Success of US’s Emergency Connectivity Fund will serve as a strong template for PCs in education in other markets

6 September 2021

The Russia-Ukraine war is hitting the global economy and Western Europe is the among the first to feel the effect.

Russia’s invasion of Ukraine is threatening a global economy yet to recover from years of setback caused by the COVID-19 pandemic. In just a few days, the prices of energy and commodities have skyrocketed, and the supply chain has become even more vulnerable. These are issues that could fuel inflation and limit growth for Western Europe and the world.

Heavily reliant of Russian oil and gas, Europe’s surging energy prices directly weaken Europeans’ purchasing power. Oil briefly passed US$100 a barrel for the first time since 2014, despite being negative just two years ago, while the price of natural gas surged as much as 62%. In February 2022, before the invasion, the Eurozone already recorded 5.8% inflation, the fourth quarter in a row at an alarmingly high level. Also, due to airspace bans, airlines will likely shift the increasing cost of flying cargo between Europe and Asia to consumers, putting additional pressure on the supply chain and pushing material costs even higher. In the semiconductor industry, bottlenecks were expected to ease in 2022 but that now seems unlikely to happen as Ukraine supplies more than half the world’s neon gas, vital for semiconductor production.

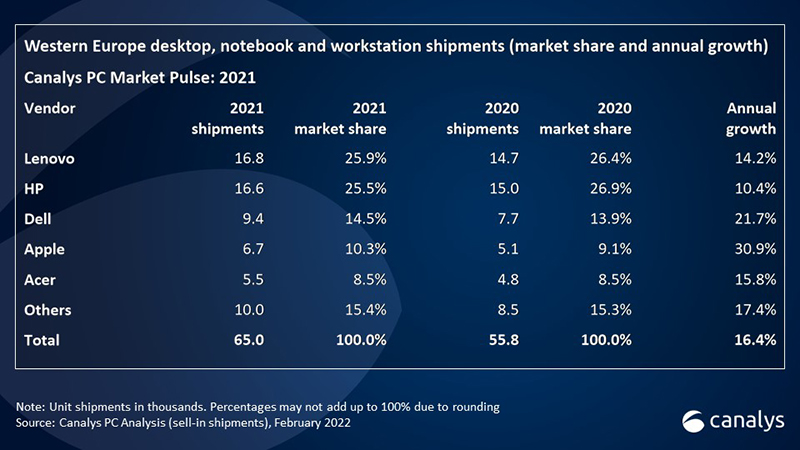

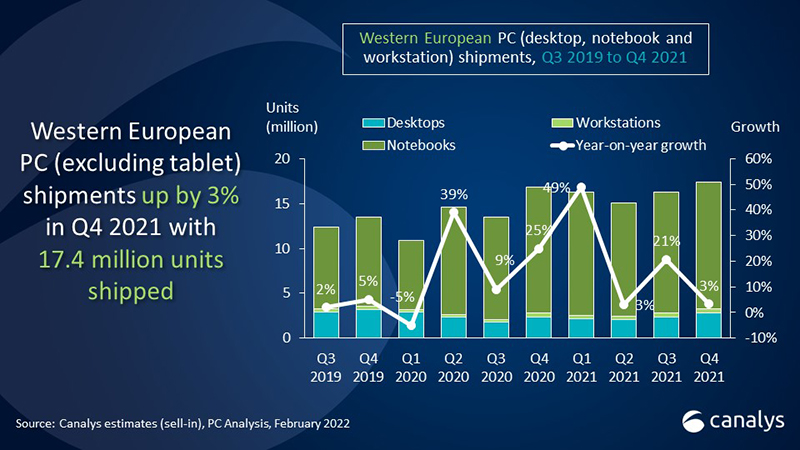

For the past few years, the PC industry has been thriving, but it is still hypersensitive to supply chain disruption. In 2021, PC vendors in Western Europe were still in an enviable position as demand continued to outstrip supply. Shipments grew 16% year on year, even though it’s almost two years since the start of the pandemic. But the PC industry could soon feel the direct impact of rising costs and longer lead times, and any vendor that can supply will win the market. On the demand side, consumers will also struggle with rising inflation and have less to spend on consumer technologies, especially for leisure purposes.

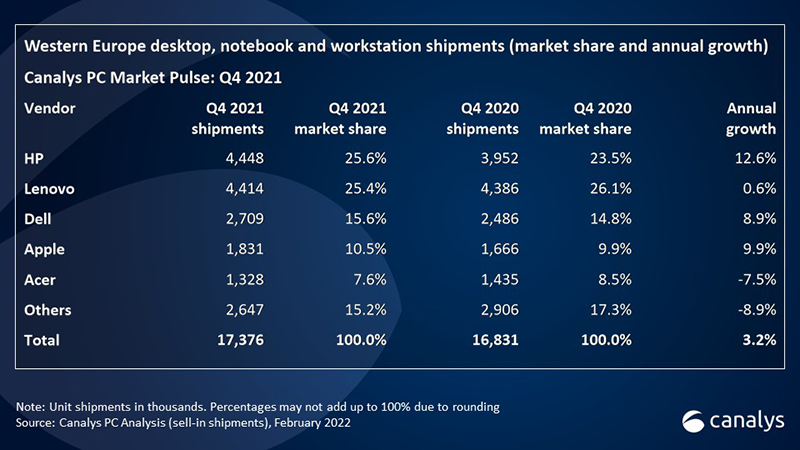

In Western Europe, HP and Lenovo dominated throughout 2021. HP secured its leadership position with 4.44 million units shipped and took 26% of the overall market and 35% of the commercial market in Q4 2021. Lenovo followed closely with 4.41 million units shipped and a 25% overall share. It edged out HP to take top spot for full-year 2021, with 16.8 million units shipped. Dell, Apple and Acer rounded out the top five in Q4 2021 with 16%, 11% and 8% shares respectively. PC vendors are now reviewing whether to stop or reduce business in Russia. Apple is the first vendor to officially stop all sales in Russia. If other vendors follow suit, in the short term, there could be a reallocation of devices from Russia to other European markets, easing the order backlogs of recent quarters. Russia will likely turn to Chinese vendors to bypass Western sanctions. Chinese vendors, such as Lenovo, Acer and Asus, which have ambitions in Western markets, will find themselves in a delicate position regarding their responses to the Ukraine conflict.