Partners are more bullish on managed services in 2023

20 June 2023

The Vodafone/Three merger has put the competitive dynamic of operators under scrutiny, but the impact for smartphone vendors is yet to be explored. However, the consolidating smartphone channel in the UK might threaten the ability for competition to remain strong for the smartphone market here. Canalys evaluates the potential implications of the changes in the UK smartphone channel on OEMs.

Last week’s much-anticipated merger between Vodafone and Three is shaking up the operator dynamic in the UK. The merger will have to go through meticulous scrutiny from competition regulators, in which network infrastructure and subscriber volumes will be at the core. However, the merger’s impact on the smartphone market cannot be underestimated.

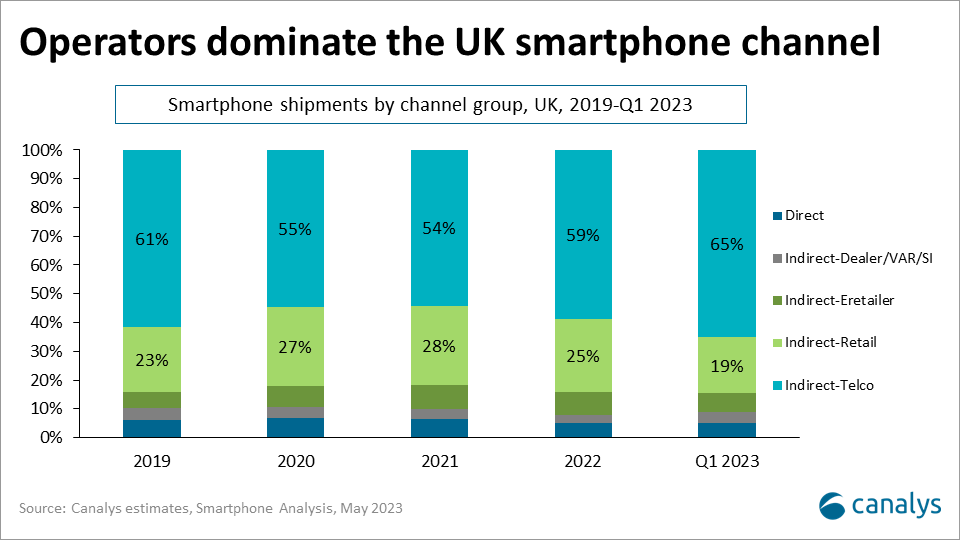

According to Canalys estimates, 59% of smartphone shipments were sold into the operator channel in 2022, making it by far the largest smartphone channel in the UK. Thus, for smartphone vendors, it is essential to evaluate potential impacts if the merger is approved.

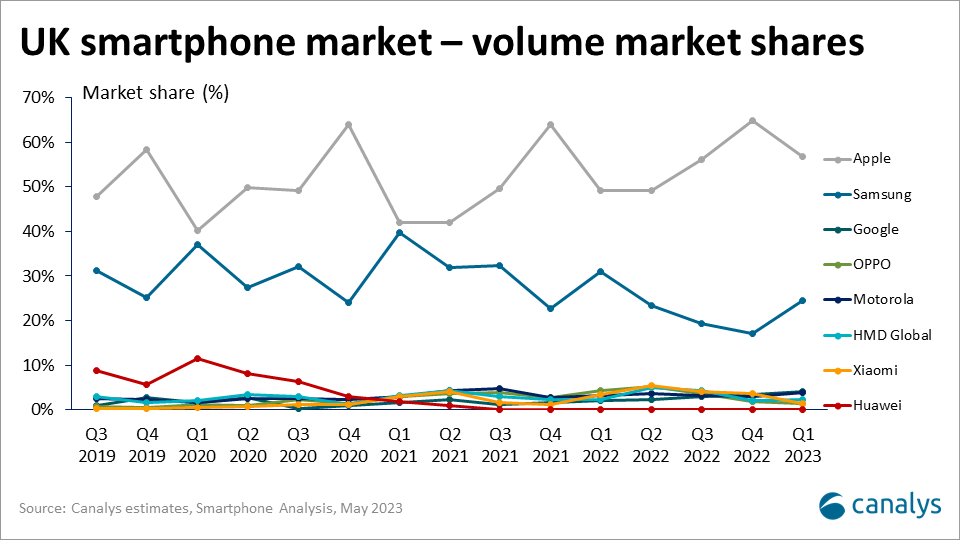

It is crucial to understand the current vendor landscape to assess the impact of the merger.

Not surprisingly, the market is dominated by Samsung and Apple. Collectively, they accounted for 78% of smartphone shipments in the UK in 2022. As they have strong presence across all operators and KAs, the merger is unlikely to have a negative impact for them. If anything, a consolidated channel will be beneficial as they can streamline sales efforts, MDFs and co-marketing funds towards fewer players. In the current market, Google Pixel would see a similar benefit. Even though Google’s market share is small, its high investment is giving it a consistent presence across all operators, similar to Apple and Samsung.

Beyond the top two, a cluster of vendors compete for smaller shares. In fact, seven vendors had at least 1% market share each last year. These vendors often depend on one or two operators to establish their presence and gain traction. For example, Xiaomi and HONOR have relied on Three, OPPO on EE, and the new vendor Nothing on O2. The dependence upon one or two operators makes a vendor’s position fragile. Three and Vodafone have traditionally been open to new vendors, and the merger might mean a door less for vendors to knock at.

Even though vendors often consider the UK’s smartphone market attractive, it is incredibly hard to break into. Ambitions of selling premium devices and of competing with Apple and Samsung are far away from reality, often resulting in vendors being forced to focus on the mid-to-low-end. Here, narrow margins, small volumes and high investment requirements make it difficult for vendors to create long-term, profitable business models. Unsuccessful attempts over the last three to four years to secure a comfortable position is as a warning that the market is considered less attractive to enter and invest into for new vendors.

There are no reasons for vendors to prioritize a market with a harsh channel – just look to North America where Chinese vendors particularly have stopped with futile entry attempts. Vendors don’t have to look further than continental Europe to find much more open-minded markets. With business conditions worsening, the UK channel must take responsibility to assure the market remains attractive for vendors to invest into. Competition between vendors is not only important to enable consumer choice, but also to secure strong competition within the channel.

Vodafone and Three’s merger will not limit all competition, but it certainly reduces the options vendors have to find a partner to invest with. It will be essential for the remaining operators to give vendors opportunities to prove themselves, even though focusing on a few specific vendors – similar to the German operator channel – might be tempting.

Perhaps this is the opportunity the other channel players can use to mix up their market presence:

Time will tell.