TWS shipments exceed 100 million in Q4 2021

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Wednesday, 9 March 2022

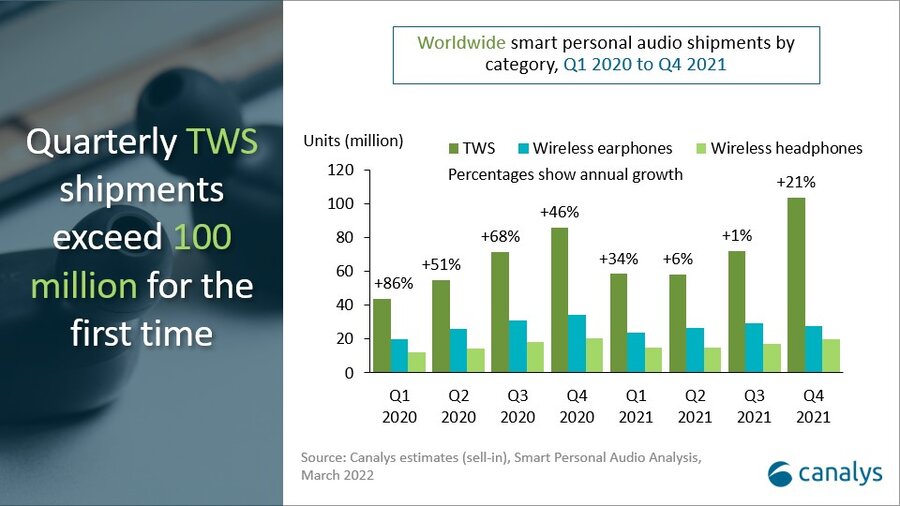

According to the latest Canalys estimates, true wireless stereo (TWS) shipments grew 21% to reach 103.8 million in Q4 2021, passing the 100 million mark for the first time. Apple drove the return of double-digit growth on the back of its third-generation AirPods launch. A strong performance from smart device and audio brands also contributed to TWS market growth, offsetting the decline of wireless earphones and headphones. Overall, smart personal audio shipments grew 7.7% to 151.4 million in Q4 2021.

“Apple prioritized serving the needs of those looking for comfort and ease of use with its third-generation AirPods, aiming to improve on the winning formula of its original AirPods design,” said Canalys Research Analyst Sherry Jin. “But Apple faces much stiffer competition in terms of comfort, sound quality, noise cancellation and affordability. It is being challenged to deliver on the spatial audio experience with improvements discernable to the average listener and better ecosystem integration to stay ahead.” Despite still leading the market, the delay of the third-generation AirPods launch to Q4 2021 hurt Apple. Its AirPods TWS shipments fell 11.4% to 86.0 million in 2021.

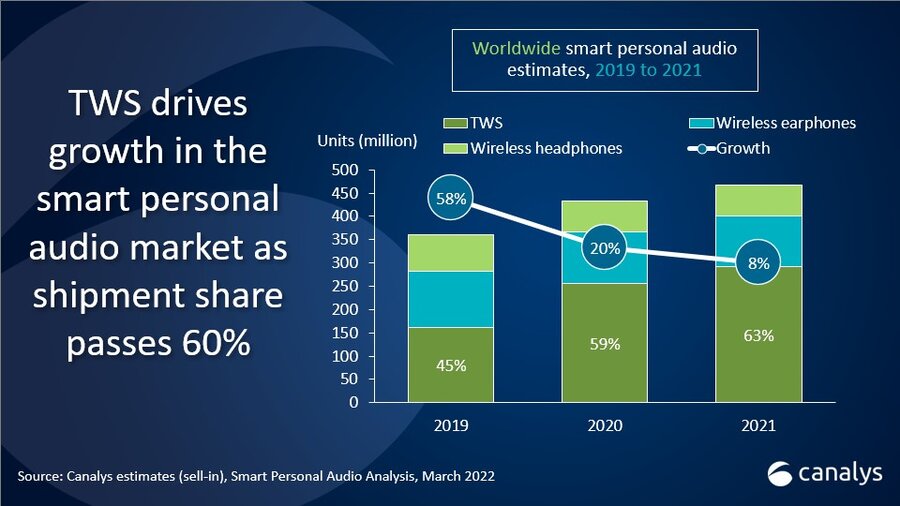

For full-year 2021, the share of TWS shipments reached 63%. The improved availability and accessibility of TWS devices is making wireless earphones obsolete and wireless headphones a niche. “TWS adoption is now taking off in developing markets worldwide, including African countries such as Nigeria,” said Canalys Analyst Cynthia Chen. “But a large number of users still rely on wired devices. Vendors must invest in market education and address key concerns over price, comfort, battery life and ease of use to encourage users to move toward wireless devices to enjoy an improved mobile user experience.”

Increased competition from audio players, such as Sony, Bose, Jabra and Skullcandy, is giving smartphone vendors a run for their money. They are being forced to improve integration of their own-brand TWS devices with their respective hardware, software and service ecosystems to ensure TWS devices are not just simple audio accessories to smartphones. “From HD content consumption on the go to gaming and remote productivity, vendors have a role to play in creating new use cases where audio can increasingly augment our daily lives,” said Chen. “Vendors must seize the growing TWS opportunity, as the category is now a driver for adopting next-generation content and technology, possibly serving as an essential entry point into the metaverse.”

|

Worldwide TWS shipments and growth |

|||||

|

Vendor |

Q4 2021 |

Q4 2021 |

Q4 2020 |

Q4 2020 |

Annual |

|

Apple* |

40.4 |

38.9% |

33.7 |

39.3% |

+20% |

|

Samsung* |

7.8 |

7.5% |

6.8 |

7.9% |

+15% |

|

Xiaomi |

6.9 |

6.7% |

7.2 |

8.4% |

-4% |

|

boat |

3.7 |

3.6% |

1.3 |

1.5% |

+195% |

|

Edifier |

3.2 |

3.1% |

3.0 |

3.5% |

+5% |

|

Others |

41.7 |

40.2% |

33.8 |

39.4% |

+23% |

|

Total |

103.8 |

100.0% |

85.8 |

100.0% |

+21% |

|

*Apple includes Beats; Samsung includes Harman subsidiaries |

|||||

|

Worldwide Smart Personal Audio shipments and growth |

|||||

|

Vendor |

2021 |

2021 |

2020 |

2020 |

Annual |

|

Apple* |

103.9 |

22.2% |

108.9 |

25.2% |

-5% |

|

Samsung* |

43.0 |

9.2% |

38.3 |

8.9% |

+12% |

|

Xiaomi |

25.3 |

5.4% |

25.4 |

5.9% |

-0.3% |

|

boAt |

20.6 |

4.4% |

8.7 |

2.0% |

+138% |

|

Skullcandy |

17.6 |

3.8% |

10.6 |

2.5% |

+66% |

|

Others |

257.0 |

55.0% |

240.2 |

55.6% |

+7% |

|

Total |

467.4 |

100.0% |

432.1 |

100.0% |

+8% |

|

*Apple includes Beats; Samsung includes Harman subsidiaries |

|||||

For more information, please contact:

Cynthia Chen (China): cynthia_chen@canalys.com +86 158 2151 8439

Sherry Jin (China): sherry_jin@canalys.com +86 158 0076 4291

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

PDF download

TWS shipments exceed 100 million in Q4 2021

TWS shipments exceed 100 million in Q4 2021