Xiaomi’s first Wear OS smartwatch marks a change in strategic direction

11 January 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

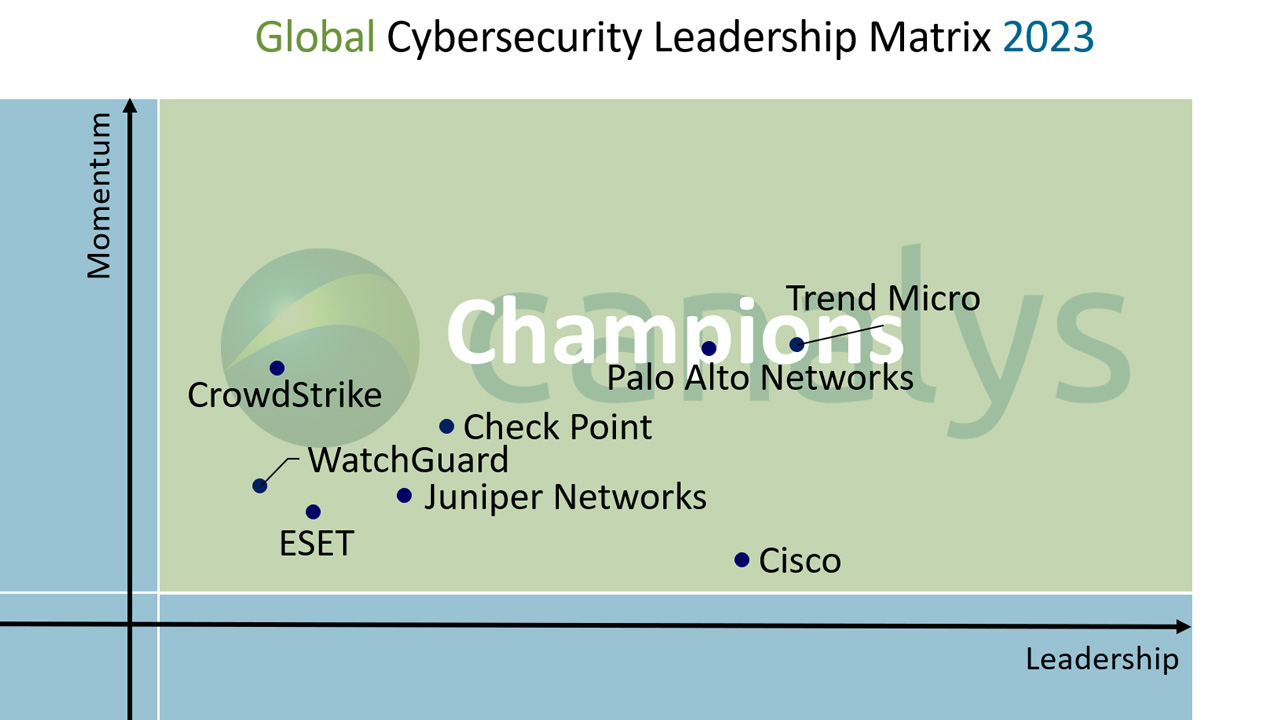

Eight vendors achieved Champion status in the 2023 Canalys Global Cybersecurity Leadership Matrix: Cisco, Check Point, CrowdStrike, ESET, Juniper Networks, Palo Alto Networks, Trend Micro and WatchGuard.

Eight vendors achieved Champion status in the 2023 Canalys Global Cybersecurity Leadership Matrix: Cisco, Check Point, CrowdStrike, ESET, Juniper Networks, Palo Alto Networks, Trend Micro and WatchGuard.

Canalys recently published its 2023 Cybersecurity Leadership Matrix, adding to its series of Leadership Matrix reports designed to highlight leading vendors in key areas of the channel ecosystem. This latest Leadership Matrix revealed eight vendors that demonstrated not just the highest levels of excellence in channel management and market performance in cybersecurity but also ongoing momentum.

Defining Champions and vendor inclusion in the Canalys Cybersecurity Leadership Matrix

Champions in the Cybersecurity Leadership Matrix have a combination of the highest and most consistent channel partner feedback, generated growth and profits for partners, and have maintained strong momentum over the last 12 months. They exhibit common characteristics. These include positive partner sentiment, a focus on continuous improvements in processes to drive simplicity and ease of doing business, a willingness to boost growth opportunities and increase profitability for partners, a focus on training and enablement, and a demonstrable commitment to growing the share of revenue generated through the channel. Champions are thought leaders in the channel and drive innovation to boost partner engagement.

The Cybersecurity Leadership Matrix assessed 30 vendors in terms of partner feedback, vendor performance, and analyst insights into their vision, leadership, competitiveness, partner initiatives and enablement. Inclusion was based on vendors meeting two thresholds: a minimum annual revenue of US$200 million from cybersecurity, excluding professional services, and more than 50% of business going through the channel.

Heightened threat levels reinforce the importance of partner enablement

Cyber-attacks continue to cause much disruption around the world. Supply chain attacks, exploitation of software vulnerabilities, the shutdown of critical infrastructure and the fallout from cyber-warfare demonstrate persisting weaknesses in cybersecurity defenses. Known ransomware attacks increased by nearly 70% last year, while the volume of breached data records grew by more than 1,500%. The need for robust cybersecurity has never been more apparent. In this evolving threat landscape, organizations depend on cybersecurity partners more than ever for support in enhancing their cyber-resilience, reducing attack surfaces and neutralizing threats.

In the highly competitive and fragmented cybersecurity market, vendors that enable their partners to grow profitably and deliver the latest technology to boost their customer’s cyber-resilience will stand out. Those vendors that support multiple partner types, enable partners to adopt a consultative-led approach, demonstrate expertise and specialize in new growth segments, extend beyond protection to detection and response, integrate with different marketplaces, and deliver scalable managed services will be better placed to succeed in the channel.

Congratulations to Check Point, ESET, Juniper Networks, Palo Alto Networks, Trend Micro and WatchGuard for retaining their status as Cybersecurity Channel Champions. They were joined by Cisco and, for the first time, CrowdStrike. Among the various successful channel initiatives these vendors rolled out, some were particularly important in enabling partners for current and future growth opportunities:

Retaining Champion status in the cybersecurity ecosystem will be even more challenging over the next 12 months. Competition will intensify as platform vendors expand further with new capabilities, and demand for specialist vendors will remain strong. Persistent economic and geopolitical uncertainties will sustain a difficult spending environment. But current threat levels show no sign of abating, which means organizations cannot afford to de-prioritize cybersecurity investment. Partners will find opportunities, especially alongside vendors that focus more on collaborative selling and delivery, and leverage generative AI to grow and optimize more advanced and profitable managed security services.