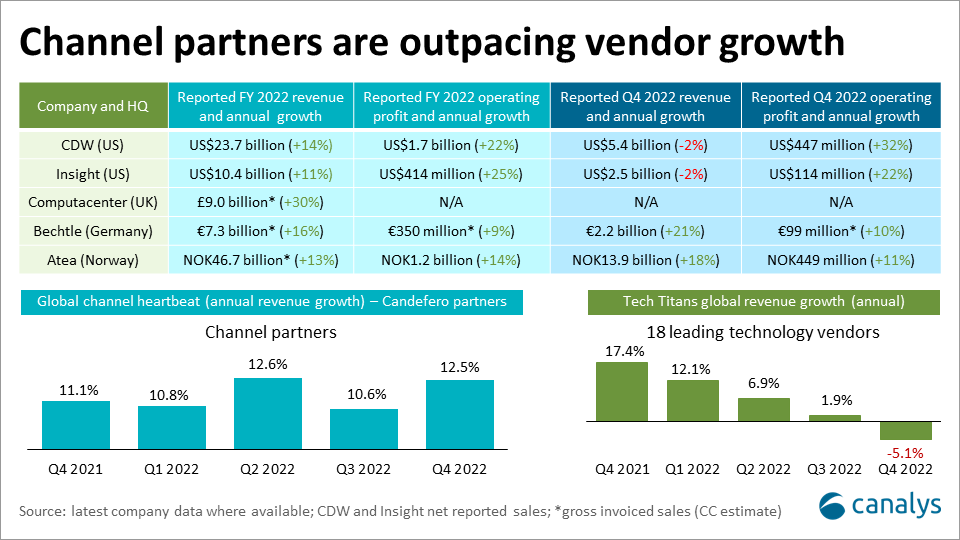

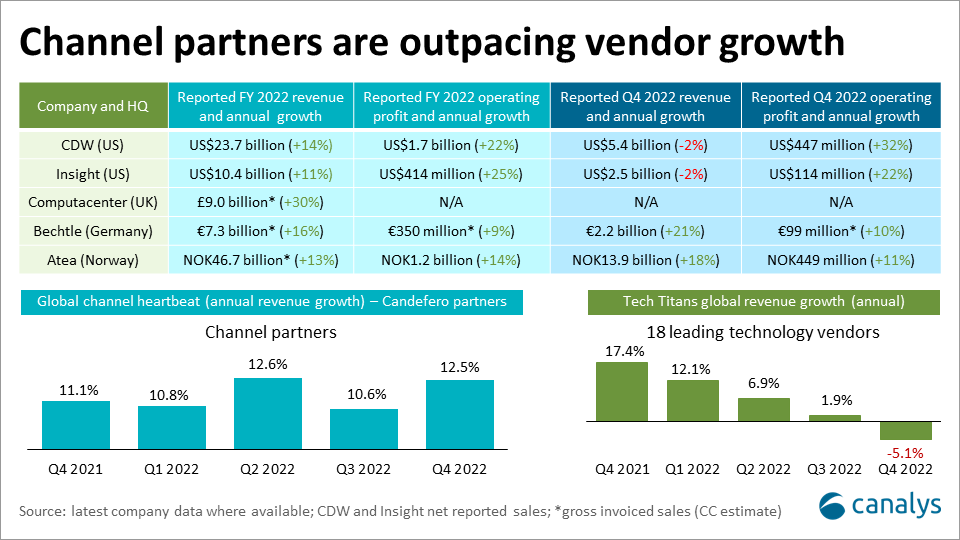

The top publicly-quoted global IT resellers – Atea, Bechtle, CDW, Computacenter and Insight – all reported robust Q4 and full-year 2022 financial results, alongside optimistic 2023 outlooks. Their performance highlights the resilience of the channel model in the face of macroeconomic uncertainty, currency volatility, ongoing supply unpredictability and IT industry pressure. All five reported full-year double-digit revenue growth and healthy profits, though a drop in PCs (and the impact of the strong dollar on international business) hit Q4 sales for both Insight and CDW. Computacenter saw the strongest full-year performance, helped by a record Q4, with gross sales up 30% in 2022 including M&A (of which 27% was in constant currency) and profits ahead of expectations. Bechtle’s gross full-year sales grew almost 17% thanks to acquisitions and organic growth, with operating profits up 9%. Q4 sales were up by a fifth. Atea jumped 13% in full-year revenue (up 18% in Q4), and 14% in profits. Insight and CDW, which only report “net” sales, were up 11% and 14% respectively in 2022, with profit growth outstripping revenue. All five have seen a recovery in share price since the start of the year – CDW and Insight are both now trading at five-year highs.

These positive trends are reflected across the wider channel community. Crayon, Data#3, Dustin, Econocom and Proact are among those reporting double-digit topline growth for the year. Channel partners surveyed worldwide by Canalys through the Candefero Heartbeat grew by over 12% on average in Q4. 72% of partners expect revenue to increase in 2023. Cash generation and working capital are improving for the channel, as excess inventories are reduced and a greater proportion of backlogged infrastructure orders are fulfilled.

The channel overall is outperforming the vendor community in both revenue and profit performance. Combined revenue for the global Tech Titans (18 leading technology vendors tracked by Canalys every quarter) fell by 5% in Q4 – the first decline in a decade – while net income shrank by 19%. The Tech Titans are expected to see further aggregated revenue declines in the first half of 2023, while the channel continues to grow. While more vendors cut headcount, channel partners are hiring – and will benefit from easing competition for skills from vendors. But the channel must navigate some complex challenges ahead, with customer budget constraints (alongside ongoing price inflation), skills shortages, rising costs and economic instability acting as headwinds. A slowdown in SMB spending is a particular risk for the channel in weakening economies. Growth and profit trends in the channel have shifted meaningfully, with the decline in PC sales, improvements in the supply of infrastructure products, and sustained demand for cybersecurity, software, networking, cloud services and hybrid IT solutions. Managed services and flexible procurement solutions (opex and as-a-service) will gain greater traction. Key factors influencing channel performance in the year ahead include:

- Easing order backlogs: improvements in infrastructure hardware supply are allowing channel partners to fulfill a bigger proportion of outstanding order backlogs for networking and data center equipment and recognize those orders in sales. This is also helping to drive software business. At the same time, customers continue to place new orders for networking and data center kit, meaning backlogs remain elevated for many. Lead times are still longer than normal for many products, but the predictability of delivery is improving significantly. Networking demand remains particularly strong – businesses are prioritizing upgrades in their networking infrastructure to support hybrid working, wireless, and modernized workloads and applications, including AI, cybersecurity and automation. Rising public cloud costs are fueling demand for more hybrid infrastructure models, including an increasing interest in repatriating certain workloads to private and co-location data centers. Customers are reassessing public cloud strategies as a result, and turning to partners for advice on building and deploying complex hybrid solutions. The need for greater energy efficiency in data centers and networks is another big driver of infrastructure modernization.

- A shift in product mix: the sales mix is changing for the channel, as PCs decline and growth shifts to networking and edge infrastructure, cloud, software, data and managed services. Cybersecurity remains a key customer priority, driving growth in both products and services. Partners with heavy exposure to client hardware have seen numbers affected, with Q4 sales for both CDW and Insight pulled down by the slump in PCs to the US public sector and education compared with Q4 2021. The breadth of product portfolios is a key strength for channel partners at a time of market uncertainty, though this gives a significant advantage to larger partners when smaller players are being forced to specialize. At the same time, this shift from lower-margin devices toward higher-value infrastructure products and solutions is boosting profitability for the channel. CDW and Insight both increased Q4 operating profits in strong double digits, despite the decline in sales. Europe-headquartered Atea, Bechtle and Computacenter all reported strong top- and bottom-line performances on the strength of their hardware businesses, though all three saw Q4 profits growing slower than sales on rising internal costs.

- Inflation and currency: price inflation has clearly contributed to a proportion of revenue gains for the channel, and that is set to continue in 2023. Vendor price increases introduced in 2022 are in many cases only now starting to flow through to reported revenues for the channel due to order backlogs, both in hardware and software. Price inflation will start to moderate as supply improves, but some vendors are still raising prices. Customer expectations around pricing changes require careful management by partners. For EMEA, LATAM and APAC partners, dollar strength has significantly exacerbated that effect, driving up local currency prices. As much as 25% to a third of revenue growth for the big European partners can be attributed to price inflation. Currency turbulence, meanwhile, creates significant volatility for partners managing international businesses, in terms of pricing and quotes, which can easily eat into profit margins. Currency is also affecting reported revenue growth for those partners with multinational operations. Computacenter, with a large US presence, benefited from the strong dollar as it reports in sterling. CDW and Insight faced the opposite effect due to their operations in EMEA and APAC.

- New reporting standards: publicly-listed channel partners have been inconsistent at adopting new accounting standards (IFRS 15 and ASC 606) to recognize certain software products and services as gross profit rather than topline sales – sometimes known as principal versus agent – making it even more difficult to compare revenue performances between partners, and recognize true business performance. Interpretation of the rules is not clearly defined, and it is largely up to individual companies to determine how these are applied. That becomes more of an issue as growth moves to software and cybersecurity subscriptions, which are often reported as gross profits (or agent fees) under the new rules. Of the big five, Bechtle, Computacenter and Atea all now report “gross” sales (or gross invoiced income) as a separate line item in their quarterly earnings statements for comparison, alongside net sales. CDW and Insight, however, do not. Netting down sales had a significant impact on reported revenue for both CDW and Insight in 2023 due to the shift in their product mixes to software and services. Q4 revenue growth for both would have been higher if recognized as topline, though netting this down helped to boost gross and operating profits as a percentage of sales.

- Services acceleration: services growth has largely lagged behind product growth for the channel in 2022. In 2023, however, services are set to play a more important role in driving differentiation and value for partners, as hardware momentum slows. Services already tend to contribute a disproportionately high share of gross margin: Insight generates only 14% of revenue from services, but an estimated 36% of gross profit (including from cloud services). For Atea, it is even more extreme: services accounted for just 19% of 2022 sales, but a massive 55% of gross profit. As industry turbulence grows, partners will turn more to both professional and managed services offerings. Consulting will be key to helping customers embrace hybrid IT, identify security threats and drive efficiencies within their organizations, among others. The big resellers are increasingly bringing on board experienced management from the services world. Insight hired its new EMEA president from Atos and a new global VP for solutions from Capgemini. Managed services will be a vital growth driver for the channel in 2023. Most of the largest channel partners are investing in their managed services capabilities, particularly as customers seek more help with total IT management, including cybersecurity and cloud, as these targeted skills remain in short supply. Atea is centralizing its managed services in the Nordics and hiring staff, as it seeks to capture growing demand. The biggest challenge will be customer budget pressure and more protracted contract negotiations, as customers try to improve terms with their MSPs.

Pressures on the channel remain intense, particularly in the face of ongoing economic instability. Maintaining double-digit growth rates will become harder in 2023, and profits will face more of a squeeze. Yet the era of the partner ecosystem is here to stay, serving the urgent needs of both vendors and customers. Shifts in vendor business models – toward SaaS, subscriptions and recurring revenue – and changes in customer buying behavior increase the need for a partner channel (not reduce it as some believe) to support customers through product lifecycles and drive renewals and long-term value. The flexibility to offer a range of procurement offers, from opex and as-a-service to capex purchases, to meet customers’ unique business needs is a vital part of that partner value. The channel will be key to meeting the increased demand for environmental sustainability services and solutions. Under pressure to cut costs, some vendors may be tempted to double down on direct business but many others will take the opposite approach. IBM, Salesforce, AWS and Google Cloud are just some of the vendors looking to increase partner-led business in 2023. That includes an increasing focus on supporting 'partner-assisted' sales for non-transacting partners, through referral and agent models.

Canalys expects average channel revenue growth rates of between 7% and 10% around the world. Longer-term uncertainty is a greater risk if the economy worsens, and if customers start to extend renewal and replacement cycles. The largest channel partners tend to have the greatest financial resilience, and also the greatest vendor support, but they may lack some agility and flexibility. Smaller partners have an opportunity to carve new value and differentiation through specializations and services, where the largest lack focus. M&A is another key route to growth in 2023, both for large and smaller partners (fuelled by access to private equity financing), while also helping to diversify businesses and acquire skills. Most of the top five resellers have amassed a cash war chest to spend on acquisition-led expansion in 2023. Bechtle has made significant moves to expand its system house division across Europe in 2022, acquiring PQR and Axez ICT Solutions in the Netherlands, and ACS in the UK during the year, as an example. The biggest issue at the moment is high valuation expectations from sellers and the continued battle with private equity for acquisition targets.