Canalys Forums 2023 welcomes TD SYNNEX as a global distributor sponsor

6 April 2023

Channel partners will benefit from focusing on sales and marketing efficiencies in 2023.

Partners are expecting revenue growth in 2023, despite the difficult times ahead. Headlines about headcount cuts are not always reflective of the wider channel landscape, where the majority are expecting to add staff this year. But whether partners are adding, freezing or reducing staff levels, everyone will benefit from focusing on their sales and marketing efficiencies. New customer acquisition is often a top-three area where companies struggle, so now is the time to reassess the process of lead-generation and make improvements wherever possible. In this blog, we’ll take a quick look at the latest trends, ahead of these important issues getting in-depth scrutiny at the APAC, EMEA and North American Canalys Forums 2023.

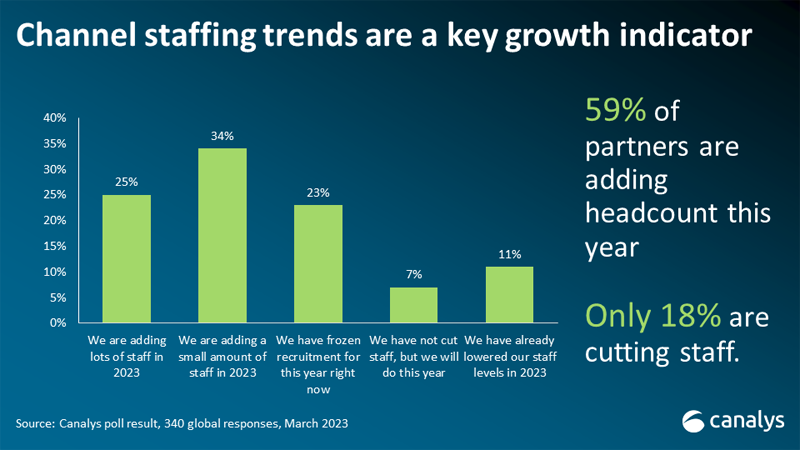

According to a recent Canalys quick poll, 59% of channel partners are adding headcount in 2023, while 36% of partners are expecting revenue growth of more than 10% this year. There is no doubt that business has become more expensive to conduct in the last year, with interest rates and other inflationary pressures driving both consumer and commercial costs. But the boost in the digitalization of the post-pandemic world requires management. Canalys data shows end customers understand the value of channel partners in helping them manage this digitalization. In times of difficulty, specialization is one of the most important factors for competitive differentiation. This is a primary driver for current staffing level increases.

Partners recognize the need to define their value propositions. Some of the greatest growth areas in channel hiring trends will be in consulting, sales, engineering and technical services roles. Skills and competition are often two of the biggest issues for partners. In many ways, this current economic crisis is no different to the ones we have faced in the past. There are specific causes, particular to our time and place, but the structural realities and the answers to the problems are the same as they ever were. Channel partners are investing in technological and vertical market specialization, helping customers to focus on either saving money or growing revenue through technology.

Adding new skills, staff and strategies is important, but can be difficult to action in the immediate future. Channel partners are also changing the ways they do business and marketing to make the most of the resources they currently have. This means re-thinking marketing strategies, improving insights and efficiency in the sales funnel, and focusing on new growth drivers, particularly in areas such as cybersecurity, AI and automation, cloud, and data management.

Canalys research shows some of the top areas where partners are focusing on these initiatives:

While headcount and staffing increases are good news, partners must also use this time to ensure they are maximizing their current and future resources. By focusing on updating their marketing and sales practices, the cost-efficiencies of additional headcount can be improved, and those revenue and profit targets will be easier to achieve.

I’ll be discussing these issues alongside our global teams of channels analysts at the Canalys Channels Forums 2023. Channel partners will be able to hear from their peers as to what is working and what they are planning. To attend, register your interest: https://www.canalys.com/events

EMEA: 3 – 5 October | NORTH AMERICA: 13 – 15 November | APAC: 5-7 December