Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

The B2B platform race: How ecosystem marketplace and integration tools are accelerating platform strategies

Learn why tech vendors are racing to become the platform of choice for customers, and the ecosystem marketplace and integration tools they are using to accelerate platform strategies.

The race to become the platform of choice for buyers

B2B businesses are locked in a race to become the integrated platform of choice for buyers. Major B2B technology players – hyperscalers, SaaS leaders, new-age cloud distributors, cybersecurity vendors, and ISVs – are making large-scale investments to accelerate integrations and digital marketplace strategies.

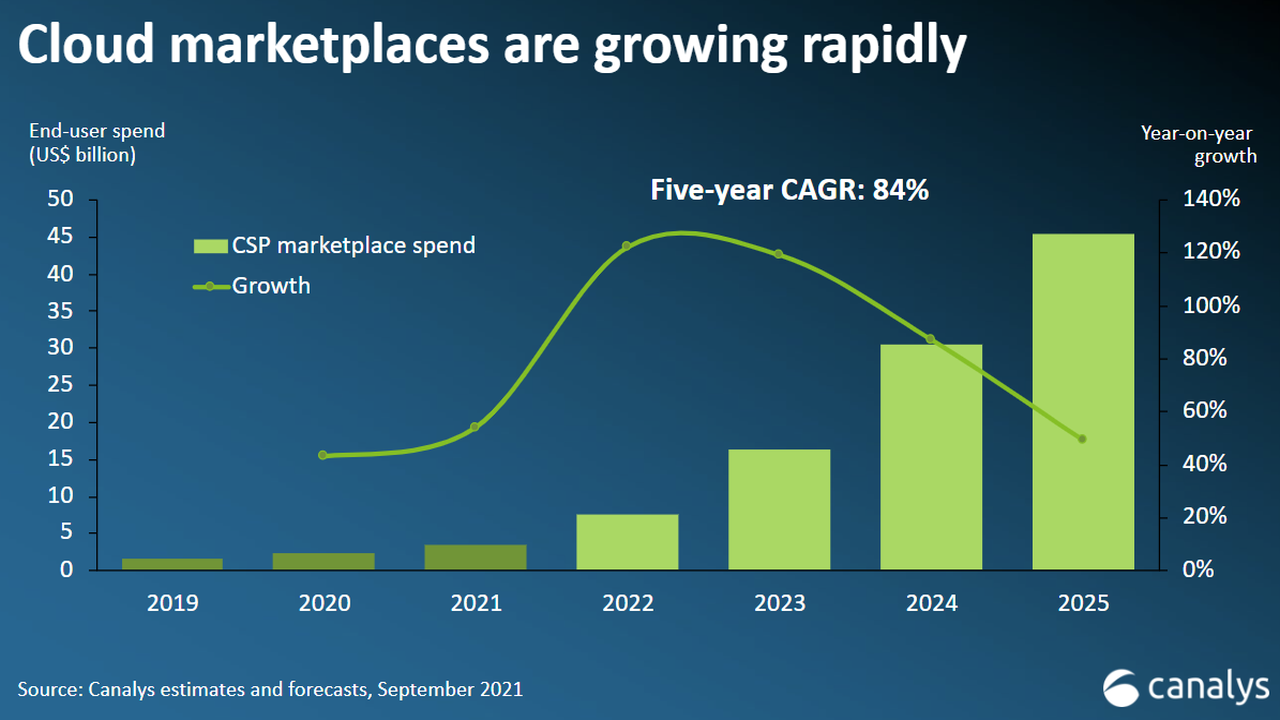

The platform race is driven by the evolving needs of modern IT buyers, the majority of whom will be millennials by the end of 2024. These digital-savvy buyers prioritize integrated solutions, streamlined procurement, and connected workflows, and their influence has driven an 84% CAGR in digital marketplaces over the past five years. To win over millennial buyers, tech vendors must strategically leverage, and accelerate, integrated ecosystem strategies.

Integrated platforms are stickier

Connected platforms unlock clear benefits; they enhance core product functionalities, improve net retention, drive innovation, cater to specialized use cases, and extend reach. Atlassian reports that dollar churn reduce by approximately half when customers add one app or integration. As a result, leading vendors are experiencing rapid growth in their own marketplaces. Over 91% of Salesforce customers now leverage AppExchange, SAP Store had 164% year-over-year growth, and Atlassian Marketplace surpassed US$4 billion in lifetime sales.

The cloud marketplace landscape is driving much of this momentum and is projected to exceed US$45 billion by 2025. Google Cloud’s marketplace third-party transaction value was up more than 500% year-on-year, and the number of active customers in AWS Marketplace increased by 287%. This growth translates into fast growing GTM channels for ISV’s such as CrowdStrike, Splunk, Snowflake, and Palo Alto Networks, who have each surpassed US$1 billion in cumulative sales through AWS Marketplace.

Beyond hypersalers and SaaS giants, cloud distribution marketplaces, such as those offered by Ingram Micro Cloud, Pax8, Sherweb and TD SYNNEX are also playing a significant role in this trend. These platforms simplify procurement and delivery of cloud services, specifically for partners (MSPs, Resellers, Professional Services firms), enabling them to more easily package and deliver integrated solutions to end customers. PAX8 reported 249% ROI for partnered technology companies, showcasing the value these marketplaces offer for vendors, partners, and end customers

The growing demand for integrated solutions and procurement is fueling the rapid adoption of ecosystem marketplace and integration platforms. These platforms include integration and marketplace tools that enable B2B businesses to build, launch, support, and scale integrated platform and marketplace strategies.

Rapid adoption of ecosystem marketplace and integration platforms

According to Canalys research, the broader ecosystem software industry is valued at US$5.3 billion, and projected to double by 2028 (US$11.8 billion). Within this space, the dedicated market for ecosystem marketplace and integration tools was valued at US$381 million in 2023. This space is still relatively immature and Canalys predicts significant growth over the next decade.

What are ecosystem marketplace and integration tools?

Ecosystem marketplace and integration tools are a critical group of ecosystem technologies that empower tech businesses to accelerate platform strategies and scale integrated ecosystems. These tools address the growing customer demand for streamlined procurement, integrated solutions, connected workflows, and specialized use cases.

There are two primary categories in this space:

- Integration platforms: These tools facilitate connections between various applications within an ecosystem, allowing data to flow freely and workflows to be automated across different platforms. They offer functionalities for API management, data integration, ETL/ELT, Low-code/no-code integrations, and IPaaS (Integration-Platform-as-a-Service).

- Marketplace platforms: These platforms enable businesses to build, manage, optimize, list, and/or transact on marketplaces. They include marketplace development platforms, marketplaces, and marketplace operations platforms. Marketplace platforms offer functionalities for marketplace operations, product listings, vendor onboarding, order processing, payment management, partner management, and much more.

By leveraging these tools, businesses can cater to the needs of today's integration-first buyers and accelerate building robust, successful ecosystems in the great platform race. Benefits of adopting ecosystem marketplace and integration tools include:

- Improved customer experience: By providing integrated solutions and streamlined procurement, these tools enhance customer satisfaction, loyalty, and lifetime value.

- Increased market reach and revenue: Integrated platforms and marketplaces offer expanded market reach, new revenue streams through commissions and fees, and higher customer lifetime value.

- Enhanced agility and innovation: Integration and marketplace tools enable faster time-to-market for new solutions and integrations with innovative partners.

- Operational efficiency: Automation and streamlined workflows result in reduced operational costs and improved resource utilization.

- Stronger partner ecosystems: Integrated tools and marketplaces facilitate deeper collaboration and value exchange with partners, fostering a thriving ecosystem.

- Customer innovation, specialized use cases, industry-specific solutions: Integrated platforms and marketplaces empower customers to integrate solutions tailored to their needs and industries, driving innovation and addressing specialized use cases.

- Faster time to market: Integration and marketplace platforms reduce the time it takes to bring new solutions to market and see ROI from investments.

Key players

- APIdeck (California, USA): Apideck enables developers to build integrations through a single API, streamlining API integration and management.

- AppDirect (California, USA): Enables businesses to sell, buy, and manage technology services through their own branded marketplace.

- AppXite (Riga, Latvia): AppXite is an ecosystem marketplace and subscription billing platform for distributors, sellers, MSPs, telcos, and vendors to automate and scale their technology-as-a-service business.

- Arcadier (Singapore): Arcadier enables customizable marketplaces and provides marketplace templates for companies.

- Arrow Electronics (Colorado, USA): Arrow Electronics offers a broad range of IT products and services and offers ArrowSphere, a cloud marketplace.

- Balluun (California, USA): Balluun enables event organizers to build year-round digital experiences that integrate marketplace, e-Commerce, networking, programming, and analytics.

- Builtfirst (California, USA): Builtfirst is a partner marketplace platform that enables companies to build partner directories, integration marketplaces, reseller marketplaces, and service marketplaces.

- Channel Program (Maryland, USA): Channel Program makes it easier for the IT channel to work together, grow, and succeed by providing a marketplace with product reviews, market research, tools for MSPs, and more.

- Clazar (California, USA): Clazar is the cloud GTM co-pilot that enables businesses to list, manage, and co-sell on cloud marketplaces with minimal engineering and no operational effort.

- CloudBlue (California, USA): CloudBlue, an Ingram Micro company, is a monetization platform that enables companies to unlock the power of digital ecosystems and marketplaces. It powers the world’s largest cloud B2B marketplaces and is an industry leader for monetizing B2B cloud subscriptions.

- iasset.com (Colorado, USA): iasset is a platform for technology vendors, distributors, resellers, and MSPs designed to streamline and automate sales and revenue operations.

- Interworks.cloud (Germany): Interworks is an end-to-end Cloud Commerce Platform tailored for global cloud distributors, CSPs, MSPs, and ISVs, and automates critical business processes for streamlined operations and maximum efficiency.

- Jitterbit (California, USA): Jitterbit provides low-code automation solutions and services to integrate data, automate EDI, and build applications.

- Labra (New Jersey, USA): Labra is an eCommerce platform for marketplace-led growth that enables ISVs, channel partners, and cloud hyperscalers to build, market, and co-sell with partners.

- Marketplacer (Melbourne, Australia): Marketplacer helps companies build online marketplaces quickly, easily, and at scale.

- MeasureMatch (London, England): MeasureMatch is a B2B marketplace technologies company that has two offerings: 1) MeasureMatch Marketplace featuring thousands of software solutions, and 2) AtlasGM for ISVs to operate their own branded marketplace.

- Mirakl (Paris, France): Mirakl is used by retail and B2B companies to create and scale marketplace and dropship business.

- Morphed (Delaware, USA): Morphed helps tech companies maximize revenue through partners and resellers through their commerce-enabled services, and app and solutions marketplace infrastructure.

- OROCommerce (California, USA): OROCommerce offers B2B marketplace solutions to build and manage marketplaces effectively.

- Pandium (New York, USA): Pandium is a platform to build, launch, and promote native software integrations. Pandium enables custom integrations up to 6x faster and with 70% fewer engineering resources.

- Partner Fleet (Illinois, USA): Partner Fleet’s turnkey marketplace platform makes it easy to go to market with partners and drive adoption of integrations and partner services.

- Pax8 (Colorado, USA): Pax8 enables partners and companies to buy, sell, and manage cloud solutions from a digital marketplace.

- Sitecore (California, USA): Sitecore offers an end-to-end digital experience platform, including OrderCloud, a headless, API-first solution for ecommerce, order management, and marketplace solutions.

- Spryker (Berlin, Germany): Offers a cloud-based, headless, fully composable platform for commerce and marketplace solutions.

- Suger (California, USA): Suger is a platform that makes it easy to list, transact, and co-sell on cloud marketplaces (AWS, Azure, GCP, Alibaba Cloud).

- Tackle.io (USA): Tackle provides a solution to help companies generate revenue through cloud partners by identifying the right buyers, growing cloud co-sell relationships, and transacting efficiently through AWS, Google Cloud, Microsoft, and Red Hat.

- TD SYNNEX (California, USA): TD SYNNEX is a leading distributor and solutions aggregator for the IT ecosystem, and provides two cloud marketplaces, StreamOne Cloud Marketplace and StreamOne Enterprise Solutions.

- Vendasta (Canada): Vendasta enables 89,000+ agencies to use its marketplace of solutions to white label solutions to sell, bill, fulfill, and deliver to their customers.

- Vtex (London, England): Vtex is an enterprise digital commerce platform that offers a marketplace and seller management product.

The future of marketplace and integration tools

The demand for integrated solutions, streamlined procurement, and marketplaces is growing quickly, and the tools that power these interconnected ecosystems will continue to innovate.

Looking ahead, AI will provide advanced insights and analytics to optimize integrations and marketplace experiences. Integration and marketplace tooling will become more user-friendly and automated. As vendors continue to expand their partner strategies and the market continues to grow, there will be seamless integrations and market consolidation with marketing automation and ecosystem management platforms.

Conclusion

There is a B2B transformation taking place; catering to the multi-faceted needs of the integration-first, digitally savvy, and well-informed buyer is no longer possible without ecosystem marketplace and integration tools. These tools are now the foundation for building a thriving ecosystem that delivers seamless experiences, integrated solutions, and streamlined procurement that modern buyers demand.