Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

iPhone 16 ban in Indonesia: what it means and why it matters

Apple's US$1 billion investment in Indonesia reflects a strategic move to comply with the country's localization policies, emphasizing the importance of meeting regulatory requirements for market access and competitive advantage in Southeast Asia. As Apple expands its regional manufacturing footprint, the company aims to leverage Indonesia's growing consumer base and strategic location to strengthen its presence in the region while navigating challenges such as cost management and market dynamics.

.png)

Apple turns to strategic investment post the iPhone 16 ban in Indonesia

Apple plans to invest US$1 billion in Indonesia to strengthen its ties with Southeast Asia's largest economy. This move aligns with Indonesia's Tingkat Komponen Dalam Negeri (TKDN) policy, which mandates that 40% of smartphone components be locally sourced for devices to be sold in the country. The investment follows the ban on the iPhone 16 due to Apple’s failure to meet these localization requirements, signaling the growing importance of compliance with Indonesia’s evolving regulatory environment. For Apple, this investment represents both a challenge and an opportunity to deepen its presence in one of the world's fastest-growing economies, while contributing to Indonesia's economic growth.

Implications of Apple’s investment in Indonesia:

- Meeting specific regulatory requirements: Apple’s investment addresses Indonesia’s stringent TKDN localization requirements, ensuring compliance and market access. This positions Apple to compete effectively in a market where meeting domestic content regulations is critical for continued operation. This requires Apple to forge relationships with local partners and expanding localized market commitments to meet longer term expansion goals.

- Further mitigating supply chain risk: Enhancing supply chain resilience: As part of its global strategy, Apple continues to diversify its manufacturing footprint, leveraging the success of its local assembly operations in India. Domestic iPhone assembly in India has grown significantly from 6% of shipments in 2019, to an anticipated 25% by 2025, reflecting Apple's dedication to expanding regional production capabilities. This strategic shift reduces over-reliance on Chinese production hubs, mitigating risks associated with geopolitical tensions, such as US sanctions or policy shifts. Additionally, Apple's investments in Indonesia, alongside existing facilities in Vietnam and Thailand that primarily manufacture Apple Watches and MacBooks, further strengthen its supply chain. Together, these initiatives create a resilient, interconnected network across Southeast Asia, enhancing Apple's capacity to adapt to global market dynamics.

- Strategic expansion in emerging markets: According to Canalys estimates, iPhone shipments in Southeast Asia have grown by 40% since 2019, reaching 6.4 million units in 2023. This growth is driven by aggressive channel expansion strategies and significant investments in above-the-line (ATL) marketing. Establishing a local assembly plant in Indonesia would help reinforce Apple’s strategy to expand its presence in Southeast Asia. Indonesia’s strategic location enhances logistics and regional distribution, positioning it as a key manufacturing and assembly hub that complements Apple’s broader network. This move also supports improved margins and greater accessibility for consumers in the region.

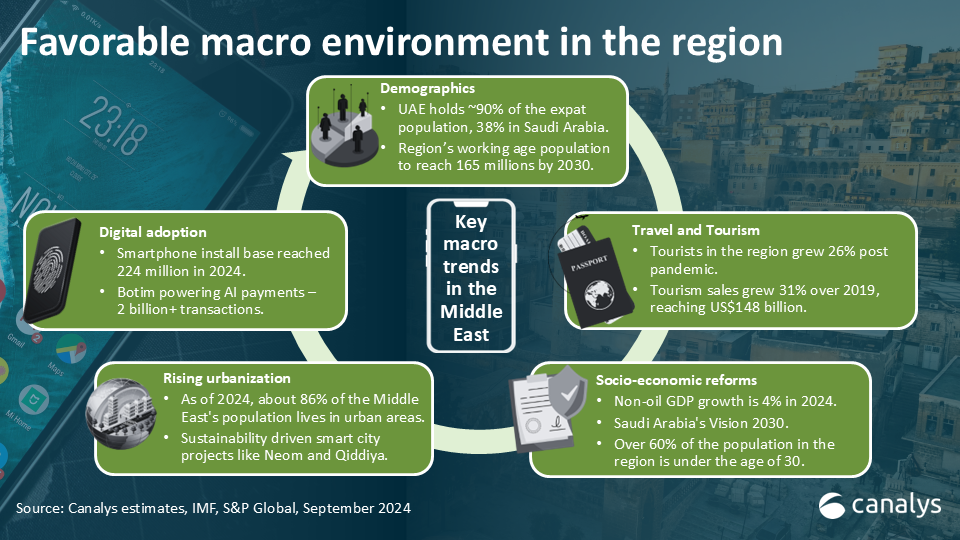

- Leveraging Indonesia’s huge consumer base: As Southeast Asia’s fastest-growing economy, Indonesia presents a promising opportunity. Its young, tech-savvy population supports Apple’s goal of expanding its installed base in markets with favorable demographics. By localizing production, Apple can make its premium products more accessible over time, appealing to price-sensitive consumers and potentially growing its market share. Despite the lack of operator postpaid solutions in Indonesia, the surge of Buy Now Pay Later and digital financing solutions has significantly improved the affordability of premium smartphones for consumers. It is vital for Apple to establish the sale of its latest iPhones to maintain the halo effect of its brand as a leader in the premium segment.

A peek into OPPO’s factory in Tengerang

Beyond the regulatory push and market opportunities, setting up a local assembly plant in Indonesia poses several challenges for Apple. Meeting a higher TKDN involves:

- Domestic sourcing: Identifying and integrating local component suppliers into its global supply chain.

- Worker training: Elevating the skills of local workers to meet Apple’s rigorous production standards.

- Infrastructure development: Establishing and operating factories tailored for high-tech assembly.

- App and content localization: Aligning software offerings with local regulatory requirements.

- Demand creation: To sustain the hefty investment of local assembly, Apple would have to invest to grow its channel and spark local demand, a challenge given the price sensitive nature of local consumers.

These initiatives come with significant expenses that will exert pressure on Apple’s cost structure, particularly as localization efforts require investments in infrastructure, workforce development, and compliance with stringent regulatory standards. Compounding this, the country’s price-sensitive market poses an additional challenge. According to Canalys estimates, over 80% of smartphones sold in Indonesia are priced under US$200, posing a challenge for premium brands like Apple due to limited disposable income. Adding to these challenges, a planned tax hike in 2025 is set to raise manufacturing and distribution costs, further putting financial strain on Apple. Balancing affordability with its premium positioning while managing rising operational expenses will be crucial to staying competitive and maintaining profitability in this challenging market.

Market dynamics shift amid ban: competitors’ strategies and growth projections

Since 2018, Indonesia's TKDN requirement has risen from 30% to 40%, with further increases planned to boost the local economy. OPPO, holding a 22% market share, exemplifies success by establishing a factory for locally assembling flagship devices like the Find N and X series. This move strengthened OPPO's brand and showcased the benefits of meeting localization mandates. However, increased localization demands will challenge entry-level-focused brands like Xiaomi and TRANSSION, squeezing already thin margins and necessitating pricing adjustments in 2024. Canalys forecasts a modest 1.2% year-on-year growth in 2025 as brands recalibrate channel strategies to tap into Indonesia's shifting upgrader market.

It's noteworthy that Indonesia’s regulatory approach sets an example of how emerging markets are looking to leverage policies to foster domestic industries. For global tech companies, it highlights the critical need to balance localization efforts with cost efficiency. Brands that navigate these complexities effectively will unlock long-term growth opportunities in one of Southeast Asia’s most vibrant economies.