APAC channel optimistic as Canalys Forums 2023 gather pace

7 June 2023

In our survey of over 500 channel partners in 76 countries, we found that sustainability remains a high priority for many, with EMEA leading the charge and the circular economy gradually gaining traction.

Canalys recently ran a worldwide survey on sustainability. We received responses from 545 channel partners in 76 countries, aiming to gauge their attitudes toward sustainability, assess their progress, and identify the opportunities and challenges that lie ahead.

Despite ongoing macroeconomic uncertainty, our survey found that sustainability remains a priority for many of our partners in 2023. But partners’ journeys toward sustainability are many and varied. Some have already embarked on their journeys, while others are still on the starting blocks, signifying an industry in the middle of transformative change.

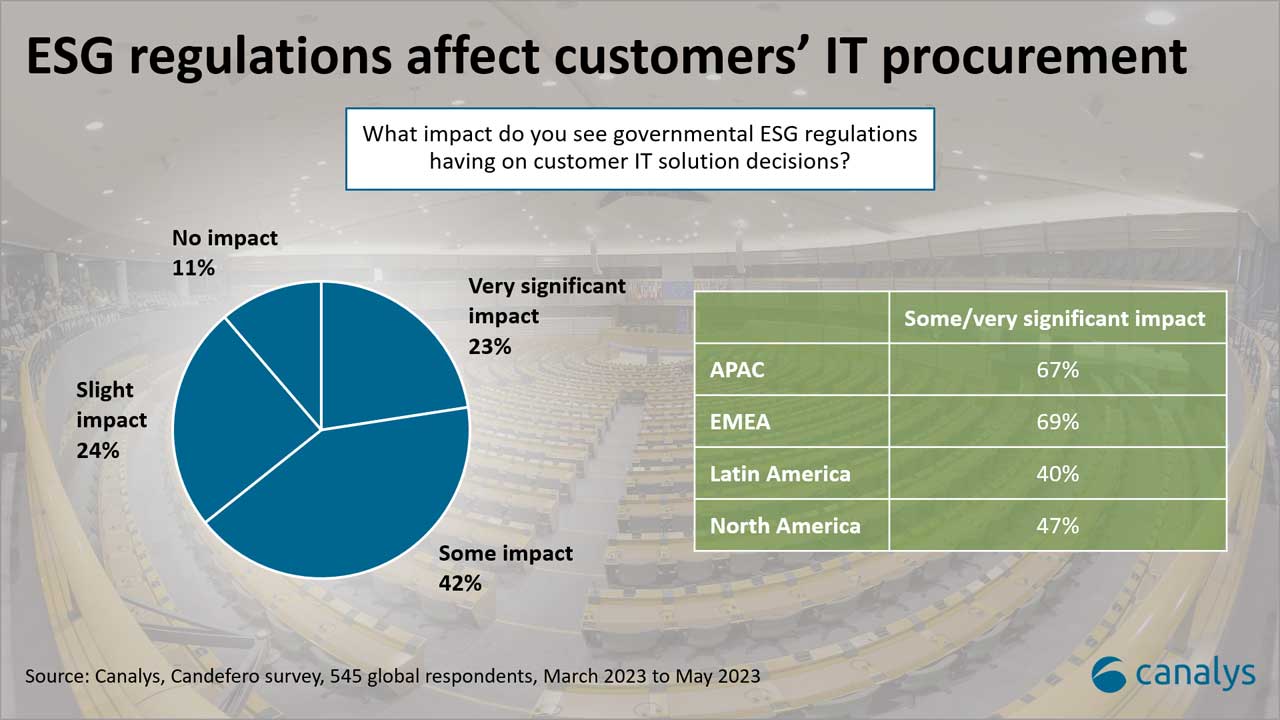

When it comes to regional differences, EMEA is leading the charge toward sustainability, while APAC partners have been demonstrating an increasing commitment. Meanwhile, most partners in the Americas remain many years behind. They need to catch up in terms of dedicating resources and tracking vital sustainability KPIs.

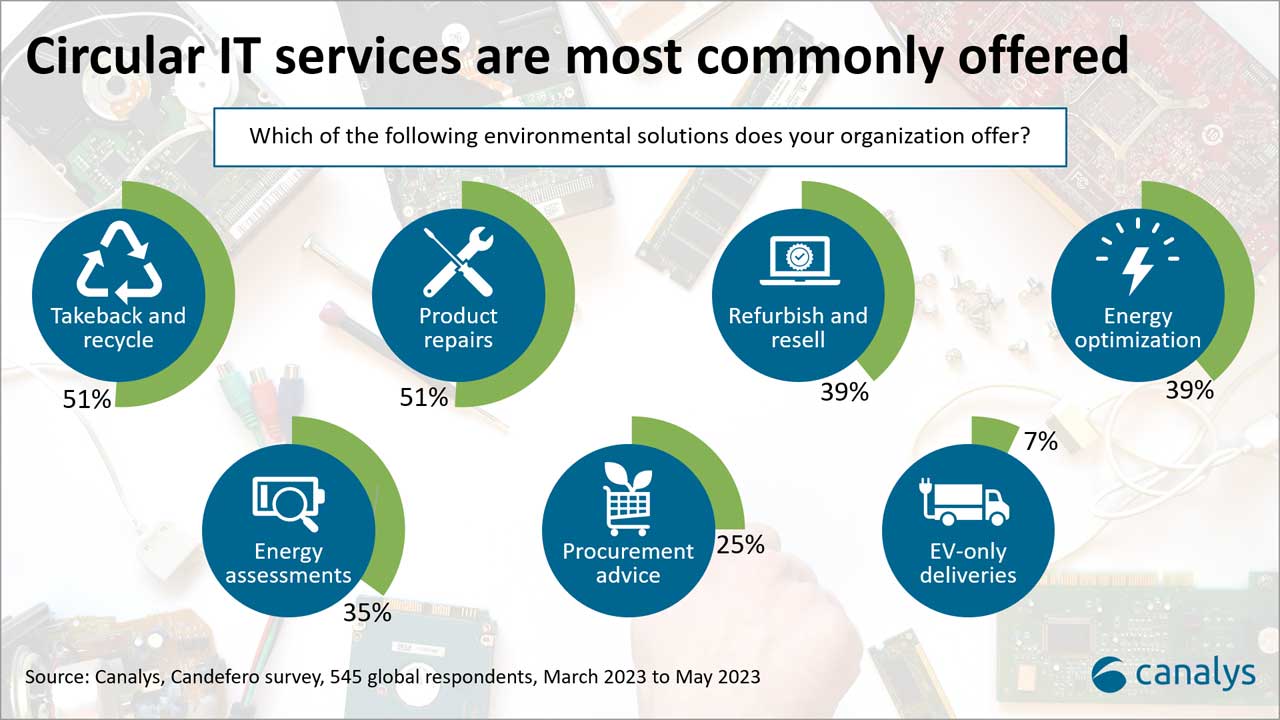

Our survey also revealed that the circular economy, which emphasizes the repair, reuse and recycling of products, is gradually growing in the channel. Yet, increasing customer awareness and changing perceptions around refurbished hardware remain a significant challenge. Moreover, persistent data privacy concerns and an unwavering vendor focus on new hardware sales are among the ongoing hurdles to the further adoption of circular models.

Our findings suggest that increasing regulatory pressures and global energy crises are key factors driving channel partners toward more sustainable solutions. The looming threat of stringent environmental regulations (especially in EMEA) is compelling partners to tackle sustainability, not only as an ethical imperative but also from a compliance perspective.

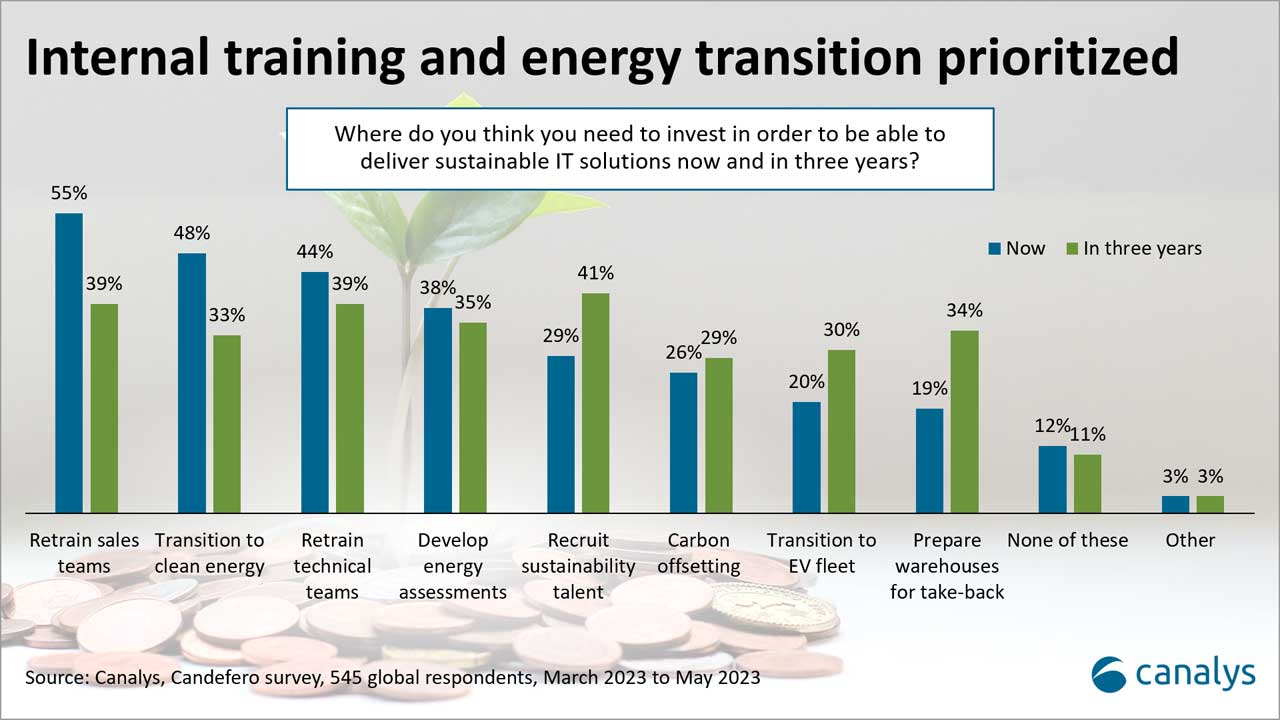

For partners, sustainability isn’t just about having green offerings, it’s about weaving sustainability into the very fabric of their organizations. This understanding has resulted in internal training being recognized as a vital investment area, particularly for sales, services and technical teams, ensuring they are adept at promoting and delivering sustainable products and services.

Our survey shows that vendors play a pivotal role in shaping partners’ sustainability progress. They are in the driving seat to decarbonize supply chains, support circular models and provide the necessary training for partners. But our research survey highlights that partners need more support from vendors to help them support their (and their customers’) sustainability objectives.

The top global challenges for our partners included customer awareness (51%), data privacy concerns (46%) and vendors discouraging circular models (36%). But let’s not see these challenges as roadblocks. Instead, let’s see them as a call to action, a call to bring about a shift in go-to-market sales culture, to enhance our refurbishing and recycling capabilities and, most importantly, to engage all customers in the journey to sustainability.

Sustainability is becoming more than just a value-add, it’s becoming an expectation and will become a recruitment and retention tool. It’s increasingly clear that those partners and vendors neglecting sustainability will risk being left behind and will become less relevant to prospects and customers. It’s vital that all stakeholders across the channel ecosystem collaborate to create new, more sustainable business practices.

If you are a channel partner keen to learn about the opportunities in sustainability, we encourage you to register for the Canalys Forums 2023. These events will give partners the chance to learn more about the latest trends in developing sustainable business models and address how they can swiftly adapt to meet the changing needs of their customers alongside top distributors and channel-committed vendors. See you there!

EMEA: 3 – 5 October | NORTH AMERICA: 13 – 15 November | APAC: 5 – 7 December