Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

What do consumers think about advanced AI capabilities on smartphones?

AI is the current hot topic in the smartphone industry. As features and capabilities turn into launches, it is becoming increasingly important for vendors to understand what their customers think about advanced AI on smartphones.

AI is the current hot topic in the smartphone industry. Vendors are investing a lot of time, resources and money into AI capabilities, and AI is increasingly taking center stage in events.

But a vendor’s success will not depend on innovation and promises alone. Instead, a vendor’s ability to bring new capabilities to consumers will be just as important. This means making new features eye-catching to increase brand awareness, making them influential in the purchase journey, increasing user stickiness and loyalty, and creating upsell opportunities.

The first point in moving the new capabilities toward consumers is understanding the status quo.

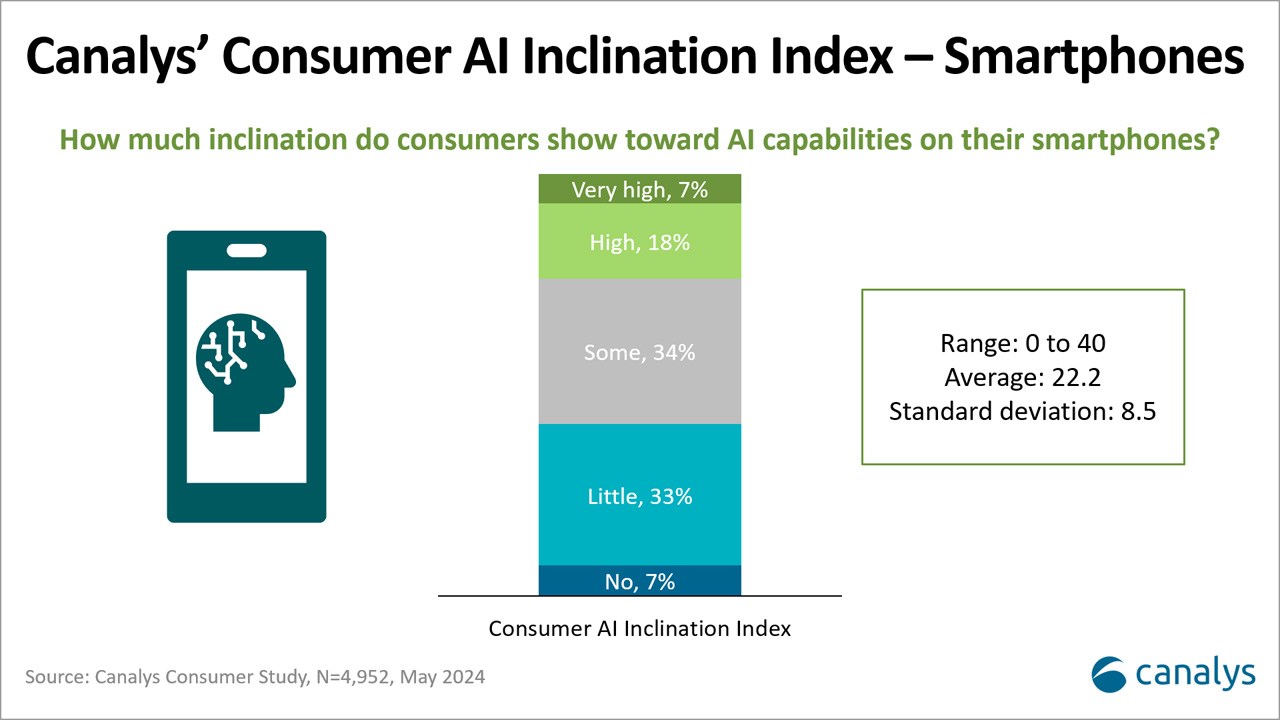

Canalys’ Consumer AI Inclination Index – Smartphones

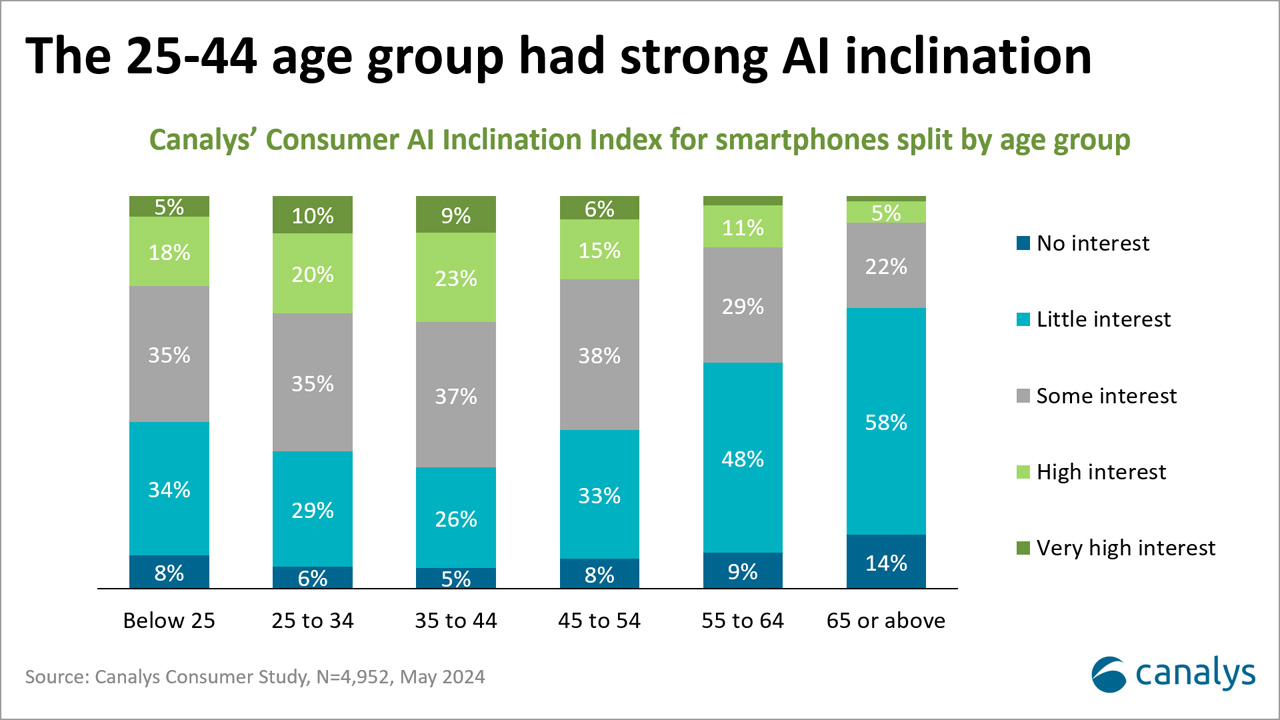

To best understand the significant variation in consumers from those who barely know about AI to those who would buy because of AI, Canalys has developed a Consumer AI Inclination Index.

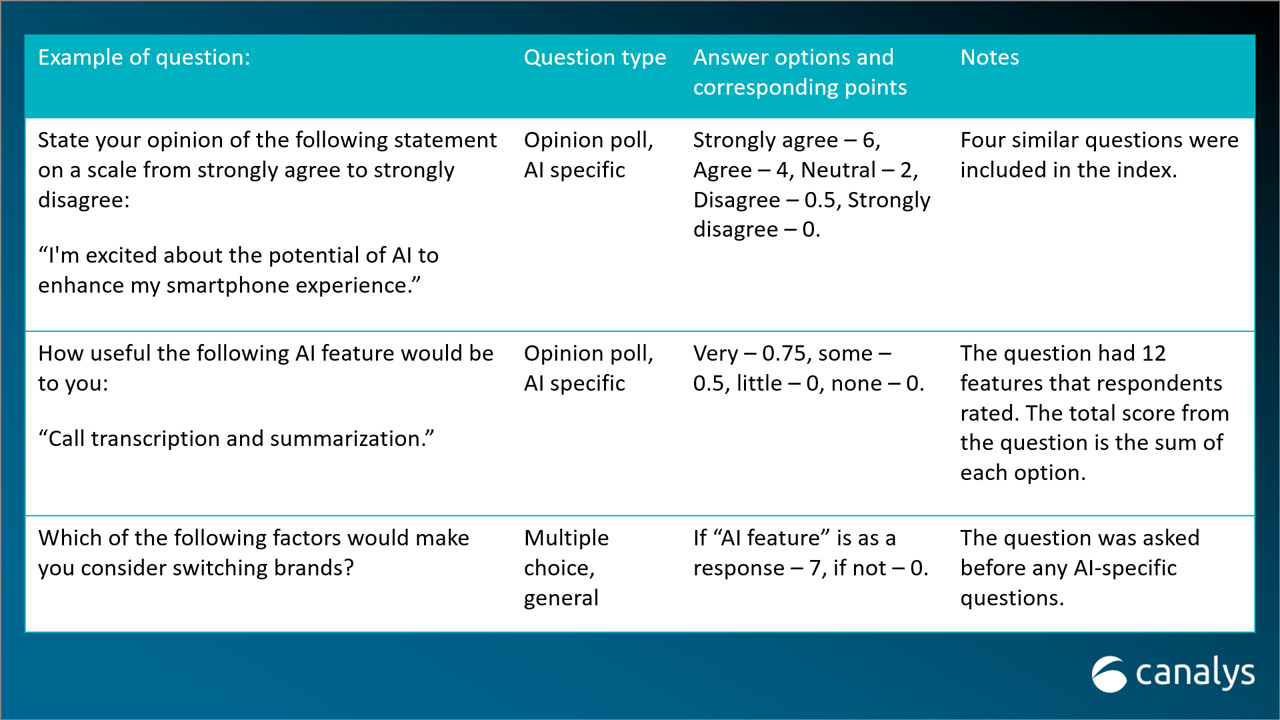

In a consumer study conducted in May 2024, Canalys surveyed 4,952 respondents in Germany, India, Mainland China, Mexico and the United States on the latest smartphone trends. The AI Inclination Index combined a selection of questions assessing each respondent’s attitude toward advanced AI on smartphones. For each question, “points” were allocated based on how well it reflected the respondent’s inclination toward AI. The Index is the sum of points from all questions.

Check out other findings from the study in Canalys’ “Now and Next for AI-Capable Smartphones 2024” report.

Four highlights from analyzing the index

1. Interest varies drastically by geography:

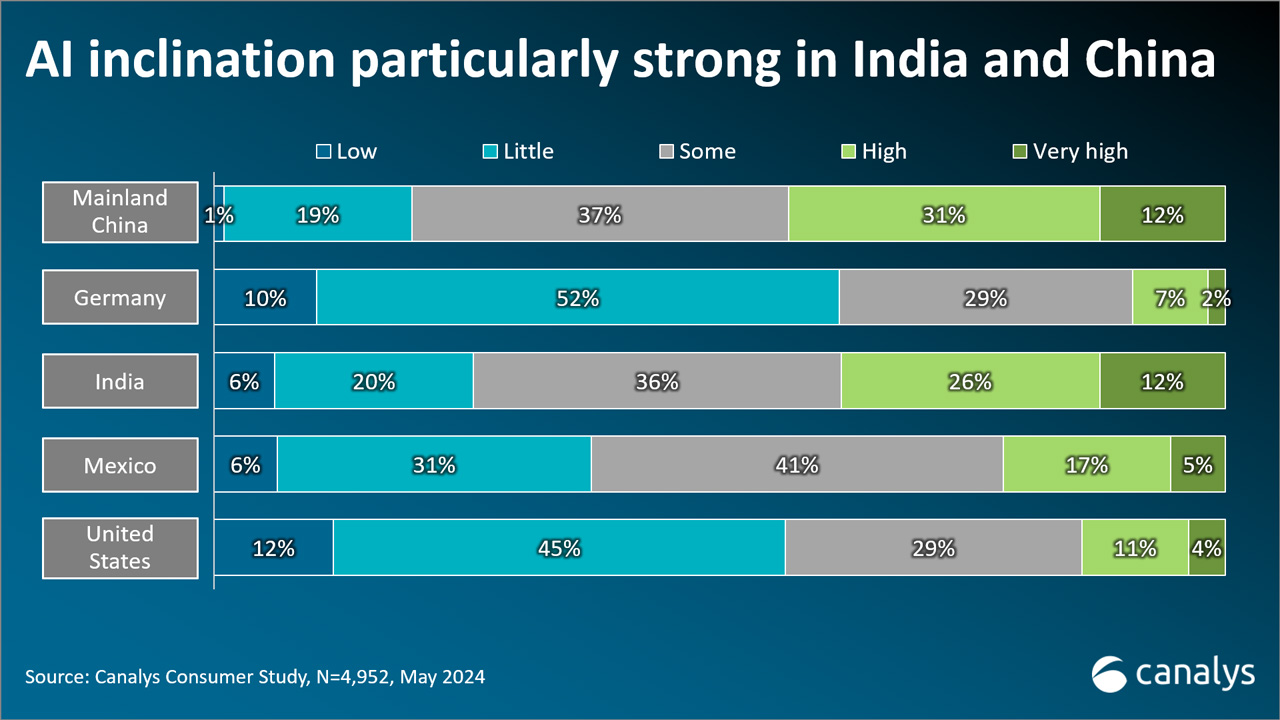

Distribution was remarkably different between the five countries tracked in the study. Respondents from India and Mainland China showed a much higher inclination than those from the United States and Germany, reflecting their hugely competitive markets driving innovation alongside a tech-savvy population with a growing middle class.

So what? Localized marketing will be vital to capturing users. Product differentiation and market leadership will be critical in markets with a dominant positive inclination. In these markets, it might become beneficial to lead with quantifiable metrics (for example, comparing NPUs) to convince consumers, especially since AI capabilities may already be a decision factor.

In contrast, in markets with a lower positive inclination, AI should be holistically part of a larger brand positioning exercise. Product demonstrations, interactive stands and entertaining advertising are tactics that can be used to promote AI, but they will not be sufficient alone.

2. High-inclination respondents stand out:

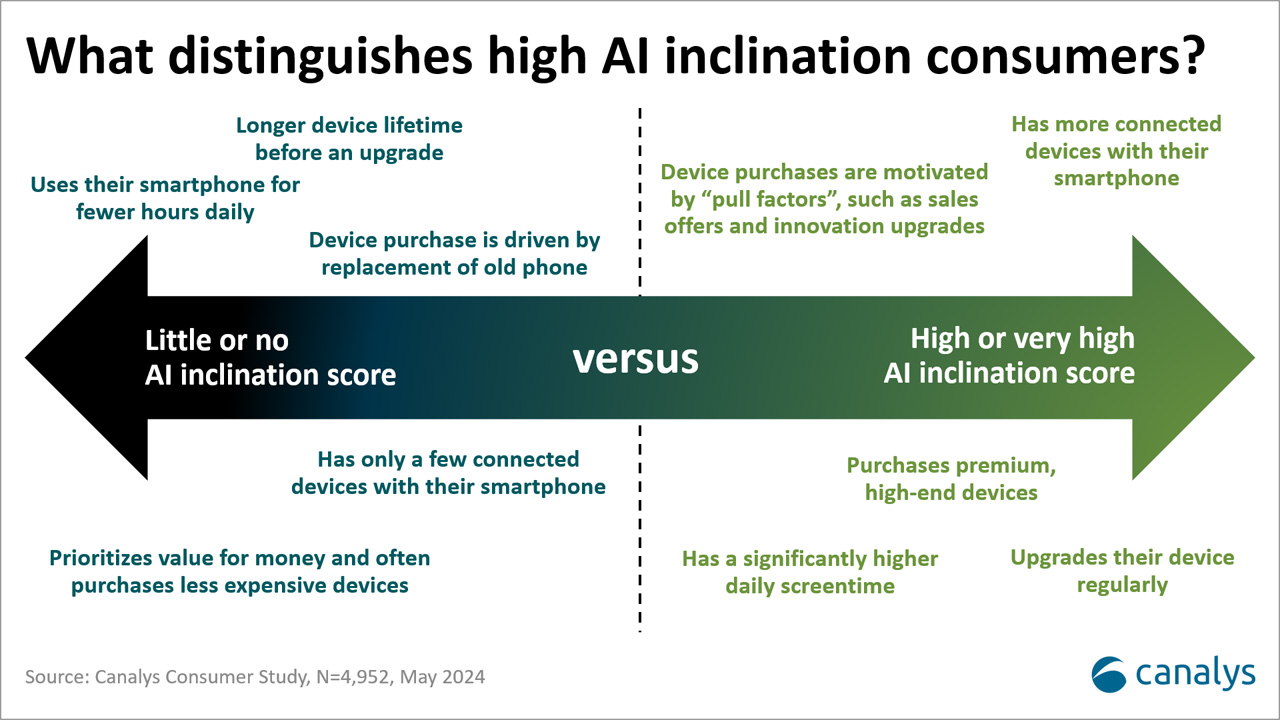

Only 7% of respondents had a very high inclination, but they are likely to have a buying intent based on AI capabilities. More interesting, they stand out by:

- Being more likely that their buying intent is to upgrade to a new phone rather than to replace their old one.

- Using more connected tech devices on a regular basis.

- Buying premium, high-end smartphones.

- Upgrading their devices often.

- Using their phones more, reflected by a much higher daily screen time.

So what? High-inclination respondents are incredibly attractive to vendors, with upsell possibilities, switcher potential and an openness to market-leading technology. Vendors can succeed by having stand-out industry-leading products.

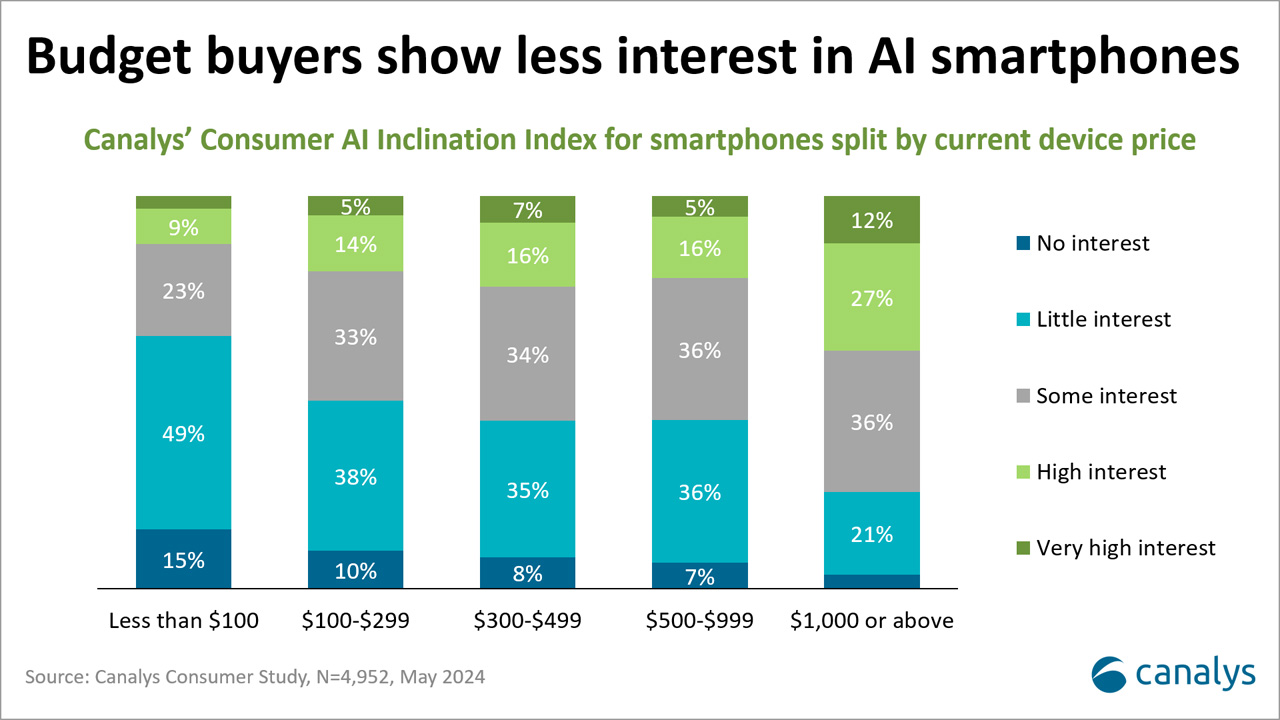

3. Most consumers are indifferent pragmatists

In contrast to the perception that it is possible to attract buyers with industry hype, most people are indifferent about AI capabilities on their smartphones. Two out of three respondents showed little or some inclination toward AI on smartphones, reflecting a market segment uninterested in where AI is in use and skeptical as to what it can add.

So what? The indifferent pragmatists will be vendors’ greatest hurdle to the broad adoption of AI-driven features on smartphones. Though the segment doesn’t have a particular interest in AI on smartphones, that doesn’t mean it cannot contribute as part of a broader proposition. Vendors must seek to attract consumers by using targeted information that can guide their purchases.

4. Young respondents did NOT have the strongest inclination

An unexpected finding initially occurred when analyzing age differences for the index: AI inclination and age do not have a strong linear correlation. 31% of respondents aged between 35 and 44 had a high or very high inclination, compared with only 23% of those aged below 25.

Perhaps some of these factors can explain the finding:

- Disposable income differences, reducing buying intent.

- Interest in the devices markets.

- Strong brand preference, trumping a focus on AI innovation.

- Different perceptions of the short-to-mid-term usefulness of AI features.

- Growing concern about overusing digital.

So what? Reaching a younger audience will require a more balanced approach than simply having the latest and greatest technology. Finding simple methods to enable users to choose how much they want to use their devices might turn out to be an unexpected differentiator.