Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Wearable AI: vendor strategies and the path to the future

This blog explores how AI is revolutionizing wearables and the strategic moves of key players like Google, Samsung, ZEPP and Suunto.

Our previous blog has comprehensively detailed how GenAI enhances applications in wearables, particularly in health and fitness use cases. With the rapid development of AI, more vendors have participated in the AI game in wearables with many new use cases coming. In this blog, we will analyze the AI strategies of major vendors in a bigger picture and discuss the trends and opportunities in key use cases for AI in wearables in the future.

The evolving AI applications in wearable devices will enhance existing use cases, create new key use cases and increase user loyalty, and both ecosystem vendors like Google and Samsung that emphasize device connectivity and professional vendors like ZEPP and Suunto that focus on sports and health scenarios, will benefit from AI-integrated devices. However, to succeed, vendors must carefully focus on two fundamental pillars of AI - models and use cases. It is crucial to ensure that their AI strategy aligns with existing resources, product lines and target consumers.

Different vendors may adopt different strategies for AI models. Whether it is to develop an in-house model, collaborate with industry-leading AI service providers or adopt both approaches, there are always some key principles for wearable vendors to follow.

- With on-device GenAI capabilities still in the distant future on wearables, vendors must ensure privacy and data protection for all users on cloud-based GenAI.

- Models should be optimized for fitness and health use cases, whether they are in-house or from third-party providers. Moreover, user data used in these types of models needs to be anonymized when used as training data. For instance, Google is fine-tuning its “Personal Health Large Language Model (PH-LLM)” based on Google Gemini while ZEPP collaborates with third-party model providers to enhance health and fitness experiences.

- Ecosystem players must ensure a consistent AI experience across devices, including seamless data sharing and maintaining high-quality AI outputs for all ecosystem devices.

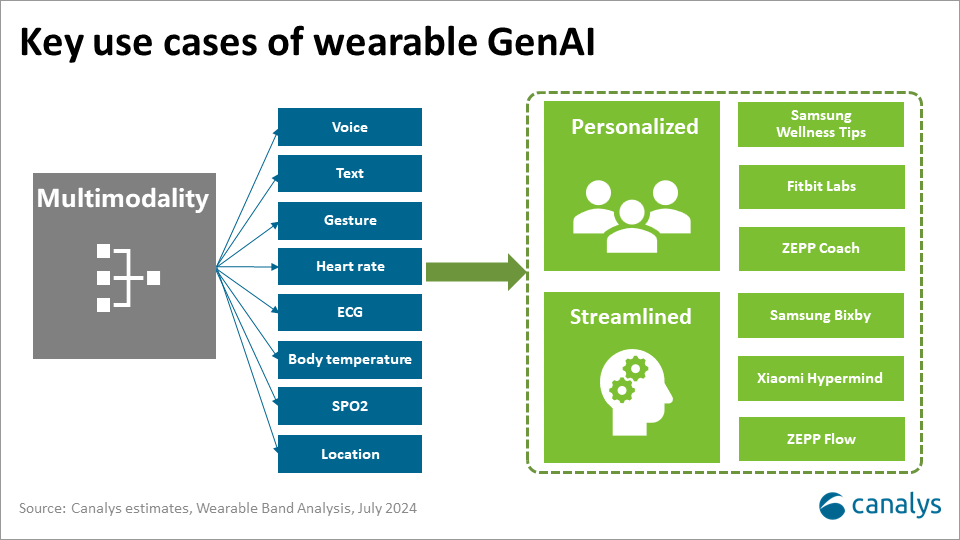

In our “Now and Next for AI-capable smartphones” report, we identified three trends for GenAI use cases - multimodality, personalized and streamlined. These trends are equally relevant for GenAI in wearable devices. However, due to differences in hardware and the specialized nature of wearables, there may be nuances in specific AI functionalities.

Multimodality offers wearables a distinct value proposition compared to other devices. Wearables leverage ECG and more sensors to collect diverse data dimensions unmatched by other technologies. With the support of AI, vendors can integrate these various data dimensions to generate new metrics, provide personalized, actionable training suggestions, create a chat “personal trainer” and streamline interactions through multiple input methods.

Personalized use cases foster higher user loyalty. Ecosystem vendors can leverage data from multiple devices to create a personalized, interconnected experience that drives attachment rates. Professional vendors can deliver tailored services, like ZEPP and Suunto's AI Coach, using their expertise in areas like sports. These use cases can improve over time as models learn more about their users as they analyze larger datasets.

Streamlined use cases extend wearable device value beyond fitness and health. Despite the wearable’s screen size limitations, GenAI enhances interaction through improved voice assistants, facilitating a shift from graphical user interfaces (GUI) to voice user interfaces (VUI). For example, ZEPP Flow allows users to start workout plans, manage schedules, respond to notifications and perform other tasks more conveniently.

The evolving landscape of wearable technology, especially with AI integration, presents significant opportunities for all players. Looking ahead, several key assumptions highlight how AI can help wearable vendors build a competitive advantage.

Canalys’ key assumptions for wearable AI opportunities

- AI enhances sensor capabilities: with one more sensor, AI will be able to create tens of new use cases based on that sensor. Such as wellness tips based on the data from that specific sensor and generating new “scores” from combined data from multiple sensors. This enhances sensor value and provides a competitive edge for devices with more sensors.

- Cloud-based AI propels e-SIM adoption: e-SIM connectivity may gain popularity through successful cloud-based GenAI use cases, offering on-the-go AI experiences.

- Privacy and consumer trust are key: vendors that address privacy issues in cloud-based AI will gain consumer trust more quickly, creating a competitive moat, enhancing user loyalty and ensuring sustained engagement.

- Enhanced interaction makes wearable AI easy to access: GenAI will make new interaction methods, such as voice and gesture controls, more user-friendly, enhancing the usability of wearables. This positions wearable devices as the closest GenAI assistant entry point to the human body, offering intuitive and seamless user experiences.

The rise of AI in wearables presents new opportunities for vendors. Improved product portfolios with higher ASPs and ecosystem attach rates will drive hardware revenue growth, and AI can also propel new revenue streams through subscription services with more use cases. More importantly, as consumers become accustomed to AI features, vendors that develop mature AI solutions will establish a significant differentiator, influencing consumer preferences when they make their next purchase decisions.