Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Transitioning from a Channel Chief to a Platform (Ecosystem) Chief

The pressure is increasing on channel and partner leaders to deliver at a new level of scale, complexity and personalization, and to figure out the people, processes, programs, and underlying technology that will drive competitive advantage in the decade of the ecosystem.

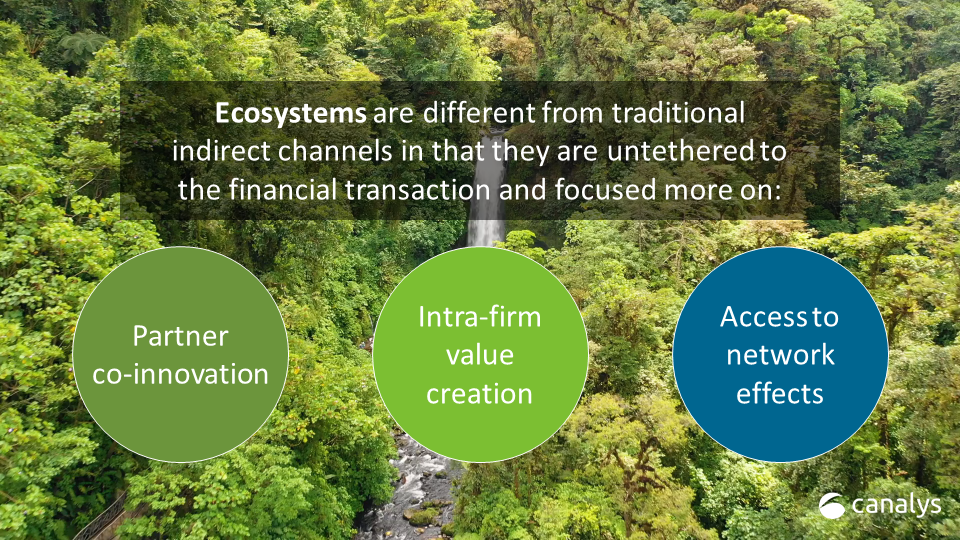

We know the most valuable companies in the world (in every industry) act as platforms for other players in the ecosystem. The platform business model has been around for thousands of years, long before the first computer. At its core, a platform is any business that provides the infrastructure for third parties to exchange value. This can be Uber facilitating riders exchanging value with drivers, a mall facilitating stores exchanging value with shoppers or Shopify facilitating merchants exchanging value with app builders.

Earlier this year, Canalys partnered with HubSpot and Partnership Leaders to publish a comprehensive, 91-page “State of Platforms” report that examined the most powerful 50 SaaS platforms in the world such as Salesforce, HubSpot, ServiceNow, Workday as well as the ultimate platforms in AWS, Microsoft, and Google.

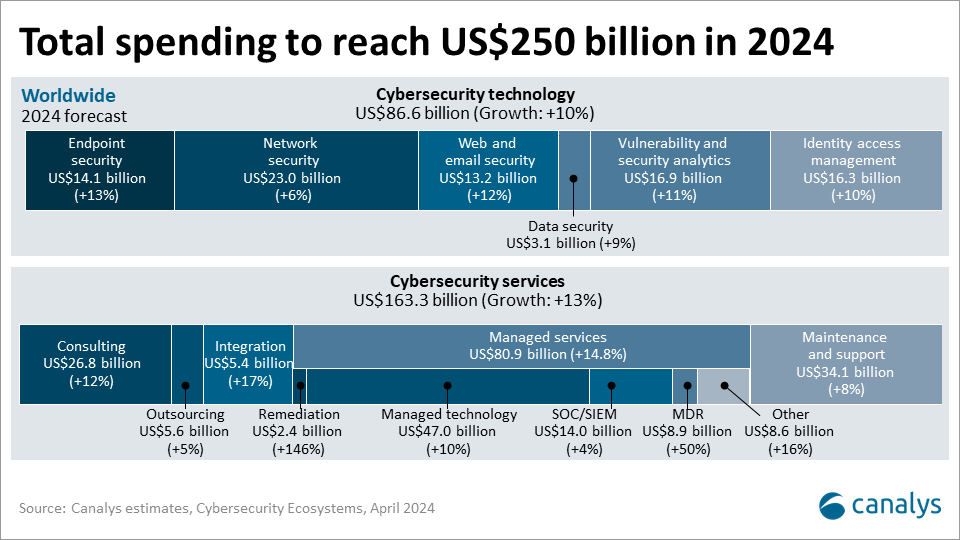

We are now moving from the early phases of ecosystem transition into more mature platform thinking and execution. By the end of the year, we will be midway through the decade of the ecosystem and winners/losers are starting to emerge. For example, the cybersecurity industry is moving from 6,500 disparate “tool makers” to four or five comprehensive platforms which will lead the industry forward into Zero Trust and SASE models.

Platforms are bidirectional – at times you may be the foundational platform that the buyer builds from and other times you will be participating in larger, more comprehensive ecosystems. Your execution has to simultaneously support both.

Many individuals confuse platforms with broad, horizontal products and UI/UX features. While there is a product element, platforms are a measure of gravity where demand is coming in equally from customers, services partners and integration partners. Modern platforms also orchestrate the ecosystem with an advanced product and services digital marketplace.

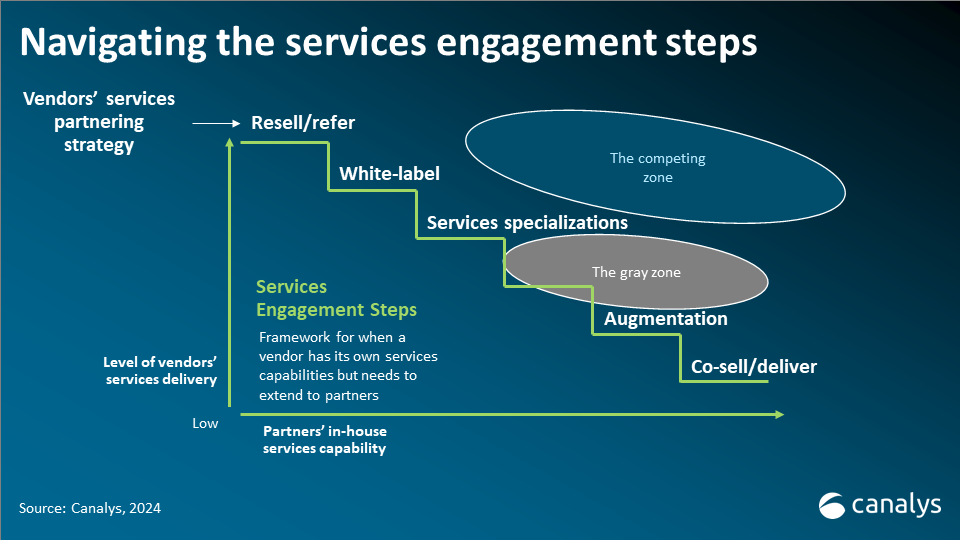

How do we evolve traditional (linear) channel programs to broader platform execution and economics? It is interesting to score your company (and your team's skillset) on this platform journey. And, yes, it is a journey, not a destination.

1. Senior executive teams must shift their go-to-market strategy

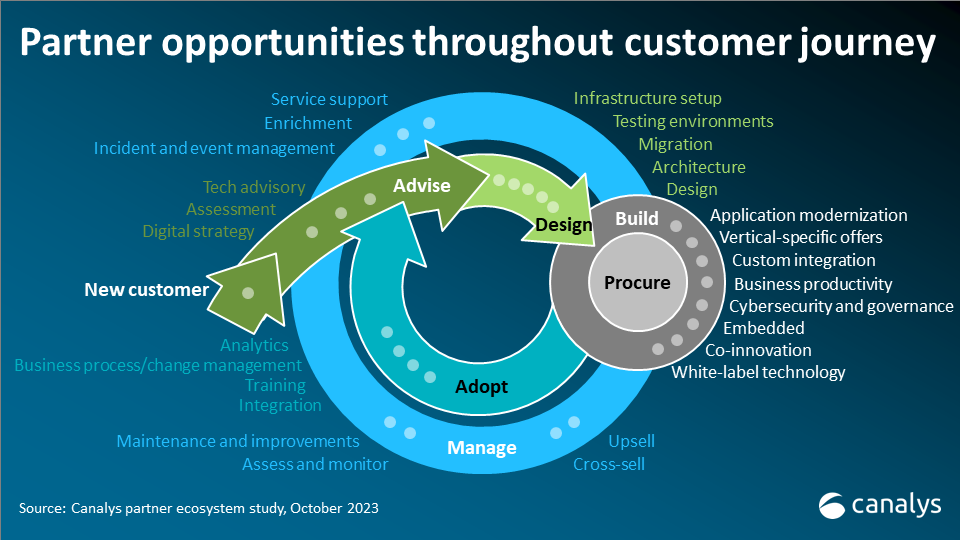

Implementing a platform model is not simply a program enhancement but a top-down cultural and strategic shift. Platforms change the economics of partnering, transitioning from funding partners only at the point of sale (gross to nets or revenue reduction) to recognizing them at the point of value (selling, general and administrative expenses (SG&A) or CAPEX). In a subscription or consumption model, getting the customer to the dance, getting them up on the dance floor and keeping them dancing all night are equally important and partners play a crucial role in all three stages.

Platform models tend to be more customer-friendly because they recognize and support the seven partners (on average) that your customer already trusts and reduces friction in the buying process. The customer can buy indirectly, through a marketplace (also indirect unless it is your own marketplace) or directly. The platform model reduces the value placed on the transaction itself and instead puts value on moments where partners add value to customers along the journey.

For example, the new, younger buyer is becoming integration-first in their buying criteria. Key technology integration partners (ISV or IHV) can make or break a deal, regardless of how strong the marketing and selling processes are.

2. Partner leadership changes are necessary to drive a platform model

One of the larger trends Canalys witnessed in the past few years was the establishment of the new Chief Partner Officer (CPO). Our friends at Nearbound.com have tracked 267 of these appointments, with new ones happening almost daily.

This is not just a promotion for the channel chief to the boardroom. It is a new job role with expanded KPIs and broader platform objectives. Companies are making these appointments to coincide with their platform ambitions. Out of the 20 appointments we analyzed in detail, very few of the new leaders have ever been present on the CRN Channel Chief list in the past. Most come from consulting and strategy backgrounds.

In most cases, the transactional-focused channel chief now reports to the CPO and sits with peers who own marketing, CX, product, technology alliances and other partner roles beyond reselling.

Monitoring, measuring and managing partners at the point of value in addition to the point of sale requires different skills, programs and organizational structures.

3. Integrate partnering professionals into lines of business

The CPO is not meant to be a new fiefdom where scores of people gather underneath. In fact it is the opposite. Partnering professionals need to be integrated into marketing, sales, product, finance, operations and customer success roles.

Depending on the size of the vendor, key partner strategy, program, operations, finance and technology roles should report directly to the CPO, while partner-facing roles should report to the CRO, CMO, CTO and others.

In a platform, partnering is not a department but a horizontal function. For example, having channel marketing professionals work in marketing and report to the CMO is important so that the organization can look holistically at the customer’s early 28 moments (before vendor selection) and make sure branding and demand generation are done internally and externally.

About a decade ago, the data science function did this successfully as a horizontal function. Instead of building an empire, the CTO or CDO embedded data scientists in every department and built a robust data lake around them that benefited all. The same theory works in partnering and is core to platforms.

4. Routes to market need to be expanded

Platforms recognize the entire customer buying journey – especially in the subscription and consumption models that almost all channel-friendly firms are moving toward. Platforms also look to reduce friction in the buying process.

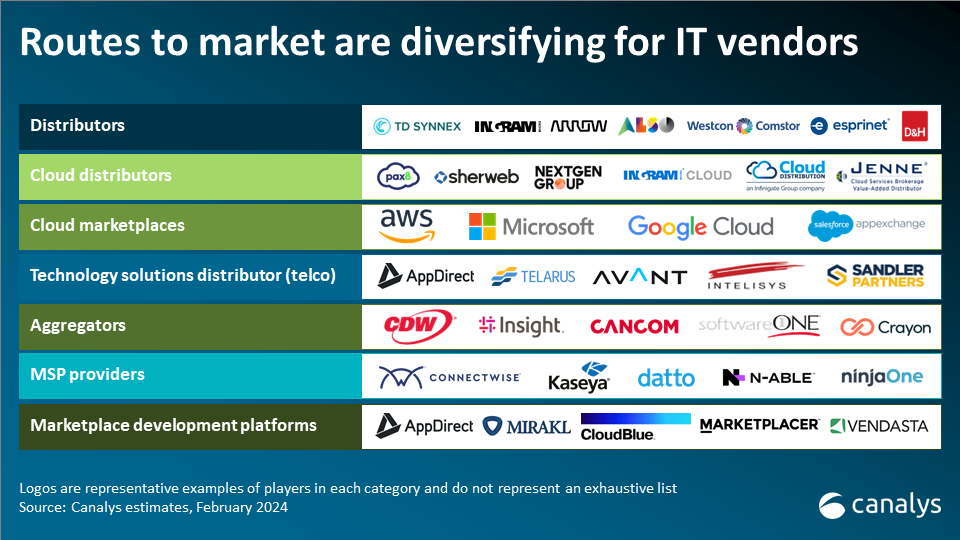

There are a total of seven digital route considerations when looking at your platform market's total addressable market (TAM). First are large cloud marketplaces being served by large hyperscalers, SaaS companies and traditional vendors. Canalys forecasts cloud marketplaces will deliver US$45 billion in revenue by 2025 and grow at a CAGR of 84%. There are already four vendors – CrowdStrike, Splunk, Palo Alto and Snowflake who are reporting over a billion dollars of business flowing from AWS alone. We are also predicting that AWS will join the top 10 distributors by 2025 and by our recent estimations, may already have.

Traditional distributors are investing billions in digital marketplace innovation. New cloud distributors, such as Pax8 and Sherweb, have grown significantly while avoiding legacy supply chain, warehousing and capital/credit value adds. In the telco market, technology solution distributors (TSDs) such as Telarus, Avant, Intelisys and AppDirect, have been very active in M&A and crossing over into IT distribution quickly.

Large resellers, several of whom are public companies, are investing significantly in digital marketplaces. There are over 150 marketplace development platforms (MDPs) that are raising billions in private equity and providing white-labeled capabilities across all industries. Finally, the platforms in the US$548 billion managed services industry, serving over 335,000 managed services providers, are actively building their own digital marketplace capabilities.

5. Partner recruitment must accelerate by ten times

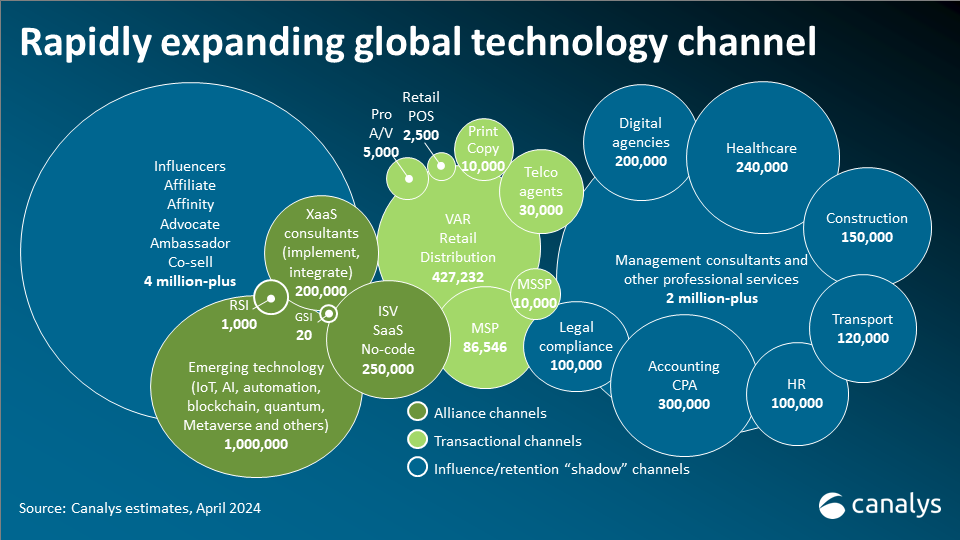

Platforms are broad and diverse and support a wide range of partner types. A long-tail strategy is required to support customers across their different roles, industries, segments, geographies, product needs and buying preferences.

Almost every vendor we come across at Canalys (estimated at 35,000) only has about 1/10 of the partners they need to achieve platform status.

Beyond understanding the TAM and how the different products are bought and sold, companies must consider how customers are influenced before, during and after the transaction. The average (medium and larger) customer trusts seven partners along their journey. One (or fewer) of those partners will ever function as a reseller. With 73.2% of the US$4.94 trillion technology industry flowing indirectly in 2024, most companies' programs are still too focused on transactional partners.

The most valuable companies today use a “surround” strategy for customer marketing, sales and customer success. Recruiting and nurturing the seven partners that are trusted by the customer is the most effective and cost-efficient way to acquire and keep customers for life.

Each trusted partner (of the seven) that is not working with you runs the risk of creating friction at key moments of the customer journey.

Recruiting these additional partners, which may have over 20 different types of business models, has to be done in a bottoms-up, community-led fashion. Understanding what they read and listen to, where they go, and who they follow is the first step. The second step is to be visible in their trusted “watering holes” and influence them at the point of influence. This is not a traditional, linear, account manager-led activity.

6. Speak the right language to these potential partners

When looking to recruit and develop more partners, which 86% of Channel Chiefs in CRN Magazine’s 2023 report said they were doing, it is important to recognize that non-transactional partners speak a different language.

Moving from margins to multiplier language is the first step in engaging with the seven partners who are trusted by each of your customers.

Several cloud companies have already made the shift to this new language and are finding success in quantifying the customer opportunity for partners. Salesforce was the first to do it and is halfway toward recruiting 500,000 partners, not bad for an almost fully direct company. AWS announced a US$6.40 multiplier at re:Invent (using Canalys research) and is quickly growing an ecosystem of systems integrators, ISVs, MSPs, agencies, integrators and consultants, none of whom are interested in the reseller motion.

Microsoft, Google and HubSpot also credit their platform success to this change of language. If you are still talking margins and incentives, and trying to explain a gold/silver/bronze program, you are behind the platform curve.

7. Move partner programs beyond precious metal tiers

This is a tricky one. An ecosystem model relies on a blend of transacting and non-transacting partners. A tiering model is still best for driving performance in a reseller motion, while a points system can recognize, measure and incentivize those non-resell moments that drive new opportunities, revenue, profit, and retention.

One of the interesting outputs of large digital marketplaces is the fee structure dropping to 3% (or less). Customers are quickly recognizing that the “cost” of reselling looks a lot like a credit card swipe at a restaurant. This is challenging for pure resellers because the cost of configuring, pricing, quoting and then taking money on behalf of a vendor is higher than that. Adding the time value of money (net 30, net 60 and so on), the risk the customer does not pay, and then the costs of recovery of bad debt are on top of this. One added wrinkle is when vendors put the risk of non-payment back on the partner to complete the contract time period (such as Microsoft).

The economics of partnering are radically shifting in a platform model. A points system is how platforms are executing this ecosystem model most effectively. Dozens of companies have transitioned and hundreds more are actively making the switch in 2024.

Awarding points for partnering moments before, during and after the transaction, as well as co-innovation, co-development, value creation, and network effects that stem from technology, strategic, and business alliances, is how platforms are operationalizing the model.

8. Incentivize partners beyond the point of sale

To expand on the points conversation above, there are dozens of moments that can be monitored, measured and managed across the customer journey as well as through alliance relationships. Applying incentive, motivation and loyalty strategies across these moments is critical to an ecosystem model.

The first step is to stop defining “top” partners by how much revenue they sell. Top partners could be focused on the early 28 moments before vendor selection (getting the customer to the dance). Another top partner could be a co-sell partner lighting up marketplace results (getting customers on the dance floor). Another top partner could show up post-sale in implementations and integration work creating stickiness (keep customers dancing). A top partner could provide a key technology integration that is truly a “better together” message to the integration-first buyer.

Vendors need to reimagine what their “top” partners actually deliver at the point of value and be able to measure that in a reliable, repeatable and scalable way to where the CFO would agree to pay for non-transacting activities.

9. Hyper-personalize your partner experience

Partners now cross over several different motions – in fact, recent research shows the average partner selects three or four different business models that they execute.

Segmenting your partners by type no longer works in a platform.

Every person inside each of these partners is unique in what their onboarding, training and competencies need to be to drive success. Your ecosystem model needs to be delivered in a single global program but executed at an individual level.

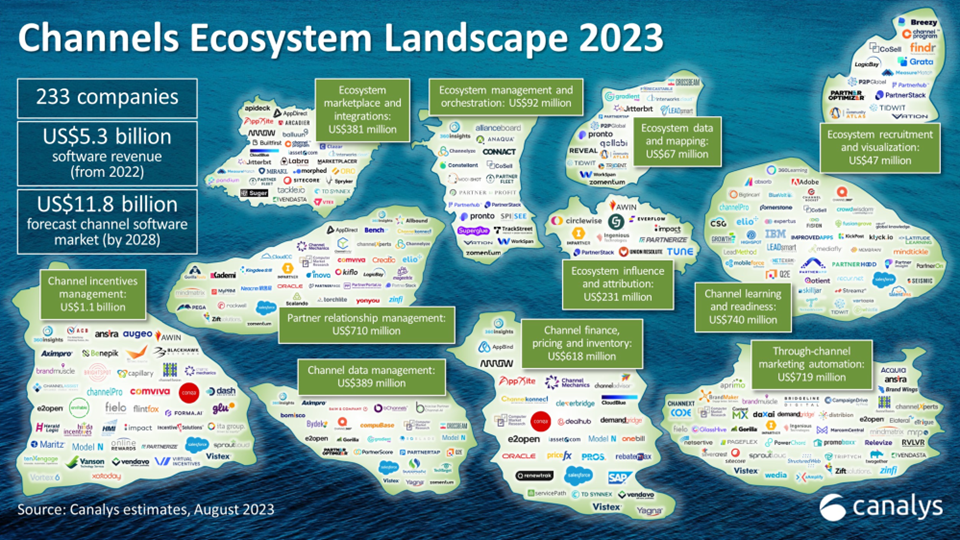

Generative AI will take this even further by hyper-personalizing content, communication and collaboration to the preference of the individual. The 233 channel software landscape vendors are actively adding features and functionality that allow vendors to operationalize AI in each of their programmatic elements.

Think of the platform-tuned partner program as a building. Every partner individual walks through the same front door (portal) and then a digital concierge ushers them from room to room via a hyper-personalized experience. An ultra-large partner such as Accenture (with over 750,000 employees) could be your largest marketing, resell, retention and co-innovation partner – all at the same time.

It now comes down to each individual and their ability to find the right education, training, certifications, competencies, enablement, incentives and engagement necessary to be successful.

10. Launch co-selling and co-marketing programs to all partners

Partners of all types need to be enabled to add value in direct business, marketplace or indirect business transacted through other resellers. How money changes hands in a platform is somewhat irrelevant.

For example, co-marketing requires affiliate, advocate, affinity, ambassador, influencer and other types of programs that pay for marketing performance. By the end of 2024, both Apple and Google will have completed the “end of cookie” transition. Your CMO is going to need help partnering to get second-party buyer intent data to replace third-party data they buy today.

For the first time in 20 years, we will not be the products on the internet and this will be one of the biggest things to ever happen to the partner channel!

Beyond early-stage co-marketing, executing effective co-selling programs is a cornerstone of platforms. Mapping opportunities with partners in real-time, sharing buyer intent signals, deploying attribution systems, through-channel marketing automation (TCMA), circular lead passing and effective deal registration management will be critical.

11. Channel technology is going to play a larger role in the platform economy

Automation, deeper integrations and data-driven decision-making are creating measurable competitive advantage through partnerships and are quickly becoming table stakes for delivering a platform model. Generative AI will play an increasing co-pilot” role for over 10 million channel and alliance professionals.

Canalys research shows that there are 233 companies forming the ecosystem software landscape and across 11 distinct innovation areas. New platform ecosystem technologies in the past few years include data and mapping, recruitment and visualization, influence and attribution, marketplace and integrations, and management and orchestration.

Over 35,000 vendors bought channel technology last year and they will spend over US$6 billion expanding their platform stacks in 2024.

12. Remove human gates to scale the platform

Partnering at scale is a complex and sometimes convoluted thing to manage effectively. It requires repeatable processes, predictable workflows, scalable business logic and a strong degree of automation that is difficult because you are dealing with money and third parties.

With the 35,000 vendors that we analyze, the average platform company has 10 times more partners than a channel reseller model.

Given the 503,000 technology industry layoffs over the past two years, very few partnering organizations have the luxury of adding resources to achieve a platform status. Many channel leaders are looking to generative AI, automation technologies and one-to-many approaches to accelerate partner recruitment, engagement, enablement, as well as program enhancements.

Process automation combined with smart investments in technology are cornerstones to successful platforms but represent the biggest skill gap facing partnering teams today.

13. Formalize a (parallel) top-down and bottom-up approach to build a platform

Building an effective reseller model over the past 43 years has been a top-down approach. Figure out a product's target addressable, serviceable available and serviceable obtainable market and start rapidly franchising through distribution and large resellers with a global channel account manager model. This is not unlike selling commodities such as coffee, donuts, or hamburgers, having a cash register on every street corner wins the day.

The platform model is much more difficult. We are not selling commodities, we are selling highly considered purchases to a new, younger buyer who surrounds themselves with seven trusted people. The permutations for most vendors reach into the tens or hundreds of thousands of people who surround the buyer in their TAM.

The bottom-up approach involves influencing the influencers and getting endorsed in the communities surrounding the people that your customer trusts (your prospective partners).

Platform companies need to rethink their partner coverage and capacity planning. Recruiting, onboarding, enabling and then engaging with 10 times more partners requires a community management strategy and execution that most vendors are simply not doing.

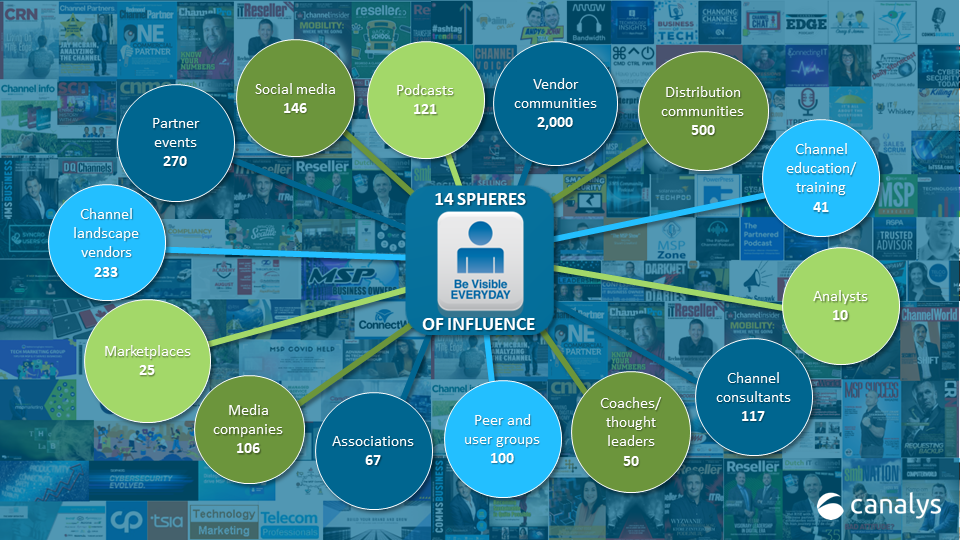

Canalys has been researching community “watering holes” over the past two years – the places that partners trust to engage with peers, listen to influencers, meet with superconnectors and cut through the noise and clutter this industry inundates them with.

There is still a misconception that partner recruitment and activation centers on a good partner program and internal communities – it does not.

A broad “Moneyball” approach is required – getting more people on base instead of swinging for the fences. Effective community management is getting on base as many times as possible with the least amount of investment. Earning that level of community endorsement and influencing the influencers creates the gravity that builds platforms.

Effective platforms drive both internal and external communities. Understanding how the seven partners who surround each customer are influenced is critically important. There are a total of 14 spheres of influence on a partner – depending on their individual preferences.

One year ago, about 20 million channel professionals needed to get educated on generative AI – and quickly. Friends, family and more importantly, customers were asking whether we just lit up SkyNet and were anxious about reports their jobs could be at risk. If you asked the 20 million people how they learned, they would talk about the events they went to (270 of them), the magazines they read (106 of them), the association meetings they attended (67 of them), social media groups they engaged in (146 of them), thought leaders and consultants they spoke to (117 of them), and so on. These are the 14 spheres.

Platforms know the watering holes surrounding their partners.

Platforms also deploy an algorithm that ranks the most influential people in these watering holes and invest money in nurturing the top trusted influencers and earning endorsements. Platform companies build their own communities but understand that 80% of influence happens outside their firewall.

Summary

We have a new digital-savvy, consumer-like end customer with a different psychology, behavior and buying journey. These new buyers surround themselves with upward of seven different partners in a customer journey that now never ends. From the first 28 moments of a B2B considered purchase before vendor selection to the new ways products and services are procured and provisioned, to the retention and renewals that rely on deep integrations, stickiness, and enrichment every 30 days forever, a platform strategy is now more important than ever.

The pressure is increasing on channel and partner leaders to deliver at a new level of scale, complexity and personalization, and to figure out the people, processes, programs, and underlying technology that will drive competitive advantage in the decade of the ecosystem.

Investors are disproportionally rewarding platform vendors. We must elevate our own skills and lead our teams to fulfill this mission. Being viewed as an ecosystem “platform” chief will be much more (personally and financially) rewarding and provide a much higher career trajectory than the isolated channel roles of the past.