Recent acquisitions flag opportunities in the wireless market

3 April 2023

In response to challenging market conditions, smartphone channel partners have adapted business models, diversified product offerings, and turned to online channels to reach customers.

Online channels have increased in importance for the European smartphone market over the last few years. Even though the pandemic forced many consumers to buy devices online, the online purchasing push is continuing post-pandemic. In contrast to during the pandemic, the main driving factors are macroeconomic and cost-of-living pressures that have sent many consumers online in search of transparent information and the best deals. As this shift continues over the next decade, channel partners must adjust to remain relevant and keep up with the competition.

Retail partners have started adjusting business models to reach new consumers. For many, this includes embracing online channels by setting up better digital and physical infrastructure suited to large-scale online business. The newest developments focus on adapting the customer experience and offerings. As part of this, consumer electronics channels are no longer trying to solely be a product reseller. They are increasingly bundling in insurance, tech support, data services, extended warranties and, in many cases, selling mobile subscriptions for MNOs.

In Europe there are several examples is this. Mediamarkt/Saturn offer insurance and support services with each device sold as part of a solution bundle option – on top of selling devices with operator subscriptions. Similarly, Portuguese player Worten diversified its business into repairs in a bundled service through the acquisition of a local repair services company. Some retailers have even converted their e-commerce shops into open marketplaces for third party vendors in exchange for a commission, which FNAC-Darty has done in France. The channel is focused on offering customers service choices through bundled solutions to create channel user stickiness and to attract new customers. Online channels have been key to bringing these initiatives forward to customers.

To understand what will come next for online channels, it is also important to consider what currently drives consumers online. Among the top factors include:

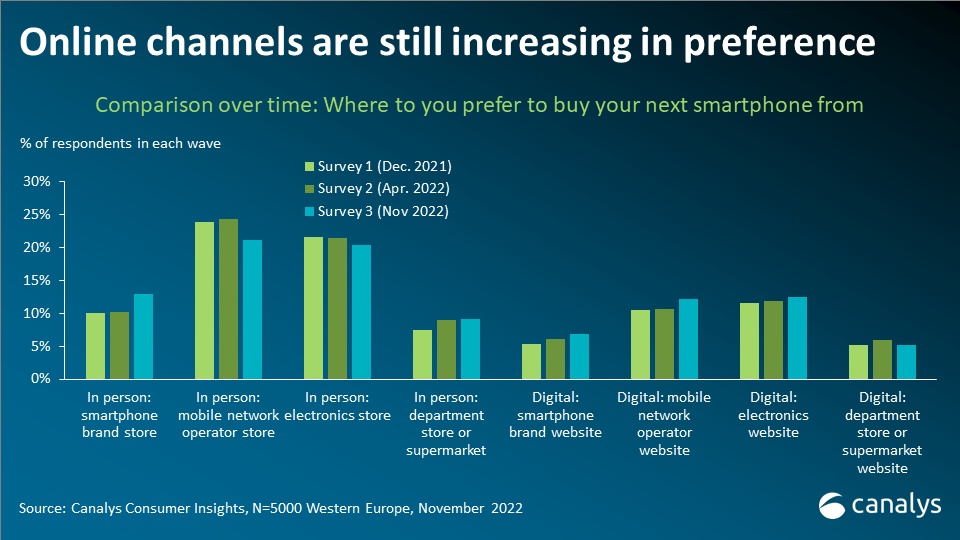

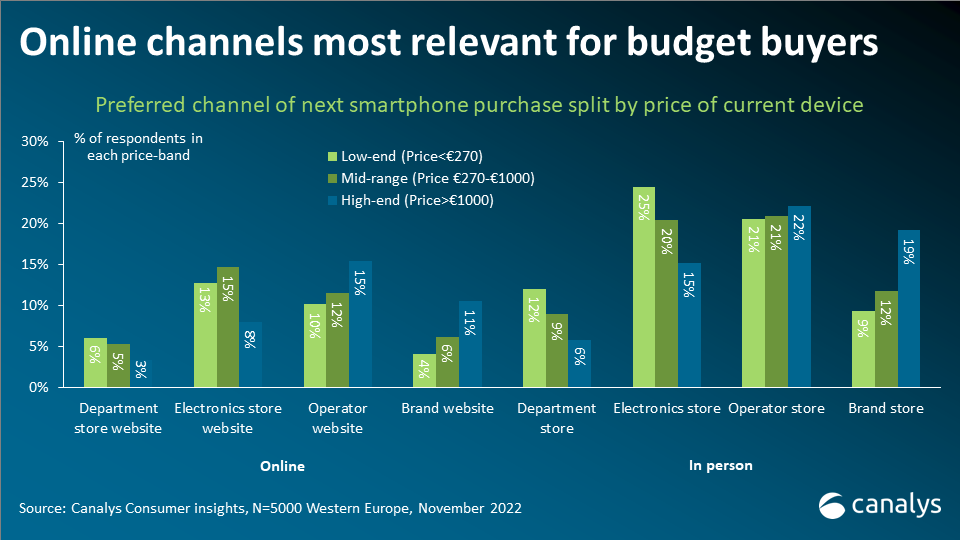

Canalys' Consumer Insight research shows online channels have increasingly been preferred by respondents over the last two years. Still, they remain mostly popular for low-to-mid-range devices. High-end device buyers continue to be drawn offline (particularly to operator and vendor stores). Bundles, expanding current subscriptions and the possibility of connecting closer with the brand are key factors for users going offline.

Moving forward, online channels will only increase in importance as a route to market. It will be particularly important for channel partners to invest in digital capabilities to remain competitive and adapt to an upcoming wave of automated personalization. Canalys expects the following trends to define online consumer electronics stores in the next decade: