Global systems integrators look to react to changing cloud landscape

31 March 2023

The growth of cloud infrastructure and adoption of public cloud in the past three years have been the key developments in the pandemic, with the size of the cloud infrastructure market growing 130.7% from a value of US$107.1 billion at the end of 2019 to US$247.1 billion at the end of 2022. Tied to this surge in cloud adoption has been an even greater growth in the wider ecosystem of partners surrounding these cloud environments. The revenue opportunities that surround these increasingly complex cloud environments can be defined under the Canalys Partner Ecosystem Multiplier and its accompanying flywheel. While the multiplier revenues that are created by these cloud deployments are often spread across a number of different ecosystem partners, both global systems integrators (GSIs) and smaller regional systems integrators (SIs) have been critical drivers of this growth. Not only have their enterprise-level customer relationships ensured a significant increase in the services they have delivered as a result of the digital transformation growth of the early 2020s, the breadth of services that they are able to offer as a result of their scale means that they have become the trusted advisor for many businesses looking to ensure a smooth transition to the public cloud, and in some cases, multi-cloud environments.

For many years, the hierarchy of consulting has been such that strategy firms (such as McKinsey, Bain and BCG), management consulting firms (such as Deloitte, PwC, EY and KPMG) and SIs (Accenture, Cognizant, Infosys and IBM) rarely crossed paths or directly competed for revenue. All of these firms remained relatively siloed and relied on their depth of expertise in those respective fields for creating growth. However, in the past decade firms across the spectrum of consulting have sensed a restriction on the ceiling of their TAM. As a result, they have looked to diversify their portfolio of offerings in order to accelerate their growth opportunities, especially as technology was becoming increasingly critical to all businesses. PwC acquired Booz & Company (now Strategy&) in 2014 to compete with the strategy firms while McKinsey acquired data and analytics firm Quantumblack in 2015 to add the ability to deliver data analytics products to their portfolio. While the success of such acquisitions can be debated, it is clear that the scale of the GSIs has provided them with the necessary firepower to diversify across the services stack. Through acquisitions and significant investment, firms such as Accenture, Cognizant, Infosys, IBM and Capgemini have successfully shifted away from operational systems integration work, to offering a breadth of services across the PEM flywheel and capturing the business transformation-related activities. By doing so, they have effectively unlocked a significant portion of the flywheel revenue.

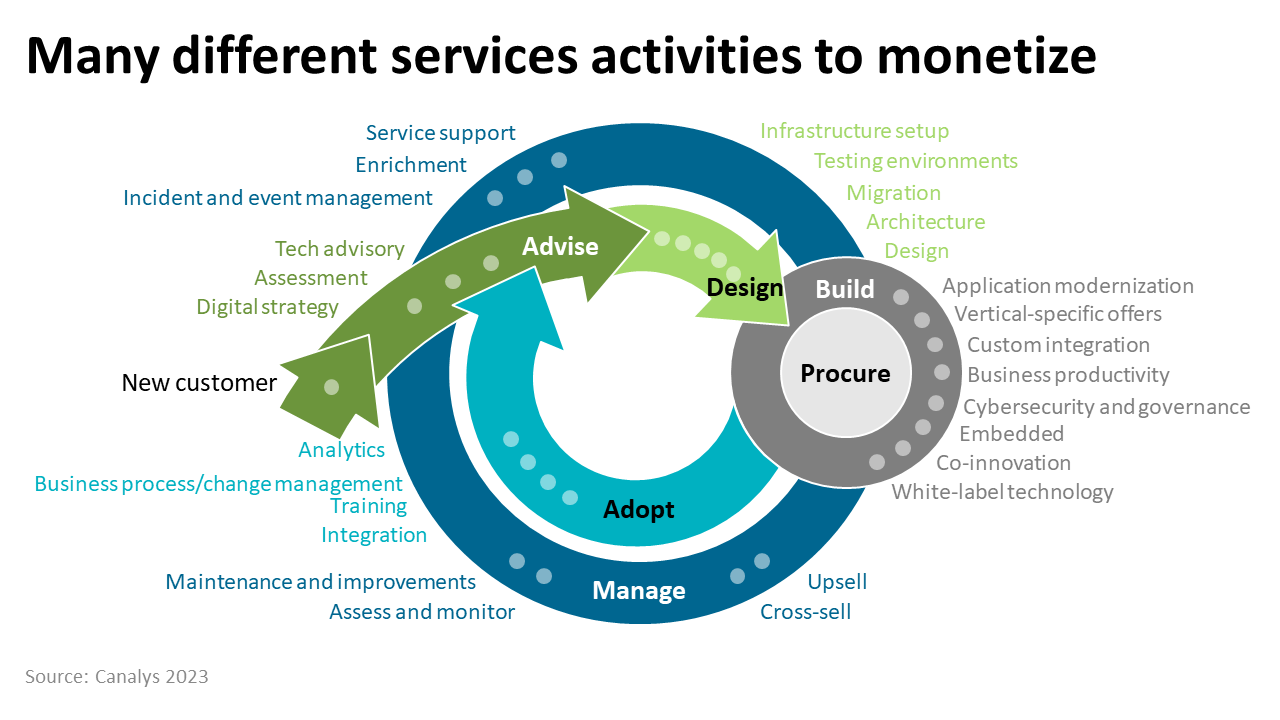

GSIs are no longer only providing design and procure services. They have built the necessary capabilities to take any business from the beginning to the end of a cloud journey. GSIs are now leading the way in technology advisory, assessment services and implementing a wider digital strategy. By entering the flywheel at this point they are able to more fully control and influence a business’ cloud transformation journey. Once set up, GSIs are able to leverage their scale to offer managed services, such as maintenance, monitoring and improvements. In addition, GSIs can begin to expand the cloud usage of their clients, while securing additional recurring revenue as a result. Recurring revenue is also available in the build segment through the use of as-a-service models. GSIs have been focusing on expanding their participation in the wider cloud ecosystem to work with other cloud channel partners and vendors to deliver the strongest and most bespoke solutions to their clients. This has included the creation of IP created by the GSIs themselves, which on occasion has been scaled and productized in an effort to further increase the revenue opportunities for these firms in the cloud. Beyond this, the growth of analytics has been a critical piece to the revenue flywheel. By helping businesses adopt to their new environments, GSIs have been ensuring that their customers are able to gain the full return on investment from their cloud spend. This ability to offer the necessary depth across the breadth of these services has been critical to the recent success of GSIs in the technology sector.

In order to diversify their service portfolio sufficiently to take full advantage of the revenue opportunities, SIs have invested heavily in practice and capability building. In 2020, Accenture invested US$3 billion in establishing their "Cloud First" initiative, which aimed to accelerate their clients' adoption of the cloud across all industry segments. As part of this initiative, between 2020 and 2022, Accenture made 18 cloud-specific acquisitions globally, with the majority of these occurring in 2021. Infosys, Tata Consulting and Wipro also made a number of cloud-focused acquisitions in 2020 and 2021 that were designed to quickly broaden their cloud capabilities in a way that would meet the unprecedented demand of their customers.

These investments have helped broaden the ability of these companies when it comes to delivering cloud services. This has not been missed by the hyper-scalers themselves, who have been placing significant emphasis on SI relationships. Google Cloud, for example, has repeatedly highlighted the health of its growth through the lens of its GSI relationships, highlighting that its revenues from GSI partners have increased 150% over two years across 2021 and 2022. Elsewhere, former competitors, AWS and IBM, are now working closely and emphasizing the importance of joint innovation and collaboration. At the end of 2022, IBM had over 50 of its software solutions available on the AWS marketplace.

One of the clearest indications of the importance of the SI relationships to the hyper-scalers is the recognition awards given by these vendors to key partners. In 2022, eleven separate SIs were recognized as AWS partners of the year in some capacity, Microsoft recognized eight separate SI partners while Google recognized 10 SI partners.

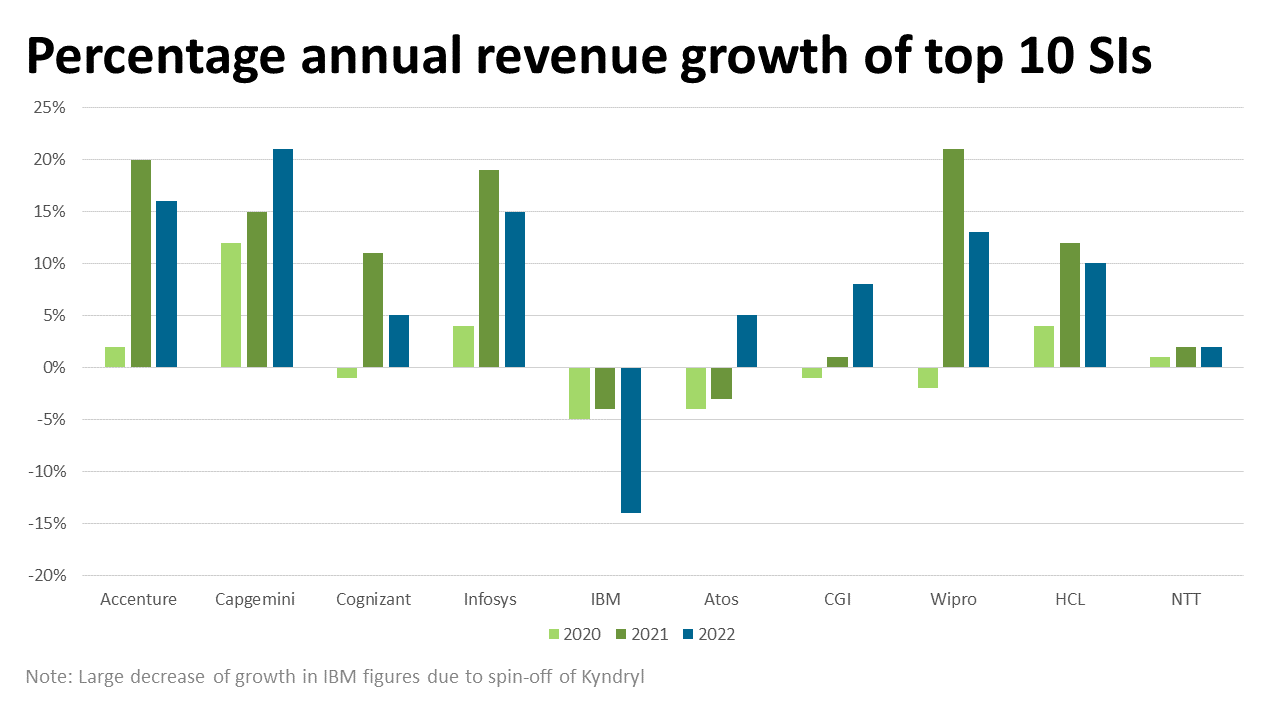

The COVID-19 pandemic provided a boost in revenue for SIs, with Canalys estimates suggesting that the top ten SIs saw year-on-year revenue growth in 2021 of 7%, with firms such as Accenture and Infosys exceeding expectations with year-on-year growth figures of 20% and 21% respectively. Despite the continued growth of cloud adoption in 2022 however, this growth slowed across the board in 2022. The top ten SIs returned a year-on-year growth rate of just 4%, with only Capgemini showing a year-on-year growth rate of over 20% among the top ten.

This slower revenue growth, which is coupled with a decline in stock price for many GSIs certainly serves as a warning signal. The macroeconomic conditions have been a test for many technology companies in recent months. 2022 saw more than 160,000 redundancies in the technology sector, many of these coming near the end of the year. Already in the first three months of 2023, there have been more than 150,000 redundancies across a number of technology sectors. Historically, vendor cutbacks have often led to cutbacks for service providers who rely on these vendors as their foot in the door for many customers.

At first glance, it would appear that the GSIs have begun to follow the wider sector trend. KPMG announced in February 2023 that it was cutting headcount in its US consulting business by 2% (or 700 jobs) while IBM has announced 3,900 job cuts and Accenture has announced global cuts of 19,000. While some may argue that these cuts are indicative of a GSI market that, as a whole, over-hired in reaction to the pandemic demand, further analysis will tell a more complex story. Despite the significant number of announced redundancies, Accenture still has 211,000 more employees in 2023 than it did in August 2020. It should not come as a shock that a company like Accenture which is aggressive in its M&A strategy will find the need to find cost efficiencies, especially when it comes to staffing. Most of the cuts are expected to be in back-end administrative functions, rather than client-facing revenue roles. In a similar vein, many of the 3,900 job cuts at IBM come directly as a result of the recent spin-off of Kyndrl. This trend also continues at Kyndryl itself, which recently announced internally an unspecified number of redundancies. Having seen share values increase by 21% following their most recent financial results that beat analyst expectations when it came to total sales, these cuts are likely to focus on creating efficiencies in the back office.

With slowing revenue growth and cloud adoption rates, GSIs will need to be more strategic when it comes to identifying opportunities. Canalys estimates suggest that the growth of cloud adoption rates globally will slow to 23.1%. While this growth is still impressive, it will represent a significant slowdown from previous years and will serve as evidence of a wider lack of willingness by CIOs to be aggressive or experimental when it comes to their IT strategies and spending. For CIOs running IT budgets in a world where inflation and interest rates are higher than pre-pandemic, efficiency will become the sought-after goal outcome.

To be successful in 2023, SIs will lean on their breadth of services. In a world where cuts, optimization and efficiency will be the name of the game, GSIs are uniquely positioned to provide offerings across the value chain, and most importantly across the PEM flywheel. By consolidating a variety of services in one strategic engagement, GSIs will be able to work with CIOs to simplify their spending on services. Spending reductions do not necessarily need to lead to a reduction in cloud spend, and GSIs must work with the wider ecosystem to provide clear observability across multi-cloud environments and help businesses first understand, and then optimize their cloud environments. While high-interest rates may slow acquisition rates, SIs that hope to succeed in these leaner times must continue to invest in broadening their portfolio across the PEM flywheel so they are able to influence cloud decisions at every key junction.