for Google’s Pixel Watch, followed by Samsung due to its significant role in Wear OS shipments. The latest Google and Samsung devices run on Wear OS 4, while Xiaomi’s Watch 2 Pro operates on version 3.5. Given Xiaomi’s tertiary position as a customer rather than a developer, the device may face limitations in both attractiveness and performance when compared with competitors.

There is potential for Xiaomi’s large basic device user base in emerging and price-oriented markets to replace their current devices with the Xiaomi Watch 2 Pro and future Xiaomi Wear OS smartwatches, especially in those markets moving from basic devices to smartwatches. The Watch 2 Pro is a good start for Xiaomi, but a long-term commitment with regular iterations will be needed. Continually developing improved devices will not only build brand loyalty and Xiaomi’s reputation as a smartwatch flagship killer, but it will also benefit the entire Wear OS ecosystem.